Saudi Arabia Automotive HMI Market Size, Share, Trends and Forecast by Product, Access Type, Technology, Vehicle Type, and Region, 2026-2034

Saudi Arabia Automotive HMI Market Summary:

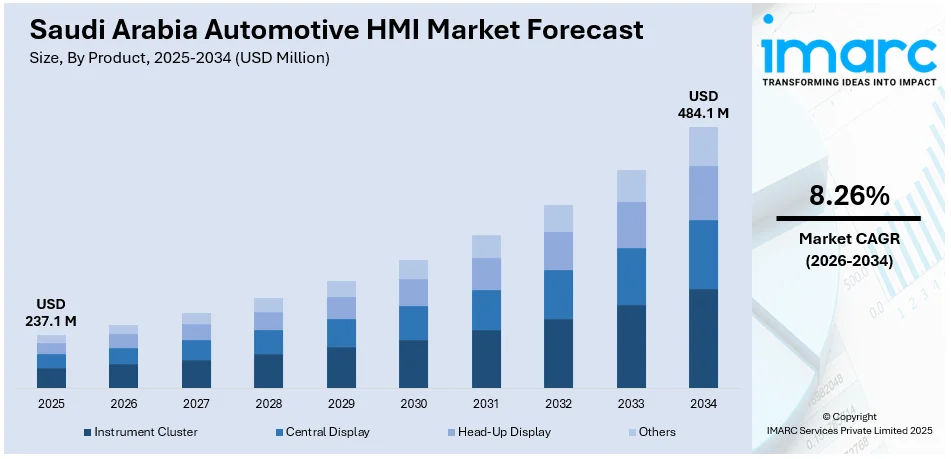

The Saudi Arabia automotive HMI market size was valued at USD 237.1 Million in 2025 and is projected to reach USD 484.1 Million by 2034, growing at a compound annual growth rate of 8.26% from 2026-2034.

The market is driven by increasing vehicle connectivity demands, rising adoption of advanced driver assistance systems, and growing consumer preference for enhanced in-vehicle experiences. Government initiatives supporting automotive sector modernization and smart mobility infrastructure development are further accelerating demand for sophisticated human-machine interface solutions. The expanding middle-class population and rising disposable incomes across the Kingdom's rapidly growing automotive ecosystem are collectively strengthening the overall Saudi Arabia automotive HMI market share.

Key Takeaways and Insights:

- By Product: Instrument cluster dominates the market with a share of 38% in 2025, driven by the essential role of digital clusters in delivering critical vehicle information and widespread advanced display integration.

- By Access Type: Standard leads the market with a share of 63% in 2025, owing to widespread adoption across entry and mid-range vehicles, cost-effectiveness for manufacturers, and established consumer familiarity.

- By Technology: Visual interface represents the largest segment with a market share of 50% in 2025, driven by the fundamental importance of touchscreen displays in modern vehicles and enhanced user experience delivery capabilities.

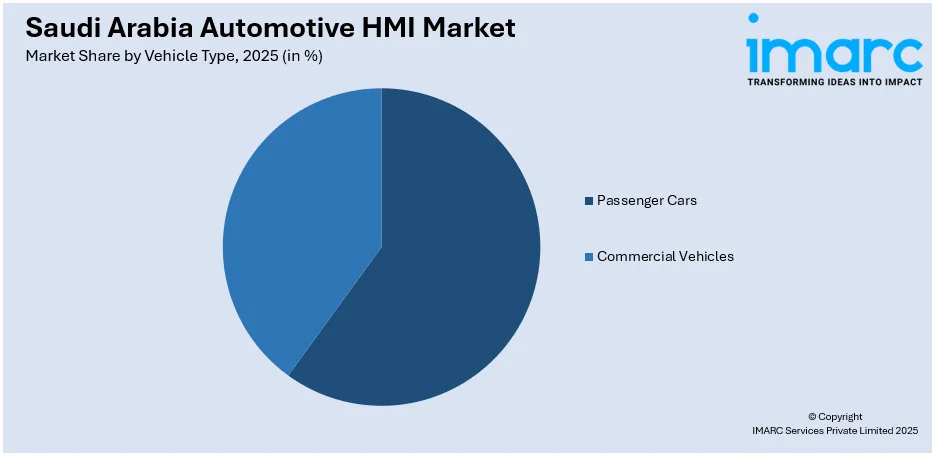

- By Vehicle Type: Passenger cars dominate the market with a share of 68% in 2025, owing to substantial consumer vehicle demand in the region, growing middle-class purchasing power, and technology-equipped vehicle adoption.

