Saudi Arabia Blenders and Mixers Market Size, Share, Trends and Forecast by Product Type, Capacity, Speed Settings, Features, and Region, 2026-2034

Saudi Arabia Blenders and Mixers Market Summary:

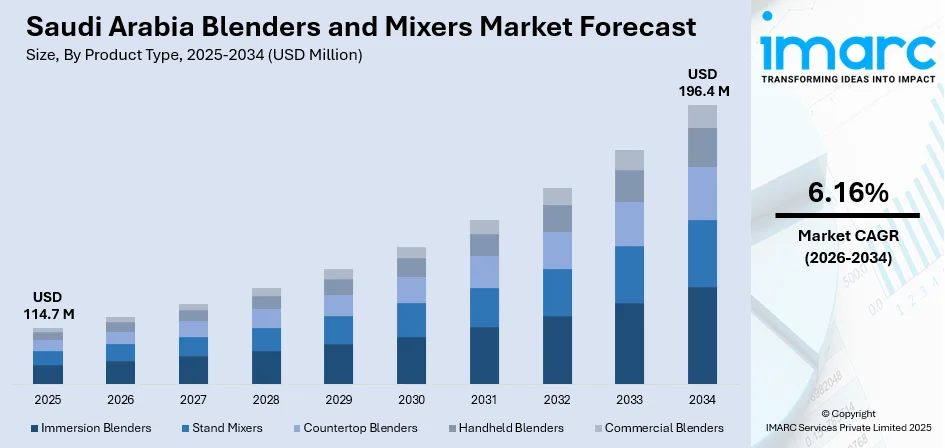

The Saudi Arabia blenders and mixers market size was valued at USD 114.7 Million in 2025 and is projected to reach USD 196.4 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034.

The Saudi Arabia blenders and mixers market is experiencing robust growth driven by increasing urbanization, rising disposable incomes, and growing consumer preference for convenient kitchen appliances. The Kingdom's Vision 2030 initiative continues to fuel demand for modern household appliances as living standards improve across urban centers. Growing health consciousness among Saudi consumers has accelerated adoption of blending appliances for preparing fresh juices, smoothies, and nutritious beverages. Expansion of e-commerce platforms and organized retail channels has enhanced product accessibility, while the flourishing foodservice sector creates substantial commercial demand for high-performance blending equipment, strengthening the Saudi Arabia blenders and mixers market share.

Key Takeaways and Insights:

- By Product Type: Countertop blenders dominate the market with a share of 37% in 2025, driven by superior blending performance, versatility for multiple food preparation tasks, and growing consumer preference for high-capacity home blending solutions.

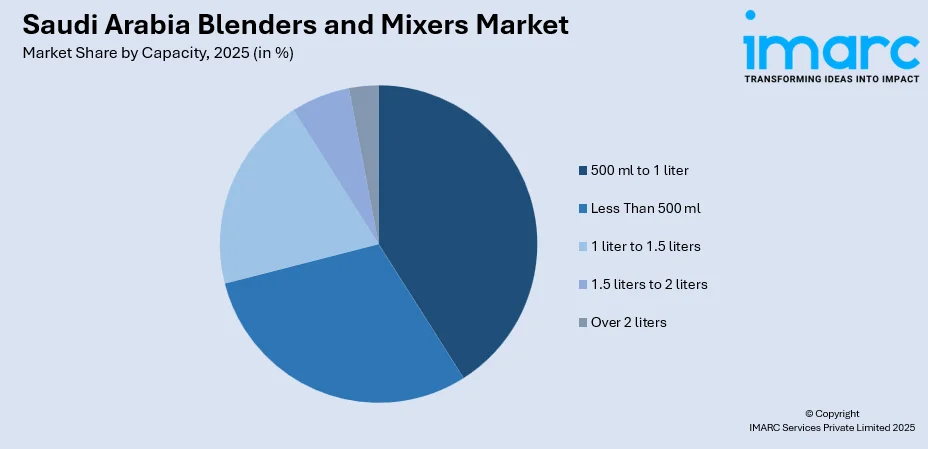

- By Capacity: 500 ml to 1 liter leads the market with a share of 41% in 2025, reflecting optimal sizing for typical Saudi household needs, balancing convenience with adequate capacity for family-sized smoothie and beverage preparation.

