Saudi Arabia Biodegradable Packaging Market Size, Share, Trends and Forecast by Material Type, Application, and Region, 2026-2034

Saudi Arabia Biodegradable Packaging Market Summary:

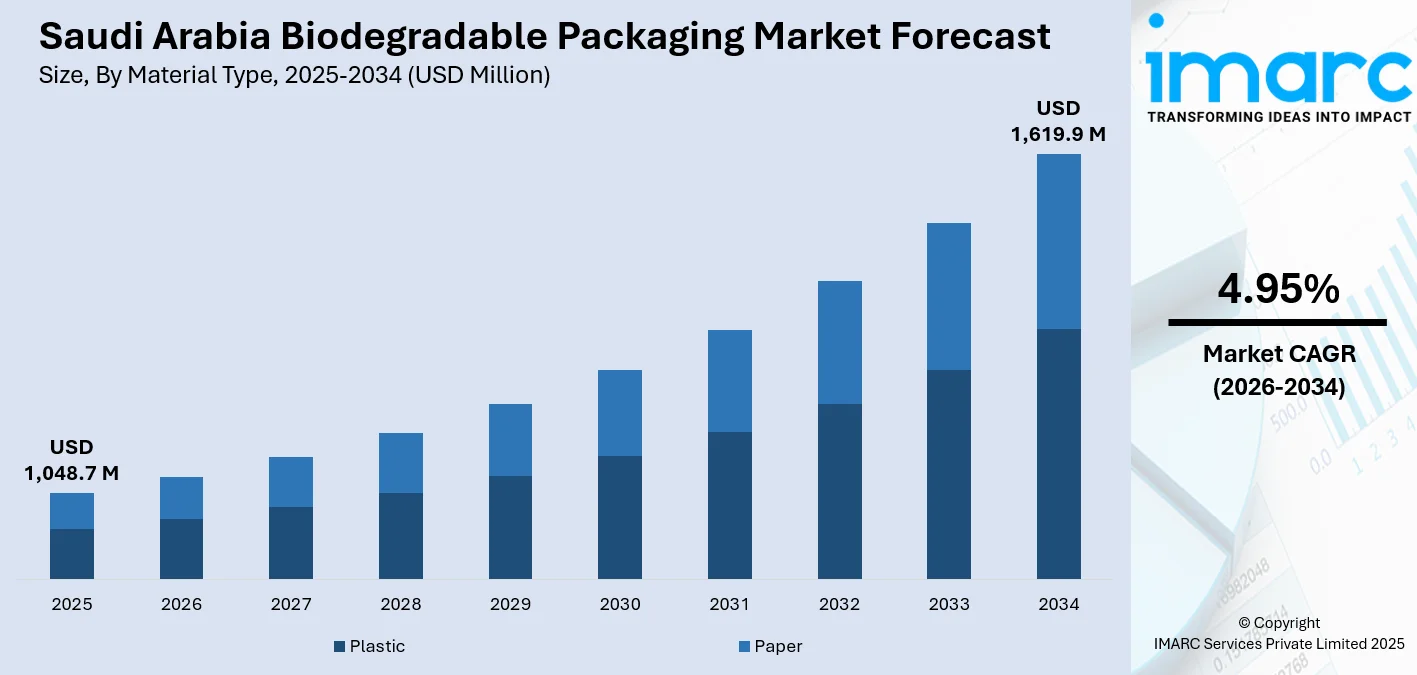

The Saudi Arabia biodegradable packaging market size was valued at USD 1,048.7 Million in 2025 and is projected to reach USD 1,619.9 Million by 2034, growing at a compound annual growth rate of 4.95% from 2026-2034.

The sector is experiencing sustained growth as the Kingdom advances its environmental sustainability agenda alongside rapid retail modernization and evolving preferences. Driven by comprehensive regulatory frameworks targeting single-use plastic reduction, Vision 2030 circular economy initiatives, and growing preference for eco-conscious products across urban centers, the market encompasses diverse paper-based and bioplastic solutions deployed across various industries. The sector benefits from government support mechanisms, modern trade channel expansion, and increasing corporate sustainability commitments among multinational brands operating within the Kingdom, thereby expanding the Saudi Arabia biodegradable packaging market share.

