Saudi Arabia Botulinum Toxin Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Saudi Arabia Botulinum Toxin Market Overview:

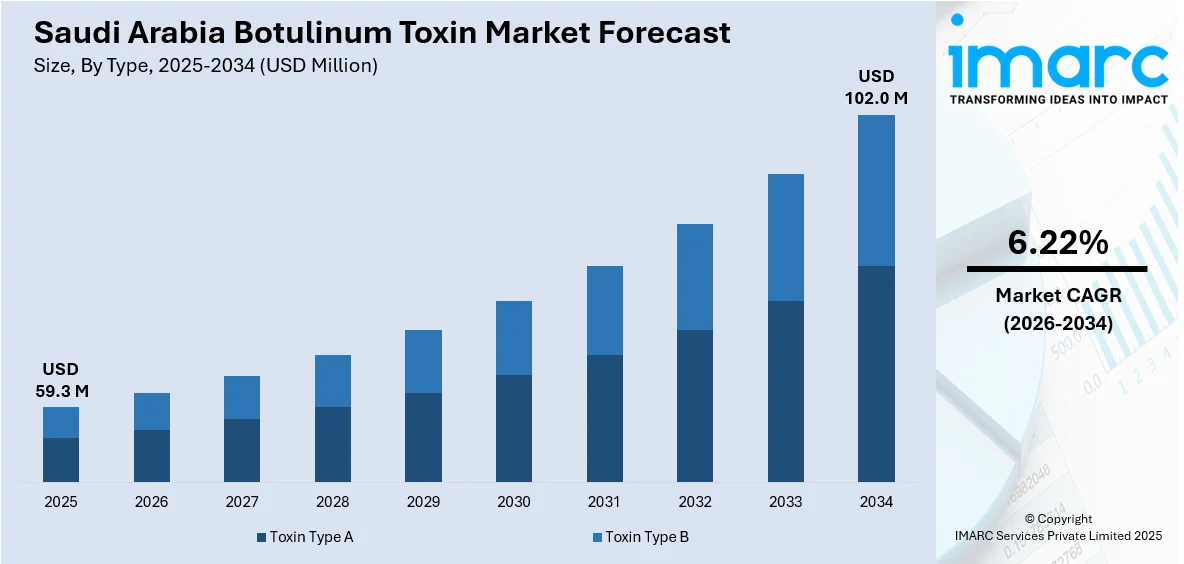

The Saudi Arabia botulinum toxin market size reached USD 59.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 102.0 Million by 2034, exhibiting a growth rate (CAGR) of 6.22% during 2026-2034. The market is growing steadily due to rising demand for non-surgical aesthetic treatments, expanding medical tourism, and increasing regulatory approvals. Strategic partnerships and product launches by global firms are further supporting market expansion and competitive activity in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 59.3 Million |

| Market Forecast in 2034 | USD 102.0 Million |

| Market Growth Rate 2026-2034 | 6.22% |

Saudi Arabia Botulinum Toxin Market Trends:

Rising Demand for Cosmetic Procedures

The demand for botulinum toxin-based cosmetic treatments in Saudi Arabia has increased due to shifting beauty standards, greater social media influence, and rising disposable income. More consumers are seeking non-invasive solutions to reduce signs of aging, especially among younger urban demographics. Dermatology and aesthetic clinics are expanding their offerings, with botulinum toxin injections becoming a regular part of beauty routines for both men and women. Social acceptance of cosmetic enhancements is also growing, driven by broader exposure to global aesthetic trends. Medical tourism adds to this trend, as patients from nearby regions prefer Saudi Arabia for its advanced infrastructure and professional services. As a result, both local and international companies are focusing on increasing their market share. In February 2025, Daewoong Pharmaceutical introduced NABOTA in Saudi Arabia following regulatory approval by the Saudi Food and Drug Authority. This move, backed by certifications from the US FDA, EMA, and Health Canada, strengthened market credibility and increased competition in the premium botulinum toxin segment. These factors indicate a growing preference for reliable, effective, and safe cosmetic treatments. This makes the market favorable for high-quality product providers and service expansions across cities like Riyadh and Jeddah.

