Saudi Arabia Automotive Radar Market Size, Share, Trends and Forecast by Range, Vehicle Type, Application, and Region, 2026-2034

Saudi Arabia Automotive Radar Market Summary:

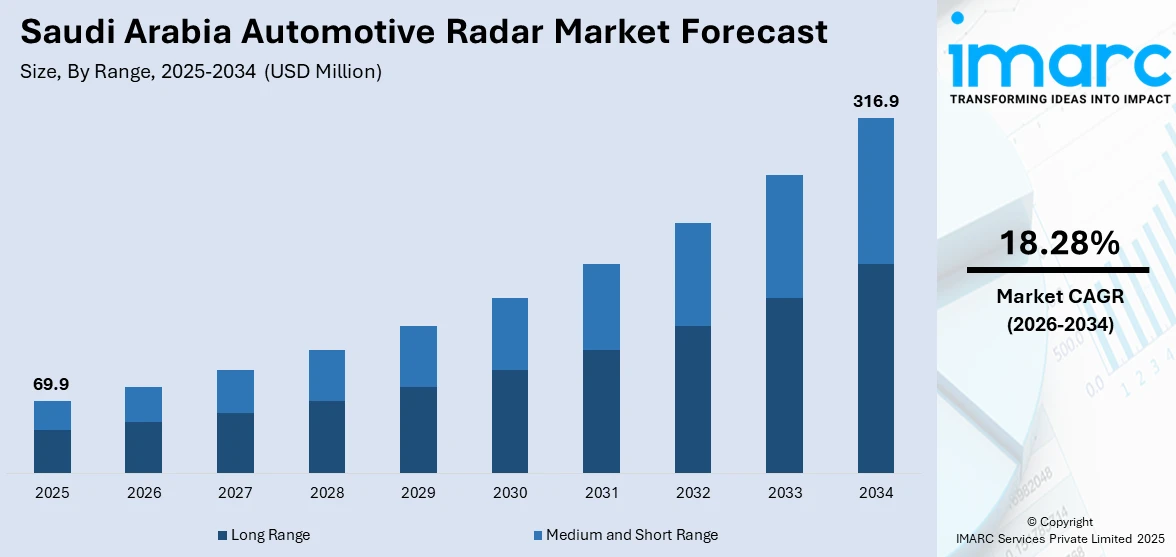

The Saudi Arabia automotive radar market size was valued at USD 69.9 Million in 2025 and is projected to reach USD 316.9 Million by 2034, growing at a compound annual growth rate of 18.28% from 2026-2034.

The market is driven by the increasing adoption of advanced driver assistance systems (ADAS), rising consumer awareness regarding vehicle safety features, and the government's commitment to developing smart mobility solutions. Stringent road safety regulations and the growing integration of radar-based technologies in premium and mid-range vehicles are further accelerating market expansion. Additionally, investments in autonomous vehicle testing and infrastructure development are strengthening the Saudi Arabia automotive radar market share.

Key Takeaways and Insights:

- By Range: Long range dominates the market with a share of 44% in 2025, driven by its critical role in enabling adaptive cruise control and collision avoidance systems for highway driving.

- By Vehicle Type: Passenger cars lead the market with a share of 70% in 2025, owing to rising demand for enhanced safety features and increasing consumer preference for ADAS-equipped vehicles.

