Saudi Arabia Biofertilizer Market Size, Share, Trends and Forecast by Type, Crop, Microorganism, Mode of Application, and Region, 2026-2034

Saudi Arabia Biofertilizer Market Overview:

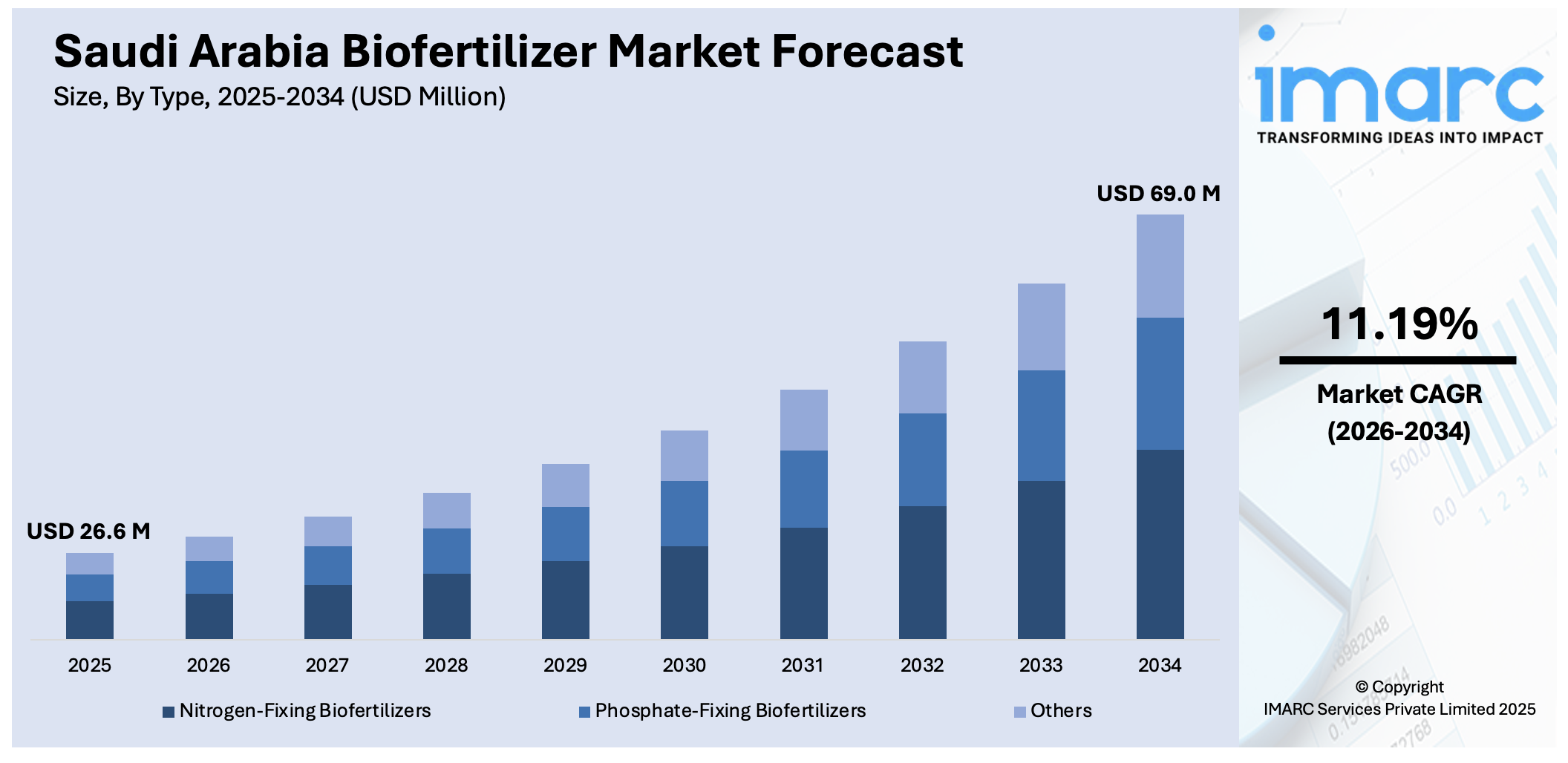

The Saudi Arabia biofertilizer market size reached USD 26.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 69.0 Million by 2034, exhibiting a growth rate (CAGR) of 11.19% during 2026-2034. The market is driven by the development of sustainable agriculture practices as part of Vision 2030 strategy, rising health consciousness among consumers, food safety concerns, and a shift towards chemical-free diets, and serious soil health deterioration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 26.6 Million |

| Market Forecast in 2034 | USD 69.0 Million |

| Market Growth Rate 2026-2034 | 11.19% |

Saudi Arabia Biofertilizer Market Trends:

