Saudi Arabia Bearings Market Size, Share, Trends and Forecast by Product, Type, End User, and Region, 2026-2034

Saudi Arabia Bearings Market Overview:

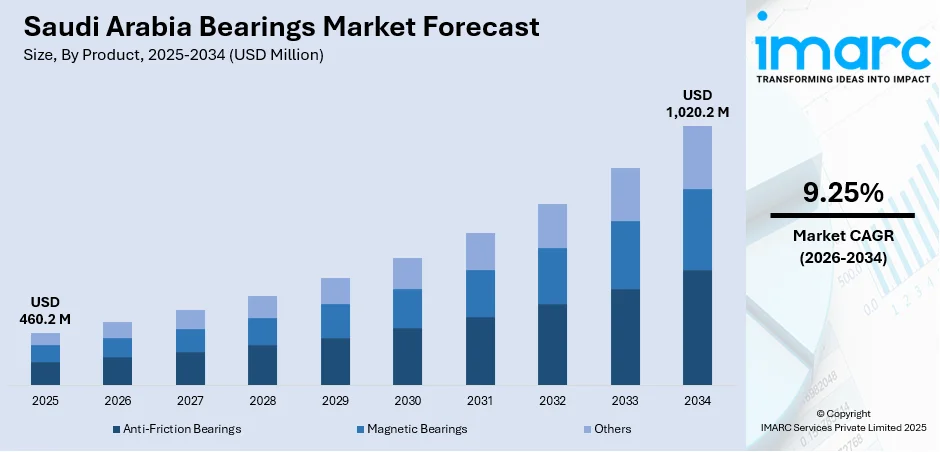

The Saudi Arabia bearings market size reached USD 460.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,020.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.25% during 2026-2034. The market is driven by the strong requirement due to the expansion of manufacturing and industrial automation sectors, particularly in petrochemicals, mining, and energy. Growth in automotive production and aftermarket services is further accelerating the need for high-performance bearing solutions, propelled by increased vehicle sales and repair activities. Additionally, government-backed infrastructure projects under Vision 2030, including transport and construction developments, are key factors expanding the Saudi Arabia bearings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 460.2 Million |

| Market Forecast in 2034 | USD 1,020.2 Million |

| Market Growth Rate 2026-2034 | 9.25% |

Saudi Arabia Bearings Market Trends:

Expanding Automotive Industry

The rapid growth of Saudi Arabia’s automotive industry is positively influencing the market. With increasing vehicle ownership, rising disposable incomes, and government incentives for local automobile assembly, the demand for bearings in engines, wheels, transmissions, and steering systems is surging. Bearings are crucial for reducing friction, enhancing fuel efficiency, and ensuring smoother vehicle performance, making them indispensable components across passenger and commercial vehicles. Additionally, the expansion of electric vehicle (EV) adoption under sustainability goals is catalyzing the demand for specialized bearings that can handle high speeds and electric drivetrains. As per industry reports, in 2024, electric vehicle (EV) sales soared to approximately 24,092 units in Saudi Arabia. As the Kingdom is developing automotive hubs and strengthening its role in regional auto trade, bearings remain essential to both manufacturing and maintenance.

To get more information on this market, Request Sample

Infrastructure and Construction Development

Saudi Arabia’s thriving construction sector, fueled by megaprojects, such as NEOM, is a significant driver of the market expansion. As per the government data, the construction industry in Saudi Arabia continued to flourish, with contract awards reaching SR185 Billion (USD 49.3 Billion) during the first half of 2024. Bearings are essential components in construction machinery, including excavators, cranes, loaders, and drilling equipment, which are heavily utilized in large-scale infrastructure projects. As the government is investing billions in smart cities, airports, railways, and housing developments, the demand for construction machinery continues to escalate, strengthening the market. High-performance bearings are required to withstand heavy loads, dust, and harsh working conditions in these environments. Additionally, rental and resale of construction machinery are catalyzing the demand for replacement bearings, ensuring continuous market activity.

Expansion of Renewable Energy Projects

The broadening of renewable energy projects, including wind and solar power, is driving the demand for bearings in Saudi Arabia. As per the IMARC Group, the Saudi Arabia renewable energy market size was valued at 2.09 Gigawatt in 2024. Bearings are vital in wind turbines, where they ensure the smooth rotation of blades and reliable power generation. Similarly, bearings are used in solar tracking systems that align panels for maximum energy efficiency. With the government’s ambitious renewable targets under Vision 2030, including generating significant portions of energy from renewables, the demand for durable, low-maintenance bearings is rising. These projects often require bearings that can withstand extreme temperatures and environmental stress, creating opportunities for advanced bearing technologies. Moreover, foreign investments in renewable infrastructure bring in sophisticated machinery dependent on precision bearings.

