Saudi Arabia Automotive Lighting Market Size, Share, Trends and Forecast by Technology, Vehicle Type, Sales Channel, Application, and Region, 2026-2034

Saudi Arabia Automotive Lighting Market Overview:

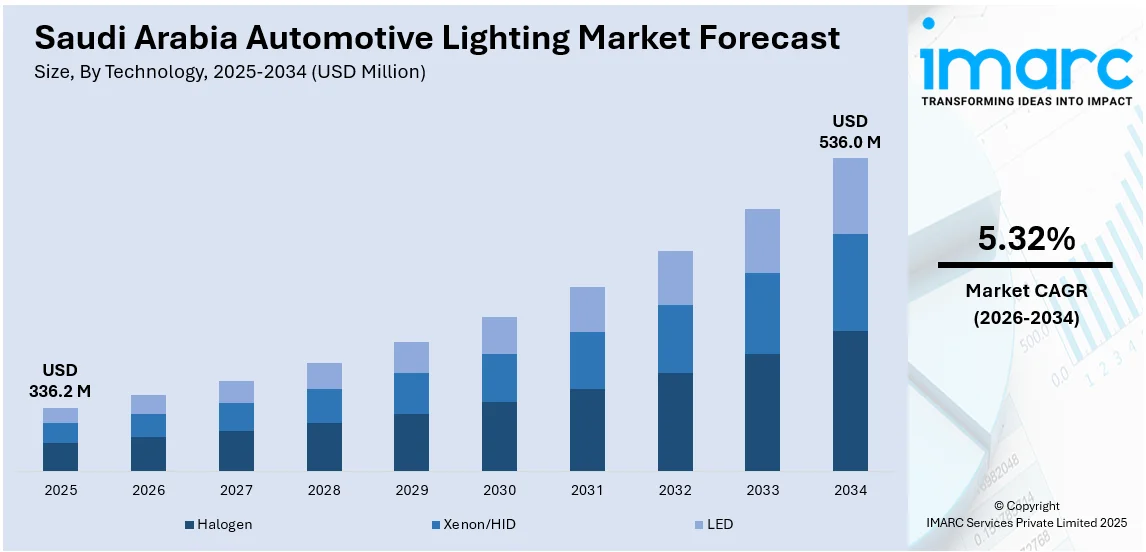

The Saudi Arabia automotive lighting market size reached USD 336.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 536.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.32% during 2026-2034. The market share is expanding, driven by the growing shift towards energy-optimized lighting technologies, along with the expansion of retail outlets that offer increased visibility and availability of automotive lighting components.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 336.2 Million |

| Market Forecast in 2034 | USD 536.0 Million |

| Market Growth Rate 2026-2034 | 5.32% |

Saudi Arabia Automotive Lighting Market Trends:

Increasing vehicle production

Rising vehicle production is offering a favorable Saudi Arabia automotive lighting market outlook. As per industry reports, in 2024, 827,857 new light vehicles were purchased in Saudi Arabia, reflecting a robust 6.6% increase compared to 2023. With more automobiles being manufactured each year, the demand for high-quality lighting systems, such as headlights, taillights, fog lights, and interior lights, is high. These lighting systems are critical for vehicle safety, visibility, and aesthetic appeal. As Saudi Arabia's automobile industry is burgeoning, there is a rising shift towards the use of energy-optimized lighting technologies like light emitting diode (LED), which are not only eco-friendly but also economical. As automakers are integrating modern technologies in vehicles, there is a greater emphasis on smart lighting solutions that enhance driving experiences and vehicle performance. Additionally, the increasing employment of electric vehicles (EVs) is also contributing to the demand for efficient lighting systems, as these vehicles require lighting solutions that utilize less power. The increasing interest in vehicle customization and safety features is creating the need for innovative automotive lighting systems.

To get more information on this market Request Sample

Expansion of retail outlets

The expansion of retail channels is fueling the Saudi Arabia automotive lighting market growth. People are gaining access to a wide assortment of lighting products and solutions. Retail outlets, both online and offline, offer increased visibility and availability of automotive lighting components, making it easier for vehicle owners to purchase and upgrade their lighting systems. With the broadening of organized retail chains, individuals are benefiting from a better shopping experience, including expert guidance, item comparisons, and installation services. The expanding retail landscape is also encouraging automotive manufacturers and lighting suppliers to introduce innovative products that cater to different customer preferences. As urban centers in Saudi Arabia are being developed and disposable incomes are increasing, the demand for stylish and energy-efficient lighting options, such as LEDs, is rising. The presence of automotive accessories in large retail stores, malls, and e-commerce platforms is enhancing market penetration and user awareness. With the retail industry thriving, the demand for automotive lighting is high. According to the IMARC Group, Saudi Arabia retail market is set to attain USD 408.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033.