- By Speed Settings: 2-5 speeds represent the largest segment with a market share of 48% in 2025, offering sufficient versatility for various blending tasks while maintaining user-friendly operation for mainstream consumers.

- By Features: Pulse function holds the largest share at 43% in 2025, providing precise control for achieving desired food textures and enabling efficient ice crushing functionality.

- Key Players: The Saudi Arabia blenders and mixers market exhibits moderate competitive intensity, characterized by the presence of established multinational home appliance manufacturers alongside regional distributors. Major global brands maintain dominant positions through extensive retail partnerships and brand recognition, while local players compete through competitive pricing and after-sales service networks.

To get more information on this market Request Sample

The market landscape reflects Saudi Arabia's rapid modernization trajectory under Vision 2030, with kitchen appliance demand accelerating as urban households embrace contemporary lifestyles. The blenders and mixers segment benefits significantly from the Kingdom's thriving foodservice industry, which reached substantial expansion in 2024 as restaurants, cafes, and juice bars proliferate across major cities. Health and wellness trends have gained considerable momentum, with Saudi consumers increasingly incorporating fresh juices and smoothies into daily routines, evidenced by the growing number of juice bars across Riyadh and Jeddah. The Saudi Energy Efficiency Program's standards for household appliances encourage adoption of energy-efficient blending equipment, while e-commerce platforms have expanded product accessibility with competitive pricing and convenient delivery options, reaching consumers in remote regions previously underserved by traditional retail channels.

Saudi Arabia Blenders and Mixers Market Trends:

Rising Demand for Smart and Connected Kitchen Appliances

Saudi consumers are increasingly adopting smart kitchen appliances featuring IoT connectivity and smartphone compatibility. The trend aligns with the Kingdom's digital transformation agenda under Vision 2030, which emphasizes technology integration across daily life. Modern blenders with digital displays, preset programs, and app-based recipe guidance are gaining traction among tech-savvy Saudi households seeking convenience and precision in food preparation.

Growing Health Consciousness Driving Premium Blender Adoption

Health and wellness awareness among Saudi consumers continues to accelerate demand for high-performance blenders capable of preparing fresh juices, smoothies, and nutritious beverages. The Saudi Arabia fruit juice market size reached USD 1.28 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1.81 Billion by 2034, exhibiting a growth rate (CAGR) of 3.96% during 2026-2034, reflecting strong consumer preference for natural and nutritious beverages. Gen Z and Millennials in Riyadh and Jeddah are increasingly incorporating smoothie bowls and protein-enriched beverages into daily routines, driving demand for powerful countertop blenders with ice-crushing capabilities and multiple speed settings.

E-commerce Expansion Reshaping Distribution Channels

Online retail is fundamentally transforming kitchen appliance distribution across Saudi Arabia. E-commerce platforms are gaining significant prominence by offering extensive product selections, competitive pricing, and convenient services including same-day delivery and flexible payment options. Major platforms have expanded product accessibility nationwide, reaching consumers in previously underserved regions. This ongoing digital shift empowers consumers, enabling easy access to diverse blender brands while thoroughly comparing specifications and reading customer reviews before finalizing their purchase decisions.

How Vision 2030 is Transforming the Saudi Arabia Blenders and Mixers Market:

Saudi Arabia's Vision 2030 is reshaping the blenders and mixers market by prioritizing economic diversification, expanding the hospitality sector, and elevating consumer lifestyles across the Kingdom. Mega-projects such as NEOM, the Red Sea Global tourism developments, Qiddiya entertainment city, and Diriyah heritage district are driving unprecedented demand for commercial-grade mixers and blenders supporting hotels, restaurants, cafes, and food service establishments. Government initiatives promoting quality of life improvements and the expansion of modern retail infrastructure have accelerated adoption of premium kitchen appliances among Saudi households. Riyadh's rapid urbanization, growing middle-class population, and the rise of dual-income households are creating substantial demand for high-performance mixers and blenders supporting contemporary cooking trends, health-conscious food preparation, and convenience-oriented lifestyles across residential and commercial applications throughout the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia blenders and mixers market demonstrates strong growth potential through 2033, underpinned by sustained urbanization, rising household formation rates, and expanding middle-class consumer segments across the Kingdom. Government initiatives promoting domestic manufacturing capabilities and retail sector development under Vision 2030 create favorable conditions for continued market expansion. Increasing consumer preference for modern kitchen appliances, coupled with enhanced product accessibility through expanding e-commerce channels, further supports positive long-term market outlook. The market generated a revenue of USD 114.7 Million in 2025 and is projected to reach a revenue of USD 196.4 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034.