To get more information on this market Request Sample

Strategic Partnerships Fuel Expansion

The market has seen increased interest from global manufacturers entering the Saudi Arabian botulinum toxin segment through distribution alliances and licensing partnerships. These collaborations are designed to improve accessibility, enhance brand visibility, and speed up product availability across major cities. Companies are leveraging local networks with strong regional experience to overcome market entry barriers and tailor offerings to suit the preferences of Middle Eastern consumers. Multinational players are focusing on aligning with distributors that have deep-rooted expertise in aesthetic medicine and established logistical networks. This approach helps in quick market penetration and builds trust among medical professionals and patients. Hugel’s agreement with Dubai-based Medica Group, announced in November 2024, expanded the presence of its Botulax toxin in the MENA region, including Saudi Arabia. Medica’s existing branches in Saudi Arabia played a critical role in streamlining distribution and increasing access to high-quality aesthetic injectables. Such developments reflect a growing trend of cross-border partnerships aimed at tapping into Saudi Arabia’s promising aesthetic market. The country’s favorable demographics, increasing awareness of cosmetic solutions, and rising demand for certified, global-standard products are expected to keep the market momentum strong in the coming years.

Saudi Arabia Botulinum Toxin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Toxin Type A

- Toxin Type B

The report has provided a detailed breakup and analysis of the market based on the type. This includes toxin type a and toxin type b.

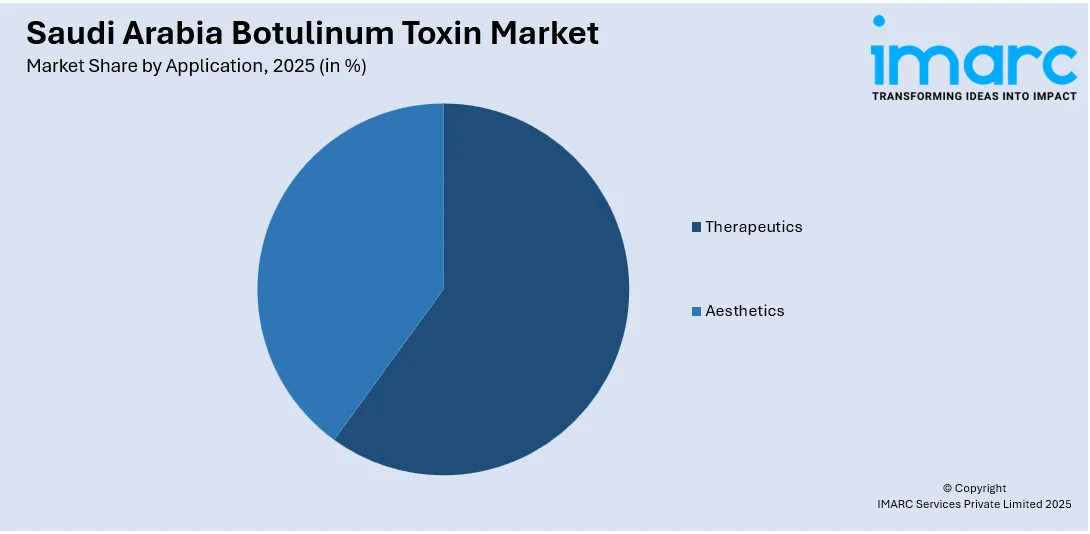

Application Insights:

Access the comprehensive market breakdown Request Sample

- Therapeutics

- Aesthetics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes therapeutics and aesthetics.

End User Insights:

- Hospitals and Clinics

- Dermatology Clinics

- Spas and Cosmetic Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, dermatology clinics, and spas and cosmetic centers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Botulinum Toxin Market News:

- February 2025: Daewoong Pharmaceutical launched its high-purity botulinum toxin NABOTA in Saudi Arabia after SFDA approval. Backed by FDA, EMA, and Health Canada certifications, the launch expanded Daewoong’s footprint in the Middle East, boosting regional competition and accelerating market growth for advanced toxin therapies.

- November 2024: Hugel partnered with Dubai-based Medica Group to expand Botulax botulinum toxin distribution across MENA, including Saudi Arabia. This strategic alliance strengthened Hugel’s regional presence, enhanced product accessibility, and intensified competition in the rapidly growing aesthetic toxin market of the Middle East and North Africa.

Saudi Arabia Botulinum Toxin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Toxin Type A, Toxin Type B |

| Applications Covered | Therapeutics, Aesthetics |

| End User Covered | Hospitals and Clinics, Dermatology Clinics, Spas and Cosmetic Centers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia botulinum toxin market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia botulinum toxin market on the basis of the type?

- What is the breakup of the Saudi Arabia botulinum toxin market on the basis of application?

- What is the breakup of the Saudi Arabia botulinum toxin market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia botulinum toxin market?

- What are the key driving factors and challenges in the Saudi Arabia botulinum toxin market?

- What is the structure of the Saudi Arabia botulinum toxin market and who are the key players?

- What is the degree of competition in the Saudi Arabia botulinum toxin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia botulinum toxin market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia botulinum toxin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia botulinum toxin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)