Key Takeaways and Insights:

- By Material Type: Paper dominates the market with a share of 57.96% in 2025, benefiting from established manufacturing infrastructure and superior cost competitiveness compared to emerging bioplastic alternatives.

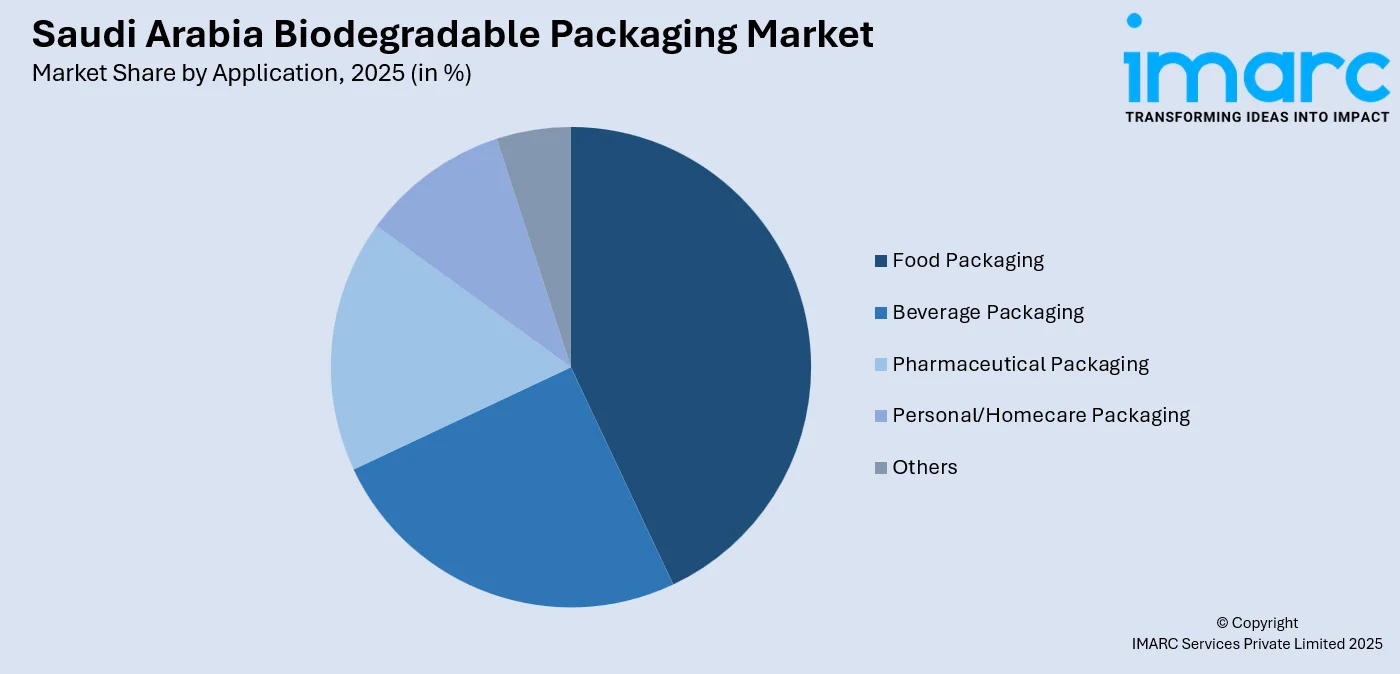

- By Application: Food packaging leads the market with a share of 42.93% in 2025, propelled by stringent food safety requirements and the Kingdom's expanding quick-service restaurant sector.

- By Region: Northern and central region represents the largest segment with a market share of 28% in 2025, anchored by Riyadh's concentration of manufacturing facilities and distribution networks.

- Key Players: The Saudi Arabia biodegradable packaging market demonstrates evolving competitive dynamics, with international sustainable packaging specialists partnering alongside regional converters to address both premium food service requirements and cost-sensitive retail applications across differentiated price segments.

