Saudi Arabia Brakes and Clutches Market Size, Share, Trends and Forecast by Technology, Product Type, Sales Channel, End Use Industry, and Region, 2026-2034

Saudi Arabia Brakes and Clutches Market Overview:

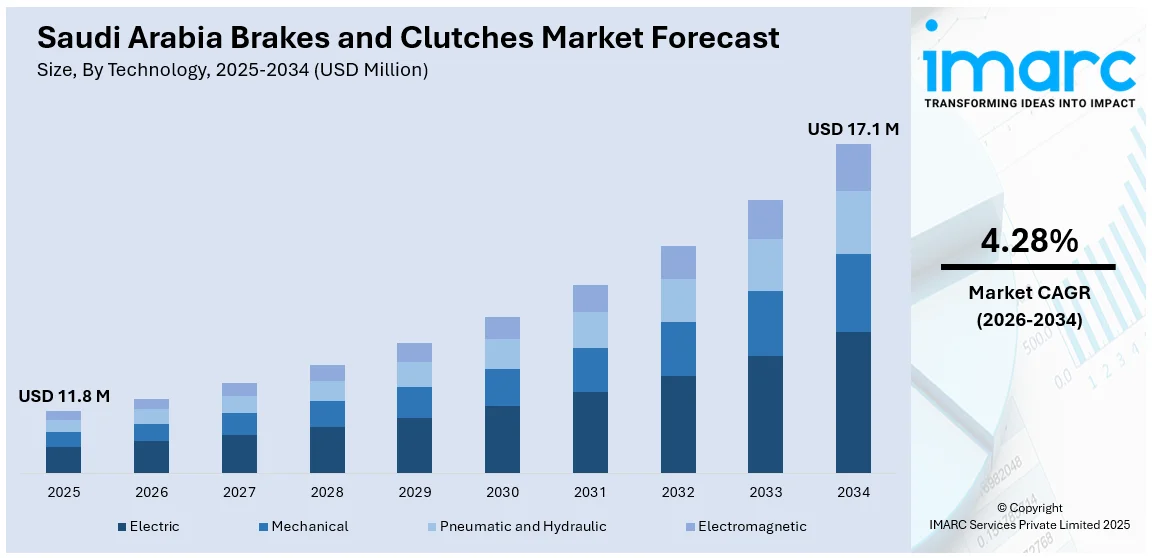

The Saudi Arabia brakes and clutches market size was valued at USD 11.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 17.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.28% during 2026-2034. Increasing demand for efficient automotive components, growing urban infrastructure, and rising vehicle ownership are the prominent factors propelling the market. Investment in domestic manufacturing encouraged by the government's push for local manufacturing under Vision 2030 and incentives for the expansion of the automotive industry are also escalating product demand. Rising trend toward electric and hybrid cars is spurring advancements in braking technology, further expanding the Saudi Arabia brakes and clutches market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.8 Million |

| Market Forecast in 2034 | USD 17.1 Million |

| Market Growth Rate 2026-2034 | 4.28% |

Saudi Arabia Brakes and Clutches Market Trends:

Technological Developments in Brake and Clutch Systems

The market for brake and clutch systems is being significantly impacted by the technological revolution taking place in Saudi Arabia's automotive industry. Demand for intelligent, self-diagnostic brake systems is being driven using smart sensors, Internet of Things (IoT) technology, and predictive maintenance solutions. By providing real-time performance feedback, these technologies improve operational efficiency and allow for prompt interventions prior to malfunctions. Autonomous systems are being developed by manufacturers to increase output, reduce downtime, and save maintenance costs. Furthermore, the transition to electric and hybrid vehicles necessitates the development of sophisticated, effective clutch and brake systems tailored for electric drive trains. Unlike conventional internal combustion engines, electric vehicles need specialized braking technology, such regenerative braking systems, which can transform kinetic energy into electric energy. Manufacturers are striving to develop strong, lightweight clutch and brake parts specifically for electric vehicles in response to the rising demand for these vehicles. The Saudi Arabian market for brake and clutch systems is changing as a result of these technological developments in order to conform to the overarching plan of reducing carbon emissions and promoting sustainability.

To get more information on this market Request Sample

Aftermarket Demand Growth

Saudi Arabia's brake and clutch aftermarket is expanding rapidly due to several factors, including rising fleet size and rising car ownership. Manufacturers are responding to consumer demands for customization by offering specialized parts and accessories. High-performance and long-lasting brake and clutch systems are in higher demand as a result of this trend, which also takes into account individual preferences and living standards. Additionally, the expansion of the nation's service facilities and distribution networks is making it easier for customers to obtain high-quality aftermarket goods. Numerous significant distribution channels and growing service facilities in locations like Riyadh and Jeddah have made it simple for customers to get high-quality brake and clutch parts. Due to consumer demands for dependability, performance, and safety in their vehicle maintenance, this growth is also driving the growth of the aftermarket sector.

