Saudi Arabia Bioplastics Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Bioplastics Market Summary:

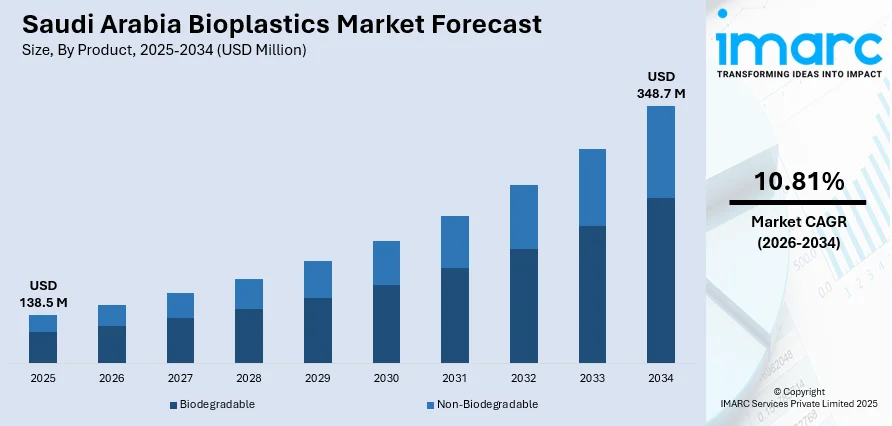

The Saudi Arabia bioplastics market size was valued at USD 138.5 Million in 2025 and is projected to reach USD 348.7 Million by 2034, growing at a compound annual growth rate of 10.81% from 2026-2034.

The Saudi Arabia bioplastics market is witnessing robust expansion driven by the Kingdom's commitment to environmental sustainability under Vision 2030 and the Saudi Green Initiative. Expanding governmental interest in circular economy practices, rising consumer understanding of plastic pollution, and growing pressure on the packaging and agriculture industries to seek a more environmentally friendly solution are driving the market growth. The introduction of regional bioplastic innovation centres and co-operations with international biopolymer producers is enhancing the Kingdom’s position as a regional leader in the adoption of sustainable materials.

Key Takeaways and Insights:

-

By Product: Non-biodegradable bioplastics dominate the market with a share of 64% in 2025, driven by their cost-effectiveness and compatibility with existing manufacturing infrastructure for packaging applications.

-

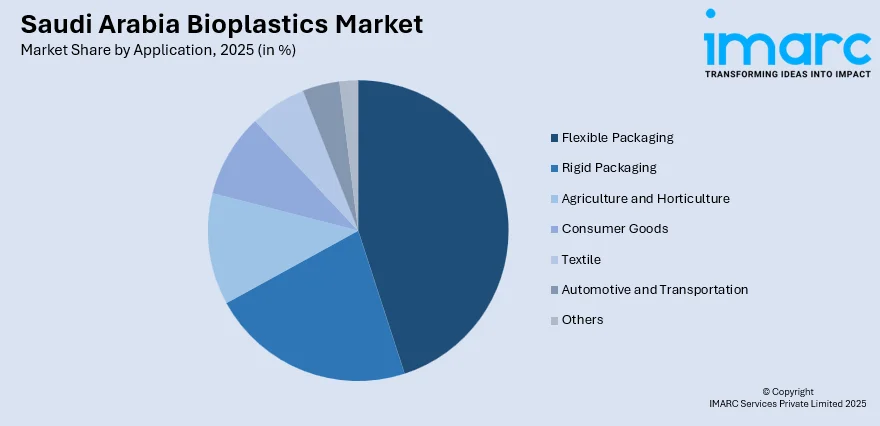

By Application: Flexible packaging leads the market with a share of 45% in 2025, owing to increasing demand from food service, retail, and e-commerce sectors seeking sustainable packaging solutions.

-

By Distribution Channel: Offline channels represent the largest segment with a market share of 69% in 2025, reflecting the dominance of industrial procurement and B2B transactions in bioplastics distribution.

-

By Region: Northern and Central region dominate the market with a share of 40% in 2025, attributed to the concentration of manufacturing facilities and major urban centers including Riyadh.

-

Key Players: The Saudi Arabia bioplastics market exhibits a moderately consolidated competitive landscape with multinational chemical corporations and regional manufacturers competing across various segments. Leading players in the industry are prioritizing innovation in product development, forming strategic alliances, and expanding production capabilities to enhance their competitive standing and consolidate market presence.