Government Support for Sustainable Agriculture

The Saudi government is becoming more proactive in the development of sustainable agriculture practices as part of its overall Vision 2030 strategy. This overall strategy focuses on environmental sustainability, food security, and lower reliance on imported farm inputs. Under this program, the Ministry of Environment, Water and Agriculture (MEWA) launched policies and subsidies to encourage the use of green inputs, such as biofertilizers. Financial incentives, international agritech company research collaborations, and farmer education campaigns have all helped create a more conducive climate for the adoption of biofertilizers. Moreover, collaborations with universities and research and development (R&D) institutions are facilitating local development and commercialization of biofertilizers specific to arid climatic conditions. In 2024, Saudi Arabia’s Ministry of Environment, Water, and Agriculture sanctioned SAR 37 billion in private investments to improve agriculture and food sectors in the country. This policy-led momentum is proving to be instrumental in generating long-term demand by balancing economic incentives and ecological outcomes, positioning biofertilizers as a critical input towards sustainable agricultural growth in the Kingdom.

To get more information on this market Request Sample

Rising Demand for Organic Produce

Demand for organic and residue-free produce is increasing in Saudi Arabia. Growing health consciousness among consumers, food safety concerns, and a shift towards chemical-free diets are driving this trend. Biofertilizers, as they are natural substitutes for chemical fertilizers, support organic cultivation. They contribute to soil health improvement, nutrient uptake enhancement, and minimizing the use of chemical interventions, hence ensuring the production of healthier crops. This increased awareness is also affecting retail chains, restaurants, and food processors to procure organically produced ingredients, thus creating downstream market pressure for farmers to transition to sustainable inputs such as biofertilizers. Additionally, labelling and certifications for organic vegetables are increasingly common in both home and export markets, further incentivizing farmers to use biofertilizers. Moreover, the demand is driven by a market-wide inclination towards transparency and sustainability in agricultural production. The Saudi Arabia organic food market size is expected to reach USD 5.1 Billion by 2033.

Depleting Soil Fertility and Environmental Concerns

The excessive use of chemical fertilizers in Saudi Arabia is bringing about serious soil health deterioration, such as low microbial activity, nutrient imbalance, and salinity. Such conditions are most serious in the arid and semi-arid areas of the Kingdom, where water shortages also exacerbate soil degradation. In response to such, agronomists, researchers, and policymakers increasingly seek biofertilizers that provide a viable sustainable alternative for reviving soil health. Biofertilizers supplement the inherent nutrient cycle by adding microorganisms that fix nitrogen from the air, solubilize phosphorus, and stimulate plant growth with biologically active substances. They also enhance soil structure, water-holding capacity, and fertility over time without contaminating groundwater or injuring biodiversity. The eco-friendly benefits of biofertilizers, coupled with the imperative to revitalize productivity in barren lands, are making them increasingly appealing throughout the value chain of agriculture.

Saudi Arabia Biofertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, crop, microorganism, and mode of application.

Type Insights:

- Nitrogen-Fixing Biofertilizers

- Phosphate-Fixing Biofertilizers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogen-fixing biofertilizers, phosphate-fixing biofertilizers, and others.

