Saudi Arabia Asphalt Pavers Market Size, Share, Trends and Forecast by Type, Paving Range, and Region, 2026-2034

Saudi Arabia Asphalt Pavers Market Summary:

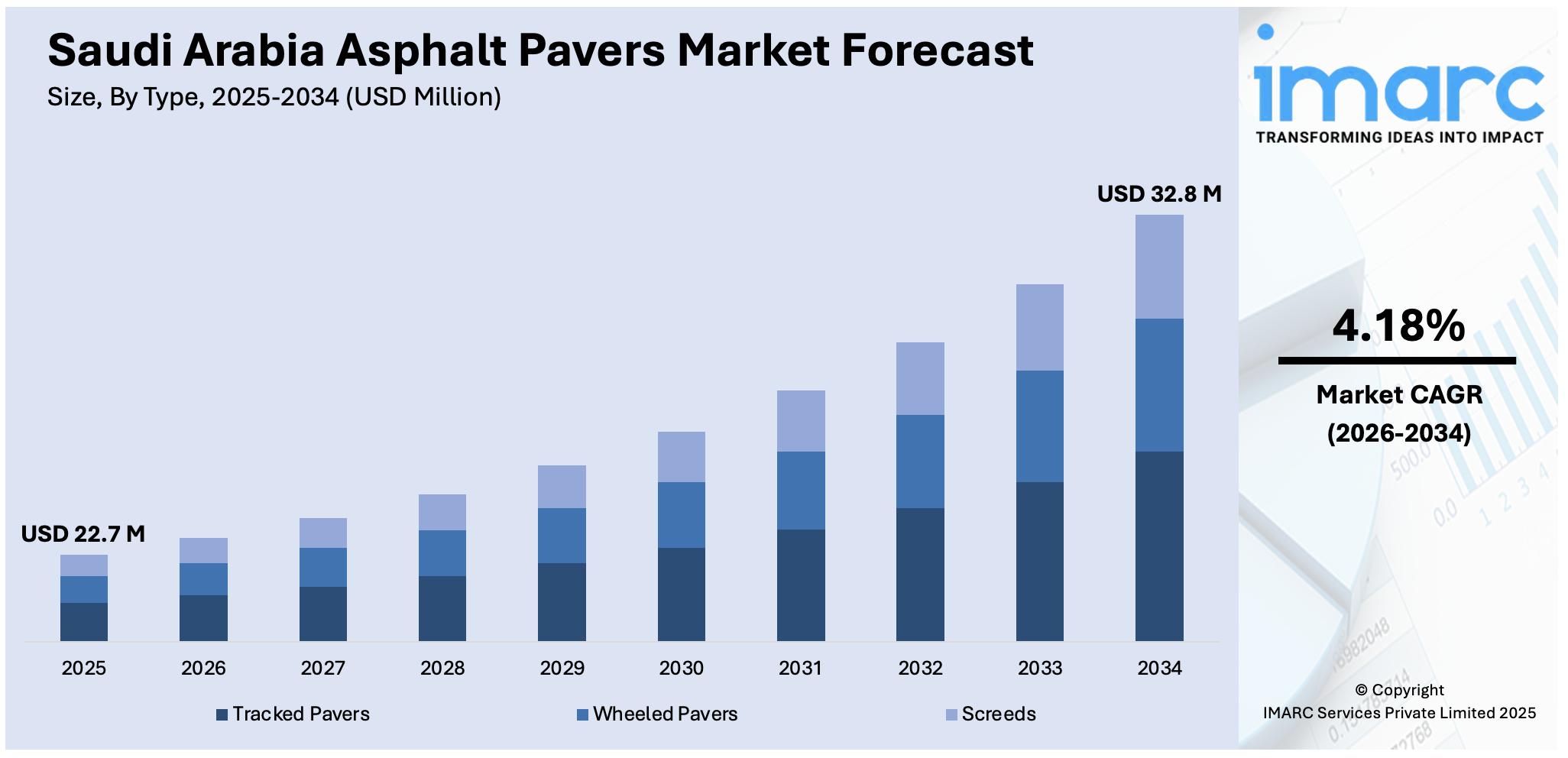

The Saudi Arabia asphalt pavers market size was valued at USD 22.7 Million in 2025 and is projected to reach USD 32.8 Million by 2034, growing at a compound annual growth rate of 4.18% from 2026-2034.