To get more information on this market Request Sample

The Saudi Arabia bioplastics market is undergoing significant transformation as the Kingdom accelerates its transition toward a circular economy and sustainable industrial practices. Government initiatives under Vision 2030 are driving substantial investments in green technologies and waste management infrastructure, creating favorable conditions for bioplastics adoption across multiple sectors. The packaging industry remains the primary demand driver, with major food and beverage companies increasingly mandating bio-based and recyclable content in their packaging materials. For instance, in February 2023, Saudi startup Plastus secured the USD 250,000 top prize at the LEAP23 Rocket Fuel Pitch Challenge in Riyadh for its fully biodegradable bioplastics produced using bacterial fermentation. The achievement highlights Saudi Arabia’s expanding innovation ecosystem and growing momentum in the development of sustainable and environmentally friendly materials.

Saudi Arabia Bioplastics Market Trends:

Rise of Homegrown Bioplastic Innovation

Saudi Arabia is gradually strengthening its base in sustainable materials by promoting domestic innovation in biodegradable plastics. Key initiatives focus on transforming organic waste into environmentally friendly bioplastics through advanced bio-based technologies, helping reduce reliance on fossil-derived materials. Despite a global investment slowdown, Saudi investors committed nearly USD 439 million to local climate-focused startups between 2018 and 2023, underscoring increasing domestic backing for sustainability-oriented ventures. The National Technology Development Programme continues to back emerging bioplastic companies developing fermentation-based solutions.

Expansion of Regional PLA Distribution Networks

Strategic partnerships are enhancing bioplastics accessibility across the Kingdom as global manufacturers establish regional distribution channels. In September 2025, TotalEnergies Corbion formed a strategic distribution agreement with Multi Trade Group, appointing them as the main distributor of Luminy PLA bioplastics in the Middle East, including Saudi Arabia. This partnership expands access to compostable bioplastics for converters, compounders, and brand owners, supporting government commitments to reduce emissions and advance circular economy goals across multiple industries.

Growth of Biodegradable Agricultural Applications

The agricultural sector is emerging as a significant growth avenue for biodegradable plastics in Saudi Arabia. The Saudi Arabia agriculture market size reached USD 136.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 212.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.02% during 2026-2034. Biodegradable mulch films, plant pots, and crop protection films are gaining traction as farmers seek to reduce soil pollution and eliminate labor-intensive plastic residue removal. Advanced bioplastics including polylactic acid, polyhydroxyalkanoates, and polybutylene succinate are replacing traditional materials in agricultural applications, aligning with sustainable farming practices encouraged by government initiatives focused on food security and environmental protection.

How Vision 2030 is Transforming the Saudi Arabia Bioplastics Market:

Vision 2030 is driving significant transformation in the Saudi Arabia bioplastics market by promoting sustainability, circular economy initiatives, and industrial diversification. The government’s strategic focus on reducing reliance on fossil fuels and fostering environmentally friendly manufacturing has encouraged investment in bioplastic production and research. Regulatory support, incentives for green technologies, and partnerships between local firms and international players are accelerating innovation in biodegradable and bio-based polymers. Moreover, rising consumer awareness and preference for sustainable packaging are creating new growth opportunities across the food, healthcare, and consumer goods industries. Vision 2030’s emphasis on technological advancement and environmental stewardship is positioning Saudi Arabia as a regional hub for bioplastics development. For instance, in November 2025, KAUST-backed startup Polymeron is converting agricultural residues into high-quality biodegradable plastics, supporting Saudi Arabia’s national objectives for sustainability and technological innovation. The company upcycles date byproducts, a key element of the Kingdom’s agricultural output, and is extending its efforts to include poultry waste. Through these initiatives, Polymeron is fostering a circular economy that maximizes the value of local resources while promoting environmentally responsible materials and advancing the development of bio-based industrial solutions.

Market Outlook 2026-2034:

The Saudi Arabia bioplastics market outlook remains positive as the Kingdom intensifies efforts to build a sustainable industrial ecosystem aligned with Vision 2030 objectives. Regulatory developments, including technical standards for biodegradable plastic products and waste management frameworks, are creating structured demand for eco-friendly materials. Major infrastructure investments in composting facilities and recycling systems are expected to enhance the commercial viability of biodegradable plastics across multiple applications. The market generated a revenue of USD 138.5 Million in 2025 and is projected to reach a revenue of USD 348.7 Million by 2034, growing at a compound annual growth rate of 10.81% from 2026-2034.

Saudi Arabia Bioplastics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Non-Biodegradable | 64% |

| Application | Flexible Packaging | 45% |

| Distribution Channel | Offline | 69% |

| Region | Northern and Central Region | 40% |

Product Insights:

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

The non-biodegradable dominates with a market share of 64% of the total Saudi Arabia bioplastics market in 2025.