- By Region: Northern and Central Region leads the market with a share of 30% in 2025, driven by major urban center concentration including Riyadh, substantial dealership networks, and higher disposable incomes.

- Key Players: The Saudi Arabia automotive HMI market exhibits a moderately consolidated competitive landscape, with established international technology providers maintaining significant presence alongside regional distributors, driven by ongoing partnerships and localization strategies.

To get more information on this market Request Sample

The Saudi Arabia automotive human-machine interface market is experiencing robust expansion fueled by the Kingdom's ambitious Vision 2030 initiative, which emphasizes economic diversification and technological advancement. As per sources, Saudi Arabia’s National Center for Industrial Development highlighted accelerating automotive sector localization efforts, bringing together industry leaders to discuss future growth and domestic production of vehicles and components supportive of advanced interface technologies. Moreover, rising urbanization rates and improving living standards are driving consumer demand for vehicles equipped with sophisticated connectivity features and intuitive interface systems. The growing emphasis on road safety and the integration of advanced driver assistance technologies are compelling automakers to incorporate state-of-the-art HMI solutions into their vehicle offerings. Additionally, the influx of international automotive brands establishing regional presence is accelerating the introduction of technologically advanced vehicles featuring premium interface capabilities. The expanding young demographic population with strong technology affinity and increasing female participation in driving activities are further contributing to heightened demand, thereby stimulating sustained market growth across the automotive sector.

Saudi Arabia Automotive HMI Market Trends:

Integration of Voice-Activated Control Systems

The automotive industry in Saudi Arabia is witnessing accelerated adoption of voice recognition and natural language processing technologies within vehicle interfaces. As per sources, in 2025, Genesis launched its Connected Services 2025 platform in the Saudi market, featuring enhanced Arabic voice navigation and real‑time system updates that improve hands‑free control and driver interaction. Furthermore, manufacturers are prioritizing hands-free interaction capabilities to enhance driver safety and convenience while navigating the Kingdom's expanding road networks. These voice-activated systems enable seamless control of navigation, entertainment, and climate functions without requiring physical engagement, aligning with evolving consumer expectations for sophisticated yet user-friendly automotive technologies.

Expansion of Augmented Reality Head-Up Displays

Automotive manufacturers are increasingly incorporating augmented reality technologies into head-up display systems, projecting critical driving information directly onto windshields. As per sources, in April 2025, Volkswagen introduced the all-new Tiguan in Saudi Arabia, featuring a 15-inch head-up display and advanced digital cockpit, integrating AR navigation and in-cabin entertainment for enhanced driver experience. Moreover, this technological advancement provides drivers with real-time navigation guidance, hazard alerts, and vehicle performance data without diverting attention from road conditions. The integration supports enhanced situational awareness and represents a significant evolution in interface design, particularly appealing to technology-conscious consumers seeking premium driving experiences.

Growing Emphasis on Personalized User Experiences

Vehicle manufacturers are focusing on developing adaptive HMI systems capable of learning and responding to individual driver preferences and behaviors. In November 2025, BMW Group KSA implemented AI‑driven personalization tools to tailor digital customer engagement and in‑vehicle experiences for Saudi drivers, enhancing features based on user data and preferences. These intelligent interfaces automatically adjust display configurations, seating positions, climate settings, and entertainment preferences based on user profiles. The personalization trend reflects broader consumer expectations for customized experiences and demonstrates the automotive industry's commitment to delivering increasingly sophisticated and intuitive human-machine interaction capabilities.