To get more information on this market Request Sample

The Kingdom's biodegradable packaging landscape is fundamentally shaped by Vision 2030's circular economy objectives and the Saudi Green Initiative's waste diversion targets. The Northern and Central Region's market leadership reflects Riyadh's role as both a consumption hub and logistics gateway, where modern trade channels and hospitality sectors drive sophisticated packaging requirements. Paper-based solutions maintain dominance through proven recyclability infrastructure and familiarity among both manufacturers and end-users, while emerging polylactic acid and starch-based alternatives gradually penetrate premium segments. The food packaging application's prominence stems from heightened safety consciousness following recent public health developments and the proliferation of cloud kitchen models requiring delivery-optimized sustainable formats. Saudi Arabia has declared stringent new rules for the packaging and labeling of fruits and vegetables available in local markets, bolstering national initiatives to guarantee food safety, promote environmental sustainability, and align with the Kingdom’s Vision 2030 reform agenda. The regulations, released on Thursday, September 18, 2025, were established by the Ministry of Environment, Water and Agriculture (MEWA). Regional disparities in adoption rates mirror infrastructure maturity, with Western Region's Red Sea tourism developments and Eastern Region's petrochemical clusters presenting distinct growth trajectories. The market's moderate growth rate reflects balancing acts between environmental aspirations, cost sensitivities in price-conscious consumer segments, and technical performance requirements that traditional petroleum-based packaging still addresses more effectively in certain applications.

Saudi Arabia Biodegradable Packaging Market Trends:

Integration of Date Palm Biomass in Localized Bioplastic Production

Saudi Arabia's abundant agricultural waste streams, particularly date palm residues from the Kingdom's position as the world's second-largest date producer, are increasingly being valorized into biodegradable packaging feedstocks through emerging biorefinery initiatives. This trend aligns with circular economy principles by converting agricultural byproducts into value-added materials while reducing reliance on imported biopolymer resins. Collaborative research between King Abdulaziz City for Science and Technology and local packaging converters is testing cellulose extraction methods that convert palm fronds and date pits into strengthening fibers for compostable food containers, creating economically viable alternatives to conventional kraft paper imports while supporting rural agricultural communities. In 2025, Polymeron, a startup from KAUST, converted agricultural waste into high-quality biodegradable plastics, promoting the Kingdom’s national goals in sustainability and innovation. Through the upcycling of date byproducts, a signature of Saudi agriculture, and by venturing into the processing of poultry waste, the company is contributing to the development of a circular economy based on local materials.

Regulatory Harmonization with GCC Standardization Frameworks

The Saudi Standards, Metrology and Quality Organization's ongoing alignment with Gulf Cooperation Council technical regulations is establishing unified biodegradability certification protocols that facilitate cross-border trade while eliminating ambiguous "green" marketing claims. This standardization trend provides clarity for manufacturers regarding compostability timeframes, material composition disclosures, and end-of-life disposal pathways. Recent consultations between regulatory authorities and industry stakeholders are developing testing methodologies specific to the Kingdom's arid climate conditions, recognizing that European biodegradation standards designed for temperate composting environments may not accurately reflect decomposition rates in Saudi Arabia's hot, low-moisture waste management contexts. In 2025, the waste management industry in Saudi Arabia experienced a structural change, establishing itself as a potential investment opportunity. The National Center for Waste Management, referred to as MWAN, informed Al-Eqtisadiah that investment prospects in the industry are projected to reach approximately SR420 billion ($112 billion) by 2040, mainly aiming at private sector involvement. Based on MWAN’s licensing database, the total number of licensed entities in the sector has reached 1,348, alongside 145 permits for recycling plants, resulting in 1,493 investing companies, highlighting the sector’s expanding investment foundation and varied activities.

Premium Positioning in Luxury Hospitality and NEOM Development Projects

Saudi Arabia's mega-tourism projects, particularly The Red Sea Development and NEOM's sustainable city concepts, are establishing biodegradable packaging as a differentiating amenity within premium hospitality experiences. Fairmont The Red Sea is one of the luxurious projects, featuring 193 rooms, six distinct dining concepts, including an overwater restaurant with views of the Red Sea, and a spa, and is planned to open on May 2026. These developments mandate comprehensive sustainability credentials that extend beyond operational carbon footprints to encompass guest-facing materials including food service ware, retail shopping bags, and room amenity packaging. The trend is cascading into mainstream hospitality as international hotel brands operating in Jeddah and Riyadh adopt corporate sustainability commitments requiring certified compostable alternatives for in-room dining and event catering applications, creating demonstration effects that influence broader consumer expectations and retail adoption patterns.

