Saudi Arabia Blockchain Market Size, Share, Trends and Forecast by Component, Provider, Type, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

Saudi Arabia Blockchain Market Overview:

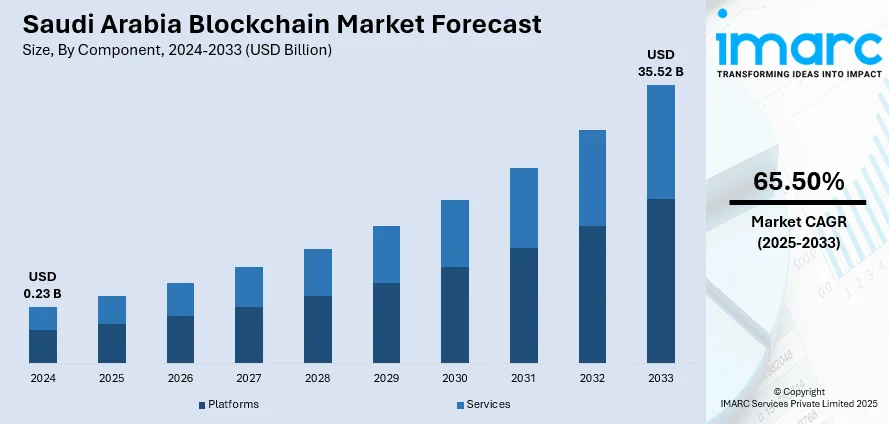

The Saudi Arabia blockchain market size reached USD 0.23 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.52 Billion by 2033, exhibiting a growth rate (CAGR) of 65.50% during 2025-2033. The economy is being pushed by robust government backing through efforts such as Vision 2030, which prioritizes the implementation of blockchain for increased transparency and efficiency. Digital transformation initiatives in various sectors, including finance and logistics, are driving blockchain implementation into major industries at a rapid pace. Public and private investment, as well as mass industry adoption, are also driving the Saudi Arabia blockchain market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.23 Billion |

| Market Forecast in 2033 | USD 35.52 Billion |

| Market Growth Rate 2025-2033 | 65.50% |

Saudi Arabia Blockchain Market Trends:

Government Vision and Strategic Initiatives

A key factor driving the growth of the sector is the government’s strategic vision and its commitment to embracing advanced technologies. As part of its Vision 2030 plan, Saudi Arabia has prioritized the adoption of digital technologies to diversify its economy and improve public sector efficiency. Blockchain is seen as a cornerstone of this transformation, with the government actively exploring its potential for enhancing various sectors, including finance, healthcare, and supply chain management. Saudi Arabia has launched initiatives like the Saudi Blockchain Initiative to promote the use of blockchain across industries, aiming to improve transparency, reduce fraud, and streamline government operations. On May 13, 2025, Nvidia announced multiple strategic partnerships with Saudi Arabia, focusing on advancing blockchain and AI infrastructure in the Kingdom. These collaborations aim to boost decentralized computing and blockchain adoption, with Nvidia’s involvement potentially influencing AI-related cryptocurrencies. Nvidia’s stock rose by 4.2% to USD 128.50, while blockchain-linked AI tokens like Render (RNDR) and Fetch.ai (FET) saw significant price increases, reflecting heightened market interest in blockchain-based AI solutions. By supporting blockchain adoption through regulations and partnerships with private enterprises, the government has created a favorable environment for innovation. This proactive stance toward blockchain technology is positioning the nation as a regional leader in the digital transformation, therefore driving the Saudi Arabia blockchain market growth.

Digital Transformation and Innovation

Saudi Arabia’s emphasis on digital transformation and innovation in its business ecosystem is another significant driver of the market growth. The country’s rapid adoption of emerging technologies such as artificial intelligence (AI), the Internet of Things (IoT), and blockchain aligns with its goal to become a global leader in technology-driven economic growth. Blockchain technology offers advantages such as increased data security, transparency, and efficiency, making it particularly attractive to industries undergoing digital transformation. On September 10, 2024, Blockchain Sports Ecosystem, a UK-based tech company, signed an MoU with Saudi's Alpha Jossor Investments to develop a USD 3.3 billion sports complex in Riyadh, Saudi Arabia. The project will include a football academy, real estate development under a smart city concept, and a digital real estate platform, with investments of USD 1.6 billion for 1,500 villas and 3,330 apartments. This partnership aligns with Saudi Arabia's Vision 2030, enhancing the country's sports and entertainment sectors. Financial institutions in Saudi Arabia are exploring blockchain for digital payments, cryptocurrency transactions, and secure record-keeping, while sectors like logistics and energy are looking at blockchain for supply chain optimization and tracking energy distribution. The growing focus on smart cities and digitized infrastructure is also creating new opportunities for blockchain solutions to improve governance and services. As Saudi businesses and government agencies continue to innovate digitally, blockchain adoption is expected to expand, further driving the market.