Saudi Arabia Blenders and Mixers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Countertop Blenders | 37% |

| Capacity | 500 ml to 1 liter | 41% |

| Speed Settings | 2-5 Speeds | 48% |

| Features | Pulse Function | 43% |

Product Type Insights:

- Immersion Blenders

- Stand Mixers

- Countertop Blenders

- Handheld Blenders

- Commercial Blenders

The countertop blenders dominate with a market share of 37% of the total Saudi Arabia blenders and mixers market in 2025.

Countertop blenders maintain market leadership due to their superior versatility, enabling consumers to prepare diverse recipes ranging from smoothies and soups to sauces and frozen desserts. These appliances offer higher motor power typically ranging from 500 to 1500 watts, providing consistent blending performance for demanding tasks including ice crushing and fibrous ingredient processing. Saudi households increasingly favor countertop models with glass jars for durability and heat resistance, supporting hot soup preparation requirements.

The segment benefits from the Kingdom's thriving café and juice bar industry, which has expanded significantly across urban centers including Riyadh, Jeddah, and Dammam. Health-conscious consumers increasingly frequent establishments offering fresh smoothies and nutritious beverages, driving commercial demand for high-performance countertop blenders. Popular retail chains across Saudi Arabia offer diverse countertop blender models from leading international brands, providing consumers with extensive options featuring glass jars, multiple speed settings, and pulse functionality.

Capacity Insights:

Access the comprehensive market breakdown Request Sample

- Less Than 500 ml

- 500 ml to 1 liter

- 1 liter to 1.5 liters

- 1.5 liters to 2 liters

- Over 2 liters

The 500 ml to 1 liter leads the market with a share of 41% of the total Saudi Arabia blenders and mixers market in 2025.

Medium-capacity blenders in the 500 ml to 1 liter range offer optimal balance between convenience and functionality for typical Saudi household requirements. These units accommodate single-serving to family-sized portions while maintaining compact footprints suitable for kitchen countertop space constraints. The capacity range aligns with popular beverage preparation needs including individual smoothies, protein shakes, and small-batch sauces that constitute primary use cases among health-conscious Saudi consumers.

Consumer preference for this segment reflects the growing trend toward personal nutrition management, with young professionals in Riyadh, Jeddah, and Dammam increasingly preparing pre-workout smoothies and meal replacement beverages. According to IMARC Group, the Saudi Arabia small home appliances market size is anticipated to reach USD 1.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033, with blenders and juicers driving demand as consumers seek to incorporate nutritious habits into daily routines.

Speed Settings Insights:

- Single Speed

- 2-5 Speeds

- 6-10 Speeds

- 10+ Speeds

The 2-5 speeds hold the largest share at 48% of the total Saudi Arabia blenders and mixers market in 2025.

Blenders with 2-5 speeds dominate consumer preference by offering adequate versatility for common food preparation tasks without overwhelming complexity. This speed range enables users to achieve appropriate consistency for smoothies at lower settings while accessing higher speeds for crushing ice and processing harder ingredients. The segment's appeal extends across demographic groups, from novice home cooks seeking straightforward operation to experienced users requiring reliable performance.

The practical functionality of mid-range speed options aligns with mainstream Saudi consumer expectations for kitchen appliances that balance capability with user-friendly operation. The Kingdom's growing middle class continues driving demand for versatile yet affordable blending solutions suitable for everyday household use. Manufacturers strategically position 2-5 speed models at competitive price points across retail channels, making them accessible to first-time purchasers establishing new households and replacement buyers upgrading existing kitchen equipment alike.