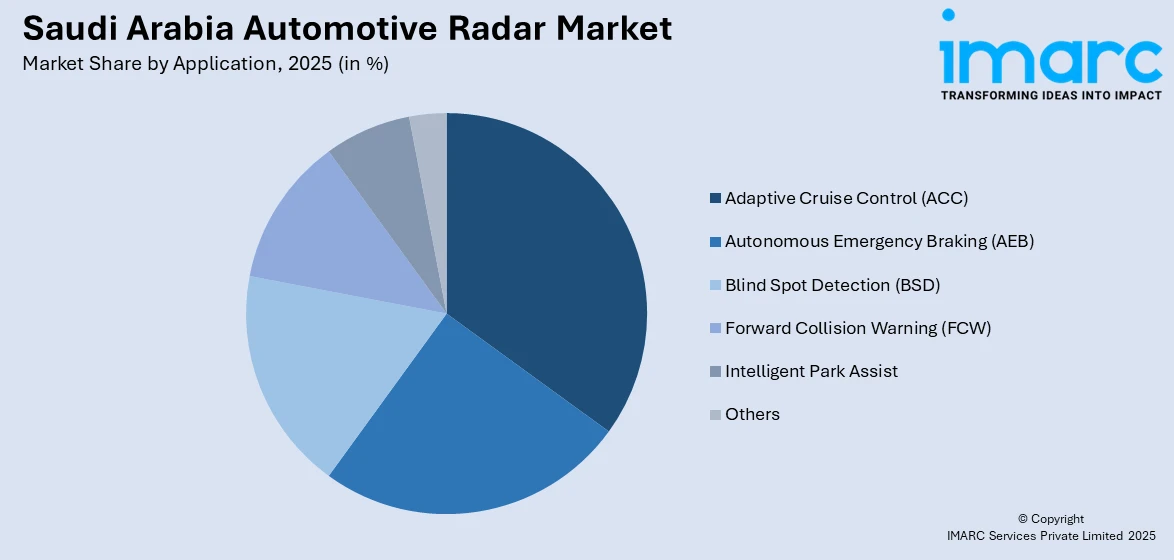

- By Application: Adaptive cruise control (ACC) represents the largest segment with a market share of 21% in 2025, driven by growing consumer preference for highway driving comfort and semi-autonomous driving capabilities.

- By Region: Northern and Central Region leads the market with a share of 30% in 2025, owing to Riyadh's population concentration, higher disposable incomes, and presence of major automotive dealerships.

- Key Players: The Saudi Arabia automotive radar market exhibits a competitive landscape characterized by established international automotive technology suppliers and tier-one manufacturers competing across diverse product segments through strategic partnerships with local distributors and assemblers.

To get more information on this market Request Sample

The Saudi Arabia automotive radar market is experiencing robust growth driven by a convergence of factors reshaping the Kingdom's automotive landscape. Rising consumer awareness about vehicle safety features is prompting increased demand for radar-enabled advanced driver assistance systems across various vehicle segments. As per sources, in November 2025, Zadar Labs partnered with Bidaya Holding and SmartChips to launch “Zadar Saudi Solutions,” advancing radar-enabled vehicle autonomy and local manufacturing, supporting Saudi Arabia’s Vision 2030 smart mobility objectives. Moreover, the government's emphasis on reducing traffic fatalities through intelligent transport solutions is compelling automakers to integrate sophisticated radar technologies in new vehicle models. Furthermore, the expansion of premium and mid-range vehicle sales, coupled with growing urbanization and infrastructure development, is creating substantial opportunities for radar system adoption. The Kingdom's strategic focus on technological advancement and smart mobility initiatives is accelerating investments in automotive safety technologies, positioning radar systems as essential components in modern vehicles sold across the region.

Saudi Arabia Automotive Radar Market Trends:

Integration of Multiple Radar Configurations in Vehicles

The Saudi Arabia automotive radar market is witnessing a significant shift toward multi-radar vehicle architectures, where manufacturers are incorporating various radar types to create comprehensive sensing capabilities. In July 2025, WeRide and Uber launched autonomous robotaxi services in Riyadh using multi‑sensor autonomous vehicles equipped with radar, lidar, and camera systems to enhance situational awareness and redundancy in urban routes. Additionally, this trend involves combining long-range radars for forward collision detection with short and medium-range sensors for surrounding awareness. Automakers are increasingly designing vehicles with strategically positioned radar units at front, rear, and corner locations to eliminate blind spots.

Advancement of Radar Technology for Urban Driving Applications

The market is experiencing growing emphasis on developing radar systems specifically optimized for urban driving conditions prevalent across Saudi Arabian cities. Manufacturers are focusing on enhancing radar resolution and processing capabilities to accurately detect and classify diverse road users, including pedestrians, cyclists, and smaller vehicles. According to sources, Saudi Arabia unveiled the “Future Mobility Sandbox,” a 1.56 sq km autonomous vehicle testbed at KAUST to support advanced sensing technologies such as radar, LiDAR, and cameras in complex urban environments. These technological improvements enable more precise object recognition at closer ranges and slower speeds, making radar systems increasingly effective for automatic emergency braking and pedestrian detection applications.

