Saudi Arabia Bath Soap Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2026-2034

Saudi Arabia Bath Soap Market Overview:

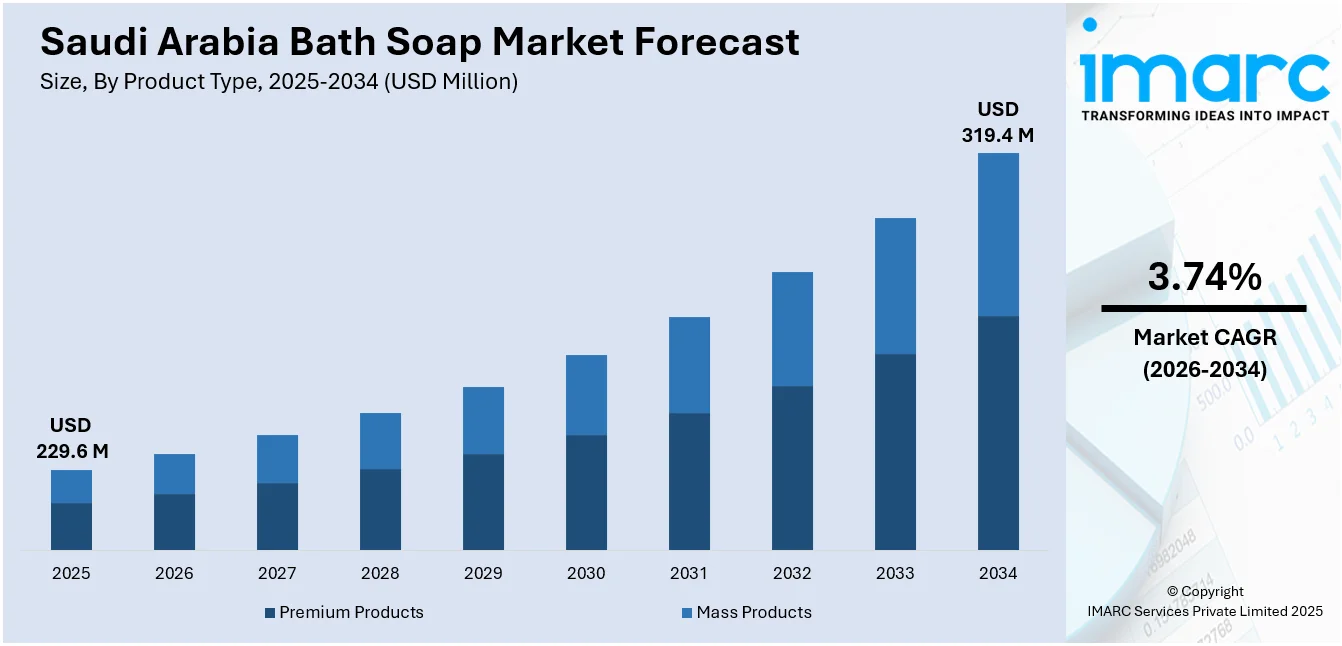

The Saudi Arabia bath soap market size reached USD 229.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 319.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. The rising consumer awareness regarding the importance of personal hygiene, the increasing demand for premium and natural soap products, a shift toward organic and skin-friendly ingredients, and growing urbanization alongside an expanding beauty and personal care industry are among the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 229.6 Million |

| Market Forecast in 2034 | USD 319.4 Million |

| Market Growth Rate 2026-2034 | 3.74% |

Saudi Arabia Bath Soap Market Trends:

Growing Demand for Natural and Organic Bath Soaps

A growing consumer preference for natural, organic, and chemical-free bath soaps is reshaping Saudi Arabia’s personal care market. Heightened awareness of the harmful effects of synthetic ingredients is driving demand for products enriched with natural oils, herbs, and botanicals. In 2024, the country’s organic cosmetics market reached USD 200.08 million and is projected to grow at a CAGR of 5.50% between 2025 and 2033. Health-conscious consumers are increasingly choosing bath soaps made from ingredients like olive oil, coconut oil, and shea butter, which offer nourishment without harsh chemicals. This shift extends beyond soaps to other personal care categories such as shampoos and body washes. Millennials and Gen Z are leading this shift. With brands introducing eco-friendly packaging and cleaner formulations, the natural bath soap segment is poised for continued expansion.

To get more information on this market Request Sample

Increased Demand for Luxury and Premium Bath Soaps

Saudi Arabia’s bath soap market is experiencing a notable surge in demand for luxury and premium products, fueled by rising disposable income, expanding middle-class affluence, and growing interest in personal grooming. According to the World Bank, the country’s per capita disposable income rose from USD 23,460 in 2022 to USD 24,980 in 2023, supporting increased spending on indulgent personal care items. Urban centers like Riyadh and Jeddah are at the forefront of this trend, where consumers seek high-end bath experiences. The premium segment, boosted by local and international brands, is thriving, especially with soaps infused with rare and beneficial ingredients such as argan oil, black seed, gold flakes, and rose extracts. These luxury products are often marketed with upscale packaging and added benefits like anti-aging, hydration, and therapeutic properties. As consumers increasingly value unique scents and holistic wellness, brands are responding with customized formulations, organic components, and refined fragrances to cater to Saudi Arabia’s discerning and style-conscious market.