Features Insights:

- Digital Display

- Pulse Function

- Ice Crushing

- Self-Cleaning

The pulse function leads the market with a 43% share of the total Saudi Arabia blenders and mixers market in 2025.

Pulse function capability has become a standard expectation among Saudi consumers seeking precise control over blending outcomes. This feature enables momentary high-speed bursts that prevent over-processing while achieving desired textures for chunky salsas, ice-based beverages, and coarse blends. The functionality proves particularly valuable for preparing traditional Saudi culinary preparations that require specific ingredient consistencies, supporting authentic recipe preparation in modern kitchen environments.

Consumer awareness about pulse function benefits has increased through social media cooking content and celebrity chef influence, with cooking shows heightening awareness regarding modern kitchen tools according to industry analysis. The feature's utility for ice crushing applications resonates strongly in Saudi Arabia's hot climate, where cold beverages and frozen desserts maintain year-round popularity. Manufacturers across price segments incorporate pulse functionality as essential equipment specification.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region witness high demand for blenders and mixers market, driven by Riyadh's position as the Kingdom's commercial hub and population center. The capital hosts major retail chains, shopping malls, and the headquarters of leading appliance distributors. Riyadh Province commands the largest share of Saudi home appliances market, benefiting from high disposable incomes and modernization initiatives including giga-projects that embed smart-infrastructure requirements throughout new developments.

The Western Region represents a significant market segment anchored by Jeddah's strategic position as Saudi Arabia's primary Red Sea port city and commercial gateway. The region benefits from robust retail infrastructure and religious tourism driving hospitality sector demand. Makkah and Jeddah Provinces demonstrate strong growth potential in home appliances, with residential sales increasing substantially as coastal resort developments and expanding urban communities drive consumer market expansion.

The Eastern Region contributes meaningfully to market demand, leveraging petrochemical wealth and industrial clusters in Dammam, Dhahran, and Al Khobar. The region hosts affluent expatriate communities and oil-adjacent populations with high purchasing power. Local manufacturing investments in Dammam exemplify growing industrial capacity for household appliances, while industrial staff housing requirements and expanding residential developments generate consistent commercial and consumer appliance demand across the province.

The Southern Region represents an emerging market with growing potential as infrastructure development extends modern retail access to cities including Abha and Jizan. The region's cooler highland climate and agricultural heritage influence consumer preferences toward food processing equipment. Government investment in southern provinces under regional development programs creates opportunities for market penetration as urbanization accelerates household formation.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Blenders and Mixers Market Growing?

Rising Urbanization and Modern Lifestyle Adoption

Saudi Arabia's rapid urbanization trajectory fundamentally reshapes consumer demand for household appliances including blenders and mixers. Urban households characterized by dual-income structures increasingly rely on time-saving appliances that simplify meal preparation. The Saudi government's Vision 2030 initiative emphasizes enhanced quality of life, motivating consumers to invest in modern home equipment. Major urban centers including Riyadh, Jeddah, and Dammam experience continuous population growth through both natural increase and internal migration from rural regions. New residential developments incorporate modern kitchen designs that accommodate contemporary appliances, while apartment living preferences favor compact, multifunctional equipment that maximizes limited space utilization.

Expanding E-commerce Infrastructure and Digital Payment Adoption

The transformation of Saudi Arabia's retail landscape through e-commerce expansion significantly drives blenders and mixers market accessibility. Digital payment penetration continues accelerating, with e-commerce sales using Mada cards. Several platforms provide extensive product selections with competitive pricing, customer reviews, and specification comparisons that empower informed purchasing decisions. Same-day delivery capabilities in major cities and installment payment options reduce purchase barriers for consumers across income segments. This digital transformation enables manufacturers and retailers to reach previously underserved consumer segments in remote regions.

Health and Wellness Consciousness Among Young Demographics

Growing health awareness among Saudi Arabia's predominantly young population creates sustained demand for blending appliances that enable nutritious food preparation. Consumers increasingly incorporate fresh juices, smoothies, and protein shakes into daily nutrition routines, driving adoption of high-performance blenders capable of processing fruits, vegetables, and supplements. Smoothie bowls and date-based energy bars are among the healthier snack options that Gen Z and Millennials in Riyadh and Jeddah are adopting. Social media influence amplifies healthy lifestyle trends, with food content creators showcasing blender-based recipes that inspire consumer purchases across demographic segments.