Growing Focus on Radar-Based Parking Assistance Solutions

The Saudi Arabia automotive radar market is demonstrating increased attention toward sophisticated parking assistance systems powered by advanced radar technologies. Vehicle manufacturers are incorporating radar sensors to enable features such as automated parallel parking, perpendicular parking assistance, and comprehensive surround-view monitoring. These systems utilize short-range radar sensors positioned around the vehicle perimeter to detect obstacles, measure distances, and guide vehicles into parking spaces. The growing popularity of larger vehicles, combined with space constraints in urban parking facilities, is driving demand for radar-enabled parking solutions.

How Vision 2030 is Transforming the Saudi Arabia Automotive Radar Market:

Saudi Arabia’s Vision 2030 is reshaping the automotive radar market by establishing ambitious targets for technological advancement and smart mobility integration across the Kingdom. The initiative's focus on economic diversification is driving substantial investments in advanced automotive technologies, positioning the country as a regional hub for intelligent transportation solutions. Government commitments to modernizing infrastructure and developing smart city projects are creating favorable conditions for radar technology adoption. The vision's emphasis on improving road safety standards and reducing traffic fatalities is accelerating regulatory support for vehicles equipped with advanced driver assistance systems. Furthermore, initiatives supporting autonomous vehicle testing and deployment are stimulating demand for sophisticated radar sensing technologies, while partnerships between local stakeholders and international technology providers are facilitating knowledge transfer and market expansion.

Market Outlook 2026-2034:

The Saudi Arabia automotive radar market revenue is projected to demonstrate substantial expansion throughout the forecast period, supported by sustained demand for advanced vehicle safety technologies and increasing regulatory emphasis on driver assistance features. The market is expected to benefit from continuous technological improvements in radar sensing capabilities and growing integration across broader vehicle segments. Rising consumer expectations for enhanced safety and convenience features, combined with expanding autonomous vehicle initiatives, are anticipated to drive revenue growth. The market generated a revenue of USD 69.9 Million in 2025 and is projected to reach a revenue of USD 316.9 Million by 2034, growing at a compound annual growth rate of 18.28% from 2026-2034.

Saudi Arabia Automotive Radar Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Range |

Long Range |

44% |

|

Vehicle Type |

Passenger Cars |

70% |

|

Application |

Adaptive Cruise Control (ACC) |

21% |

|

Region |

Northern and Central Region |

30% |

Range Insights:

- Long Range

- Medium and Short Range

Long range dominates with a market share of 44% of the total Saudi Arabia automotive radar market in 2025.

Long range commands the leading position in the Saudi Arabia automotive radar market, driven by its essential role in enabling critical highway safety features and semi-autonomous driving capabilities. Long range radar systems provide detection capabilities extending several hundred meters, making them indispensable for adaptive cruise control systems that maintain safe following distances at highway speeds. As per sources, the Saher automated enforcement system using cameras and radar significantly reduced speeding and reckless driving violations on Saudi roads, improving overall traffic safety nationwide.

The increasing adoption of semi-autonomous driving features requiring extended environmental awareness is strengthening demand for long-range radar technologies across premium vehicle segments. These systems enable vehicles to detect and track objects at considerable distances, providing drivers with adequate response time for potential hazards ahead. Automakers are prioritizing long-range radar integration as foundational technology for advanced driver assistance systems, recognizing its critical importance in collision avoidance applications. The segment continues expanding as safety-conscious consumers increasingly demand sophisticated highway driving assistance features in their vehicles.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

Passenger cars lead with a share of 70% of the total Saudi Arabia automotive radar market in 2025.

The passenger cars dominate the Saudi Arabia automotive radar market, reflecting substantial demand for advanced safety technologies in personal vehicles across the Kingdom. This segment's leadership is attributed to the expanding middle-class population with increasing disposable incomes seeking vehicles equipped with modern safety and convenience features. Premium and luxury vehicle brands, which command significant sales volumes in Saudi Arabia, are incorporating comprehensive radar-based ADAS packages as standard or optional equipment to meet evolving consumer expectations for enhanced vehicle safety.

