Saudi Arabia Auto Parts Aftermarket Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Auto Parts Aftermarket Overview:

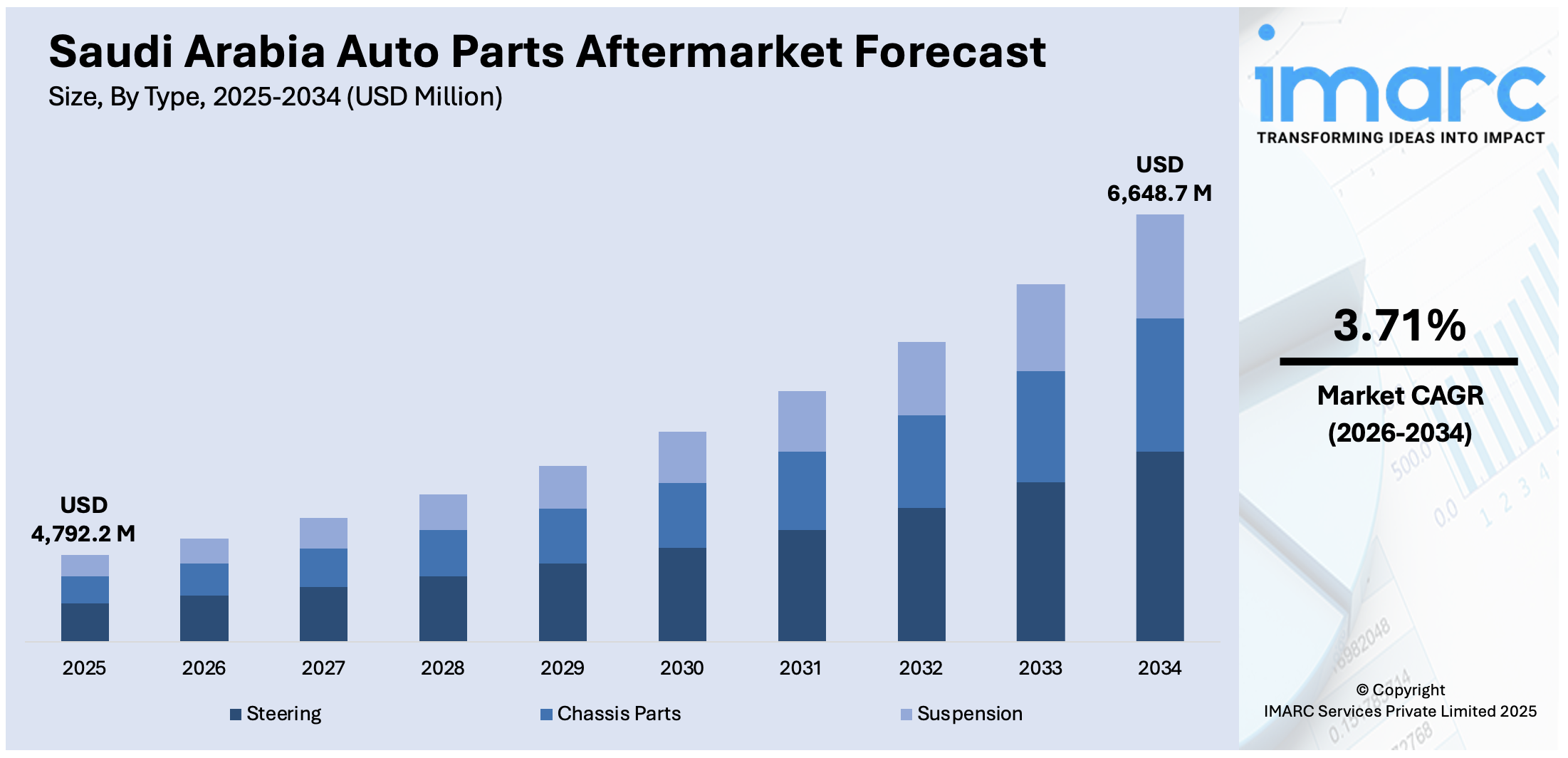

The Saudi Arabia auto parts aftermarket size reached USD 4,792.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,648.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.71% during 2026-2034. At present, with the increasing production and sales of cars, trucks, and commercial vehicles domestically, the demand for auto parts, including brakes, filters, batteries, lighting, and engine components, is rising. Besides this, the broadening of retail channels, which is making spare parts and accessories more accessible to a wider customer base, is contributing to the expansion of the Saudi Arabia auto parts aftermarket share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4,792.2 Million |

|

Market Forecast in 2034

|

USD 6,648.7 Million |

| Market Growth Rate 2026-2034 | 3.71% |

Saudi Arabia Auto Parts Aftermarket Trends:

