Saudi Arabia C4 Raffinate Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia C4 Raffinate Market Overview:

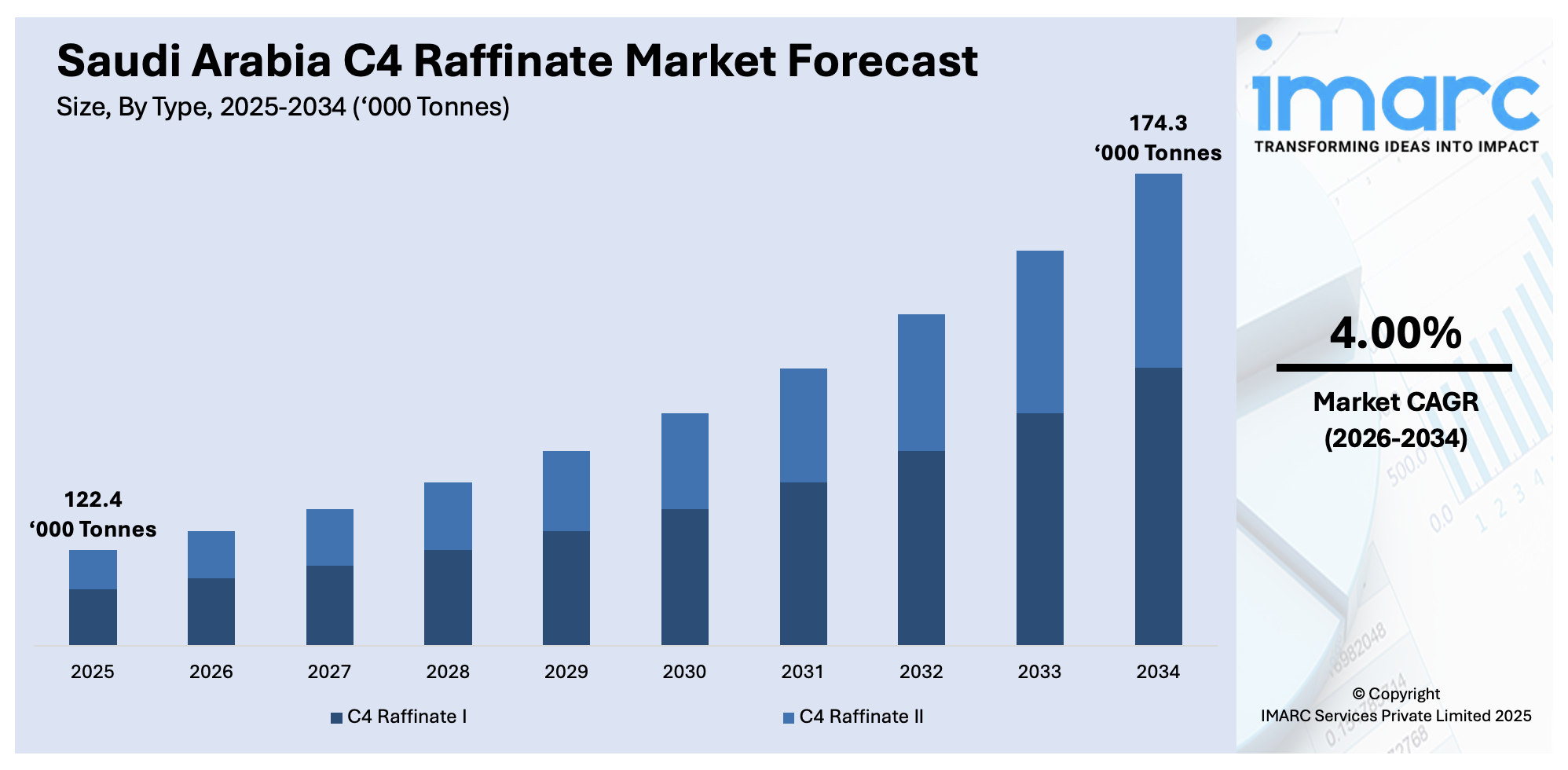

The Saudi Arabia C4 raffinate market size reached 122.4 Thousand Metric Tonnes in 2025. Looking forward, IMARC Group expects the market to reach 174.3 Thousand Metric Tonnes by 2034, exhibiting a growth rate (CAGR) of 4.00% during 2026-2034. The growing demand for butadiene and other chemicals is offering a favorable market outlook. The persistent transition towards cleaner energy solutions and environmental regulations is also contributing to the market growth. In addition, Saudi Arabia's Vision 2030 is playing a crucial role in expanding the Saudi Arabia C4 raffinate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 122.4 Thousand Metric Tonnes |

