Saudi Arabia Automotive Paints and Coatings Market Size, Share, Trends and Forecast by Resin Type, Technology, Layer, Application, and Region, 2025-2033

Saudi Arabia Automotive Paints and Coatings Market Overview:

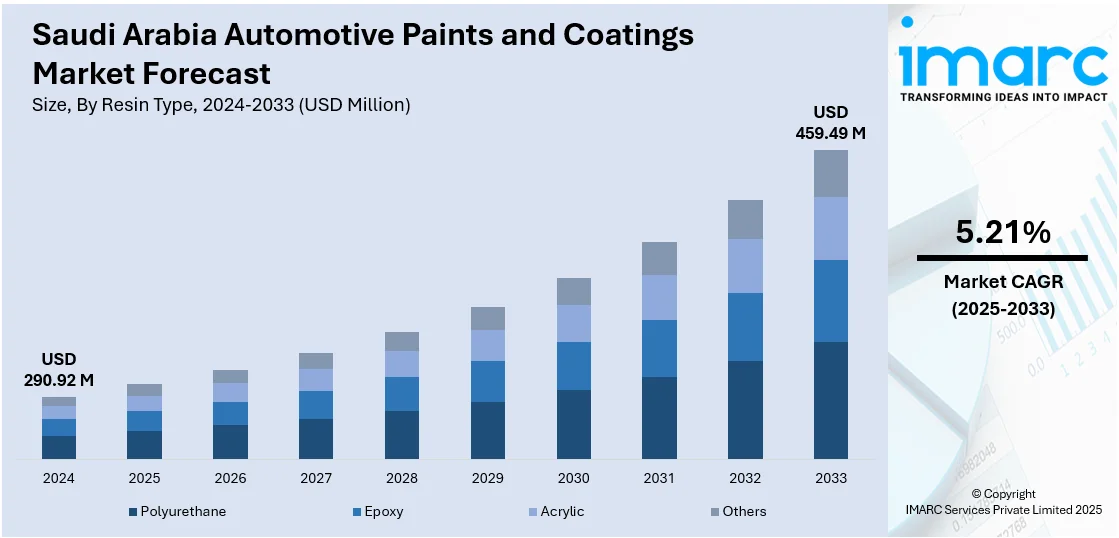

The Saudi Arabia automotive paints and coatings market size reached USD 290.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 459.49 Million by 2033, exhibiting a growth rate (CAGR) of 5.21% during 2025-2033. Expanding luxury and high-performance vehicle demand, rising need for heat-resistant and UV-protective coatings, increased customization preferences, growing investments in certified coating application centers, urbanization-led vehicle density, development of specialized detailing and body repair centers, rise in aftermarket customization services, rising adoption of eco-friendly coating technologies, integration of digital application solutions, and focus on sustainable refinishing systems are some of the factors positively impacting the Saudi Arabia automotive paints and coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 290.92 Million |

| Market Forecast in 2033 | USD 459.49 Million |

| Market Growth Rate 2025-2033 | 5.21% |

Saudi Arabia Automotive Paints and Coatings Market Trends:

Urbanization and Development of Specialized Aftermarket Services

The rapid pace of urbanization and the parallel growth of specialized automotive aftermarket services are significantly shaping Saudi Arabia’s automotive paints and coatings market. Expanding urban centers such as Riyadh, Jeddah, and Dammam are experiencing rising vehicle density, leading to higher incidences of minor collisions, abrasions, and paint damage. This urban mobility trend is fueling consistent demand for high-quality refinishing products, protective coatings, and aesthetic enhancement solutions. The emergence of specialized body shops and detailing centers offering professional-grade repainting, surface protection films, and ceramic coatings is also a major market trend. On July 10, 2023, Delta Coatings International has announced a strategic three-year expansion plan, including the opening of a new facility in Saudi Arabia, to enhance its waterproofing and protective coatings services across the Middle East. The company's move to offer turnkey project delivery and launch innovative products like DELTAShield PROSeal supports Saudi Arabia’s growing demand for durable, high-performance coatings essential for infrastructure and automotive sectors under Vision 2030.

The Saudi Arabia automotive paints and coatings market growth reflects substantial investments in training, certification, and the adoption of cutting-edge application technologies to meet consumer expectations for precision and quality. Moreover, the popularity of aftermarket customization, including color changes, unique finishes, and performance coatings, is expanding opportunities for premium and specialty coating manufacturers. Sustainability concerns are also beginning to influence consumer choices and regulatory policies. Eco-friendly paints with lower VOC emissions, waterborne technologies, and energy-saving curing systems are increasingly penetrating the Saudi market. Analysts tracking Saudi Arabia automotive paints and coatings market trends emphasize a transition toward integrated service models that combine product supply, technical support, and digital solutions for color matching and defect analysis. The Saudi Arabia automotive paints and coatings market outlook remains positive, supported by dynamic urban expansion, rising consumer sophistication, and continuous investments in automotive aftermarket infrastructure.

Expanding Luxury and High-Performance Vehicle Segment

Saudi Arabia's growing demand for luxury and high-performance vehicles is emerging as a crucial driver for its automotive paints and coatings sector. Rising disposable incomes, cultural affinity for premium vehicles, and a young, affluent population are significantly increasing the market for high-end automobiles that require superior coating solutions for aesthetic enhancement and surface protection. As a result, automotive paints and coatings must meet rigorous standards for gloss retention, color accuracy, and long-term durability under harsh climatic conditions. A key observation within market is the heightened requirement for coatings capable of withstanding extreme heat, intense UV radiation, and frequent dust exposure. The Saudi Arabia automotive paints and coatings market forecast highlights rising preferences for innovative technologies such as heat-reflective coatings and scratch-resistant clear coats that maintain vehicle appearance despite environmental stressors.