How Vision 2030 is Transforming the Saudi Arabia Biodegradable Packaging Market:

Saudi Arabia’s Vision 2030 is pushing a clear shift in the packaging sector, with biodegradable materials moving from niche to mainstream. The plan’s focus on waste reduction, circular economy practices, and local manufacturing has tightened rules around single use plastics and encouraged alternatives that break down naturally. Government bodies are promoting compostable and bio based packaging through regulations, public procurement preferences, and extended producer responsibility programs. Retailers, food service companies, and FMCG brands are responding quickly. Many are replacing conventional plastic with paper based, starch based, and plant derived packaging to stay aligned with new compliance norms and consumer expectations. At the same time, Vision 2030 incentives are attracting investment into domestic production of biodegradable packaging, reducing reliance on imports and building local supply chains. Public awareness campaigns tied to sustainability goals are also shaping buying habits. Shoppers are paying more attention to packaging choices, which is reinforcing demand. Together, regulation, investment, and consumer behavior are reshaping how packaging is produced and used across the Kingdom.

Market Outlook 2026-2034:

Saudi Arabia's biodegradable packaging sector is positioned for steady advancement as regulatory enforcement mechanisms strengthen, manufacturing localization initiatives mature, and sustainability awareness deepens across consumer segments. The market's growth trajectory will be influenced by planned expansions in domestic paper manufacturing capacity that reduce import dependency, ongoing negotiations regarding extended producer responsibility frameworks that clarify end-of-life management obligations, and the Kingdom's strategic positioning as a potential regional bioplastics export hub leveraging existing petrochemical infrastructure for bio-based monomer production. The market generated a revenue of USD 1,048.7 Million in 2025 and is projected to reach a revenue of USD 1,619.9 Million by 2034, growing at a compound annual growth rate of 4.95% from 2026-2034. Investment flows into composting infrastructure development, supported by municipal waste management modernization programs, will address critical disposal pathway gaps that currently constrain market expansion.

Saudi Arabia Biodegradable Packaging Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Type |

Paper |

57.96% |

|

Application |

Food Packaging |

42.93% |

|

Region |

Northern and Central Region |

28% |

Material Type Insights:

- Plastic

- Starch-based Plastics

- Cellulose-based Plastics

- Polylactic Acid (PLA)

- Poly-3-Hydroxybutyrate (PHB)

- Polyhydroxyalkanoates (PHA)

- Others

- Paper

- Kraft Paper

- Flexible Paper

- Corrugated Fiberboard

- Boxboard

Paper dominates with a market share of 57.96% of the total Saudi Arabia biodegradable packaging market in 2025.

Paper-based biodegradable packaging maintains its commanding position through established supply chain ecosystems and favorable economics that align with price-sensitive bulk purchasing across Saudi Arabia's retail and quick-service restaurant sectors. The material's dominance reflects decades of infrastructure investment in paper recycling collection systems, particularly in major metropolitan areas where municipal waste management programs have created consumer familiarity with paper disposal pathways. Kraft paper's inherent strength properties and printability enable brand differentiation without compromising structural integrity during storage and transportation across the Kingdom's extreme temperature variations, from coastal humidity in Jeddah to interior desert heat exceeding forty-five degrees Celsius.

The corrugated fiberboard subsegment demonstrates particular strength in e-commerce fulfillment applications, where Saudi Arabia's rapidly expanding online retail sector demands protective packaging solutions that satisfy both sustainability expectations and logistics performance requirements. Boxboard applications dominate in pharmaceutical and personal care secondary packaging, where regulatory compliance regarding material safety documentation favors paper substrates with established approval histories over emerging bioplastic alternatives requiring extensive validation testing. The paper segment's continued expansion is supported by planned capacity additions at domestic pulp mills in the Eastern Province, which will reduce import dependency and improve price competitiveness against petroleum-derived flexible packaging incumbents.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Packaging

- Beverage Packaging

- Pharmaceutical Packaging

- Personal/Homecare Packaging

- Others

Food packaging leads with a share of 42.93% of the total Saudi Arabia biodegradable packaging market in 2025.

Food packaging applications command the largest market share due to converging regulatory pressures and consumer health consciousness that prioritize material safety and environmental responsibility. The segment's growth is anchored by Saudi Arabia's expanding food service industry, where international quick-service restaurant chains implement global sustainability mandates requiring compostable takeaway containers, cups, and cutlery across all franchise locations. Recent food safety incidents have heightened scrutiny of packaging migration properties, creating preference for cellulose-based materials perceived as inherently safer than synthetic alternatives, particularly in direct-contact applications for hot foods and acidic preparations.