Mid-range vehicle manufacturers are increasingly integrating radar systems to differentiate their offerings and address growing consumer demand for advanced safety capabilities. The rising awareness regarding vehicle safety features among Saudi consumers is prompting automakers to expand radar technology availability across diverse price segments. Additionally, family-oriented purchasing decisions increasingly prioritize safety features, strengthening demand for radar-equipped passenger cars. The segment benefits from robust vehicle sales growth and the Kingdom's relatively young population demonstrating strong interest in technological innovation and modern automotive features.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning (FCW)

- Intelligent Park Assist

- Others

Adaptive cruise control (ACC) exhibits a clear dominance with a 21% share of the total Saudi Arabia automotive radar market in 2025.

Adaptive cruise control (ACC) leads the Saudi Arabia automotive radar market applications, driven by the substantial highway network and long-distance driving patterns prevalent across the Kingdom. ACC systems utilize radar technology to automatically adjust vehicle speed and maintain safe following distances, significantly enhancing driver comfort and safety during extended highway journeys between major cities. In November 2024, Saudi developer Nasser Al-Khaldi launched an AI-driven driver-assist system using cameras and radar, compatible with over 64 car models, improving highway safety and semi-autonomous driving.

The expanding availability of adaptive cruise control across mid-range vehicles is broadening adoption among diverse consumer segments seeking enhanced driving convenience. Integration of ACC with other safety systems creates compelling value propositions for safety-conscious consumers evaluating vehicle options. The technology addresses specific driving requirements in Saudi Arabia, where intercity travel often involves extended periods on highways connecting Riyadh, Jeddah, and other major metropolitan areas. Automakers recognize ACC as a key differentiating feature that enhances customer satisfaction and supports premium positioning strategies in the competitive automotive market.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 30% of the total Saudi Arabia automotive radar market in 2025.

Northern and Central Region dominates the Saudi Arabia automotive radar market, anchored by Riyadh's position as the Kingdom's capital and largest metropolitan area with the highest concentration of population and economic activity. This region benefits from substantial vehicle sales volumes across all segments, supported by established premium vehicle dealerships and comprehensive automotive distribution networks. The region's extensive highway infrastructure connecting major cities creates strong demand for long-range radar applications essential for highway safety features and advanced driver assistance systems.

Urban traffic conditions in Riyadh drive adoption of proximity-based safety features including blind spot detection and automatic emergency braking systems. Government institutions and corporate headquarters concentrated in this region contribute to fleet purchases incorporating advanced safety technologies. Higher disposable incomes enable consumers to purchase premium vehicles equipped with comprehensive radar-based safety packages. The region's continued infrastructure development and smart city initiatives create favorable conditions for advanced automotive technology adoption, positioning it as the primary market for radar-equipped vehicles throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Automotive Radar Market Growing?

Rising Government Initiatives for Road Safety Enhancement

The Saudi Arabia automotive radar market is experiencing significant growth driven by government commitment to improving road safety standards across the Kingdom. Regulatory frameworks are evolving to encourage incorporation of advanced safety features in vehicles sold domestically, while inspection requirements increasingly consider vehicle safety equipment. According to sources, in July 2025, the General Authority for Roads updated the Saudi Roads Code to include advanced infrastructure standards supporting autonomous and smart mobility, such as real‑time communication systems and intelligent parking features, reinforcing the adoption of radar‑based safety technologies. The national program for road safety establishes measurable targets for accident reduction, supporting investments in radar-enabled technologies.

Increasing Adoption of Advanced Driver Assistance Systems

The market is witnessing strong momentum due to escalating adoption of advanced driver assistance systems across diverse vehicle segments in Saudi Arabia. Consumer awareness regarding vehicle safety features continues growing, prompting increased demand for radar-enabled functionalities including lane-keeping assist, blind spot detection, and automatic emergency braking. Automakers are responding by integrating radar-based systems in new vehicle models across premium and mid-range categories. The rising number of road accidents and emphasis on reducing traffic fatalities through intelligent transport solutions are accelerating ADAS uptake throughout the Kingdom.