How Vision 2030 is Transforming the Saudi Arabia Automotive HMI Market:

Saudi Arabia’s Vision 2030 is reshaping the automotive HMI market by prioritizing economic diversification and technological advancement across the transportation sector. The strategic framework encourages foreign direct investment in automotive manufacturing, facilitating technology transfer and localization of advanced interface systems. Government initiatives promoting smart city development and intelligent transportation infrastructure are driving demand for connected vehicle technologies featuring sophisticated human-machine interfaces. The emphasis on enhancing quality of life and reducing dependence on petroleum exports has accelerated electric vehicle adoption, necessitating innovative HMI solutions for emerging mobility platforms. Additionally, workforce nationalization programs are cultivating domestic expertise in automotive technology development, while regulatory modernization ensures alignment with international safety and connectivity standards, collectively positioning the Kingdom as a regional automotive innovation hub.

Market Outlook 2026-2034:

The Saudi Arabia automotive HMI market is positioned for sustained revenue growth throughout the forecast period, supported by continued government investment in transportation infrastructure and automotive sector development. The expansion of electric vehicle adoption and autonomous driving technologies will necessitate increasingly sophisticated interface solutions, driving sustained demand for advanced HMI systems. Rising consumer expectations for connected and intelligent vehicle experiences, coupled with the Kingdom's strategic positioning as a regional automotive hub, will further contribute to positive market revenue trajectory through the projection period. The market generated a revenue of USD 237.1 Million in 2025 and is projected to reach a revenue of USD 484.1 Million by 2034, growing at a compound annual growth rate of 8.26% from 2026-2034.

Saudi Arabia Automotive HMI Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Instrument Cluster |

38% |

|

Access Type |

Standard |

63% |

|

Technology |

Visual Interface |

50% |

|

Vehicle Type |

Passenger Cars |

68% |

|

Region |

Northern and Central Region |

30% |

Product Insights:

- Instrument Cluster

- Central Display

- Head-Up Display

- Others

Instrument cluster dominates with a market share of 38% of the total Saudi Arabia automotive HMI market in 2025.

Instrument clusters represent the dominant product segment within the Saudi Arabia automotive HMI market, serving as the primary information display interface for drivers across all vehicle categories. Digital instrument clusters have largely replaced traditional analog configurations, offering highly customizable displays that present navigation directions, vehicle diagnostics, fuel efficiency metrics, and entertainment information through high-resolution screens. According to reports, in 2025 MG ZS launched in Saudi Arabia with top trims featuring a fully digital 12.3‑inch instrument cluster alongside an advanced infotainment display, highlighting local adoption of digital cluster technology in mainstream models.

The continued evolution toward fully digital cockpit configurations is reinforcing instrument cluster prominence, with manufacturers integrating advanced graphics processing capabilities and configurable display layouts that adapt to individual driver preferences. Consumer demand for comprehensive information presentation and aesthetic sophistication is driving adoption of larger, curved display panels that seamlessly integrate with contemporary vehicle interior designs. These advanced instrument clusters deliver enhanced functionality, visual elegance, and intuitive information hierarchy, establishing them as essential components in modern automotive human-machine interface system architecture.

Access Type Insights:

- Standard

- Multimodal

Standard leads with a share of 63% of the total Saudi Arabia automotive HMI market in 2025.

Standard access interfaces maintain market leadership by providing reliable, cost-effective interaction solutions suitable for high-volume vehicle production across the Saudi Arabian market. These systems typically incorporate responsive touchscreen displays combined with tactile physical controls, offering intuitive operation familiar to broad consumer demographics regardless of technological proficiency levels. As per sources, Nissan launched the all‑new Magnite in Riyadh with an 8‑inch touchscreen featuring wireless Apple CarPlay and Android Auto, highlighting widespread adoption of connected standard access interfaces in entry-level models.

Manufacturers continue refining standard access systems to deliver improved touchscreen responsiveness and expanded functionality while maintaining competitive pricing structures attractive to cost-conscious consumers. The integration of smartphone connectivity protocols including wireless mirroring capabilities and voice assistance features within standard interfaces effectively addresses consumer expectations for connected experiences without requiring premium system investments. This strategic approach ensures continued segment relevance across diverse vehicle categories while enabling automakers to offer compelling technology packages that satisfy evolving market demands.

Technology Insights:

- Visual Interface

- Acoustic

- Mechanical

- Others

Visual interface exhibits a clear dominance with a 50% share of the total Saudi Arabia automotive HMI market in 2025.