Saudi Arabia Automotive Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, vehicle type, sales channel, and application.

Technology Insights:

- Halogen

- Xenon/HID

- LED

The report has provided a detailed breakup and analysis of the market based on the technology. This includes halogen, xenon/HID, and LED.

Vehicle Type Insights:

- Passenger Vehicle

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicle and commercial vehicle.

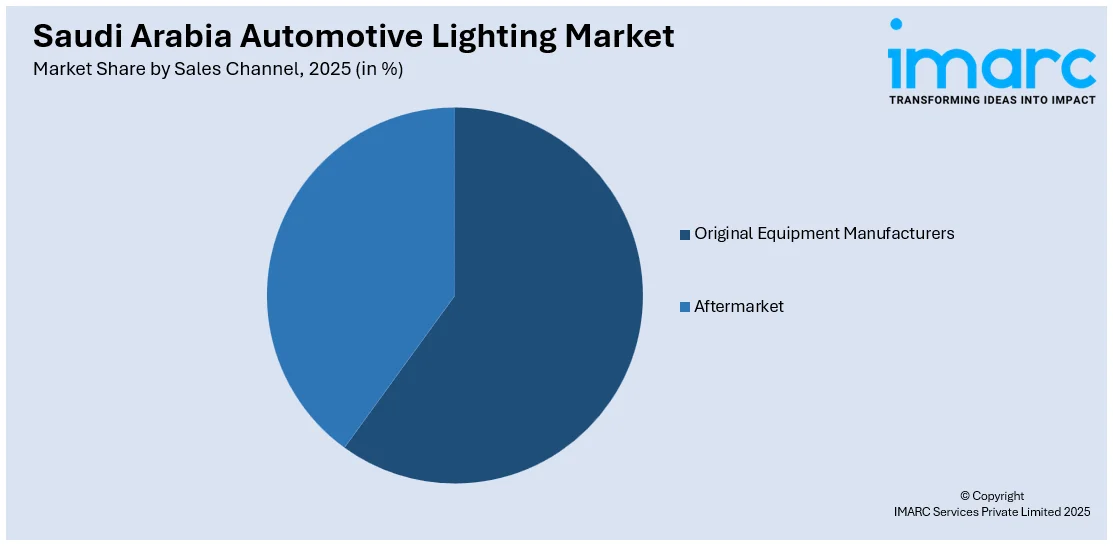

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturers

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes original equipment manufacturers and aftermarket.

Application Insights:

- Front Lighting/Headlamps

- Rear Lighting

- Side Lighting

- Interior Lighting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes front lighting/headlamps, rear lighting, side lighting, and interior lighting.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Automotive Lighting Market News:

- In December 2024, Al-Futtaim Electric Mobility Company introduced BYD, the world’s foremost new energy vehicle (NEV) manufacturer, in Saudi Arabia. The BYD SONG was a plug-in hybrid SUV that integrated the practicality of an SUV with the environment friendly performance of an EV. It aimed to enhance the SUV experience with a range of sophisticated features in its standard FWD trim, such as ambient lighting and a 360° camera.

- In July 2024, Aljomaih Automotive, the authorized dealer of the GAC Motor brand in Saudi Arabia, revealed the introduction of the new M8 multi-purpose family vehicle (MPV) during an event at the Aljomaih GAC Motor showroom in Riyadh. The M8 featured a stylish exterior with vivid colors and LED lights. The roomy interior was designed with premium materials and included separate climate control for the front and back rows, as well as heated and cooled seats in both sections.

Saudi Arabia Automotive Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniogies Covered | Halogen, Xenon/HID, LED |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Applications Covered | Front Lighting/Headlamps, Rear Lighting, Side Lighting, Interior Lighting |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia automotive lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia automotive lighting market on the basis of technology?

- What is the breakup of the Saudi Arabia automotive lighting market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia automotive lighting market on the basis of sales channel?

- What is the breakup of the Saudi Arabia automotive lighting market on the basis of application?

- What is the breakup of the Saudi Arabia automotive lighting market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia automotive lighting market?

- What are the key driving factors and challenges in the Saudi Arabia automotive lighting market?

- What is the structure of the Saudi Arabia automotive lighting market and who are the key players?

- What is the degree of competition in the Saudi Arabia automotive lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia automotive lighting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia automotive lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia automotive lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)