The Saudi Arabia asphalt pavers market shows a positive outlook, supported by sustained infrastructure spending and long-term urban development plans. Ongoing highway expansion, smart city construction, and tourism related projects are driving steady demand for modern paving equipment. Contractors are increasingly investing in high efficiency, automated asphalt pavers to improve productivity and project quality. Additionally, growing private sector participation and emphasis on durable road networks are strengthening equipment replacement cycles, creating consistent opportunities for manufacturers and service providers across the market.

Key Takeaways and Insights:

- By Type: Tracked pavers dominate the market with a share of 46% in 2025, owing to their enhanced grip and stability on desert terrains and unimproved surfaces. These machines are preferred for large-scale highway and mega project construction across the Kingdom.

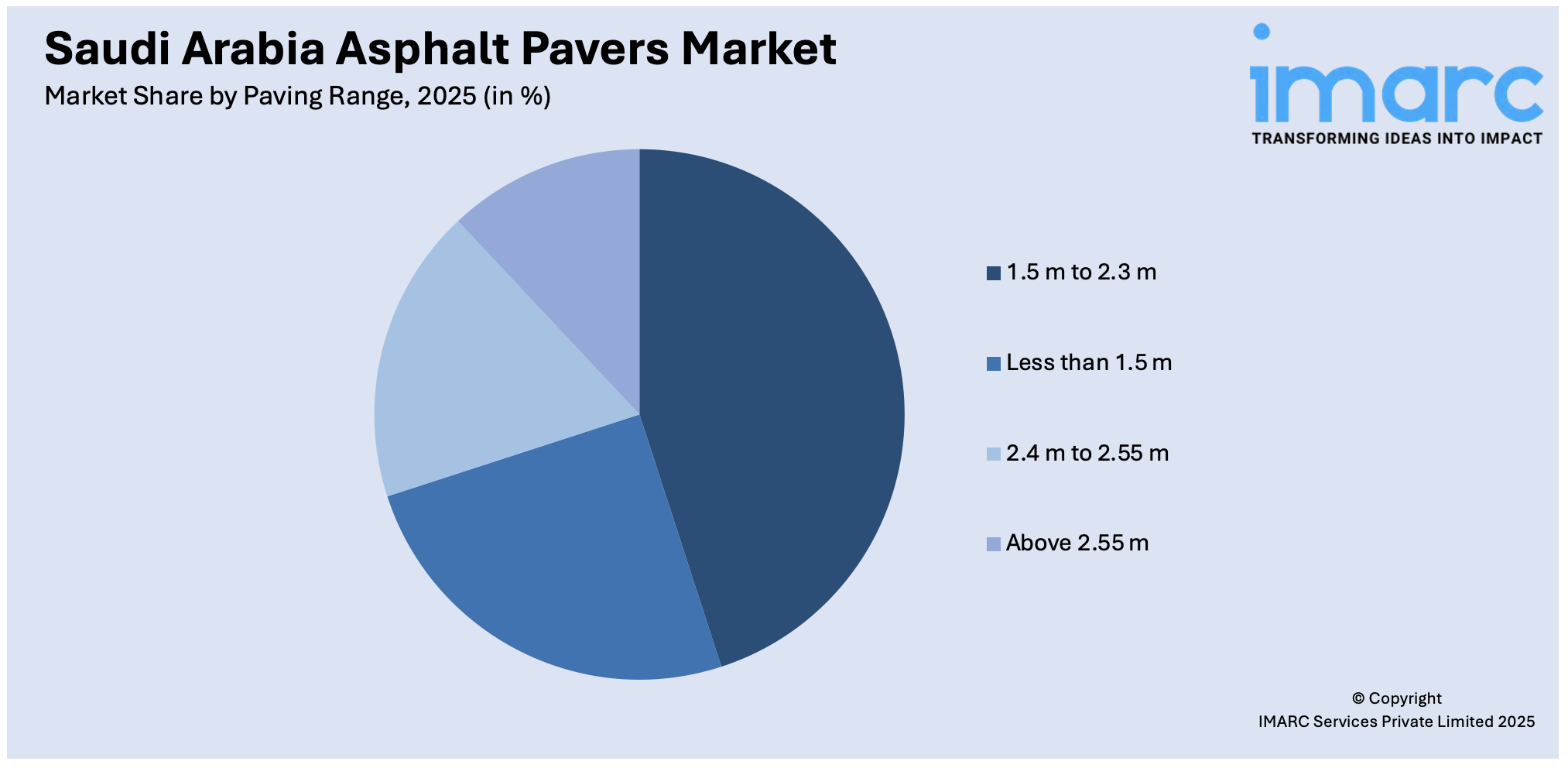

- By Paving Range: 1.5 m to 2.3 m leads the market with a share of 35% in 2025. This versatile paving width is optimal for urban arterial roads, secondary highways, and residential street construction, meeting diverse project requirements throughout the Kingdom.

- By Region: Northern and Central Region comprises the largest region with 30% share in 2025, driven by the concentration of infrastructure projects in Riyadh and surrounding areas, extensive ring road developments, and ongoing urban expansion initiatives under Vision 2030.

- Key Players: Key players drive the Saudi Arabia asphalt pavers market by expanding distribution networks, introducing technologically advanced machinery, and strengthening after-sales support. Their investments in automation, global positioning system (GPS) integration, and fuel-efficient systems enhance operational efficiency and accelerate adoption across both public and private infrastructure projects.

To get more information on this market Request Sample

