Saudi Arabia Biopsy Devices Market Size, Share, Trends and Forecast by Procedure Type, Product, Guidance Technique, Application, End User, and Region, 2026-2034

Saudi Arabia Biopsy Devices Market Overview:

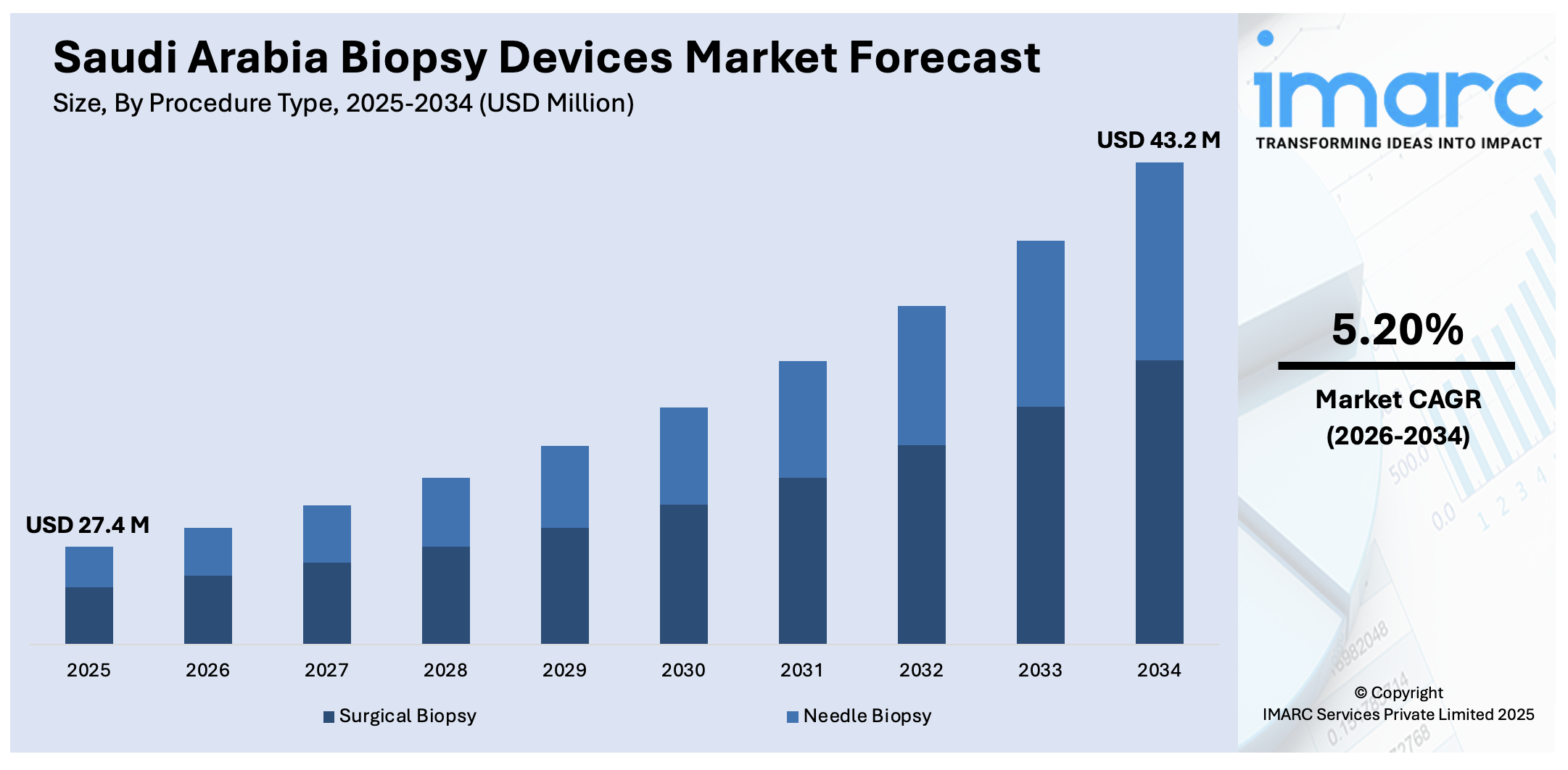

The Saudi Arabia biopsy devices market size reached USD 27.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 43.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.20% during 2026-2034. The market is witnessing steady growth, driven by the rising cancer screening efforts, growing use of image-guided procedures, and significant investment in both public and private healthcare infrastructure. Moreover, technological advancements in minimally invasive tools and the focus of Saudi government on healthcare advancement and investments in healthcare infrastructure and technology are contributing to a steady rise in the Saudi Arabia biopsy devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 27.4 Million |

| Market Forecast in 2034 | USD 43.2 Million |

| Market Growth Rate 2026-2034 | 5.20% |

Saudi Arabia Biopsy Devices Market Trends:

Rising Focus on Early Cancer Detection

Saudi Arabia is intensifying its efforts to promote early cancer detection through widespread national screening initiatives. These programs, supported by the Ministry of Health and aligned with Vision 2030 objectives, are targeting common cancers such as breast, prostate, and colorectal types. The campaigns are raising public awareness and also encouraging individuals to seek regular health checkups and screenings. This has led to an increase in referrals for diagnostic evaluations, where biopsy remains a critical step in confirming malignancies. With a growing number of early-stage diagnoses, the demand for biopsy procedures is accelerating, shaping a positive market outlook as hospitals and specialized diagnostic centers expand their diagnostic capabilities to meet rising clinical needs. Modern healthcare facilities are adopting image-guided and minimally invasive biopsy tools to support early intervention and enhance patient outcomes. The growing burden of cancer-related mortality and economic strain has placed diagnostic preparedness at the forefront of national health priorities. According to the report published by the OECD, cancer poses a major public health challenge in Saudi Arabia, being the fifth leading cause of death. Between 2023 and 2050, an estimated 10,700 premature deaths (1 in 16) will occur, lowering life expectancy by 0.6 years. Health spending on cancer could rise by 190%, costing SAR 1.4 billion more annually. As early detection continues to be a national priority, supported by both public policy and clinical advancements, it is expected to be a key driver of Saudi Arabia biopsy devices market growth.

To get more information on this market Request Sample

Public and Private Healthcare Expansion

Saudi Arabia is witnessing significant investment in both public and private healthcare infrastructure, aimed at improving access to specialized diagnostic services. The construction of new hospitals, modernization of existing facilities, and the rollout of mobile diagnostic units are helping bridge regional disparities in healthcare access. For instance, in February 2025, Saudi Arabia announced significant healthcare expansions, including a new Oncology Center of Excellence by Johns Hopkins Aramco Healthcare and a major growth of Aster Pharmacy. These initiatives aim to enhance cancer care accessibility and advance the Kingdom’s healthcare sector under Vision 2030, promoting private sector involvement and medical tourism. These efforts are especially impactful in semi-urban and rural areas, where biopsy services were previously limited or unavailable. Mobile clinics equipped with portable imaging and biopsy tools are bringing early diagnostic services directly to underserved populations. Private sector participation is also rising, with diagnostic chains and specialty centers expanding operations in line with rising demand for precision diagnostics. These investments are complemented by government initiatives under Vision 2030, which prioritize digital healthcare, early detection, and clinical capacity-building. As healthcare infrastructure continues to evolve, the accessibility and volume of biopsy procedures are expected to grow substantially, influencing procurement patterns and technology adoption. This trend underpins a strong market forecast for the coming years.

Saudi Arabia Biopsy Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on procedure type, product, guidance technique, application, and end user.

Procedure Type Insights:

- Surgical Biopsy

- Needle Biopsy

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surgical biopsy and needle biopsy.

Product Insights:

- Biopsy Guidance Systems

- Needle-Based Biopsy Guns

- Biopsy Needles

- Biopsy Forceps

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes biopsy guidance systems, needle-based biopsy guns, biopsy needles, biopsy forceps, and others.

Guidance Technique Insights:

- Ultrasound Guided Biopsy

- Stereotactic Guided Biopsy

- MRI Guided Biopsy

- Others

A detailed breakup and analysis of the market based on the guidance techniques have also been provided in the report. This includes ultrasound guided biopsy, stereotactic guided biopsy, MRI guided biopsy, and others.

