Saudi Arabia Biosensors Market Size, Share, Trends and Forecast by Product, Technology, Application, End Use, and Region, 2026-2034

Saudi Arabia Biosensors Market Overview:

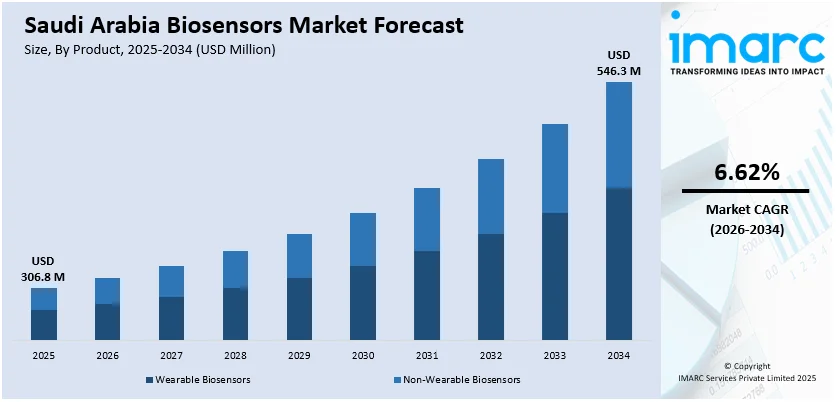

The Saudi Arabia biosensors market size reached USD 306.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 546.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.62% during 2026-2034. The market is experiencing significant growth, driven by advancements in healthcare technologies and growing need for real-time monitoring of health conditions. Increased adoption of biosensors in diagnostics, glucose monitoring, and medical research is fueling market growth. Government initiatives, rising healthcare investments, and demand for personalized healthcare solutions are further influencing the Saudi Arabia biosensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 306.8 Million |

| Market Forecast in 2034 | USD 546.3 Million |

| Market Growth Rate 2026-2034 | 6.62% |

Saudi Arabia Biosensors Market Trends:

Government Support for Healthcare Innovations

The government of Saudi Arabia has been actively backing healthcare innovation through several initiatives that support the growth and implementation of cutting-edge medical technologies, such as biosensors. Under the Vision 2030 program, the government is investing heavily in enhancing the healthcare system, facilitating the integration of digital health solutions, and improving the quality of patient care. This has resulted in growing demand for biosensors, especially in fields such as chronic disease management, diagnostics, and personalized medicine. Initiatives to upgrade healthcare infrastructure, including the implementation of smart hospitals and digital health platforms, have boosted the use of biosensors in clinical practice. According to the data published by ITA, in 2023, Saudi Arabia allocated $50.4 billion, or 16.96% of its budget, to healthcare, emphasizing privatization. The Ministry of Health oversees services, while NUPCO centralizes medical supply procurement. Key regulators include the SFDA for imports, CCHI for insurance, and the NCP for asset privatization, enhancing digital health services. Additionally, government-sponsored funding for research and development in healthcare technology has fueled innovation, making biosensors more efficient and affordable. Therefore, biosensors are rapidly emerging as an integral part of the nation's healthcare revolution, being one of the major contributors to the Saudi Arabia biosensors market growth.

To get more information on this market Request Sample

Rise in Chronic Diseases Management

The growing incidence of chronic diseases like diabetes and cardiovascular conditions in Saudi Arabia has led to an increased reliance on biosensors for monitoring and managing these health issues. A study in Alqunfudah, Saudi Arabia, found that 36.1% of 332 participants had Type 2 diabetes, while 28.3% had impaired fasting glucose. Significant predictors included age and hypertension. With 52.4% being female and 45.2% over 50, the need for early detection and community screening programs is essential. Biosensors, particularly those used for glucose monitoring, have become essential tools for individuals with diabetes, allowing for continuous, real-time tracking of blood sugar levels. This helps patients make timely adjustments to their treatment plans and lifestyle. Similarly, biosensors for heart rate and blood pressure monitoring are crucial in managing cardiovascular diseases, enabling early detection of abnormalities and reducing the risk of serious health complications. The non-invasive nature of these devices enhances patient comfort and compliance, especially for long-term monitoring. With healthcare professionals advocating for more personalized, real-time management of chronic diseases, the demand for biosensors in Saudi Arabia is rapidly increasing, contributing to improved health outcomes and quality of life for patients.

