Saudi Arabia Big Data and Artificial Intelligence Market Report by Component (Hardware, Software, Service), Organization Size (SMEs, Large Enterprises), End User (IT And Telecom, Retail, Public and Government Institutions, BFSI, Healthcare, Energy, Construction and Manufacturing, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia big data and artificial intelligence market size reached USD 5.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 39.0 Million by 2034, exhibiting a growth rate (CAGR) of 25.30% during 2026-2034. The growing digitalization in various fields, including business operations, social interactions, and IoT devices, which has led to exponential growth in data generation, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.1 Million |

|

Market Forecast in 2034

|

USD 39.0 Million |

| Market Growth Rate 2026-2034 | 25.30% |

Big data refers to the complex and vast sets of data that are too large and intricate for traditional data processing methods to handle effectively. It encompasses structured and unstructured data from various sources, including social media, sensors, and online transactions. Big data technologies enable the storage, analysis, and extraction of valuable insights from this data, helping organizations make informed decisions, detect patterns, and uncover trends. Artificial intelligence (AI) refers to the field of computer science dedicated to creating intelligent machines that can mimic human cognitive functions. AI encompasses numerous techniques, such as machine learning and deep learning, which enable systems to learn from data and enhance their performance over time. AI applications range from natural language processing and image recognition to autonomous vehicles and recommendation systems. Together, big data and AI synergize to process vast datasets, extract meaningful information, and automate decision-making processes. They find applications in healthcare, finance, marketing, and many other sectors, revolutionizing how businesses operate and providing insights that were previously unimaginable.

Saudi Arabia Big Data and Artificial Intelligence Market Trends:

Vision 2030 and Government-Led Digital Transformation

Saudi Arabia’s Vision 2030 strategy is a foundational driver for the market growth, as the government is prioritizing digital transformation, smart cities, and a knowledge-based economy. Public-sector initiatives are encouraging ministries and state-owned enterprises to adopt data-driven decision-making, invest in analytics platforms, and build national AI capabilities. Large-scale projects, such as smart city developments and e-government programs, generate enormous volumes of data requiring advanced analytics, while government funding and national strategies are creating favorable conditions for private investment. In June 2025, Naver Cloud entered a memorandum of understanding (MOU) with New Murabba, a real estate development firm affiliated with Saudi Arabia’s Public Investment Fund (PIF), to collaborate on future city infrastructure technologies, such as robotics, autonomous driving, and smart city solutions. Regulatory frameworks, national AI strategies, and public-private partnerships sponsored or encouraged by the state provide both leadership and resources for talent development and infrastructure.

Rapid Cloud and Infrastructure Expansion

The expansion of cloud services and modern data centers across Saudi Arabia underpins the scalability and availability of big data and AI solutions. As per the IMARC Group, the Saudi Arabia cloud services market size reached USD 4.0 Billion in 2024. As hyperscalers and regional cloud providers are increasing local presence, enterprises are gaining easier access to elastic compute, storage, and managed AI services, reducing entry barriers for innovations. Improved connectivity, carrier-neutral data centers, and lower-latency networks support real-time analytics, machine learning (ML) model training, and large-scale data processing. This infrastructure growth is enabling startups and established firms alike to deploy sophisticated AI workloads without heavy upfront capital expenditure. Additionally, enterprise migration to hybrid and multi-cloud architectures allows the integration of on-premises data with cloud-native analytics tools, accelerating proof-of-concept projects and large-scale production deployments.

Corporate Investments and Private Sector Digitization

Large corporates and conglomerates in Saudi Arabia are investing heavily in digital transformation programs, which include building analytics teams, procuring big data and AI platforms, and upskilling staff. In May 2025, Crown Prince Mohammed bin Salman of Saudi Arabia established a new firm under the Public Investment Fund (PIF) called ‘Humain’ to create and oversee AI technologies. Led by the crown prince, Humain would offer an extensive array of AI services, products, and tools, such as next-generation data centers, AI infrastructure, cloud features, and sophisticated AI models and solutions. These companies often act as anchor customers for technology vendors and startups, sponsoring pilot projects that scale into enterprise-wide solutions. Digitization efforts, spanning customer experience automation, supply chain optimization, and operational efficiency are driving consistent procurement demand for big data tools, ML models, and managed services.