Expansion of Smart Mobility Infrastructure and Autonomous Vehicle Testing

Saudi Arabia is steadily progressing in testing and development of autonomous and semi-autonomous vehicles, boosting demand for automotive radar systems significantly. Several pilot projects and smart mobility initiatives, particularly in smart city zones, are leveraging radar technology for real-time object detection, collision avoidance, and precise environmental mapping. In July 2025, Saudi Arabia launched the first pilot phase of autonomous self‑driving vehicles across seven key locations in Riyadh, including major highways and airport terminals—under public‑private partnerships with Uber, WeRide, and AiDriver. These developments encourage local automotive stakeholders to invest in radar integration early in vehicle design phases.

Market Restraints:

What Challenges the Saudi Arabia Automotive Radar Market is Facing?

High Costs Associated with Advanced Radar Systems

The Saudi Arabia automotive radar market faces challenges from the elevated costs associated with sophisticated radar technologies and their integration into vehicles. Advanced radar systems, particularly those offering high resolution and extended detection capabilities, require significant investments in sensor hardware, signal processing components, and system integration engineering. These costs are ultimately reflected in vehicle pricing, potentially limiting adoption among price-sensitive consumer segments.

Limited Consumer Awareness in Certain Market Segments

Despite growing overall awareness, the Saudi Arabia automotive radar market encounters constraints from insufficient understanding of radar-based safety technologies among certain consumer demographics. Some potential vehicle buyers remain unfamiliar with ADAS functionalities and their benefits, reducing demand in segments where education gaps persist. The complexity of explaining radar system capabilities and limitations can create confusion among consumers evaluating vehicle options.

Infrastructure and Environmental Adaptation Challenges

The Saudi Arabia automotive radar market faces constraints related to infrastructure readiness and environmental factors affecting radar system performance. Extreme weather conditions, including dust storms and intense heat prevalent in the Kingdom, can potentially impact radar sensor accuracy and reliability. Road infrastructure in certain areas may not fully support optimal ADAS functionality, while variations in road marking quality can affect some radar-dependent features.

Competitive Landscape:

The Saudi Arabia automotive radar market features a dynamic competitive landscape characterized by international automotive technology suppliers and tier-one component manufacturers establishing regional presence through partnerships and distribution agreements. Competition centers on technological differentiation, product reliability, and service support capabilities that meet the demanding requirements of local automotive assemblers and importers. Market participants are investing in localized technical support infrastructure and training programs to strengthen relationships with regional customers. Strategic collaborations between technology providers and local distributors are enhancing market access while facilitating technology transfer and knowledge sharing.

Recent Developments:

- In July 2025, Riyadh’s Public Transport Authority launched a self-driving taxi pilot with WeRide and GAC, deploying radar-equipped autonomous vehicles across seven locations. This 12-month initiative under Vision 2030 aims to improve urban mobility, demonstrate advanced ADAS technology adoption, and position Saudi Arabia as a leader in smart transportation.

Saudi Arabia Automotive Radar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ranges Covered | Long Range, Medium and Short Range |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Intelligent Park Assist, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia automotive radar market size was valued at USD 69.9 Million in 2025.

The Saudi Arabia automotive radar market is expected to grow at a compound annual growth rate of 18.28% from 2026-2034 to reach USD 316.9 Million by 2034.

Long range held the largest market share, driven by its critical role in enabling advanced highway safety features such as adaptive cruise control and forward collision warning systems that require extended detection capabilities for high-speed driving scenarios across the Kingdom's extensive road network.

Key factors driving the Saudi Arabia automotive radar market include rising consumer demand for advanced vehicle safety technologies, government initiatives supporting road safety improvement, expansion of premium vehicle segments, Vision 2030 smart mobility investments, and growing adoption of ADAS features.

Major challenges include high costs associated with advanced radar systems, limited consumer awareness in certain market segments, infrastructure adaptation requirements, environmental factors affecting sensor performance, and the need for localized technical support and service capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)