Increasing vehicle production

Rising vehicle production is positively influencing the market in Saudi Arabia. According to industry reports, in 2024, 827,857 new light vehicles debuted on Saudi roads, marking a solid 6.6% increase compared to 2023. As more cars, trucks, and commercial vehicles are manufactured and sold within the country, the need for spare parts, such as brakes, filters, batteries, lighting, and engine components, is rising steadily. Every new vehicle is contributing to the future aftermarket as it undergoes wear and tear over time. Local production is also supporting the development of a domestic supply chain, making it easier and faster for customers to access parts. This growth is encouraging auto part manufacturers, distributors, and service providers to expand their offerings and improve availability across regions. In addition, increasing vehicle manufacturing is enabling the high availability of a wide variety of vehicle models, which leads to a more diverse aftermarket product range. People are benefiting from more choices, competitive pricing, and quicker service. Workshops and service centers are also growing alongside this trend, offering more aftermarket solutions to meet rising demand. As the local automotive industry continues to develop, the aftermarket is thriving by supporting long-term vehicle performance and customer satisfaction. This cycle of production and part replacement is strengthening the market consistently over time.

To get more information on this market Request Sample

Expansion of retail channels

The expansion of retail channels is impelling the Saudi Arabia auto parts aftermarket growth. As physical stores, online platforms, and authorized service centers are increasing across the country, people are finding it easier to locate, compare, and purchase the parts they need. Retail expansion allows a broader range of auto parts to be available in both urban and rural areas, reducing delays and improving convenience for vehicle owners and repair businesses. E-commerce platforms are also contributing by offering competitive pricing, home delivery, and detailed product information, which helps customers make informed decisions. Retailers often provide installation services and connect buyers with trusted workshops, creating a complete user experience. As more players are entering the market, competition is improving quality and affordability. Distributors and suppliers are benefiting from expanded networks that help them reach more customers quickly and efficiently. Overall, the growing presence of diverse retail channels is positively influencing the market by increasing availability, refining customer service, and boosting user confidence in purchasing replacement parts and accessories. As per the IMARC Group, the Saudi Arabia retail market is set to attain USD 408.70 Billion by 2033, exhibiting a CAGR of 4.20% during 2025-2033.

Saudi Arabia Auto Parts Aftermarket Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Steering

- Chassis Parts

- Suspension

The report has provided a detailed breakup and analysis of the market based on the type. This includes steering, chassis parts, and suspension.

