Saudi Arabia Building Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Building Materials Market Overview:

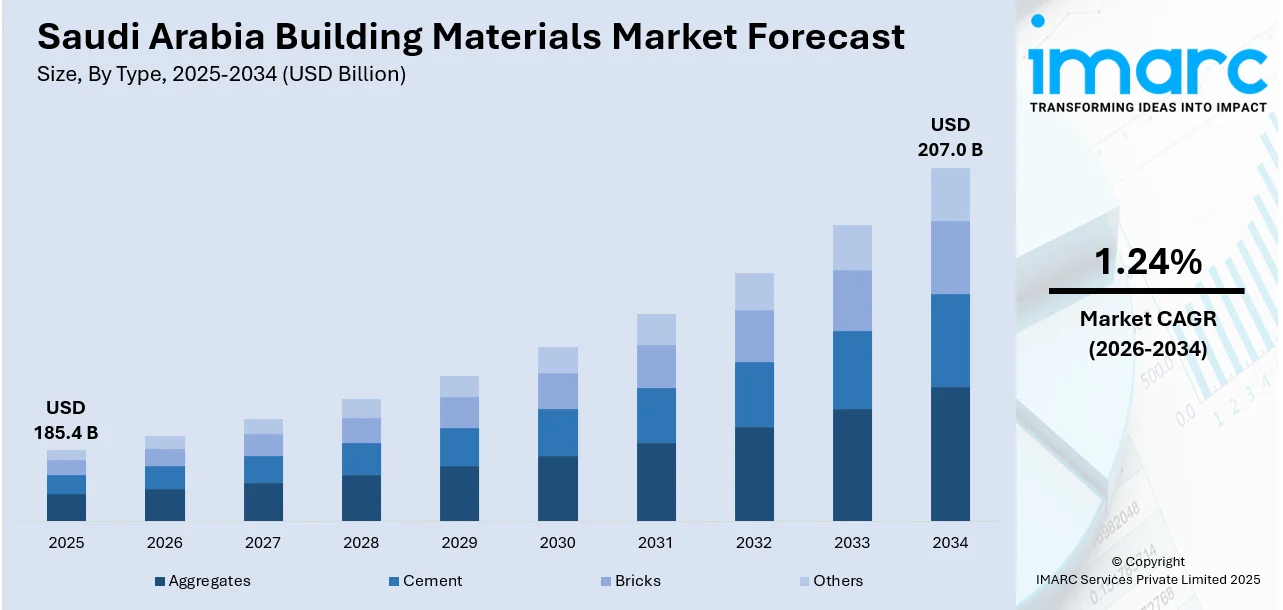

The Saudi Arabia building materials market size reached USD 185.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 207.0 Billion by 2034, exhibiting a growth rate (CAGR) of 1.24% during 2026-2034. Saudi Arabia is presently undergoing rapid infrastructure development which is catalyzing the need for effective construction materials. This trend, along with the heightened focus on economic diversification initiatives, is bolstering the market growth. Additionally, the adoption of advanced construction technologies is expanding the Saudi Arabia building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 185.4 Billion |

| Market Forecast in 2034 | USD 207.0 Billion |

| Market Growth Rate 2026-2034 | 1.24% |

Saudi Arabia Building Materials Market Trends:

Rising Focus on Infrastructure Development

Saudi Arabia is presently undergoing rapid infrastructure development which is greatly increasing the need for construction materials. Expansive infrastructure initiatives, including the creation of new urban areas transit systems, and business structures, are growing nationwide. Key projects such as the Vision 2030 initiative are promoting the development of smart cities and contemporary infrastructures necessitating huge amounts of construction materials. Projects such as NEOM and the Red Sea initiatives are in progress, drawing interest from both local and foreign investors. The continuous development of skyscrapers, housing complexes, and industrial zones is additionally driving the demand for construction materials in Saudi Arabia. As the government maintains its emphasis on improving the country's infrastructure to accommodate rising urban populations, the need for concrete, steel, and vital other construction materials is rising. In 2024, Saudi Arabia initiated a transformative path with the development of The Mukaab, an innovative cube-shaped high-rise skyscraper in Riyadh. Designed to achieve a remarkable height of 400 meters, this extraordinary edifice intends to be the tallest building in the world when finished.