The Saudi Arabia asphalt pavers market is experiencing sustained expansion, as the Kingdom intensifies its infrastructure development under Vision 2030. Authorities continue to prioritize high-quality road networks connecting major economic zones, tourism destinations, and residential communities. The Royal Commission for Riyadh City (RCRC) launched the second phase of its Main and Ring Road Development Program in February 2025, allocating over SAR 8 Billion for eight projects designed to enhance urban mobility and accommodate increasing traffic volumes. This national push for improved connectivity is driving contractors to adopt mechanized paving solutions that ensure faster project completion and superior surface quality. Furthermore, the emergence of smart city initiatives and mega developments is reshaping demand patterns, as construction firms seek advanced paving machinery equipped with digital controls and automated features. Growing emphasis on sustainable construction practices and environmental compliance is also influencing equipment selection, with operators favoring asphalt pavers that offer reduced emissions and improved fuel efficiency.

Saudi Arabia Asphalt Pavers Market Trends:

Smart City Projects Driving Equipment Modernization

The construction of smart cities and mega urban developments is reshaping the Saudi Arabia asphalt pavers market growth. As per IMARC Group, the Saudi Arabia smart cities market size reached USD 13,209.6 Million in 2024. Flagship projects under Vision 2030 are demanding highly efficient and automated paving machinery capable of meeting strict quality standards. These developments require faster project execution, precise material control, and uniform surface finishing across large scale road networks. Integration of digital controls is becoming a key selection criterion for contractors. As a result, demand is rising for advanced asphalt pavers that enhance productivity, reduce rework, and support long term infrastructure durability.

