Saudi Arabia Biscuits Market Size, Share, Trends and Forecast by Product Type, Ingredient, Packaging Type, Distribution Channel, and Region, 2025-2033

Saudi Arabia Biscuits Market Size and Share:

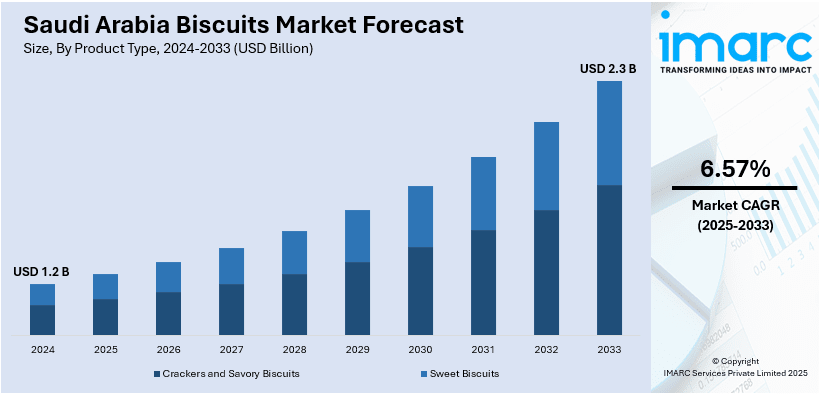

The Saudi Arabia biscuits market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.57% during 2025-2033. The market is influenced by several drivers, including rising disposable incomes, heightened demand for convenience food, and evolving consumer attitudes toward healthier and premium products. The growth in online shopping and e-commerce, and the increase in retail channels, is also contributing to the development of the Saudi Arabia biscuits market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate 2025-2033 | 6.57% |

Saudi Arabia Biscuits Market Trends:

Increasing Demand for Healthier Biscuits

In Saudi Arabia, healthier biscuit consumption is on the rise as consumers are becoming increasingly health-conscious. As people become more aware of the effects of sugar and artificial ingredients on their health, they are turning to biscuits with reduced sugar levels, added fiber, and vitamins and minerals fortified in them. Manufacturers are reacting by launching whole grain, gluten-free, and functional benefit biscuits such as weight management or digestive health. This trend is most noticeable among the young and health-conscious consumers as well as families seeking healthy snacks for kids. In addition, a growing demand exists for organic biscuits, which are seen as a healthier choice compared to standard products, reflecting a shift in the Saudi Arabia biscuits market outlook, toward clean eating. Lately, the Saudi Food and Drug Authority (SFDA) has implemented three new technical regulations designed to enhance public health and foster healthy eating habits, with the goal of fulfilling the aims of the Health Sector Transformation Program, which is part of Saudi Arabia’s Vision 2030. The initiative is part of SFDA’s proactive measures designed to enhance human life expectancy and decrease the prevalence of chronic illnesses. The rules encompass revealing caffeine levels in drinks, marking high-salt dishes, and indicating physical activity on menus at eateries and cafes that provide food to customers away from home. The rules will take effect on July 1, 2025.

E-commerce and Online Retail Growth

The expansion of e-commerce and online retail platforms is facilitating the Saudi Arabia biscuits market growth. With growing internet penetration and ubiquitous use of mobile phones, more consumers are buying biscuits online. E-commerce websites such as Souq, Noon, and grocery home delivery services allow consumers to purchase biscuits from their homes, with discounts or offers at times. This change has allowed brands to connect with more people, particularly in smaller cities and rural communities where conventional retail points may not be available. With online purchasing of food products gaining popularity, companies are also strengthening their web presence, opening subscription-based options and adding new types of biscuits to meet the changing preferences of online consumers. This trend will continue as online shopping convenience and ease propel the consumer behavior of the biscuits market. For example, in January 2025, e-commerce sales in Saudi Arabia utilizing Mada cards increased by 44.64 percent year-over-year, totaling SR20.87 billion ($5.56 billion), highlighting the Kingdom’s rapid transition to digital payment methods. Figures from the Saudi Central Bank, also known as SAMA, revealed that transaction volumes surged by 33.65 percent to 111.42 million, indicating an increase in consumer spending and the expanding use of contactless payment technologies. The data includes online shopping, app purchases, and e-wallet transactions, not counting credit card payments through Visa or MasterCard.

Saudi Arabia Biscuits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, ingredient, packaging type, and distribution channel.

Product Type Insights:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-coated Biscuits

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes crackers and savory biscuits (plain crackers, flavored crackers), and sweet biscuits (plain biscuits, cookies, sandwich biscuits, chocolate-coated biscuits, others).

Ingredient Insights:

- Wheat

- Oats

- Millets

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes wheat, oats, millet, and others.

Packaging Type Insights:

- Pouches/Packets

- Jars

- Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pouches/packets, jars, boxes, and others.

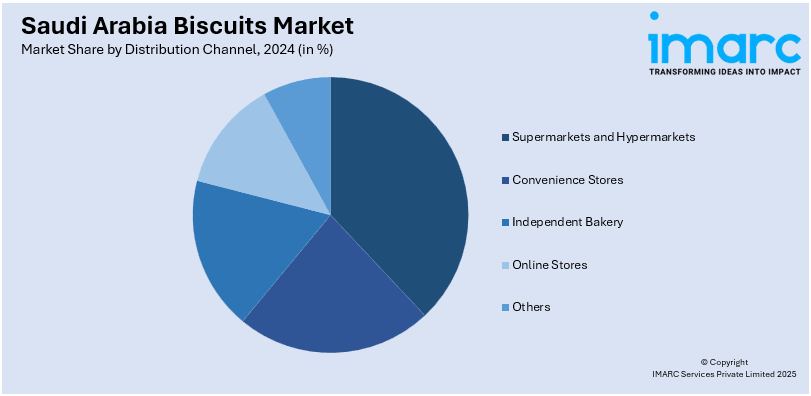

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, independent bakery, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Biscuits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Wheat, Oats, Millets, Others |

| Packaging Types Covered | Pouches/Packets, Jars, Boxes, Others |

| Distribution Channels | Supermarkets and Hypermarkets, Convenience Stores, Independent Bakery, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia biscuits market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia biscuits market on the basis of product type?

- What is the breakup of the Saudi Arabia biscuits market on the basis of ingredient?

- What is the breakup of the Saudi Arabia biscuits market on the basis of packaging type?

- What is the breakup of the Saudi Arabia biscuits market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia biscuits market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia biscuits market?

- What are the key driving factors and challenges in the Saudi Arabia biscuits market?

- What is the structure of the Saudi Arabia biscuits market and who are the key players?

- What is the degree of competition in the Saudi Arabia biscuits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia biscuits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia biscuits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia biscuits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)