Manufacturers are also emphasizing customization, with a growing portfolio of metallic, pearlescent, and matte finishes designed specifically for luxury vehicles. Furthermore, local dealerships and service providers are expanding their premium after-sales services, offering advanced refinishing and detailing packages that rely heavily on superior quality paints and coatings to meet customer expectations. On February 13, 2025, Nouryon opened a new office in Al Dhahran, Saudi Arabia, strengthening its presence to support customer service, logistics, and supply chain operations across key sectors including building, construction, and polymer specialties. This strategic investment enhances regional access to specialty chemicals crucial for coatings and paints, directly supporting Saudi Arabia’s growing automotive coatings and construction market. Nouryon’s expanded local footprint is expected to improve supply reliability and foster stronger industry partnerships in sectors demanding high-performance coating solutions. Advancements in chemical formulations and application technologies are enabling faster curing times and improved adhesion to lightweight substrates, essential for high-performance vehicles utilizing aluminum and composite materials. The development of flexible coating systems that adapt to vehicle-specific performance requirements is also gaining traction.

Saudi Arabia Automotive Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, technology, layer, and application.

Resin Type Insights:

- Polyurethane

- Epoxy

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, epoxy, acrylic, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent-borne, water-borne, powder, and others.

Layer Insights:

- E-coat

- Primer

- Base Coat

- Clear Coat

The report has provided a detailed breakup and analysis of the market based on the layer. This includes e-coat, primer, base coat, and clear coat.

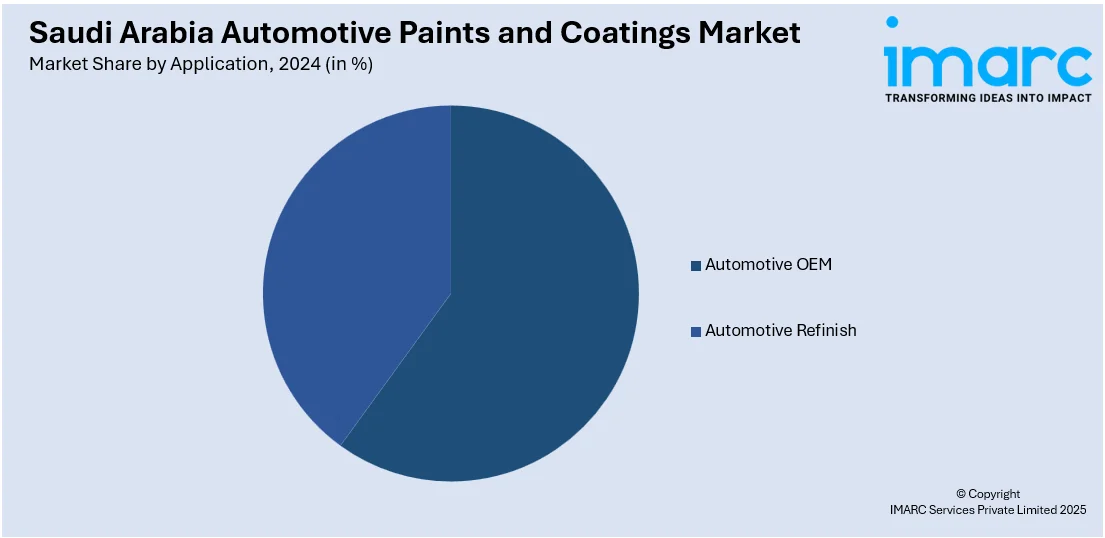

Application Insights:

- Automotive OEM

- Automotive Refinish

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive OEM and automotive refinish.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Automotive Paints and Coatings Market News:

- February 19, 2025: Saudi Industrial Paint Company (SIPCO), a subsidiary of Kaizen Paint Middle East, has acquired full ownership of Premium Paints Company to strengthen its local manufacturing capabilities and support Saudi Arabia’s Vision 2030 localization strategy. This acquisition is expected to enhance SIPCO’s production of high-performance, climate-suited coatings, which is vital for sectors including automotive paints and coatings, given the Kingdom’s infrastructure boom and rising demand for durable, high-quality finishes.

Saudi Arabia Automotive Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Epoxy, Acrylic, Others |

| Technologies Covered | Solvent-borne, Water-borne, Powder, Others |

| Layers Covered | E-coat, Primer, Base Coat, Clear Coat |

| Applications Covered | Automotive OEM, Automotive Refinish |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia automotive paints and coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia automotive paints and coatings market on the basis of resin type?

- What is the breakup of the Saudi Arabia automotive paints and coatings market on the basis of technology?

- What is the breakup of the Saudi Arabia automotive paints and coatings market on the basis of layer?

- • What is the breakup of the Saudi Arabia automotive paints and coatings market on the basis of application?

- What is the breakup of the Saudi Arabia automotive paints and coatings market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia automotive paints and coatings market?

- What are the key driving factors and challenges in the Saudi Arabia automotive paints and coatings market?

- What is the structure of the Saudi Arabia automotive paints and coatings market and who are the key players?

- What is the degree of competition in the Saudi Arabia automotive paints and coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia automotive paints and coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia automotive paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia automotive paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)