Non-biodegradable plastics continue to dominate the Saudi Arabia bioplastics market due to their established manufacturing infrastructure, cost efficiency, and widespread industrial adoption. Traditional plastics benefit from decades of investment in production facilities, supply chains, and distribution networks, making them more economically attractive compared with emerging biodegradable alternatives. Additionally, non-biodegradable polymers offer consistent performance, durability, and compatibility with a wide range of industrial applications, from packaging to construction, which encourages continued use despite growing environmental concerns.

Another factor contributing to the dominance of non-biodegradable plastics is the higher production cost and limited availability of biodegradable materials. Bioplastics often require specialized feedstocks, advanced processing technologies, and supply chain adaptations that increase overall expenses. In Saudi Arabia, while sustainability initiatives under Vision 2030 are promoting biodegradable solutions, industrial stakeholders and consumers still rely heavily on conventional plastics for predictable performance, scalability, and regulatory familiarity, maintaining their leading position in the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Textile

- Automotive and Transportation

- Others

The flexible packaging leads the market with a share of 45% of the total Saudi Arabia bioplastics market in 2025.

Flexible packaging dominates the Saudi Arabia bioplastics market due to its widespread use across food, beverage, and consumer goods sectors, where demand for sustainable, lightweight, and durable packaging solutions is rising. Bioplastics offer the environmental advantage of being biodegradable or compostable, aligning with Saudi Arabia’s Vision 2030 sustainability goals. Manufacturers prefer flexible formats for cost-effectiveness, ease of transport, and reduced material usage, making them more appealing than rigid alternatives for both domestic and export-oriented products.

Additionally, flexible bioplastic packaging supports supply chain efficiency by reducing storage space and lowering shipping costs due to its lightweight nature. The growing consumer preference for eco-friendly packaging further drives adoption, prompting brands to switch from conventional plastics. Regulatory incentives and corporate sustainability initiatives encourage producers to integrate biodegradable films, pouches, and wraps, solidifying flexible packaging’s leading position. Technological advances in biopolymer processing also enhance performance, durability, and barrier properties, reinforcing its market dominance.

Distribution Channel Insights:

- Online

- Offline

The offline represents the largest share with 69% of the total Saudi Arabia bioplastics market in 2025.

Offline distribution channels maintain market dominance primarily due to established industrial procurement practices and traditional supply chain networks. Manufacturers, distributors, and end-users in sectors such as packaging, food processing, and consumer goods prefer direct engagement with suppliers to assess product quality, negotiate bulk orders, and ensure timely delivery. Face-to-face interactions also allow buyers to verify certifications, sustainability claims, and material performance, which is particularly important for bioplastics, where regulatory compliance and product reliability are critical factors for adoption.

Additionally, offline distribution benefits from Saudi Arabia’s well-developed industrial zones and logistics infrastructure, enabling efficient transportation and storage of bioplastic products. Local distributors and retailers play a key role in educating end-users about product applications, handling, and biodegradability standards. Many businesses still rely on traditional procurement methods due to long-standing relationships with suppliers, limited digital adoption in certain regions, and the need for personalized service, making offline channels the preferred choice over online platforms in the current market landscape.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region leads the market with a share of 40% of the total Saudi Arabia bioplastics market in 2025.

In Saudi Arabia’s Northern region, the bioplastics market is driven by growing industrial activity and the presence of manufacturing hubs focused on packaging, food processing, and consumer goods. Businesses are increasingly adopting sustainable materials to comply with environmental regulations and meet rising consumer demand for eco-friendly products. The region’s access to raw materials, proximity to key logistics networks, and government incentives for green initiatives further encourage manufacturers to integrate biodegradable and bio-based plastics into their production processes.

In the Central region, which includes Riyadh as a major commercial and industrial hub, demand for bioplastics is fueled by corporate sustainability initiatives and Vision 2030 policies promoting environmental stewardship. Key drivers include rising awareness of plastic waste reduction, government support for circular economy projects, and investment in research and development for bio-based materials. The concentration of large enterprises, retail chains, and food manufacturers in this region creates a strong market for bioplastics across packaging, disposable goods, and specialty industrial applications.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Bioplastics Market Growing?

Vision 2030 Circular Economy Initiatives

Saudi Arabia's Vision 2030 transformation program is driving substantial investments in sustainable industrial practices and circular economy infrastructure. The government has set ambitious targets to divert municipal solid waste from landfills and promote the use of recyclable and biodegradable materials across industrial sectors. In early 2024, the Ministry of Environment, Water and Agriculture announced a waste management plan aiming to recycle up to 95% of waste and add significant value to the Kingdom's gross domestic product. The National Center for Waste Management and Saudi Investment Recycling Company are leading initiatives to build comprehensive waste processing infrastructure, creating favorable conditions for bioplastics adoption.