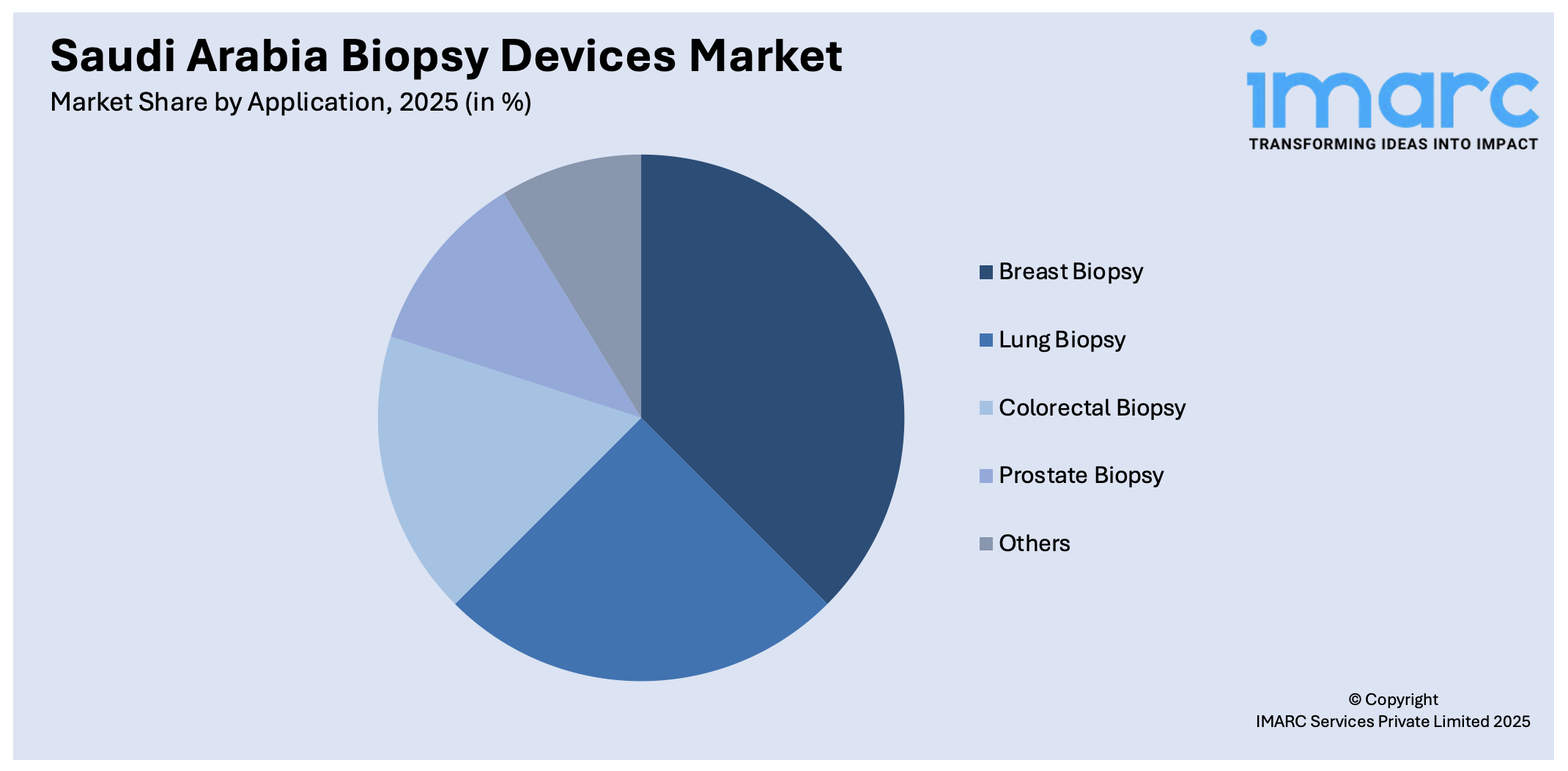

Application Insights:

Access the comprehensive market breakdown Request Sample

- Breast Biopsy

- Lung Biopsy

- Colorectal Biopsy

- Prostate Biopsy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes breast biopsy, lung biopsy, colorectal biopsy, prostate biopsy, and others.

End User Insights:

- Hospitals and Clinics

- Academic and Research Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, academic and research institutes, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Biopsy Devices Market News:

- In November 2023, King Faisal Specialist Hospital and Research Centre (KFSH&RC) in Riyadh was the first in the Middle East to adopt liquid biopsy technology, which analyzes a 10ml blood sample to detect cancer-related genes and mutations. This non-invasive method aids in early diagnosis, treatment monitoring, and tracking of tumor biomarkers.

Saudi Arabia Biopsy Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Procedure Types Covered | Surgical Biopsy, Needle Biopsy |

| Products Covered | Biopsy Guidance Systems, Needle-Based Biopsy Guns, Biopsy Needles, Biopsy Forceps, Others |

| Guidance Techniques Covered | Ultrasound Guided Biopsy, Stereotactic Guided Biopsy, MRI Guided Biopsy, Others |

| Applications Covered | Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, Others |

| End Users Covered | Hospitals and Clinics, Academic and Research Institutes, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia biopsy devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia biopsy devices market on the basis of procedure type?

- What is the breakup of the Saudi Arabia biopsy devices market on the basis of product?

- What is the breakup of the Saudi Arabia biopsy devices market on the basis of guidance technique?

- What is the breakup of the Saudi Arabia biopsy devices market on the basis of application?

- What is the breakup of the Saudi Arabia biopsy devices market on the basis of end user?

- What is the breakup of the Saudi Arabia biopsy devices market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia biopsy devices market?

- What are the key driving factors and challenges in the Saudi Arabia biopsy devices?

- What is the structure of the Saudi Arabia biopsy devices market and who are the key players?

- What is the degree of competition in the Saudi Arabia biopsy devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia biopsy devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia biopsy devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia biopsy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)