Strategic Initiatives and Local Manufacturing

Local Manufacturing and Strategic Initiatives Through strategic investments and domestic manufacturing initiatives, Saudi Arabia's Vision 2030 plays a pivotal role in transforming the market for brake and clutch systems. To reduce reliance on imports and boost the domestic automotive industry, the government is encouraging more local production through its efforts to manufacture and assemble cars and parts locally. These initiatives entail the establishment of industrial clusters and areas, such as King Abdullah Economic City, which provide infrastructure and incentives for producers. By offering infrastructure, logistical support, and a supply chain network, these regions foster an environment that is advantageous for component manufacturers. Funding and incentives for manufacturing investments are offered by the Saudi Industrial Development Fund (SIDF) to both domestic and foreign businesses. The programs are strengthening the country's manufacturing capabilities and making Saudi Arabia a regional center to produce automotive parts. The adoption of technological advancements and environmental friendliness creates a number of opportunities for both domestic and international businesses, which is contributing to the Saudi Arabia brakes and clutches market growth.

Saudi Arabia Brakes and Clutches Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, product type, sales channel, and end use industry.

Technology Insights:

- Electric

- Mechanical

- Pneumatic and Hydraulic

- Electromagnetic

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electric, mechanical, pneumatic and hydraulic, and electromagnetic.

Product Type Insights:

- Dry

- Oil Immersed

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dry and oil immersed.

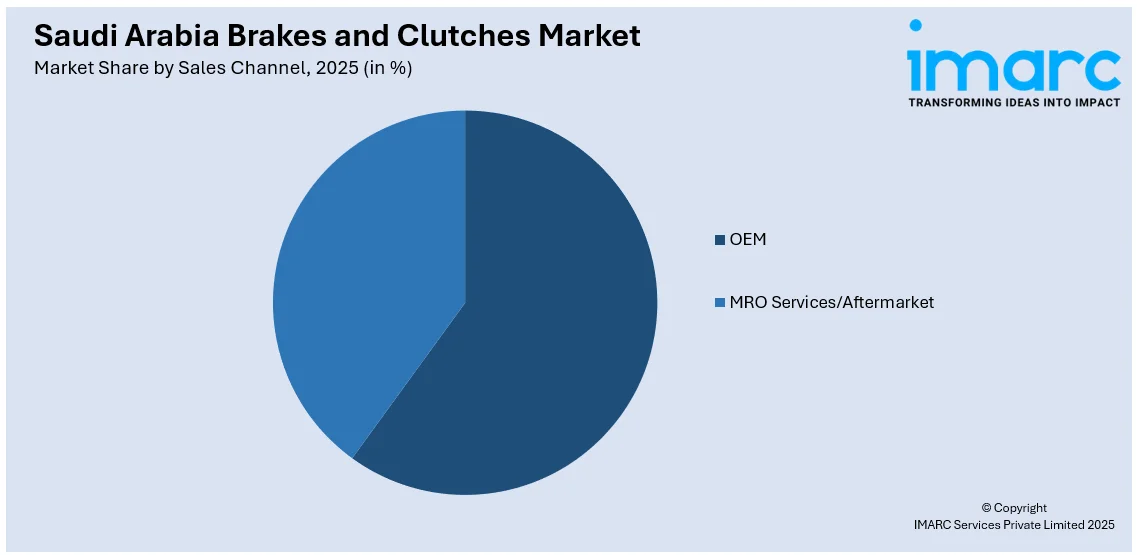

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- MRO Services/Aftermarket

A detailed breakup and analysis of the market based on the sales channel has also been provided in the report. This includes OEM and MRO services/ aftermarket.

End Use Industry Insights:

- Mining and Metallurgy Industry

- Construction Industry

- Power Generation Industry

- Industrial Production

- Commercial

- Logistics and Material Handling Industry

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes mining and metallurgy industry, construction industry, power generation industry, industrial production, commercial, and logistics and material handling industry.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Brakes and Clutches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electric, Mechanical, Pneumatic and Hydraulic, Electromagnetic |

| Product Types Covered | Dry, Oil Immersed |

| Sales Channels Covered | OEM, MRO Services/ Aftermarket |

| End Use Industries Covered | Mining and Metallurgy Industry, Construction Industry, Power Generation Industry, Industrial Production, Commercial, Logistics and Material Handling Industry |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia brakes and clutches market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia brakes and clutches market on the basis of technology?

- What is the breakup of the Saudi Arabia brakes and clutches market on the basis of product type?

- What is the breakup of the Saudi Arabia brakes and clutches market on the basis of sales channel?

- What is the breakup of the Saudi Arabia brakes and clutches market on the basis of end use industry?

- What is the breakup of the Saudi Arabia brakes and clutches market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia brakes and clutches market?

- What are the key driving factors and challenges in the Saudi Arabia brakes and clutches market?

- What is the structure of the Saudi Arabia brakes and clutches market and who are the key players?

- What is the degree of competition in the Saudi Arabia brakes and clutches market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia brakes and clutches market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia brakes and clutches market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia brakes and clutches industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)