Saudi Arabia Automotive Connectors Market Size, Share, Trends and Forecast by Connection Type, Connector Type, System Type, Vehicle Type, Application, and Region, 2026-2034

Saudi Arabia Automotive Connectors Market Overview:

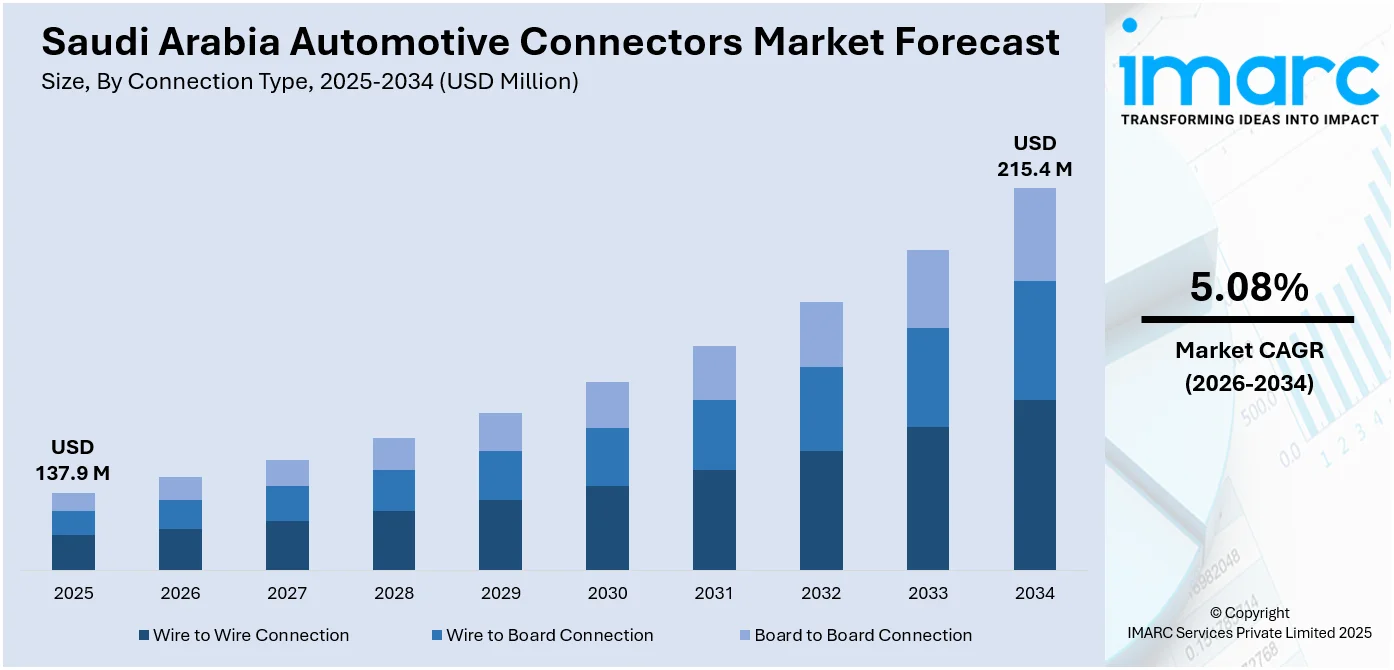

The Saudi Arabia automotive connectors market size reached USD 137.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 215.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.08% during 2026-2034. The market is driven by the rapid expansion of the automotive sector, increasing adoption of electric and hybrid vehicles, rising integration of advanced driver assistance systems (ADAS), and government-backed localization initiatives. Growing demand for vehicle safety, infotainment, and in-vehicle connectivity further supports market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 137.9 Million |

| Market Forecast in 2034 | USD 215.4 Million |

| Market Growth Rate 2026-2034 | 5.08% |

Saudi Arabia Automotive Connectors Market Trends:

Rising Adoption of Connected Vehicle Platforms and Smart Mobility Solutions

The increasing emphasis on vehicle connectivity in Saudi Arabia is propelling demand for advanced automotive connectors. As OEMs integrate telematics, vehicle-to-everything (V2X) communication, and real-time diagnostics, robust and high-speed connectors are essential to ensure data integrity across various subsystems. This demand is further supported by the Kingdom's smart mobility ambitions under Vision 2030, which aims to establish intelligent transportation infrastructure and smart city integration. For instance, in October 2024, Saudi Arabia’s Ministry of Energy announced a joint venture between Saleh Suleiman Alrajhi & Sons and Foxconn Interconnect Technology (FIT) to locally manufacture electric vehicle (EV) charging stations. The initiative supports Vision 2030 by reducing import dependence, creating jobs, and fostering local talent. Backed by top government officials, the venture leverages FIT’s advanced design and manufacturing expertise and Alrajhi’s local market experience. The chargers will be tailored for Saudi conditions, enhancing the Kingdom’s EV infrastructure and technological self-reliance. Automotive connectors used in ECU communications, GPS modules, infotainment systems, and wireless communication units are witnessing high adoption. The trend is especially prominent in fleet operations and public transportation systems being modernized for real-time tracking and efficiency. As smart mobility becomes a cornerstone of urban development, the automotive connector market is adapting to increasingly digital and interconnected vehicle environments.

To get more information on this market Request Sample

Electrification and EV Infrastructure Fueling Demand for High-Performance Connectors

Saudi Arabia’s rapid shift toward electric vehicles (EVs), driven by policy support and foreign investments, is transforming the demand for automotive connectors. EVs require high-voltage, heat-resistant, and durable connectors for components such as battery systems and inverters. As EV charging infrastructure expands across cities and highways, there is growing need for connectors with superior safety, sealing, and thermal management. This includes connectors for both vehicles and fast-charging stations. In response, manufacturers are innovating compact, high-current connector solutions tailored to the Kingdom’s environmental and performance requirements, aligning with national sustainability goals. For instance, in April 2025, Tesla began its sales operations in Saudi Arabia, debuting the Cybertruck in key cities including Riyadh, Jeddah, and Dammam. The company intends to establish a network of charging stations to support its entry. Aimed at the expanding base of urban electric vehicle consumers, the launch heightens competition with existing EV players such as Lucid and BYD in Saudi Arabia’s rapidly developing electric mobility market. Consequently, Tesla's entry into Saudi Arabia's EV market could drive increased demand for advanced automotive connectors essential to electric vehicle systems.

Saudi Arabia Automotive Connectors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on connection type, connector type, system type, vehicle type, and application.

Connection Type Insights:

- Wire to Wire Connection

- Wire to Board Connection

- Board to Board Connection

The report has provided a detailed breakup and analysis of the market based on the connection type. This includes wire to wire connection, wire to board connection, and board to board connection.

Connector Type Insights:

- PCB Connectors

- IC Connectors

- RF Connectors

- Fiber Optic Connectors

- Others

A detailed breakup and analysis of the market based on the connector type have also been provided in the report. This includes PCB connectors, IC connectors, RF connectors, fiber optic connectors, and others.

System Type Insights:

- Sealed Connector System

- Unsealed Connector System

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes sealed connector system and unsealed connector system.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles (light commercial vehicles, and heavy commercial vehicles), and electric vehicles.