Rising Environmental Awareness and Consumer Preferences

Growing environmental consciousness among Saudi consumers and businesses is reshaping material preferences across packaging and consumer goods sectors. The visible impacts of plastic pollution in marine ecosystems along the Red Sea and Arabian Gulf are driving demand for sustainable alternatives. Industry reports indicate that a significant majority of the population is expected to prioritize eco-friendly products in their purchasing decisions. This shift in consumer behavior is encouraging businesses across retail, food service, and hospitality sectors to adopt biodegradable packaging solutions that align with evolving customer expectations and corporate sustainability commitments.

Regulatory Support for Sustainable Materials

Government regulatory initiatives are creating structured demand pathways for bioplastics in Saudi Arabia. The Saudi Standards, Metrology and Quality Organization has implemented technical regulations for biodegradable plastic products, mandating specific standards for product certification, compliance thresholds, and labeling requirements. These regulatory frameworks are compelling industries including food and beverage packaging to transition toward biodegradable or recyclable materials. The development of standards and certifications pertaining to biodegradability and compostability ensures product quality and environmental compliance while providing market confidence for bioplastics adoption.

Market Restraints:

What Challenges the Saudi Arabia Bioplastics Market is Facing?

Higher Production Costs Compared to Conventional Plastics

Bioplastics remain significantly more expensive than conventional petroleum-based plastics, making it difficult for price-sensitive packaging manufacturers to adopt them. The region’s abundant supply of low-cost traditional plastics further limits the economic viability of bioplastic alternatives. As a result, despite their environmental benefits, biodegradable materials face challenges in competing with established petroleum-based plastics in the market.

Limited Composting Infrastructure

Biodegradable plastics require specific industrial composting conditions to break down effectively. In Saudi Arabia, the waste management and composting infrastructure is still under development, limiting the practical environmental benefits of bioplastics. Without sufficient facilities, these materials often end up in regular waste streams, reducing their decomposition efficiency and undermining their intended sustainability impact. Expanding composting infrastructure is essential for maximizing bioplastics’ ecological value.

Consumer Education and Market Awareness Gaps

A major challenge for bioplastics in Saudi Arabia is the low awareness among businesses and consumers regarding their benefits and proper disposal methods. Without clear labeling and targeted educational initiatives, many biodegradable products are discarded with general waste, diminishing their environmental impact. Increasing market knowledge, promoting correct usage, and highlighting disposal practices are crucial to enhancing the adoption and effectiveness of bioplastics in the Kingdom.

Competitive Landscape:

The Saudi Arabia bioplastics market features an evolving and competitive landscape shaped by the presence of global chemical companies alongside regional manufacturers. International players are capitalizing on the Kingdom’s strategic location and increasing emphasis on sustainability to build partnerships and strengthen distribution channels. Competitive pressure is rising as market participants prioritize product innovation, expand production capacity, and form strategic alliances with local converters and brand owners. Key strategies include launching certified bio-based polymer portfolios, developing regional distribution networks, and investing in technical expertise to support customers in adopting sustainable material solutions.

Recent Developments:

-

In July 2025, SS Royal Kit, Emirates Investment, and Global Biopolymers Industries partnered to launch a new enterprise aimed at revolutionizing the PLA bioplastics sector. Named Emirates Biotech, the company will lead the manufacturing and distribution of PLA biopolymers throughout the Middle East, Africa, and India, providing a sustainable, circular alternative to conventional fossil fuel-derived plastics. This initiative seeks to promote eco-friendly materials while supporting the transition toward a more environmentally responsible plastics industry.

Saudi Arabia Bioplastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Flexible Packaging, Rigid Packaging, Agriculture and Horticulture, Consumer Goods, Textile, Automotive and Transportation, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia bioplastics market size was valued at USD 138.5 Million in 2025.

The Saudi Arabia bioplastics market is expected to grow at a compound annual growth rate of 10.81% from 2026-2034 to reach USD 348.7 Million by 2034.

Non-biodegradable bioplastics dominated the market with a 64% share in 2025, driven by their compatibility with existing manufacturing infrastructure and cost-effectiveness for packaging applications.

Key factors driving the Saudi Arabia bioplastics market include Vision 2030 circular economy initiatives, rising environmental awareness among consumers, government regulations promoting sustainable materials, and growing demand from packaging and agriculture sectors.

Major challenges include higher production costs compared to conventional plastics, limited industrial composting infrastructure, consumer education gaps regarding proper disposal methods, and reliance on imports due to limited domestic manufacturing capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)