Key Growth Drivers of Saudi Arabia Big Data and Artificial Intelligence Market:

Talent Development and Academic-Industry Collaboration

Investments in human capital and stronger ties between universities, research centers, and industry are expanding Saudi Arabia’s AI talent pool and research output. Scholarship programs, specialized AI courses, and government-sponsored research initiatives are producing data scientists, ML engineers, and domain experts. Collaborations between academia and enterprises on pilot projects and proof-of-concepts help transition theoretical research into commercial applications. Local talent availability lowers implementation costs and shortens project timelines, enabling more organizations, especially SMEs, to experiment with AI. Training programs run by global vendors and consultancy-led upskilling initiatives are further supporting adoption. Continuous talent development is central to sustainable market growth because advanced analytics ecosystems depend as much on people and processes as on technology.

Increasing Availability of Localized Data and Data Sovereignty Policies

As organizations are collecting more locally generated data, including customer transactions, the Internet of Things (IoT) sensor feeds, telecom usage, and government records, the value of localized analytics is rising. Data sovereignty and regulatory considerations often require data residency within national borders, encouraging deployment of local cloud regions and on-premise solutions that comply with national policies. The availability of localized datasets improves the relevance and accuracy of big data and AI models for regional dialects, consumer behavior, and operational patterns, which, in turn, is increasing enterprise confidence in deploying AI at scale. Localization also encourages international vendors to partner with local players and establish regional operations, thereby strengthening the ecosystem and providing more customized, compliant solutions to Saudi customers.

Growing Startup Ecosystem and Access to Funding

A burgeoning startup ecosystem focused on AI, analytics, and big data-driven applications is positively influencing the market by delivering niche solutions and rapid innovations. Incubators, accelerators, and increased venture capital activity, both domestic and regional, are enabling AI startups to develop industry-specific products and demonstrate viability through agile pilots. These startups often collaborate with larger enterprises to address specialized needs, such as Arabic natural language processing (NLP), energy optimization, and fintech risk models. The presence of early adopters willing to pilot emerging technologies shortens the sales cycle for innovative vendors. As success stories are emerging, investor confidence is growing, creating a virtuous cycle of funding, talent attraction, and commercial scaling that collectively propels the big data and AI market forward.

Saudi Arabia Big Data and Artificial Intelligence Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, organization size, and end user.

Component Insights:

To get more information on this market, Request Sample

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and service.

Organization Size Insights:

- SMEs

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMEs and large enterprises.

End User Insights:

- IT and Telecom

- Retail

- Public and Government Institutions

- BFSI

- Healthcare

- Energy

- Construction and Manufacturing

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes IT and telecom, retail, public and government institutions, BFSI, healthcare, energy, construction and manufacturing, and others.