Saudi Arabia Blockchain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, provider, type, deployment mode, organization size, and vertical.

Component Insights:

- Platforms

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platforms and services (professional services and managed services).

Provider Insights:

- Application Provider

- Infrastructure Provider

- Middleware Provider

The report has provided a detailed breakup and analysis of the market based on the provider. This includes application provider, infrastructure provider, and middleware provider.

Type Insights:

- Public

- Private

- Hybrid

- Consortium

The report has provided a detailed breakup and analysis of the market based on the type. This includes public, private, hybrid, and consortium.

Deployment Mode Insights:

- On-Premises

- Cloud

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises, cloud, and hybrid.

Organization Size Insights:

- SMEs

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMEs and large enterprises.

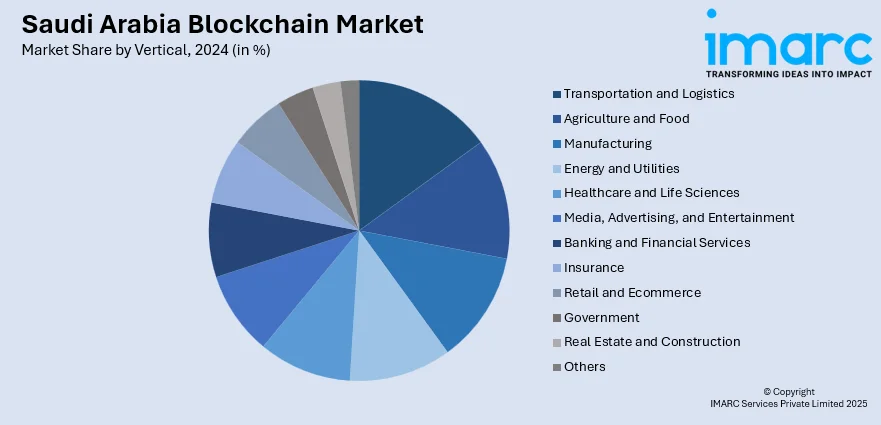

Vertical Insights:

- Transportation and Logistics

- Agriculture and Food

- Manufacturing

- Energy and Utilities

- Healthcare and Life Sciences

- Media, Advertising, and Entertainment

- Banking and Financial Services

- Insurance

- Retail and Ecommerce

- Government

- Real Estate and Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes transportation and logistics, agriculture and food, manufacturing, energy and utilities, healthcare and life sciences, media, advertising, and entertainment, banking and financial services, insurance, IT and telecom, retail and ecommerce, government, real estate and construction, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Blockchain Market News:

- On February 13, 2025, the Web3 Alliance of Saudi Arabia (WASA) was launched to foster the adoption of blockchain and Web3 technologies, in alignment with Saudi Arabia’s Vision 2030. The alliance, founded by The Sandbox, Animoca Brands, and Outlier Ventures, aims to build a collaborative ecosystem for businesses to drive growth through key pillars including awareness, standards, networking, and R&D. WASA's board includes prominent local leaders and experts, with a focus on supporting the Kingdom's digital transformation and innovation in the blockchain sector.

Saudi Arabia Blockchain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Providers Covered | Application Provider, Infrastructure Provider, Middleware Provider |

| Types Covered | Public, Private, Hybrid, Consortium |

| Deployment Modes Covered | On-Premises, Cloud, Hybrid |

| Organization Sizes Covered | SMES, Large Enterprises |

| Verticals Covered | Transportation and Logistics, Agriculture and Food, Manufacturing, Energy and Utilities, Healthcare and Life Sciences, Media, Advertising, and Entertainment, Banking and Financial Services, Insurance, IT and Telecom, Retail and Ecommerce, Government, Real Estate and Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia blockchain market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia blockchain market on the basis of component?

- What is the breakup of the Saudi Arabia blockchain market on the basis of provider?

- What is the breakup of the Saudi Arabia blockchain market on the basis of type?

- What is the breakup of the Saudi Arabia blockchain market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia blockchain market on the basis of organization size?

- What is the breakup of the Saudi Arabia blockchain market on the basis of vertical?

- What is the breakup of the Saudi Arabia blockchain market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia blockchain market?

- What are the key driving factors and challenges in the Saudi Arabia blockchain market?

- What is the structure of the Saudi Arabia blockchain market and who are the key players?

- What is the degree of competition in the Saudi Arabia blockchain market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia blockchain market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia blockchain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia blockchain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)