Integration of GPS and Automated Grade Control Systems

Adoption of digital technologies in paving equipment is accelerating across the Kingdom as contractors prioritize accuracy and efficiency. Modern asphalt pavers featuring GPS-linked control panels, automatic screed leveling, and real-time material flow monitoring are gaining traction. These features help minimize material wastage while ensuring consistent pavement thickness and surface quality. Enhanced data analytics also support predictive maintenance, reducing equipment downtime on large infrastructure sites. Consequently, digital-ready pavers are becoming essential for meeting tight project timelines and stringent performance benchmarks.

Emphasis on Sustainable and Eco-Friendly Paving Solutions

Environmental compliance and sustainability goals are influencing equipment procurement decisions in Saudi Arabia. Contractors are increasingly selecting asphalt pavers with reduced emissions, improved fuel efficiency, and compatibility with recycled asphalt materials. These machines support compliance with evolving environmental regulations while lowering operating costs over project lifecycles. Demand is also rising for pavers equipped with intelligent engine management systems that optimize fuel consumption. As sustainability becomes central to infrastructure planning, eco-friendly paving equipment is gaining stronger preference across public and private projects.

How Vision 2030 is Transforming the Saudi Arabia Asphalt Pavers Market:

Saudi Vision 2030 is reshaping the Saudi Arabia asphalt pavers market by accelerating large scale infrastructure development and localization goals. Mega projects, such as highways, economic cities, tourism corridors, and smart urban zones, are driving sustained demand for advanced paving equipment. Government focus on quality road networks, durability standards, and faster project execution is encouraging adoption of high capacity, automated, and GPS enabled asphalt pavers. Vision 2030 also promotes private sector participation and public-private partnerships (PPP) models, expanding contractor investments in modern machinery fleets. Additionally, emphasis on local manufacturing, technology transfer, and after sales service development is improving equipment availability and lifecycle support. Sustainability initiatives under Vision 2030 are further catalyzing the demand for fuel efficient, low emission pavers aligned with compliance requirements.

Market Outlook 2026-2034:

The Saudi Arabia asphalt pavers market outlook remains positive, as infrastructure investments continue under Vision 2030. The Kingdom's focus on expanding road networks, developing tourism corridors, and enhancing logistics routes creates sustained demand for paving machinery. Public sector initiatives are complemented by private developer participation in industrial zone road upgrades and residential community developments. The market generated a revenue of USD 22.7 Million in 2025 and is projected to reach a revenue of USD 32.8 Million by 2034, growing at a compound annual growth rate of 4.18% from 2026-2034. Increasing adoption of technologically advanced equipment, combined with ongoing mega project execution, supports market growth as contractors seek efficient solutions for meeting quality standards and project timelines.

Saudi Arabia Asphalt Pavers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Tracked Pavers | 46% |

| Paving Range | 1.5 m to 2.3 m | 35% |

| Region | Northern and Central Region | 30% |

Type Insights:

- Tracked Pavers

- Wheeled Pavers

- Screeds

Tracked pavers dominate with a market share of 46% of the total Saudi Arabia asphalt pavers market in 2025.

Tracked pavers have established dominance in the Saudi Arabia asphalt pavers market, owing to their superior performance on challenging terrains prevalent throughout the Kingdom. These machines provide excellent traction and stability on soft desert bases and unimproved surfaces, making them essential for new road construction projects. Their ability to maintain a stable platform during wide-width paving operations ensures uniform asphalt distribution, which is critical for meeting the quality standards demanded by government contracts and mega developments across the nation.

The preference for tracked pavers is further reinforced by their effectiveness on steep gradients and varied topographies found in mountainous regions and construction corridors. Leading equipment manufacturers report strong demand from contractors engaged in NEOM, Red Sea Project, and other giga projects, where high-output tracked models equipped with GPS-linked control panels and thermal sensors are specified. Additionally, their durability, high load-bearing capacity, and compatibility with advanced automation systems make tracked pavers a long-term investment choice for contractors handling continuous, large-scale infrastructure development across Saudi Arabia.

