Saudi Arabia Calcium Chloride Market Size, Share, Trends and Forecast by Product Type, Application, Raw Material, Grade, and Region, 2025-2033

Saudi Arabia Calcium Chloride Market Overview:

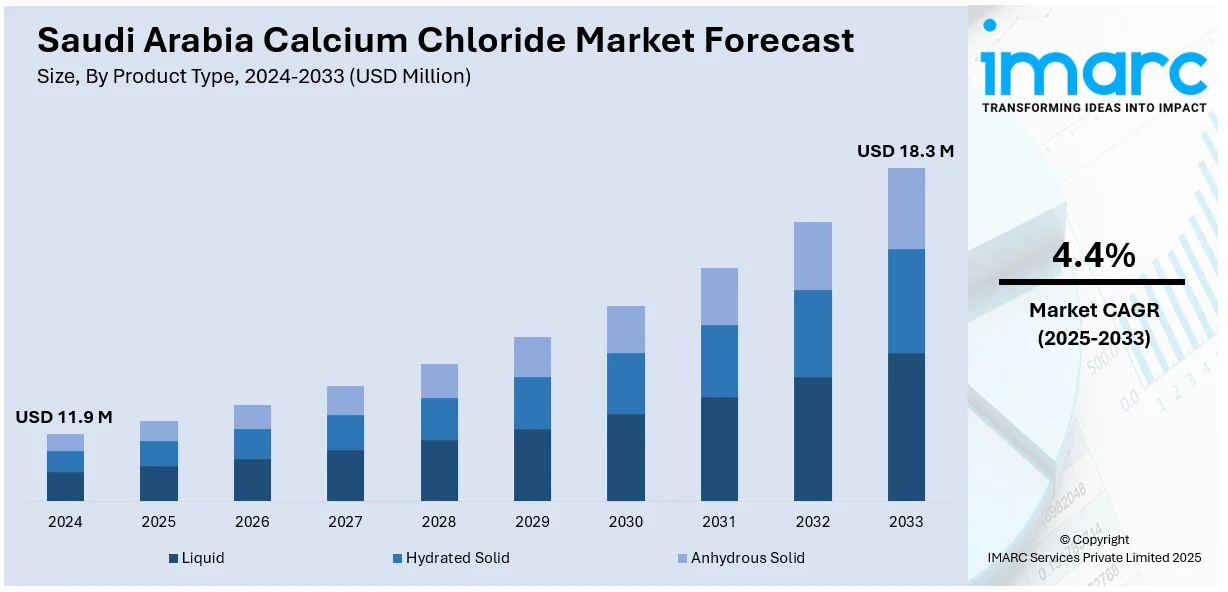

The Saudi Arabia calcium chloride market size reached USD 11.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 18.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The market is driven by increased demand from oil and gas drilling operations, especially in offshore projects. Rising infrastructure development, expanding industrial wastewater treatment, and growing applications in de-icing, dust control, and food processing also contribute to market growth, supported by favorable climatic and economic factors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.9 Million |

| Market Forecast in 2033 | USD 18.3 Million |

| Market Growth Rate 2025-2033 | 4.4% |

Saudi Arabia Calcium Chloride Market Trends:

Rising Use in Desalination and Industrial Water Treatment

Saudi Arabia’s high dependence on desalination has led to an uptick in calcium chloride demand for water treatment applications. For instance, as per industry reports, the National Water Company (NWC) of Saudi Arabia completed 118 water and sanitation projects in 2024 across all regions, costing over SAR 5.57 billion and benefiting 1.8 million people. These included 80 water supply projects and 38 sanitation projects, spanning 3.2 million meters of pipelines, expanded wastewater treatment capacities, and construction of 51 water reservoirs. The compound is used to reduce fluoride and remove impurities, enhancing desalination efficiency. With increasing investment in water infrastructure, including the Red Sea Project and Neom, the demand for calcium chloride in treating brine discharge and stabilizing treated water is accelerating. Additionally, as industrial activity diversifies under Vision 2030, more sectors are requiring stringent water quality compliance. This is pushing utility providers and manufacturers to adopt reliable and cost-effective solutions, including calcium chloride. Its compatibility with existing treatment systems and ability to optimize water recovery processes makes it a preferred choice in industrial and municipal treatment facilities across the Kingdom.

Expanding Demand in Oilfield Chemicals and Fluid Engineering

Saudi Arabia’s upstream oil and gas sector, central to its economy, remains a major consumer of calcium chloride, particularly in drilling fluid preparation and workover operations. The compound helps regulate formation pressures and stabilize boreholes, reducing risks during drilling. As the Kingdom ramps up activities in complex fields and increases the number of horizontal and deep-water wells, calcium chloride’s relevance continues to grow. Moreover, national targets for crude production capacity and gas exploration are fueling an increase in drilling fluid volume and sophistication. For instance, in November 2023, InoChem, a subsidiary of Sahara International Petrochemical Co. (Sipchem), commenced trial runs at its greenfield soda ash and calcium chloride complex in Ras Al-Khair, Saudi Arabia. The project, valued at SAR 2.9 billion ($783 million), targets annual outputs of 300,000 tons of soda ash and 348,000 tons of calcium chloride in multiple grades and forms.

