Saudi Arabia Bags Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Bags Market Overview:

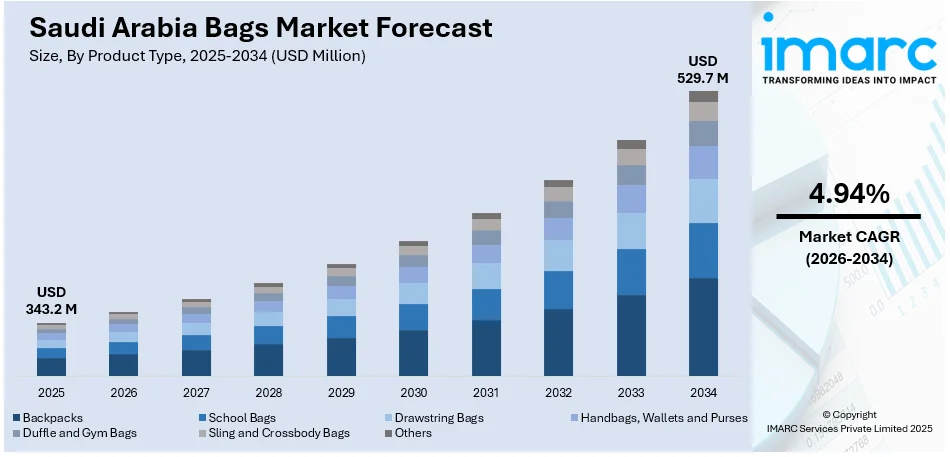

The Saudi Arabia bags market size reached USD 343.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 529.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is driven by the convergence of consumer buying power, changing fashion trends, and heightened exposure to international trends. Government policies to stimulate local production and entrepreneurship, growth of e-commerce and growing need for luxury and eco-friendly bags due to shifting consumer preferences toward superior and environment-friendly choices are some of the other factors further contributing to the dynamic and expanding Saudi Arabia bags market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 343.2 Million |

|

Market Forecast in 2034

|

USD 529.7 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Saudi Arabia Bags Market Trends:

Government Support for Domestic Brands

Saudi Arabia's handbag industry is fueled by robust government efforts toward developing domestic talent and minimizing import dependence. Initiatives such as the "Made in Saudi" program, announced in March 2021, are at the forefront of this change. These initiatives are aimed at supporting domestic production and services domestically, consistent with Saudi Vision 2030's overall objectives. Luxury houses and institutions are taking a leading role in spotting and developing Saudi designers, providing platforms for the development of commercially sustainable brands. The Chalhoub Group's Fashion Lab program, for example, delivers retail visibility, mentorship, and workshops to nascent Saudi brands, increasing visibility and interaction. While these efforts are raising the profile of Saudi-made handbags, they are also helping to build a strong local fashion economy.

To get more information on this market Request Sample

E-Commerce and Digital Transformation

The Saudi Arabian fashion industry is in the midst of a digital revolution, with e-commerce becoming a leading player in the retail sector. According to the IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024, and is further expected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. Websites such as Namshi.com have ridden on this wave, earning heavy revenue and providing a vast range of clothing, accessories, and shoes to customers at the touch of a button. The ease of online shopping, and the convenience of accessing both local and global brands, is transforming consumer behavior and outlooks. With the online world continuing to be transformed, the Saudi fashion business is poised to expand, further propelling the Saudi Arabia bags market growth.

