Saudi Arabia Asset Performance Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Industry Vertical, and Region, 2026-2034

Saudi Arabia Asset Performance Management Market Overview:

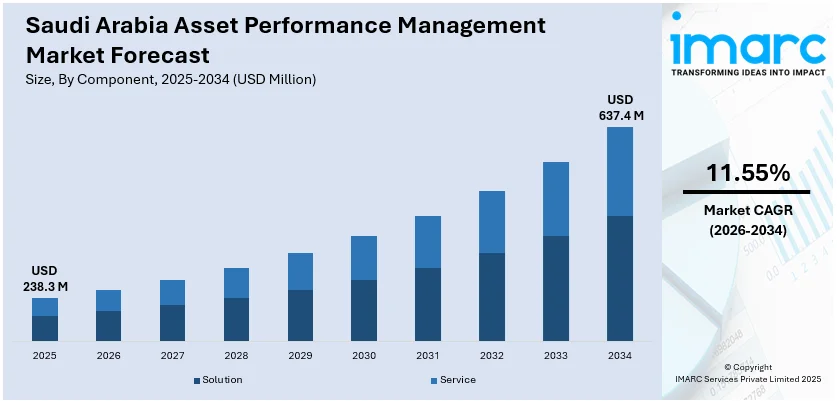

The Saudi Arabia asset performance management market size reached USD 238.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 637.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.55% during 2026-2034. Rising applications in the oil and gas industry, along with the growing adoption of artificial intelligence (AI) that enables root cause analysis and anomaly detection, are contributing to the expansion of the Saudi Arabia asset performance management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 238.3 Million |

| Market Forecast in 2034 | USD 637.4 Million |

| Market Growth Rate 2026-2034 | 11.55% |

Saudi Arabia Asset Performance Management Market Trends:

Growing utilization in oil and gas industry

The increasing applications of asset performance management in the oil and gas industry are positively influencing the market. As the share of the oil and gas industry in the economy of the country is rising, the demand for asset performance assessment solutions to enhance operational efficiency is growing. As per the General Authority for Statistics, in 2024, Saudi Arabia's GDP hit SR4.07 Trillion (USD 1.09 Trillion), with crude oil and natural gas accounting for 22.3%. The sector relies largely on large, sophisticated, and expensive infrastructure, making asset use and upkeep critical. Asset performance management solutions assist in monitoring equipment conditions, predicting problems, and extending asset life, assuring continuous production and eliminating costly downtime. With increased exploration and production, oil and gas businesses are employing asset performance management systems to improve reliability and safety. These solutions support real-time monitoring and data analysis, enabling proactive decision-making and timely interventions. As the oil and gas sector is working to optimize costs and increase output, asset performance management is becoming essential for managing performance and preventing unplanned disruptions. The industry is also seeking to comply with environmental and safety regulations, which asset performance management supports through better risk management and maintenance planning. Moreover, the sector is benefiting from predictive maintenance capabilities that reduce labor costs and spare parts employment. With Saudi Arabia being a worldwide oil hub, the continuous expansion of upstream and downstream operations is driving the demand for effective asset management systems.

To get more information on this market Request Sample

Increasing utilization of AI

Rising adoption of AI is fueling the Saudi Arabia asset performance management market growth. AI-based tools enable real-time data analysis, helping industries monitor equipment performance, predict failures, and minimize unplanned downtimes. As industries like manufacturing and utilities are adopting digital transformation, AI solutions aid in optimizing asset life cycles and resource employment. The ability of AI to process large datasets quickly supports condition-based maintenance, allowing companies to move away from traditional time-based models. This not only reduces operational costs but also improves overall equipment effectiveness. The rising demand for smart infrastructure and the government’s efforts to support automation is further accelerating AI incorporation in asset management. AI also enables root cause analysis and anomaly detection, providing early warnings of potential issues. With increasing awareness about the long-term cost savings and productivity improvements that AI can deliver, businesses are investing in AI-oriented asset performance management solutions. As the AI industry is thriving in the country, the demand for asset performance management solutions continues to rise. According to the IMARC Group, the Saudi Arabia AI market is set to attain USD 4,018 Million by 2033, exhibiting a CAGR of 15.80% from 2025-2033.

Saudi Arabia Asset Performance Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, and industry vertical.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

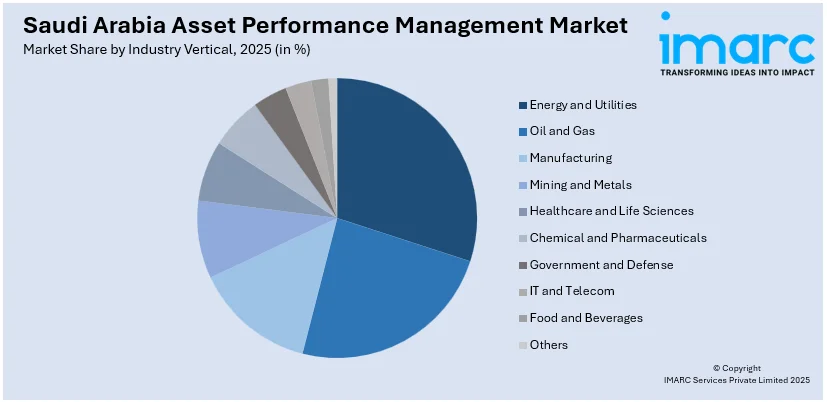

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- Oil and Gas

- Manufacturing

- Mining and Metals

- Healthcare and Life Sciences

- Chemical and Pharmaceuticals

- Government and Defense

- IT and Telecom

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes energy and utilities, oil and gas, manufacturing, mining and metals, healthcare and life sciences, chemical and pharmaceuticals, government and defense, IT and telecom, food and beverages, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Asset Performance Management Market News:

- In February 2025, mCloudTech.ai Corp., a well-known provider of AI-based cloud applications, announced that it was set to introduce new Web3 features for AssetCareⓇ, mCloudTech.ai's main asset performance management platform on Google Cloud in Saudi Arabia in 2025. This launch emphasized the firm’s collaboration with Google Cloud and underscored Saudi Arabia's key role in spearheading digital transformation to enhance sustainability initiatives. The solution facilitated complete lifecycle management for carbon credits, encompassing issuance, trading, and retirement.

- In April 2024, BlackRock Saudi Arabia teamed up with Public Investment Fund to create a multi-asset investment platform in Riyadh. It was to be supported by an initial investment mandate of as much as USD 5 Billion from PIF. The agreement signified progress in PIF's efforts to enhance the international diversity and dynamism of the Saudi investment and asset management sector.

Saudi Arabia Asset Performance Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | Energy and Utilities, Oil and Gas, Manufacturing, Mining and Metals, Healthcare and Life Sciences, Chemical and Pharmaceuticals, Government and Defense, IT and Telecom, Food and Beverages, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia asset performance management market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia asset performance management market on the basis of component?

- What is the breakup of the Saudi Arabia asset performance management market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia asset performance management market on the basis of organization size?

- What is the breakup of the Saudi Arabia asset performance management market on the basis of industry vertical?

- What is the breakup of the Saudi Arabia asset performance management market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia asset performance management market?

- What are the key driving factors and challenges in the Saudi Arabia asset performance management market?

- What is the structure of the Saudi Arabia asset performance management market and who are the key players?

- What is the degree of competition in the Saudi Arabia asset performance management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia asset performance management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia asset performance management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia asset performance management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)