Paving Range Insights:

Access the comprehensive market breakdown Request Sample

- Less than 1.5 m

- 1.5 m to 2.3 m

- 2.4 m to 2.55 m

- Above 2.55 m

1.5 m to 2.3 m leads with a share of 35% of the total Saudi Arabia asphalt pavers market in 2025.

The 1.5 m to 2.3 m paving range segment holds the largest share, owing to its optimal versatility for diverse road construction applications across Saudi Arabia. This width range is ideally suited for urban arterial roads, secondary highway lanes, and residential street developments, which constitute a significant portion of ongoing infrastructure projects. Contractors favor pavers in this range for their flexibility in navigating both confined urban spaces and extended highway stretches without requiring frequent equipment changes between job sites.

Demand for this paving width category is supported by the extensive municipal road development programs underway throughout the Kingdom. The Roads General Authority reported executing 23 road projects in the Riyadh region alone, as of November 2024, including 20 preventive maintenance projects spanning 215 kilometers, with many utilizing equipment in this versatile width range. The segment benefits from balanced procurement across both government agencies and private developers undertaking commercial and industrial zone road works.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 30% share of the total Saudi Arabia asphalt pavers market in 2025.

Northern and Central Region commands the largest market share, driven by the concentration of major infrastructure investments in Riyadh and surrounding governorates. High population density, rising vehicle ownership, and expanding suburban zones are increasing demand for new road networks and capacity upgrades. Contractors in the region are prioritizing high-output, automated asphalt pavers to meet strict quality and timeline requirements. Continuous rehabilitation of highways and arterial roads is sustaining steady equipment utilization. In September 2024, the Municipality of Riyadh finalized five contracts totaling SAR 6 Billion to enhance road quality in the Saudi capital, with the project spanning an area of 83 Million square meters over five years.

The region benefits from ongoing urban expansion initiatives under Vision 2030, including developments such as King Salman Park Project, Sports Boulevard Project, and Riyadh Art Project. The Northern areas additionally contribute through NEOM-related road construction and logistics corridor developments connecting economic zones. Municipal authorities continue to award road upgrade contracts, with the Roads General Authority executing multiple maintenance and safety enhancement projects throughout the region to support growing population and commercial activity.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Asphalt Pavers Market Growing?

Vision 2030 Infrastructure Expansion Programs

The Saudi government's Vision 2030 initiative is driving unprecedented infrastructure development across the Kingdom, creating sustained demand for asphalt paving equipment. Authorities are executing comprehensive road network expansions to strengthen intercity connectivity, support tourism destinations, and enhance logistics corridors linking industrial zones with ports. Mega projects, including smart cities, economic hubs, and entertainment zones, require large-scale, high-quality paving works to meet international standards. Increased budget allocations for transport infrastructure are accelerating project timelines and equipment procurement. Contractors are upgrading fleets with advanced, high-capacity asphalt pavers to improve productivity, durability, and surface uniformity. Additionally, long-term maintenance programs are ensuring consistent demand for paving machinery across both urban and remote regions. The scale and sophistication of mega project road construction necessitate technologically advanced paving solutions, supporting the market growth.

Urbanization and Transportation Network Enhancements

Rapid urbanization and population growth in Saudi Arabia are compelling authorities to expand and upgrade transportation networks throughout the Kingdom. Urban population (% of total population) in Saudi Arabia reached 85.17 % in 2024, according to the World Bank collection of development indicators, intensifying demand for quality road infrastructure connecting growing residential communities with commercial centers and employment hubs. Municipal agencies across major cities are continuously awarding contracts for road upgrades, intersection improvements, and new arterial route construction. The ongoing urban development momentum ensures consistent demand for asphalt pavers as contractors equip themselves with reliable machinery to execute the expanding portfolio of road projects efficiently. This sustained pipeline of urban road projects is also encouraging fleet modernization, with contractors investing in high-efficiency, automated asphalt pavers to meet tighter timelines and quality expectations.