Increasing Demand for Luxury and Eco-Friendly Products

Saudi consumers are preferring luxury handbags based on a variety of factors such as increased disposable incomes, exposure to international fashion trends, and an increased interest in quality craftsmanship. The luxury segment is growing at the highest rate, with consumers perceiving high-quality bags not as mere fashion items but as an investment. This transition is accompanied by an increasing interest in sustainability, as most consumers look for products that come from environmentally friendly materials. This is evident in Samsonite’s figures –in 2023, the portion of products made partly from recycled materials increased to 34% of the company's overall sales from approximately 23% in 2022. Samsonite's most eco-friendly luggage yet, the Magnum Eco Collection, employs recycled materials sourced from discarded yoghurt cups for its exterior and PET bottles for the inner lining. The biggest item in the collection is projected to reuse approximately 483 yoghurt cups and 14 PET bottles. Nonetheless, Samsonite’s emphasis extends beyond just providing sustainable product lines. In addition to increasing the use of recycled materials in its products and preserving its leadership in durable luggage, the company aims to ensure 100% renewable electricity in its operations and greatly cut value chain emissions by 2030. Hence, companies are reacting to this by creating top-quality leather products that appeal both to luxury and to the environment. Furthermore, the official entry of global auction houses such as Christie's into the Saudi market is making the resale market legitimate, providing authentic, collectible, and rare handbags to sophisticated consumers. This convergence of luxury and sustainability is setting new standards in the Saudi handbag market, appealing to a sophisticated and conscientious consumer base.

Saudi Arabia Bags Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, material type, distribution channel, and end user.

Product Type Insights:

- Backpacks

- School Bags

- Drawstring Bags

- Handbags, Wallets and Purses

- Duffle and Gym Bags

- Sling and Crossbody Bags

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes backpacks; school bags; drawstring bags; handbags, wallets and purses; duffle and gym bags; sling and crossbody bags; and others.

Material Type Insights:

- Polyesters

- Nylon

- Leather

- Cotton Canvas

- Others

A detailed breakup and analysis of the market based on the material type has also been provided in the report. This includes polyesters, nylon, leather, cotton canvas, and others.

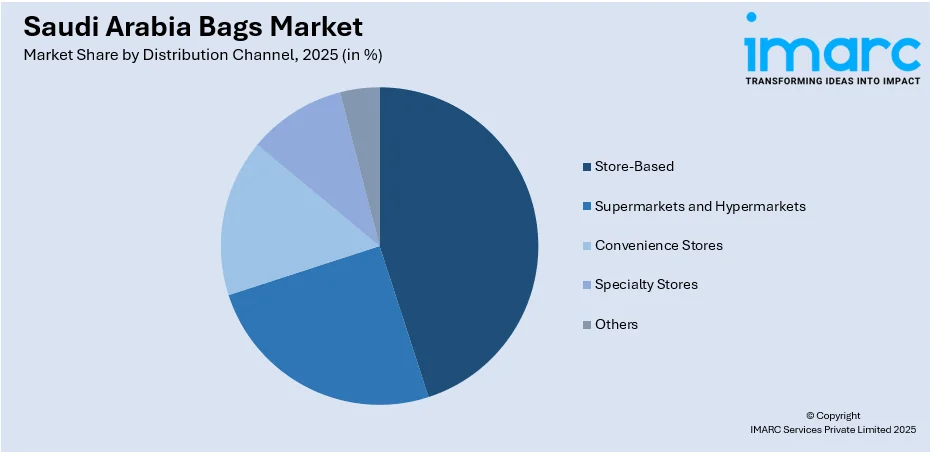

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Store-Based

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes store-based, supermarkets and hypermarkets, convenience stores, specialty stores, and others.

End User Insights:

- 5 to 12 Years

- 13 to 19 Years

- 20 Years and Above

The report has provided a detailed breakup and analysis of the market based on the end user. This includes 5 to 12 years, 13 to 19 years, and 20 years and above.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Backpacks, School Bags, Drawstring Bags, Handbags, Wallets and Purses, Duffle and Gym Bags, Sling and Crossbody Bags, Others |

| Material Types Covered | Polyesters, Nylon, Leather, Cotton Canvas, Others |

| Distribution Channels Covered | Store-Based, Supermarkets & Hypermarket, Convenience Stores, Specialty Stores, Others |

| End Users Covered | 5 To 12 Years, 13 To 19 Years, 20 Years & Above |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia bags market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia bags market on the basis of product type?

- What is the breakup of the Saudi Arabia bags market on the basis of material type?

- What is the breakup of the Saudi Arabia bags market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia bags market on the basis of end user?

- What is the breakup of the Saudi Arabia bags market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia bags market?

- What are the key driving factors and challenges in the Saudi Arabia bags market?

- What is the structure of the Saudi Arabia bags market and who are the key players?

- What is the degree of competition in the Saudi Arabia bags market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia bags market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia bags market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia bags industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)