Key Growth Drivers of Saudi Arabia Bearings Market:

Growth in Industrial Manufacturing and Machinery

Saudi Arabia’s expanding industrial sector, driven by Vision 2030’s economic diversification, is driving the demand for bearings used in machinery and equipment. Bearings play a critical role in ensuring operational efficiency, reducing downtime, and extending the lifespan of industrial machines. Industries, such as mining, steel, cement, and petrochemicals, rely heavily on heavy-duty bearings to withstand high temperatures, heavy loads, and continuous operations. The establishment of new industrial zones and manufacturing clusters is increasing the utilization of high-precision bearings in production lines and robotics. Government initiatives to localize manufacturing and promote industrial self-sufficiency are further supporting this trend. With foreign investments bringing advanced technologies and automation, the need for durable, high-performance bearings is rising rapidly.

Rising Demand from Oil and Gas Sector

The oil and gas sector, a backbone of Saudi Arabia’s economy, remains a significant consumer of bearings. Bearings are extensively used in drilling rigs, pumps, compressors, turbines, and other heavy-duty equipment that operate under extreme pressure and demanding conditions. As Saudi Arabia continues investing in upstream exploration, refining, and petrochemical expansions, the demand for high-performance bearings is growing. Bearings designed for oil and gas applications must withstand corrosion, heavy loads, and harsh operating environments, creating opportunities for premium and technologically advanced products. The expansion of offshore projects and enhanced recovery methods is further increasing reliance on reliable bearings. Moreover, the emphasis on maintaining efficiency and minimizing downtime in oilfield operations is fueling the market expansion.

Technological Advancements and Smart Bearings

The adoption of advanced technologies, including the Internet of Things (IoT)-enabled smart bearings, is propelling the market growth in Saudi Arabia. Smart bearings equipped with sensors monitor temperature, vibration, and load, enabling predictive maintenance and reducing unplanned downtime in critical operations. Industries, such as automotive, oil and gas, and manufacturing, are adopting these solutions to improve operational efficiency and cut costs. With the government encouraging digital transformation, industrial players are investing in smart technologies, including connected bearings. Additionally, global manufacturers are introducing high-performance materials like ceramics and composites, enhancing durability and efficiency. This shift towards advanced bearings is supporting high-speed applications, energy efficiency, and safety. The rising awareness about cost savings through predictive maintenance is further boosting the adoption.

Saudi Arabia Bearings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, type, and end user.

Product Insights:

- Anti-Friction Bearings

- Magnetic Bearings

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes anti-friction bearings, magnetic bearings, and others.

Type Insights:

- Ball Bearings

- Roller Bearings

- Plain Bearings

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes ball bearings, roller bearings, plain bearings, and others.

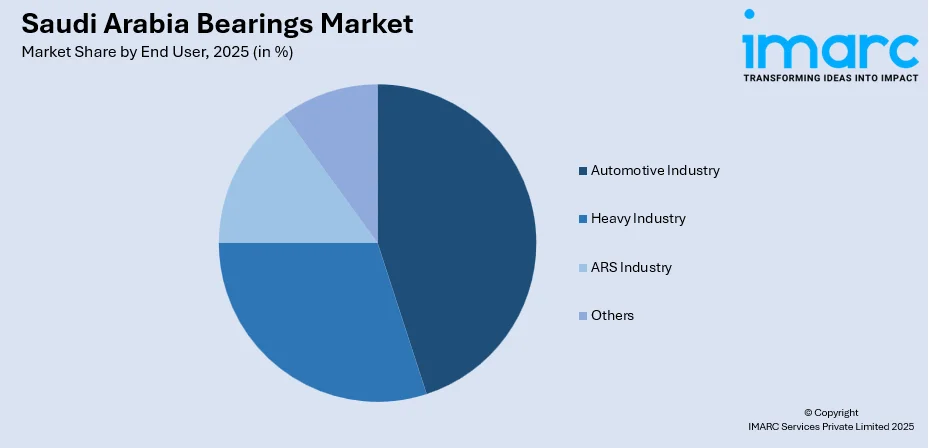

End User Insights:

- Automotive Industry

- Heavy Industry

- ARS Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive industry, heavy industry, ARS industry, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Anti-Friction Bearings, Magnetic Bearings, Others |

| Types Covered | Ball Bearings, Roller Bearings, Plain Bearings, Others |

| End Users Covered | Automotive Industry, Heavy Industry, ARS Industry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia bearings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia bearings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia bearings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bearings market in Saudi Arabia was valued at USD 460.2 Million in 2025.

The Saudi Arabia bearings market is projected to exhibit a CAGR of 9.25% during 2026-2034, reaching a value of USD 1,020.2 Million by 2034.

Vision 2030’s focus on diversifying the economy has encouraged industrial growth, which is supporting the use of bearings in production and engineering applications. The oil and gas sector is also contributing significantly, as bearings are needed in drilling and refining equipment. Additionally, rising demand for energy-efficient machinery and advanced automotive designs is driving the adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)