Visual interface technologies command the largest market share within the Saudi Arabia automotive HMI market, encompassing touchscreen displays, digital instrument panels, infotainment screens, and head-up display systems. The inherent human preference for visual information processing positions this technology segment as fundamental to automotive HMI system design and development strategies. As per sources, in January 2025, the third‑generation Volkswagen Tiguan debuted in Saudi Arabia featuring a Digital Cockpit Pro display and head‑up display projecting key vehicle data directly into the driver’s line of sight, underscoring rising implementation of advanced visual interfaces locally.

The proliferation of multi-screen configurations and the integration of advanced driver monitoring systems are expanding visual interface applications within contemporary vehicles. Manufacturers are implementing edge-to-edge displays and curved screen technologies that complement interior aesthetics while maximizing information presentation capabilities and minimizing driver distraction. These developments reflect the continued prioritization of visual interaction methodologies in automotive interface design, with enhanced graphics processing enabling sophisticated animations, intuitive menu structures, and seamless transitions that elevate the overall driving experience throughout the Kingdom.

Vehicle Type Insights:

Access the comprehensive market breakdown Request Sample

- Passenger Cars

- Commercial Vehicles

Passenger cars lead with a market share of 68% of the total Saudi Arabia automotive HMI market in 2025.

Passenger cars represent the dominant vehicle category driving automotive HMI market demand in Saudi Arabia, reflecting the Kingdom's substantial private vehicle ownership rates and growing consumer purchasing power across diverse demographic segments. Rising household incomes and improved automotive financing accessibility through competitive loan structures are enabling increased adoption of technology-equipped personal vehicles featuring advanced interface systems. According to reports, in 2025, Saudi Arabia’s best-selling cars were the Hyundai Accent (19,081 units) and Kia Pegas (15,528 units), reflecting strong local demand for affordable, tech-equipped subcompact sedans.

The expansion of female driving privileges and significant youth demographic growth are contributing to sustained passenger car demand, with consumers increasingly prioritizing connectivity features and intuitive interfaces in their purchasing decisions. Manufacturers are responding strategically by offering comprehensive HMI packages across vehicle segments, from economy models to premium luxury offerings, ensuring broad market penetration. This approach enables automakers to capture diverse consumer segments while meeting varying expectations for technology integration, interface sophistication, and overall driving experience enhancement.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 30% of the total Saudi Arabia automotive HMI market in 2025.

Northern and Central Region maintains market leadership, anchored by Riyadh's prominent position as the Kingdom's capital and largest metropolitan area with substantial population concentration. The presence of government institutions, multinational corporate headquarters, and affluent residential communities drives considerable demand for premium vehicles equipped with advanced HMI technologies and sophisticated interface systems. Extensive automotive dealership networks and comprehensive service infrastructure support robust vehicle sales volumes, while the region's economic vitality ensures sustained consumer purchasing capacity for technology-equipped vehicles.

Ongoing infrastructure development projects and ambitious urban expansion initiatives throughout the region are sustaining automotive market growth and creating favorable conditions for HMI adoption. The presence of major automotive distribution centers and the region's strategic economic significance within national development plans position the Northern and Central Region as the primary demand center for sophisticated automotive interface solutions. Government investments in smart city infrastructure and intelligent transportation systems further complement market expansion within this economically vital region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Automotive HMI Market Growing?

Accelerating Digital Transformation in Automotive Sector

The automotive industry in Saudi Arabia is undergoing comprehensive digital transformation, fundamentally reshaping vehicle design philosophies and consumer expectations across the Kingdom. Manufacturers are incorporating advanced computing platforms capable of supporting sophisticated interface applications, artificial intelligence integration, and over-the-air update capabilities that enhance system performance remotely. As per sources, in October 2025, Kia launched Kia Connect in Saudi Arabia, offering over 50 connected car features including remote control, digital key, geo-fence alerts, and over-the-air map updates for seamless vehicle management. Moreover, this technological evolution enables continuous HMI system enhancement throughout vehicle lifecycles, delivering improved functionality and personalized experiences.