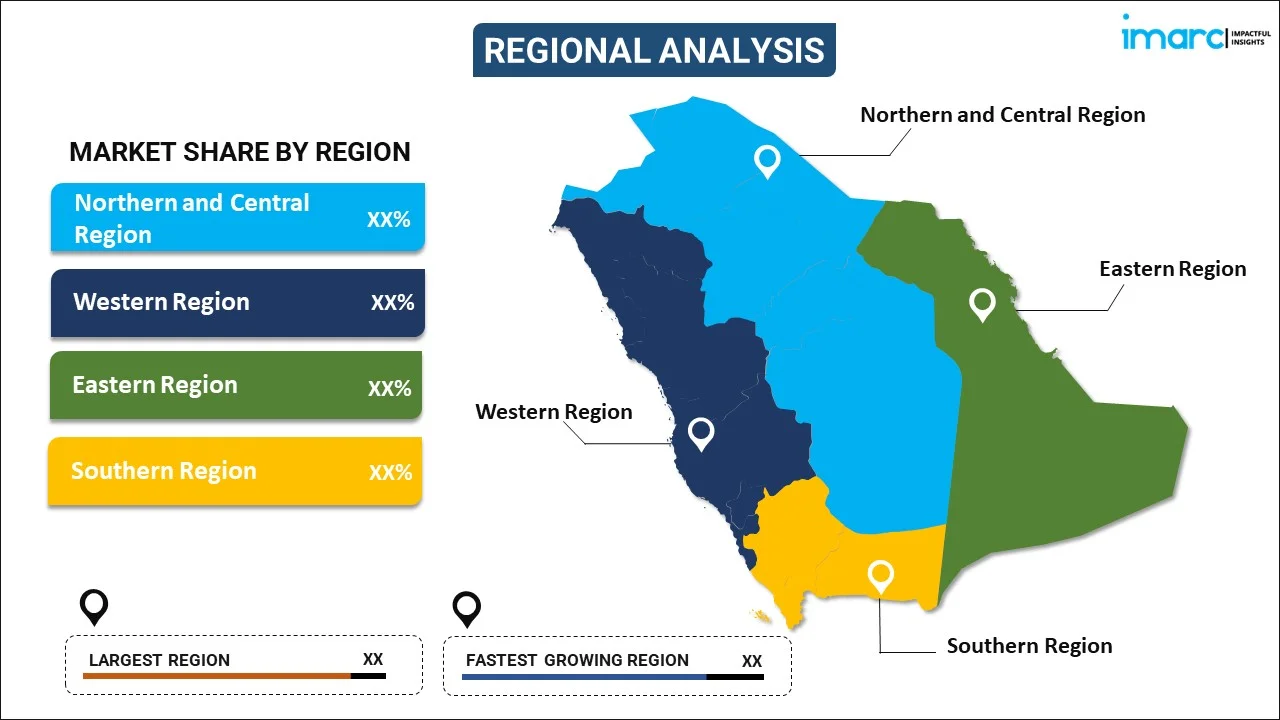

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Big Data and Artificial Intelligence Market News:

- September 2025: Dyna.Ai, a prominent global AI-as-a-service provider, revealed its plans to enhance its investment and expand its footprint in Saudi Arabia. Recruitment would persist in the country to satisfy the need for advanced AI solutions, encompassing complex algorithms, AI-human interaction technologies, and big data analytics.

- July 2025: Cloudera and Aramco, a prominent integrated energy and chemicals company, reached a Memorandum of Understanding (MoU). The MoU detailed strategies for collaborative initiatives to utilize Cloudera’s platform and Aramco’s industry know-how to develop AI-driven solutions and applications that could advance the broadening of the digital oil and gas industry in Saudi Arabia. Cloudera and Aramco aimed to investigate new trends and technologies in data science, big data, and AI.

- April 2025: Microsoft and Databricks enhanced their strategic alliance to improve the accessibility of Azure Databricks features for organizations throughout Saudi Arabia. This improved cooperation represented a crucial advancement in enabling local enterprises to harness the opportunities presented by big data and AI, fostering innovations and aiding the Kingdom's bold Vision 2030 objectives.

Saudi Arabia Big Data and Artificial Intelligence Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Service |

| Organization Sizes Covered | SMEs, Large Enterprises |

| End Users Covered | IT and Telecom, Retail, Public and Government Institutions, BFSI, Healthcare, Energy, Construction and Manufacturing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia big data and artificial intelligence market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia big data and artificial intelligence market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia big data and artificial intelligence industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The big data and artificial intelligence market in Saudi Arabia was valued at USD 5.1 Million in 2025.

The Saudi Arabia big data and artificial intelligence market is projected to exhibit a CAGR of 25.30% during 2026-2034, reaching a value of USD 39.0 Million by 2034.

Government-backed investments in smart cities require advanced data analytics and AI systems to manage energy, transportation, and citizen services efficiently. Enterprises are utilizing big data and AI solutions for predictive analytics, customer personalization, fraud detection, and operational optimization. The financial sector, healthcare, retail, and logistics are among the leading adopters, leveraging AI to enhance decision-making and service delivery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)