The food packaging segment benefits from government procurement specifications for school meal programs and healthcare facility catering services that increasingly mandate biodegradable single-use items as part of broader institutional sustainability commitments. Fresh produce packaging represents a growing subsegment, where date exporters and greenhouse vegetable producers adopt breathable paper-based clamshells and trays to meet European import requirements for sustainable packaging while extending shelf life through moisture management properties. The Kingdom's position as a major food importer also influences adoption patterns, as international suppliers increasingly ship products in biodegradable formats to maintain brand consistency across global markets, thereby normalizing these materials within Saudi retail channels and creating consumer familiarity that supports domestic adoption.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 28% share of the total Saudi Arabia biodegradable packaging market in 2025.

The Northern and central region's market leadership stems from Riyadh's concentration of population, retail infrastructure, and manufacturing capacity that creates both demand density and supply chain efficiency. The capital city's status as the Kingdom's administrative center drives government procurement volumes for biodegradable packaging across ministries, educational institutions, and healthcare facilities implementing sustainability directives. Riyadh's position as a distribution hub for national retail chains enables centralized sustainable packaging sourcing decisions that cascade across regional store networks, while the city's growing expatriate population brings elevated environmental awareness and willingness to pay premiums for eco-friendly products.

The region's industrial zones host converting operations that process imported parent reels of biodegradable films and paper stocks into finished packaging formats, benefiting from proximity to end-user industries and shorter lead times compared to imports. The Northern and Central Region's leadership is reinforced by ongoing developments in the King Salman Energy Park, where petrochemical companies are exploring bio-based polymer production leveraging existing infrastructure, potentially establishing the region as a future bioplastics manufacturing cluster. The concentration of modern hypermarkets and premium grocery chains in Riyadh creates demonstration effects, where visible sustainability initiatives influence consumer expectations and purchasing behaviors that subsequently diffuse into secondary cities and other regions through retail chain expansions and social media amplification.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Biodegradable Packaging Market Growing?

Regulatory Frameworks Targeting Single-Use Plastic Reduction

Saudi Arabia's evolving environmental regulations, including municipal bans on certain single-use plastic items and proposed extended producer responsibility schemes, are creating compliance-driven demand for biodegradable alternatives across packaging value chains. The Ministry of Environment, Water and Agriculture's ongoing consultations regarding comprehensive plastic waste management regulations signal forthcoming mandates that will require manufacturers and retailers to transition toward certified biodegradable materials for specific product categories. These regulatory developments align with the Kingdom's G20 commitments on marine plastic pollution and create predictable policy environments that justify capital investments in biodegradable packaging conversion equipment and material innovation. IMARC Group predicts that the Saudi Arabia plastic recycling market is projected to attain USD 826.59 Million by 2033.

Vision 2030 Circular Economy Objectives and Green Investment Incentives

The Kingdom's strategic emphasis on diversifying beyond petroleum dependence includes targeted support for circular economy industries, with biodegradable packaging identified as a priority sector for technology transfer and manufacturing localization. Government initiatives providing preferential financing, customs duty exemptions on sustainable packaging production equipment, and streamlined licensing for bio-based material facilities are reducing barriers to entry for both domestic entrepreneurs and international partners. The Saudi Industrial Development Fund's dedicated sustainability financing windows and the National Industrial Development and Logistics Program's sector-specific support mechanisms are catalyzing investments in paper mill modernization and bioplastic compounding capacity that will expand domestic supply and improve price competitiveness against imported conventional packaging alternatives. In 2025, Saudi Arabia announced a green financing program valued at SR1 billion (US$266.6 million). The initiative seeks to speed up investment from the private sector in sustainable, environment friendly projects, representing an important step in the Kingdom’s shift towards a greener, more varied economy.

Expansion of Modern Retail Formats and Food Service Channels

The proliferation of international hypermarket chains, convenience store networks, and quick-service restaurant brands throughout Saudi Arabia's urban centers is driving standardized adoption of sustainable packaging systems aligned with corporate parent companies' global environmental commitments. Operators such as multinational coffeehouse chains and fast-casual dining concepts implement uniform biodegradable packaging specifications across all Saudi locations to maintain brand consistency and leverage economies of scale in sustainable material procurement. This modern trade expansion creates volume thresholds that improve biodegradable packaging economics through bulk purchasing while establishing consumer expectations for environmental responsibility that influence competitive positioning across the retail landscape. IMARC Group stated that the Saudi Arabia retail market is expected to reach USD 411.7 Billion by 2034.