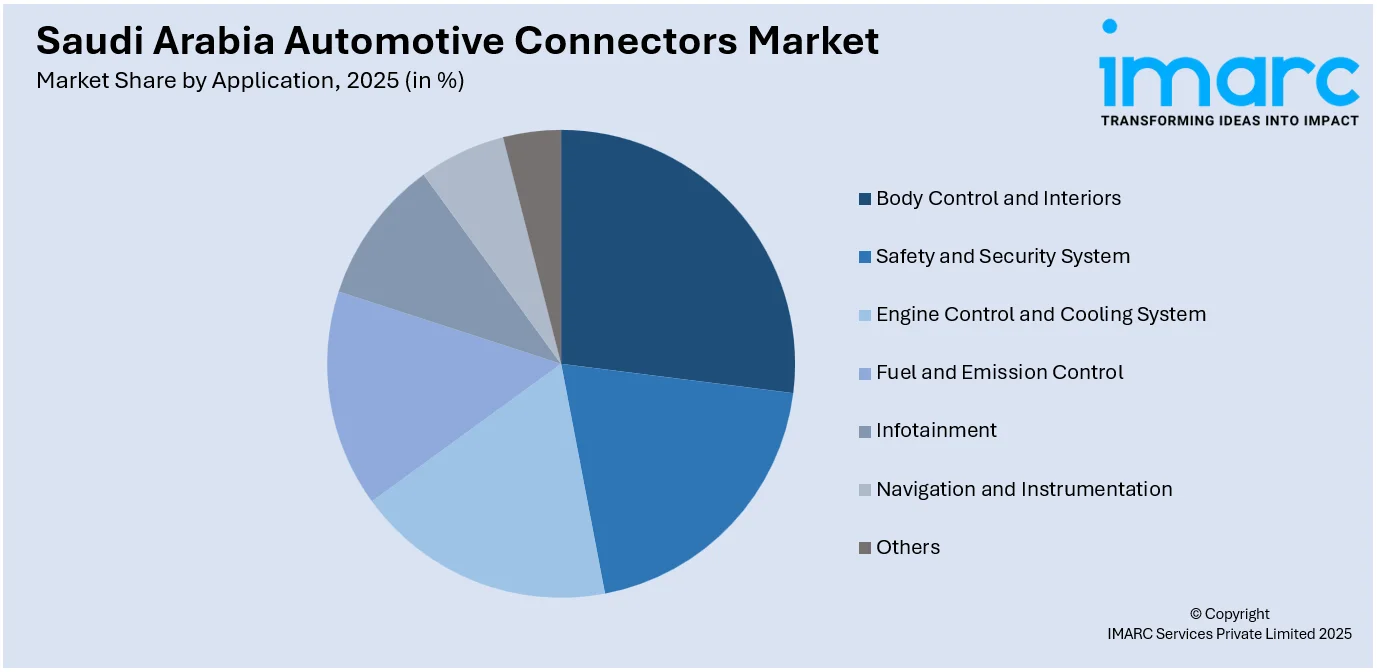

Application Insights:

Access the comprehensive market breakdown Request Sample

- Body Control and Interiors

- Safety and Security System

- Engine Control and Cooling System

- Fuel and Emission Control

- Infotainment

- Navigation and Instrumentation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes body control and interiors, safety and security system, engine control and cooling system, fuel and emission control, infotainment, navigation and instrumentation, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Automotive Connectors Market News:

- In March 2025, Infineon Technologies became one of the first companies to announce a RISC-V-based automotive microcontroller family, expanding its AURIX™ line. These microcontrollers will serve a wide range of vehicle applications and enable early software development through a virtual prototype launched at Embedded World 2025. Partnering with firms like Synopsys and IAR, Infineon aims to build a strong RISC-V ecosystem, supporting real-time, scalable, and secure computing for software-defined vehicles. This move aligns with Infineon's leadership in automotive microcontrollers and commitment to innovation in vehicle electronics.

- In February 2025, Ceer, Saudi Arabia’s first EV brand, signed SAR 5.5 billion (USD 1.5 Billion) in agreements, over 80% with Saudi companies, to supply vehicle components and charging equipment. This supports Vision 2030 goals of economic diversification and localization. Partnering with global and local firms, Ceer is building a robust EV supply chain and aims to localize 45% of its operations.

Saudi Arabia Automotive Connectors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connection Types Covered | Wire to Wire Connection, Wire to Board Connection, Board to Board Connection |

| Connector Types Covered | PCB Connectors, IC Connectors, RF Connectors, Fiber Optic Connectors, Others |

| System Types Covered | Sealed Connector System, Unsealed Connector System |

| Vehicle Types Covered |

|

| Applications Covered | Body Control and Interiors, Safety and Security System, Engine Control and Cooling System, Fuel and Emission Control, Infotainment, Navigation and Instrumentation, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia automotive connectors market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia automotive connectors market on the basis of connection type?

- What is the breakup of the Saudi Arabia automotive connectors market on the basis of connector type?

- What is the breakup of the Saudi Arabia automotive connectors market on the basis of system type?

- What is the breakup of the Saudi Arabia automotive connectors market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia automotive connectors market on the basis of application?

- What is the breakup of the Saudi Arabia automotive connectors market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia automotive connectors market?

- What are the key driving factors and challenges in the Saudi Arabia automotive connectors?

- What is the structure of the Saudi Arabia automotive connectors market and who are the key players?

- What is the degree of competition in the Saudi Arabia automotive connectors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia automotive connectors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia automotive connectors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia automotive connectors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)