To get more information on this market Request Sample

Government Investments and Economic Diversification

The government of Saudi Arabia is constantly investing in economic diversification initiatives, which are driving the demand in the building materials industry. The government's push to diversify the economy away from oil revenues through initiatives such as Vision 2030 is resulting in huge investments in different non-oil sectors, especially real estate and construction. The construction of mega-projects, such as entertainment centers, tourist sites, and residential towns, is driving a consistent demand for building materials. These projects are also facilitating public-private initiatives, leading to many large-scale projects that necessitate enormous amounts of building materials. The government backing infrastructure expansion, such as the redevelopment of existing urban settlements and the building of new towns, is catalyzing the demand for construction materials and presenting opportunities for both domestic and foreign suppliers. In 2025, AlUla has been named in the Smart City Index 2025, released by the International Institute for Management Development (IMD), among five other Saudi cities, including Makkah, Madinah, Riyadh, Jeddah, and Al-Khobar. This achievement showcases Saudi Vision 2030's advancement of smart city evolution through innovative approaches spearheaded by the Saudi Data and AI Authority (SDAIA) along with other government bodies.

Technological Advancements in Construction

The adoption of advanced construction technologies is contributing to the Saudi Arabia building materials market growth. Companies are increasingly utilizing innovations like 3D printing, sustainable building practices, and modular construction techniques, which are driving the need for specialized materials. These technologies are improving efficiency in construction and reducing costs, while simultaneously rising the demand for high quality, durable materials that can meet new standards. For instance, the integration of smart building materials such as energy efficient insulation ecofriendly cement, is becoming a trend in both residential and commercial construction. The ongoing shift towards sustainability and eco conscious building practices is promoting interest in materials that support environmental goals. As these technologies continue to evolve, they are significantly influencing material choices and market dynamics, further driving the demand for innovative building solutions in the country. In 2024, City Cement's subsidiary, Nizak Mining Company, entered into an agreement with Next Generation SCM, a UK industrial group, to form a revolutionary joint venture for low carbon concrete production in Saudi Arabia. The project inaugurated the kingdom's first calcined clay supplementary cementitious material (SCM) plant with an initial production capacity of 350,000t per annum, doubling the capacity by the second year.

Saudi Arabia Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Aggregates

- Cement

- Bricks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes aggregates, cement, bricks, and others.

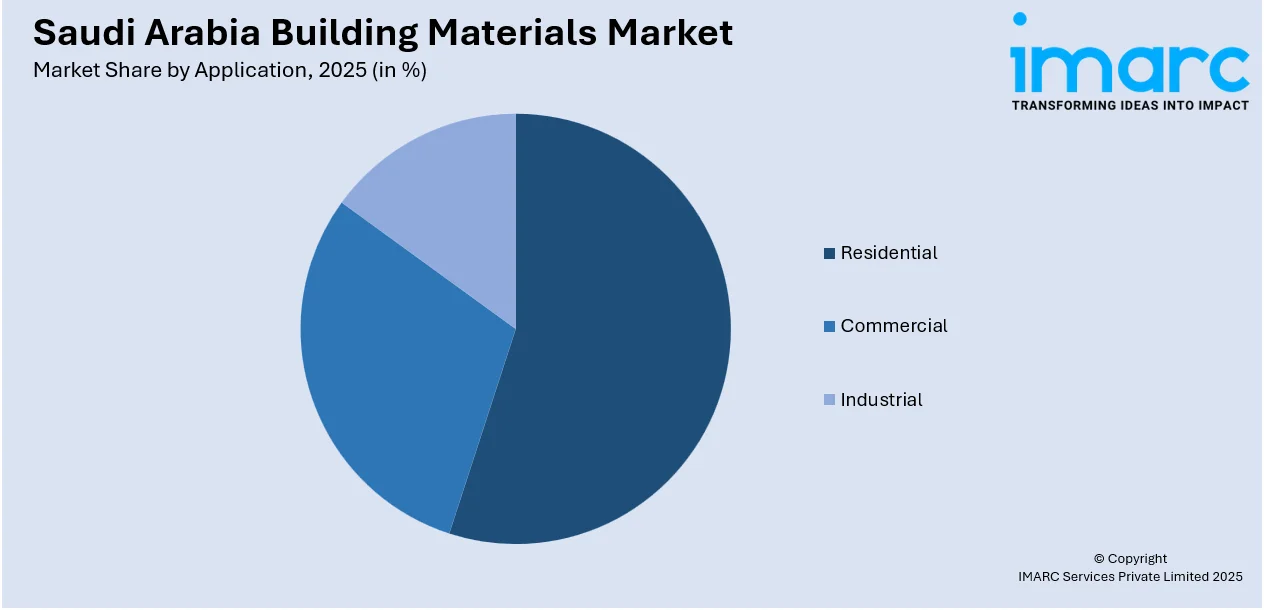

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia building materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aggregates, Cement, Bricks, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia building materials market on the basis of type?

- What is the breakup of the Saudi Arabia building materials market on the basis of application?

- What is the breakup of the Saudi Arabia building materials market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia building materials market?

- What are the key driving factors and challenges in the Saudi Arabia building materials market?

- What is the structure of the Saudi Arabia building materials market and who are the key players?

- What is the degree of competition in the Saudi Arabia building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia building materials market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)