Market Restraints:

What Challenges the Saudi Arabia Biodegradable Packaging Market is Facing?

Performance Limitations in Hot and Humid Storage Conditions

Biodegradable packaging materials, particularly cellulose-based and starch-derived alternatives, demonstrate reduced structural integrity and barrier properties when exposed to Saudi Arabia's extreme temperatures and coastal humidity. These performance gaps limit adoption in applications requiring extended shelf life, moisture protection, or resistance to heat-induced deformation during warehouse storage and transportation across the Kingdom's vast distances under intense solar exposure.

Limited Industrial Composting Infrastructure and Consumer Confusion

The absence of widespread municipal composting facilities capable of processing certified biodegradable packaging creates end-of-life disposal challenges that undermine environmental benefit claims. Most biodegradable materials entering conventional landfills or incineration streams fail to achieve advertised decomposition outcomes, while consumer confusion regarding proper disposal methods, including misplacement in recycling bins that contaminate paper streams, reduces actual sustainability impacts and creates skepticism regarding green marketing assertions.

Price Premiums Relative to Conventional Petroleum-Based Packaging

Biodegradable packaging alternatives typically command cost premiums ranging from fifteen to forty percent above functionally equivalent conventional plastic packaging, creating resistance among price-sensitive consumer segments and retail categories with thin profit margins. These price differentials reflect smaller production scales, imported raw material dependencies, and less mature manufacturing processes compared to established petrochemical packaging industries, limiting adoption primarily to premium product categories and brands with sufficient pricing power to absorb or pass through sustainability-related cost increases.

Competitive Landscape:

The Saudi Arabia biodegradable packaging market exhibits a transitional competitive structure characterized by established regional paper and plastic converters adapting existing manufacturing capabilities alongside emerging specialists in bio-based materials. Market participants range from multinational sustainable packaging corporations establishing local partnerships to access growing Gulf Cooperation Council demand, to family-owned converters diversifying product portfolios in response to customer sustainability requirements. Competitive differentiation increasingly centers on material innovation, technical service capabilities, and ability to navigate complex regulatory landscapes while maintaining price competitiveness against conventional packaging alternatives. The market demonstrates moderate entry barriers due to capital requirements for specialized converting equipment and certification compliance costs, though relatively fragmented supplier bases limit individual player pricing power. Strategic positioning varies between volume-focused commodity paper packaging producers competing on cost efficiency and scale, versus premium bio-plastics suppliers targeting differentiated applications in food service and pharmaceutical sectors where performance specifications and sustainability credentials justify higher price points.

Saudi Arabia Biodegradable Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Applications Covered | Food Packaging, Beverage Packaging, Pharmaceutical Packaging, Personal/Homecare Packaging, Others |

| Regions Covered | Northern and Central Region ,Western Region ,Eastern Region , Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia biodegradable packaging market size was valued at USD 1,048.7 Million in 2025.

The Saudi Arabia biodegradable packaging market is expected to grow at a compound annual growth rate of 4.95% from 2026-2034 to reach USD 1,619.9 Million by 2034.

Paper materials dominated the market with a commanding share of 57.96% in 2025, benefiting from established recycling infrastructure, proven performance characteristics, favorable economics compared to emerging bioplastic alternatives, and widespread familiarity among manufacturers and consumers across diverse packaging applications.

Key factors driving the Saudi Arabia biodegradable packaging market include evolving regulatory frameworks targeting single-use plastic reduction, expansion of modern retail formats implementing corporate sustainability commitments, Vision 2030 circular economy objectives with associated green investment incentives, and growing consumer environmental consciousness particularly among urban populations and younger demographics.

Major challenges include performance limitations of biodegradable materials under extreme heat and humidity conditions, absence of widespread industrial composting infrastructure creating end-of-life disposal difficulties, significant price premiums relative to conventional packaging that limit adoption in cost-sensitive segments, and consumer confusion regarding proper disposal methods that undermines actual environmental benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)