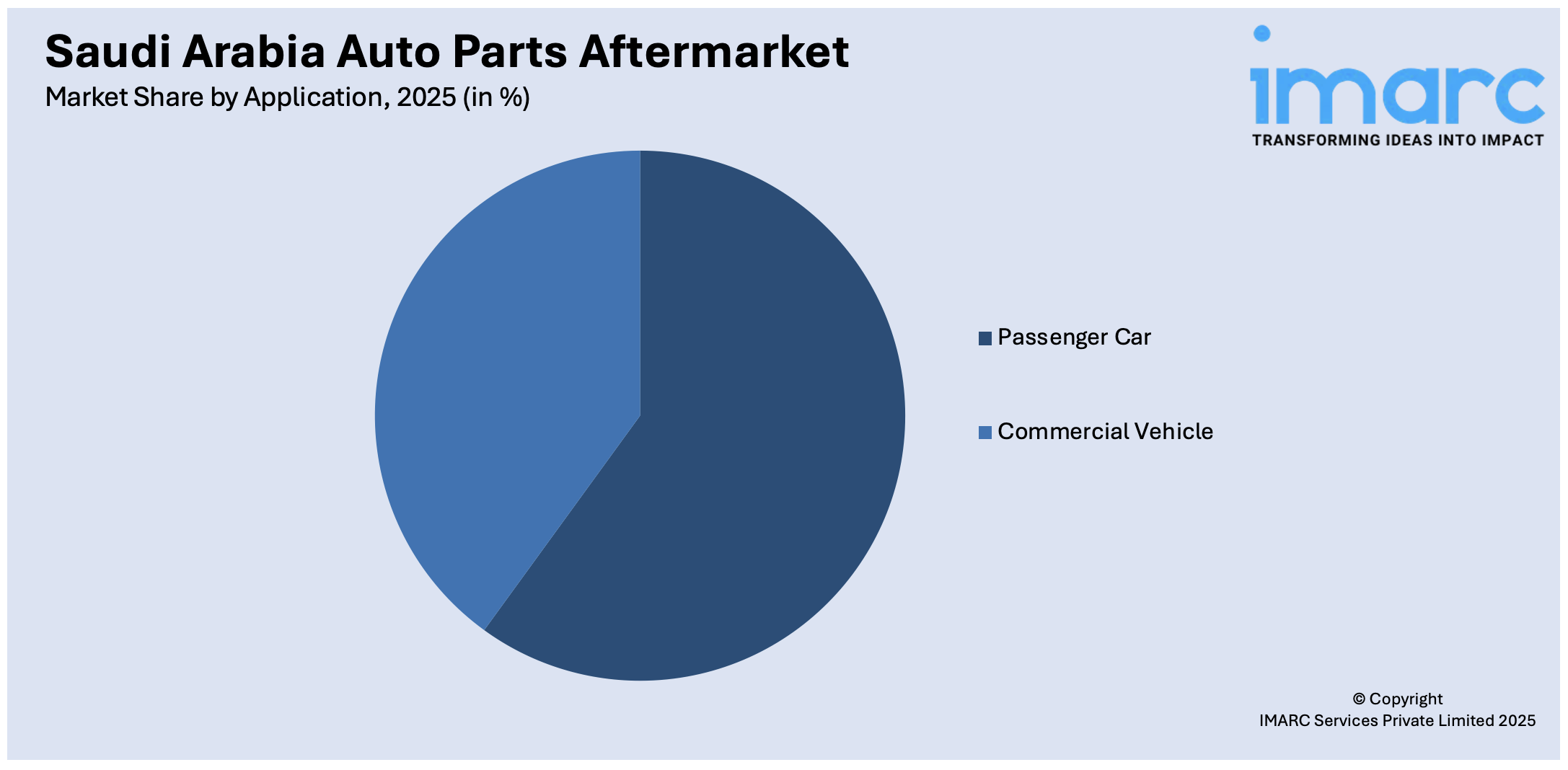

Application Insights:

Access the comprehensive market breakdown Request Sample

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes passenger car and commercial vehicle.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Auto Parts Aftermarket News:

- In April 2025, Automechanika Riyadh, the premier regional trade exhibition for the automotive aftermarket sector in Saudi Arabia, was formally opened by Mr. Ajlan Saad Al-Ajlan, Vice Chairman of the Board of Directors at the Riyadh Chamber. The event took place at the Riyadh International Convention and Exhibition Centre (RICEC). It displayed a variety of product sectors, such as parts and components, tires and batteries, and diagnostics and repairs.

- In February 2024, Neweast partnered with Isuzu Motors to announce the launch of a cutting-edge dealership in the Kingdom of Saudi Arabia (KSA). Neweast General Trading led the automotive sector, addressing the growing need for dependable and high-quality aftermarket automotive spare components. The dealership, covering 8,060 square meters, served as a symbol of dedication to quality. Meticulously crafted with Isuzu's legacy in focus, the facility sought to turn each customer visit into an unforgettable experience, embodying the partners' mutual commitment to improving the customer journey.

Saudi Arabia Auto Parts Aftermarket Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steering, Chassis Parts, Suspension |

| Applications Covered | Passenger Car, Commercial Vehicle |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia auto parts aftermarket performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia auto parts aftermarket on the basis of type?

- What is the breakup of the Saudi Arabia auto parts aftermarket on the basis of application?

- What is the breakup of the Saudi Arabia auto parts aftermarket on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia auto parts aftermarket?

- What are the key driving factors and challenges in the Saudi Arabia auto parts aftermarket?

- What is the structure of the Saudi Arabia auto parts aftermarket and who are the key players?

- What is the degree of competition in the Saudi Arabia auto parts aftermarket?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia auto parts aftermarket from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia auto parts aftermarket.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia auto parts aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)