Rising Consumer Expectations for Connected Experiences

Saudi Arabian consumers are demonstrating increasing preference for vehicles offering seamless connectivity with personal devices, cloud services, and intelligent transportation infrastructure throughout daily commutes. The proliferation of smartphone usage and digital lifestyle integration is driving demand for automotive interfaces capable of mirroring familiar interaction paradigms. Consumers expect intuitive access to navigation services, entertainment content, communication platforms, and vehicle management functions through cohesive interface environments. These evolving expectations compel manufacturers to prioritize HMI system development and differentiate offerings accordingly.

Government Support for Automotive Industry Development

The Kingdom's vision 2030 strategic framework emphasizes automotive sector development as a key component of economic diversification efforts aimed at reducing petroleum dependency. Government initiatives supporting local manufacturing establishment, foreign investment attraction, and technology transfer are creating favorable conditions for advanced automotive technology adoption. According to sources, in November 2025, Saudi Arabia’s Ministry of Investment, NIDC, Stellantis, and Petromin signed an MoU to explore local passenger and commercial vehicle manufacturing, advancing Vision 2030’s automotive industrialization goals. Furthermore, infrastructure investments in expanding road networks, smart city developments, and electric vehicle charging facilities complement automotive market expansion.

Market Restraints:

What Challenges the Saudi Arabia Automotive HMI Market is Facing?

High Technology Integration Costs

The integration of advanced HMI systems significantly increases vehicle manufacturing costs, creating pricing pressures that may limit market penetration across price-sensitive consumer segments. Sophisticated display technologies, computing hardware, and software development requirements contribute to elevated system costs that manufacturers must carefully balance against competitive pricing imperatives and consumer affordability expectations.

Infrastructure Limitations in Remote Areas

Connectivity-dependent HMI features may experience reduced functionality in regions with limited telecommunications infrastructure coverage across the Kingdom. Remote areas lacking reliable network connectivity present challenges for cloud-based services and real-time data applications, potentially diminishing the value proposition of advanced interface systems for consumers residing outside major urban centers and metropolitan areas.

Consumer Adaptation Requirements

The transition from traditional vehicle controls to advanced digital interfaces requires consumer adaptation and may present usability challenges for certain demographic groups. Unfamiliarity with touchscreen operation, voice recognition systems, and gesture controls can create friction in user adoption, particularly among older consumers accustomed to conventional automotive interfaces and mechanical control systems.

Competitive Landscape:

The Saudi Arabia automotive HMI market competitive environment reflects the convergence of global automotive technology providers, tier-one suppliers, and regional distribution networks operating within an expanding market opportunity. Market participants are pursuing strategic partnerships with automakers to secure integration agreements and establish technological differentiation through proprietary interface solutions. Investment in research and development capabilities, localization initiatives, and after-sales support infrastructure characterizes competitive positioning strategies adopted by leading industry participants. The market structure encourages continuous innovation while maintaining accessibility across vehicle segments through diversified product offerings addressing varying price points and feature requirements.

Recent Developments:

- In February 2025, JETOUR unveiled its T1 urban light off-road SUV in Riyadh, Saudi Arabia, featuring advanced touchscreen HMI, a 2.0T+8AT powertrain, intelligent four-wheel drive, and seven driving modes. The launch targets Saudi Arabia’s expanding SUV market, marking a key milestone in JETOUR’s global expansion strategy.

Saudi Arabia Automotive HMI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Instrument Cluster, Central Display, Head-Up Display, Others |

| Access Types Covered | Standard, Multimodal |

| Technologies Covered | Visual Interface, Acoustic, Mechanical, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia automotive HMI market size was valued at USD 237.1 Million in 2025.

The Saudi Arabia automotive HMI market is expected to grow at a compound annual growth rate of 8.26% from 2026-2034 to reach USD 484.1 Million by 2034.

Instrument cluster held the largest market share, driven by universal vehicle integration requirements, digital display technology advancements, and the essential role these systems play in delivering critical driving information to vehicle operators.

Key factors driving the Saudi Arabia automotive HMI market include accelerating digital transformation, rising consumer expectations for connected experiences, government support for automotive development, and increasing adoption of advanced driver assistance systems.

Major challenges include high technology integration costs, infrastructure limitations in remote regions, consumer adaptation requirements for digital interfaces, cybersecurity concerns regarding connected vehicle systems, software complexity management, supply chain constraints for advanced components, and maintaining consistent interface usability standards across platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)