Advancements in Technology

Technological improvement is one of the major factors driving the Saudi Arabia asphalt pavers market, as it increases productivity, precision, and compliance with demanding infrastructure standards. Greater use of GPS-based leveling systems, combined with automatic screed control and real-time material flow monitoring, is being increasingly adopted by contractors to ensure uniform pavement quality and reduce rework. Advanced automation enables higher paving speeds while maintaining consistent thickness across wide road sections, which is critical in mega projects and high-traffic corridors. Digital control panels and telematics support predictive maintenance, minimizing downtime in harsh operating environments. Fuel-efficient engines and intelligent power management systems help lower operating costs and emissions, aligning with sustainability goals. Compatibility with recycled asphalt materials and thermal profiling technologies further enhances performance. As project timelines tighten under Vision 2030, technology-driven asphalt pavers are becoming essential tools for delivering large-scale, high-quality road infrastructure efficiently.

Market Restraints:

What Challenges the Saudi Arabia Asphalt Pavers Market is Facing?

High Initial Equipment Investment Costs

The substantial upfront costs associated with advanced asphalt pavers present a significant barrier for market expansion, particularly among smaller construction firms. Sophisticated models with GPS integration and thermal sensors command premium prices. These high acquisition costs limit equipment procurement capabilities for regional contractors operating with constrained capital budgets, potentially restricting broader market penetration despite strong infrastructure demand.

Skilled Equipment Operator Shortage

Saudi Arabia faces a considerable talent crisis affecting the construction equipment sector. This deficit extends to qualified operators capable of handling technologically advanced paving machinery with digital controls and automated systems. The shortage creates project delays, increases operating costs through reliance on expensive foreign labor, and may slow adoption of sophisticated equipment that requires specialized training. Addressing this challenge through skill enhancement programs remains critical for sustaining market growth.

Supply Chain Disruptions and Import Dependencies

The Saudi construction equipment sector relies heavily on imported machinery from international manufacturers, creating vulnerability to supply chain disruptions and geopolitical tensions. Red Sea shipping route disturbances have impacted equipment delivery timelines and increased transportation costs for construction machinery. Fluctuations in global markets, trade policies, and competing demand from multiple concurrent mega projects can affect equipment availability, pricing, and lead times, potentially constraining contractors' ability to secure required paving machinery for project execution.

Competitive Landscape:

The Saudi Arabia asphalt pavers market features a competitive landscape, dominated by established international equipment manufacturers with strong regional distribution networks. Leading players focus on expanding product portfolios, introducing technologically advanced machinery, and strengthening after-sales support to capture market share. Companies are investing in local service centers, training facilities, and parts warehouses to enhance customer support and equipment uptime. Strategic partnerships with regional distributors enable manufacturers to extend market reach across diverse governorates. Competition is intensifying, as firms differentiate through automation capabilities, fuel efficiency, and digital integration features. The growing emphasis on equipment rental services provides alternative market access for contractors seeking cost-effective solutions without substantial capital investments.

Saudi Arabia Asphalt Pavers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tracked Pavers, Wheeled Pavers, Screeds |

| Paving Ranges Covered | Less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, Above 2.55 m |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia asphalt pavers market size was valued at USD 22.7 Million in 2025.

The Saudi Arabia asphalt pavers market is expected to grow at a compound annual growth rate of 4.18% from 2026-2034 to reach USD 32.8 Million by 2034.

Tracked pavers dominated the market with a share of 46%, driven by superior traction and stability on desert terrains, making them preferred for large-scale highway and mega project construction throughout the Kingdom.

Key factors driving the Saudi Arabia asphalt pavers market include Vision 2030 infrastructure programs, mega city project construction, urbanization and population growth, expanding road networks, and increasing adoption of technologically advanced paving equipment.

Major challenges include high initial equipment investment costs, skilled operator shortages, supply chain disruptions from Red Sea shipping disturbances, and import dependencies affecting equipment availability and pricing across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)