Growth in Food-Grade and Agricultural Applications

The use of calcium chloride in food processing and post-harvest treatment is growing in Saudi Arabia due to its preservative and firming properties. In the food industry, it is employed for pickling, cheese production, and as a calcium fortifier in beverages. Rising consumer awareness about food quality and safety has prompted processors to adopt recognized food-grade additives, bolstering demand. Simultaneously, agricultural use is expanding for soil conditioning and as a calcium supplement in hydroponics and greenhouse farming. With climate-controlled agriculture gaining momentum in arid zones, calcium chloride is proving effective in improving nutrient availability and crop resistance. Its multifunctional role in boosting shelf life and agricultural yields aligns well with the country’s food security strategies and import substitution goals. For instance, Zirax Limited is recognized as a major participant in the global food-grade calcium chloride market. Through its agriculture division, the company directs 40% of its calcium chloride production toward date palm farming in Saudi Arabia and the UAE, incorporating formulation adjustments tailored to withstand high-temperature soil environments.

Saudi Arabia Calcium Chloride Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, raw material, and grade.

Product Type Insights:

- Liquid

- Hydrated Solid

- Anhydrous Solid

The report has provided a detailed breakup and analysis of the market based on the product type. This includes liquid, hydrated solid, and anhydrous solid.

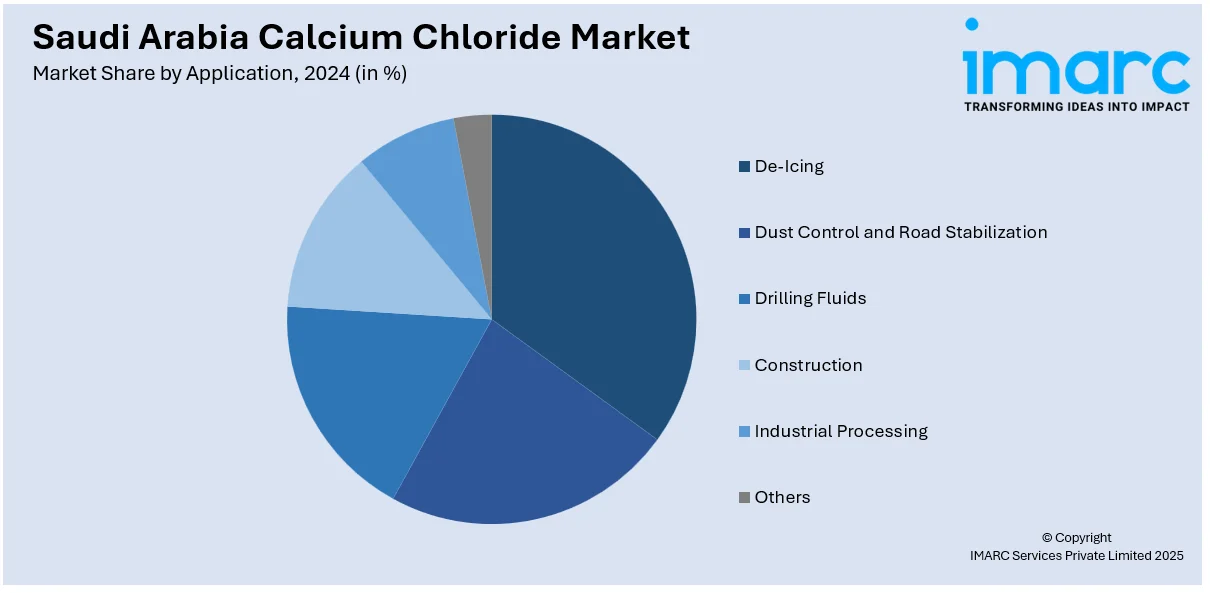

Application Insights:

- De-Icing

- Dust Control and Road Stabilization

- Drilling Fluids

- Construction

- Industrial Processing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes de-icing, dust control and road stabilization, drilling fluids, construction, industrial processing, and others.

Raw Material Insights:

- Natural Brine

- Solvay Process (by-Product)

- Limestone and HCL

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes natural brine, Solvay process (by-product), limestone and HCL, and others.

Grade Insights:

- Food Grade

- Industrial Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes food grade and industrial grade.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Calcium Chloride Market News:

- In February 2024, Nama Chemicals, a publicly listed company in Saudi Arabia, revealed plans to build a SAR 71.24 million (USD 19 Million) wastewater treatment facility to manage discharge from its calcium chloride and epoxy resin units. The project will operate under a five-year lease-to-own arrangement and is slated for completion by August 2025, followed by a two-month trial production period prior to full-scale operation.

Saudi Arabia Calcium Chloride Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid, Hydrated Solid, Anhydrous Solid |

| Applications Covered | De-Icing, Dust Control and Road Stabilization, Drilling Fluids, Construction, Industrial Processing, Others |

| Raw Materials Covered | Natural Brine, Solvay Process (by-Product), Limestone and HCL, Others |

| Grades Covered | Food Grade, Industrial Grade |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia calcium chloride market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia calcium chloride market on the basis of product type?

- What is the breakup of the Saudi Arabia calcium chloride market on the basis of application?

- What is the breakup of the Saudi Arabia calcium chloride market on the basis of raw material?

- What is the breakup of the Saudi Arabia calcium chloride market on the basis of grade?

- What are the various stages in the value chain of the Saudi Arabia calcium chloride market?

- What are the key driving factors and challenges in the Saudi Arabia calcium chloride market?

- What is the structure of the Saudi Arabia calcium chloride market and who are the key players?

- What is the degree of competition in the Saudi Arabia calcium chloride market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia calcium chloride market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia calcium chloride market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia calcium chloride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)