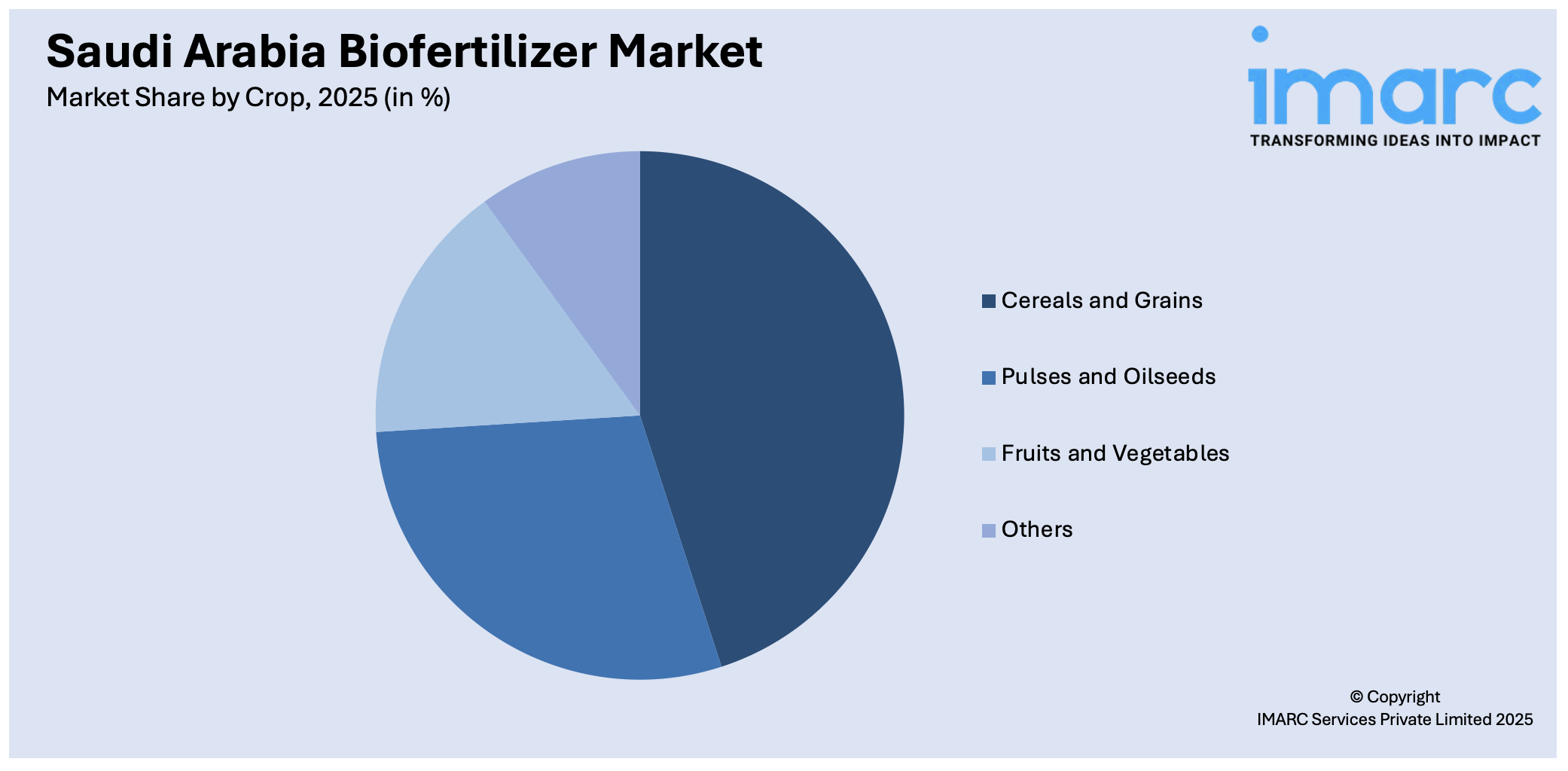

Crop Insights:

Access the comprehensive market breakdown Request Sample

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the crop have also been provided in the report. This includes cereals and grains, pulses and oilseeds, fruits and vegetables, and others.

Microorganism Insights:

- Cyanobacter

- Rhizobium

- Phosphate Solubilizing Bacteria

- Azotobacter

- Others

A detailed breakup and analysis of the market based on the microorganism have also been provided in the report. This includes cyanobacter, rhizobium, phosphate solubilizing bacteria, azotobacter, and others.

Mode of Application Insights:

- Seed Treatment

- Soil Treatment

- Others

A detailed breakup and analysis of the market based on the mode of application have also been provided in the report. This includes seed treatment, soil treatment, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia biofertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen-Fixing Biofertilizers, Phosphate-Fixing Biofertilizers, Others |

| Crops Covered | Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Microorganisms Covered | Cyanobacter, Rhizobium, Phosphate Solubilizing Bacteria, Azotobacter, Others |

| Mode of Applications Covered | Seed Treatment, Soil Treatment, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia biofertilizer market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia biofertilizer market on the basis of type?

- What is the breakup of the Saudi Arabia biofertilizer market on the basis of crop?

- What is the breakup of the Saudi Arabia biofertilizer market on the basis of microorganism?

- What is the breakup of the Saudi Arabia biofertilizer market on the basis of mode of application?

- What is the breakup of the Saudi Arabia biofertilizer market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia biofertilizer market?

- What are the key driving factors and challenges in the Saudi Arabia biofertilizer market?

- What is the structure of the Saudi Arabia biofertilizer market and who are the key players?

- What is the degree of competition in the Saudi Arabia biofertilizer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia biofertilizer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia biofertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia biofertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)