| Market Forecast in 2034 | 174.3 Thousand Metric Tonnes |

| Market Growth Rate 2026-2034 | 4.00% |

Saudi Arabia C4 Raffinate Market Trends:

Expanding Industrial Demand for C4 Raffinate in Petrochemical Production

The petrochemical industry's demand for C4 raffinate-derived chemicals is impelling the market growth. This is because of the escalating demand for butadiene and other chemicals derived from C4 raffinate, which is a major constituent used in the manufacturing of synthetic rubbers and plastics. Large petrochemical facilities in the region are expanding to meet both domestic and export market demands. Since Saudi Arabia is concentrating on economic diversification and decreasing dependence on crude oil exports, the government is heavily investing in petrochemical industries, providing a positive climate for the production of C4 raffinate and downstream products. Through these investments, the industry is improving petrochemical products, which will further drive the demand for C4 raffinate in the market. The IMARC Group predicts that the Saudi Arabia petrochemicals sector size is projected to reach USD 9.0 Billion by 2033.

To get more information on this market Request Sample

Rising Demand for Clean Energy and Environmental Regulations

The Saudi Arabian C4 raffinate sector is also benefiting from the persistent transition towards cleaner energy solutions and environmental regulations. As worldwide and domestic policies are strengthening to curb emissions, industries are making greater use of products produced from C4 raffinate, which are being integrated into green applications. The refining industry is responding by refining its process and reducing waste, which is aiding in the increased production of C4 raffinate. In addition to this, heightened interest in sustainability is driving further investments in those technologies that work towards lowering the environmental footprint of petrochemical and refining operations. This is driving the demand for C4 raffinate as a crucial byproduct in refining operations, which is improving due to both regulatory pressure and industry demands for more sustainable solutions.

Government Support and Economic Modification Approaches

Saudi Arabia's Vision 2030 is playing crucial role in contributing to the Saudi Arabia C4 raffinate market growth. The government is also actively engaged in economic diversification, lessening reliance on oil exports by promoting the development of non-oil sectors such as chemicals and petrochemicals. This vision is creating a positive investment environment in refining and petrochemical industries, which are significant consumers of C4 Raffinate. The government is giving both domestic and international organizations lucrative incentives to install manufacturing facilities and increase manufacturing capacities. These initiatives are continuously driving the market, as increased industrial output requires a steady supply of C4 raffinate. The synergy of long-term strategic initiatives, funding, and development of infrastructure is positively influencing the market. For instance, Saudi Chemical Company's board recommended cash dividends of SAR 42.16 million for 2024, a bourse disclosure said. The firm declared to pay a dividend of SAR 0.05 per share, representing 5% of the share capital, for 843.20 million qualifying shares.

Saudi Arabia C4 Raffinate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- C4 Raffinate I

- C4 Raffinate II

The report has provided a detailed breakup and analysis of the market based on the type. This includes C4 raffinate I and C4 raffinate II.