Saudi Arabia Bath Soap Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, form, and distribution channel.

Product Type Insights:

- Premium Products

- Mass Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes premium products and mass products.

Form Insights:

- Solid Bath Soaps

- Liquid Bath Soaps

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes solid bath soaps and liquid bath soaps.

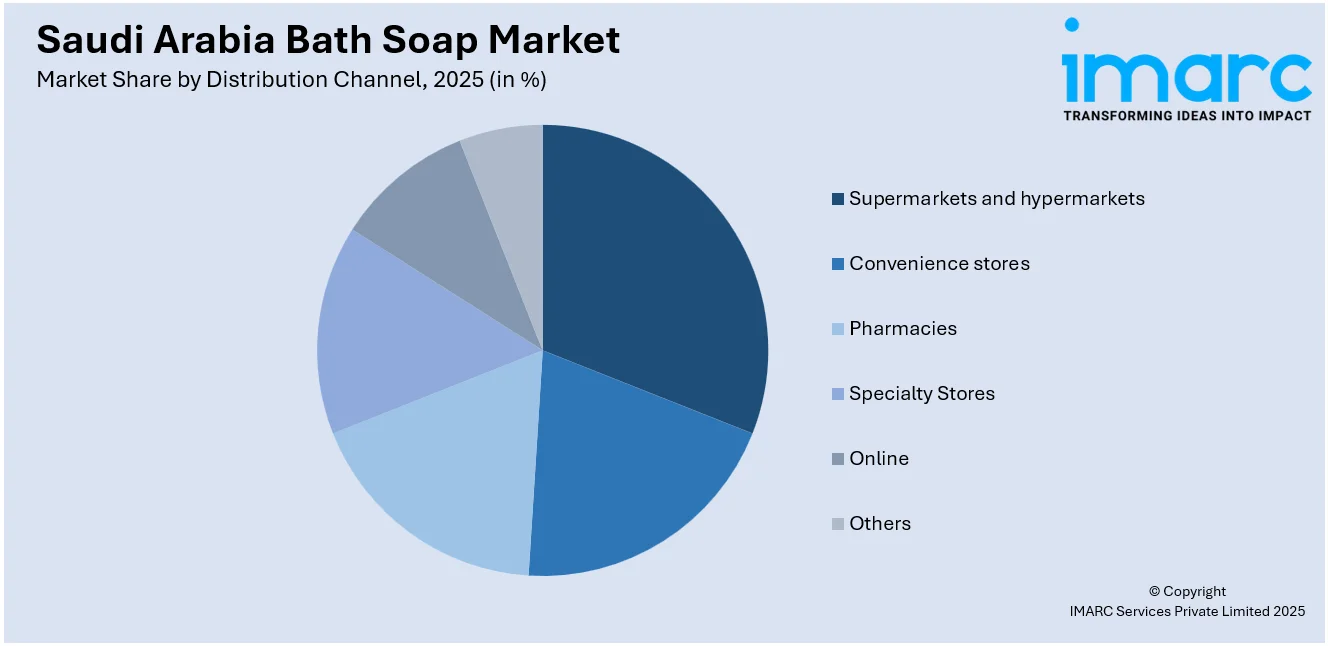

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and hypermarkets

- Convenience stores

- Pharmacies

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, pharmacies, specialty stores, online, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Bath Soap Market News:

- February 2025: STADA expanded its Oilatum skincare line in Saudi Arabia, introducing nine new products, including bath soaps, to address the country's rising cases of eczema and dry skin. The range features rich moisturizing creams, gentle body washes, and baby-specific items like soothing bath bubbles and head-to-toe wash. These products are enriched with ceramides, pro-vitamin B5, and glycerine to hydrate and restore the skin's barrier.

- January 2025: Riyadh-based artisanal soap brand Mayassem introduced its "Arabian Silk Road" collection, featuring handcrafted soaps infused with local ingredients such as camel milk from Janadriyah, olive oil from Al-Jouf, and honey from Baha. Mayassem specializes in handmade soaps reflecting Saudi Arabia's rich natural resources and cultural heritage.

- September 2024: Nykaa established a new subsidiary in Saudi Arabia, marking a significant step in its Middle East expansion. This move aims to introduce its diverse range of beauty and personal care products, including bath soaps, to the Saudi market. By leveraging its experience in India's D2C sector, Nykaa seeks to cater to the growing demand for quality bath soaps and related products in Saudi Arabia.

Saudi Arabia Bath Soap Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Premium Products, Mass Products |

| Forms Covered | Solid Bath Soaps, Liquid Bath Soaps |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Specialty Stores, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia bath soap market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia bath soap market on the basis of product type?

- What is the breakup of the Saudi Arabia bath soap market on the basis of form?

- What is the breakup of the Saudi Arabia bath soap market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia bath soap market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia bath soap market?

- What are the key driving factors and challenges in the Saudi Arabia bath soap market?

- What is the structure of the Saudi Arabia bath soap market and who are the key players?

- What is the degree of competition in the Saudi Arabia bath soap market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia bath soap market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia bath soap market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia bath soap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)