Saudi Arabia Biosensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, technology, application, and end use.

Product Insights:

- Wearable Biosensors

- Non-Wearable Biosensors

The report has provided a detailed breakup and analysis of the market based on the product. This includes wearable biosensors and non-wearable biosensors.

Technology Insights:

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Thermal Biosensors

- Nanomechanical Biosensors

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electrochemical biosensors, optical biosensors, piezoelectric biosensors, thermal biosensors, nanomechanical biosensors, and others.

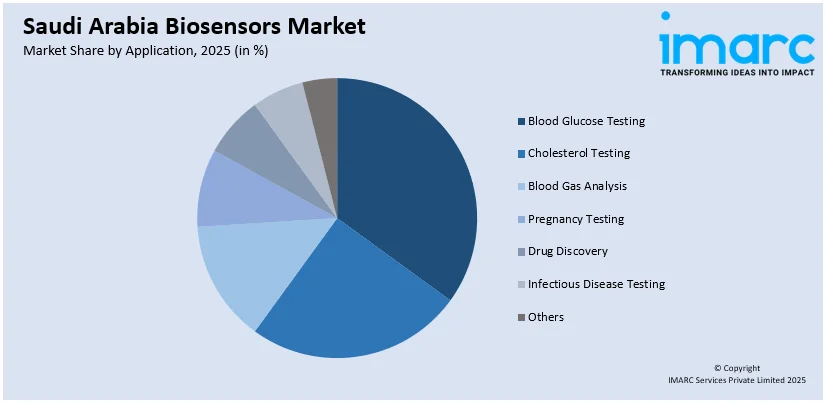

Application Insights:

Access the comprehensive market breakdown Request Sample

- Blood Glucose Testing

- Cholesterol Testing

- Blood Gas Analysis

- Pregnancy Testing

- Drug Discovery

- Infectious Disease Testing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes blood glucose testing, cholesterol testing, blood gas analysis, pregnancy testing, drug discovery, infectious disease testing, and others.

End Use Insights:

- Point of Care Testing

- Home Healthcare Diagnostics

- Research Laboratories

- Security and Biodefense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes point of care testing, home healthcare diagnostics, research laboratories, security and biodefense, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Biosensors Market News:

- In August 2023, Nemaura Medical received SFDA approval for its non-invasive glucose sensor, sugarBEAT®, marking a significant advancement in diabetes care in the Middle East. With high diabetes prevalence and a provisional order for 1.7 million sensors, the company aims to enhance metabolic health management across the region.

Saudi Arabia Biosensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wearable Biosensors, Non-Wearable Biosensors |

| Technologies Covered | Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, Thermal Biosensors, Nanomechanical Biosensors, Others |

| Applications Covered | Blood Glucose Testing, Cholesterol Testing, Blood Gas Analysis, Pregnancy Testing, Drug Discovery, Infectious Disease Testing, Others |

| End Uses Covered | Point of Care Testing, Home Healthcare Diagnostics, Research Laboratories, Security and Biodefense, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia biosensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia biosensors market on the basis of product?

- What is the breakup of the Saudi Arabia biosensors market on the basis of technology?

- What is the breakup of the Saudi Arabia biosensors market on the basis of application?

- What is the breakup of the Saudi Arabia biosensors market on the basis of end use?

- What is the breakup of the Saudi Arabia biosensors market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia biosensors market?

- What are the key driving factors and challenges in the Saudi Arabia biosensors market?

- What is the structure of the Saudi Arabia biosensors market and who are the key players?

- What is the degree of competition in the Saudi Arabia biosensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia biosensors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia biosensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia biosensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)