Market Restraints:

What Challenges the Saudi Arabia Blenders and Mixers Market is Facing?

Import Dependency and Supply Chain Vulnerabilities

Saudi Arabia's reliance on imported household appliances creates exposure to global supply chain disruptions and currency fluctuations. The Kingdom imports majority of consumer electronics and home appliances from manufacturing hubs in Asia and Europe. Global chip shortages, shipping delays, and price instability during 2024-2025 caused inventory disruptions in major electronics stores, increasing customer wait times and inflating retail prices.

Intense Price Competition and Margin Pressure

The blenders and mixers market experiences considerable price competition from multiple manufacturers competing across various consumer segments. Aggressive promotional activities and discount campaigns compress profit margins for retailers and distributors. Price-sensitive consumers frequently prioritize affordability over brand loyalty, creating challenges for premium product positioning and long-term brand building in the competitive marketplace.

Product Commoditization and Limited Differentiation

Basic blender functionality has become largely commoditized, with numerous brands offering similar specifications at comparable price points. Limited differentiation opportunities challenge manufacturers seeking to establish competitive advantages beyond pricing strategies. Consumer perception of blenders as simple household commodities reduces willingness to pay premium prices for incremental feature improvements.

Competitive Landscape:

The Saudi Arabia blenders and mixers market features a competitive structure comprising established multinational home appliance manufacturers, regional distributors, and specialized kitchen equipment suppliers. Global brands leverage extensive distribution networks, brand recognition, and product innovation capabilities to maintain market positions across consumer segments. Local distributors provide market access, after-sales service infrastructure, and consumer financing options that support sales conversion. Competition intensifies as e-commerce platforms enable direct brand-to-consumer relationships while traditional retail channels emphasize experiential showroom environments. Market participants differentiate through product quality, warranty terms, service responsiveness, and pricing strategies tailored to specific demographic segments.

Recent Developments:

- 2025: Panasonic Marketing Middle East and Africa (PMMAF), a subsidiary of Panasonic Holdings Corporation, announced a partnership with Alessa Industries Co., appointing them as the official distributor of Panasonic's premium large home appliances including kitchen equipment in Saudi Arabia, expanding brand accessibility across the Kingdom.

- May 2024: Modern Electronics Company (MEC), part of the Al Faisaliah Group, entered a strategic partnership with Arçelik Hitachi Home Appliances Sales Middle East (AHME) to distribute Hitachi Home appliances in Saudi Arabia, expanding product range availability for Saudi households.

Saudi Arabia Blenders and Mixers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Immersion Blenders, Stand Mixers, Countertop Blenders, Handheld Blenders, Commercial Blenders |

| Capacities Covered | Less Than 500 ml, 500 ml to 1 liter, 1 liter to 1.5 liters, 1.5 liters to 2 liters, Over 2 liters |

| Speed Settings Covered | Single Speed, 2-5 Speeds, 6-10 Speeds, 10+ Speeds |

| Features Covered | Digital Display, Pulse Function, Ice Crushing, Self-Cleaning |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia blenders and mixers market size was valued at USD 114.7 Million in 2025.

The Saudi Arabia blenders and mixers market is expected to grow at a compound annual growth rate of 6.16% from 2026-2034 to reach USD 196.4 Million by 2034.

Countertop blenders dominated the market with a 37% share in 2025, driven by superior blending performance, versatility for multiple food preparation tasks, and growing consumer preference for high-capacity home blending solutions suitable for Saudi households.

Key factors driving the Saudi Arabia blenders and mixers market include rising urbanization and modern lifestyle adoption under Vision 2030, expanding e-commerce infrastructure with digital payment systems, and growing health consciousness among young demographics seeking nutritious food preparation solutions.

Major challenges include import dependency creating supply chain vulnerabilities, intense price competition compressing profit margins, product commoditization limiting differentiation opportunities, and fluctuating currency exchange rates affecting imported appliance costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)