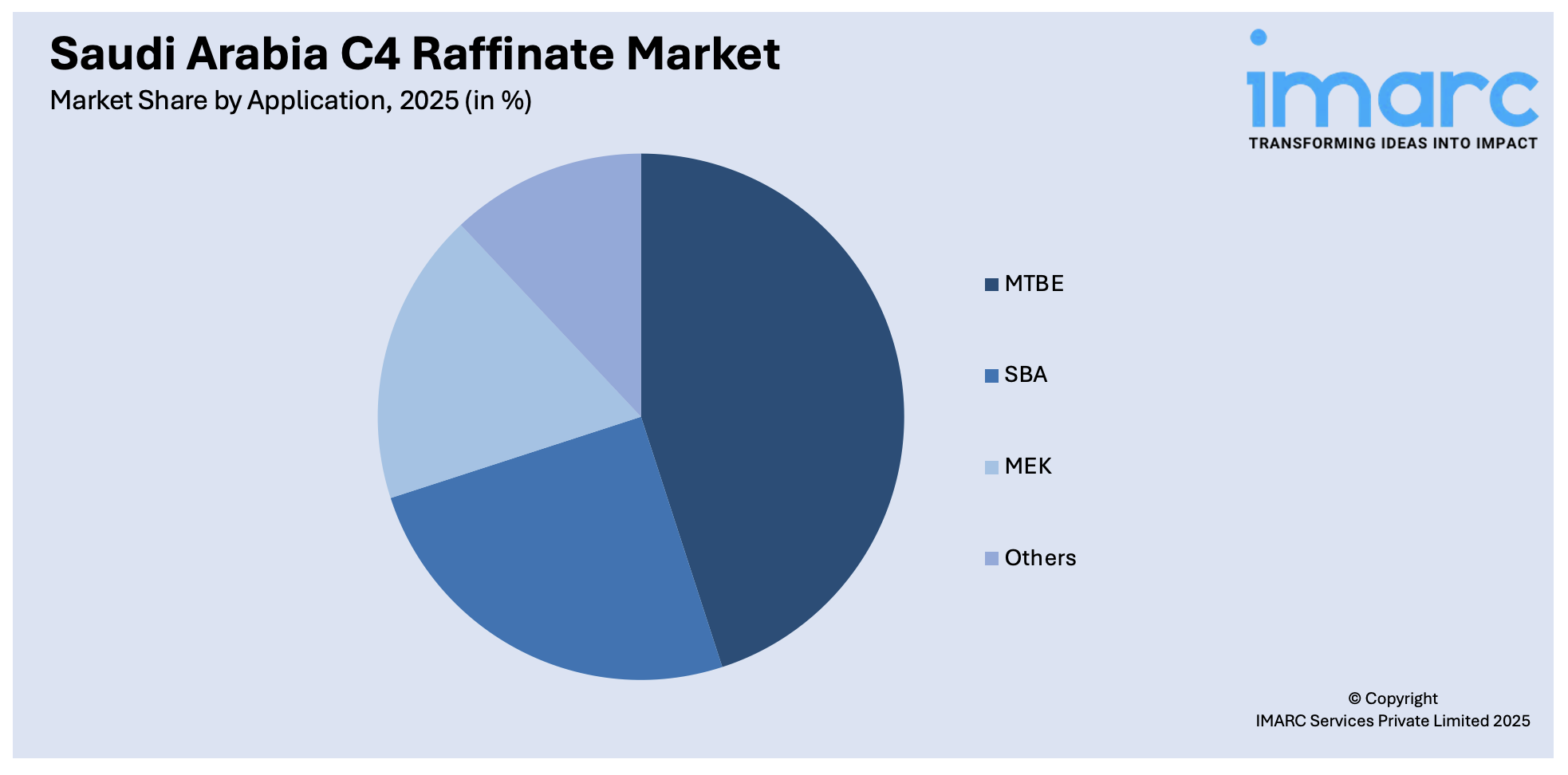

Application Insights:

Access the comprehensive market breakdown Request Sample

- MTBE

- SBA

- MEK

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes MTBE, SBA, MEK, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia C4 Raffinate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Metric Tonnes |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | C4 Raffinate I, C4 Raffinate II |

| Applications Covered | MTBE, SBA, MEK, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia C4 raffinate market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia C4 raffinate market on the basis of type?

- What is the breakup of the Saudi Arabia C4 raffinate market on the basis of application?

- What is the breakup of the Saudi Arabia C4 raffinate market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia C4 raffinate market?

- What are the key driving factors and challenges in the Saudi Arabia C4 raffinate market?

- What is the structure of the Saudi Arabia C4 raffinate market and who are the key players?

- What is the degree of competition in the Saudi Arabia C4 raffinate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia C4 raffinate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia C4 raffinate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia C4 raffinate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)