Saudi Arabia Car Audio Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Sound Management, Sales Channel, and Region, 2026-2034

Saudi Arabia Car Audio Market Overview:

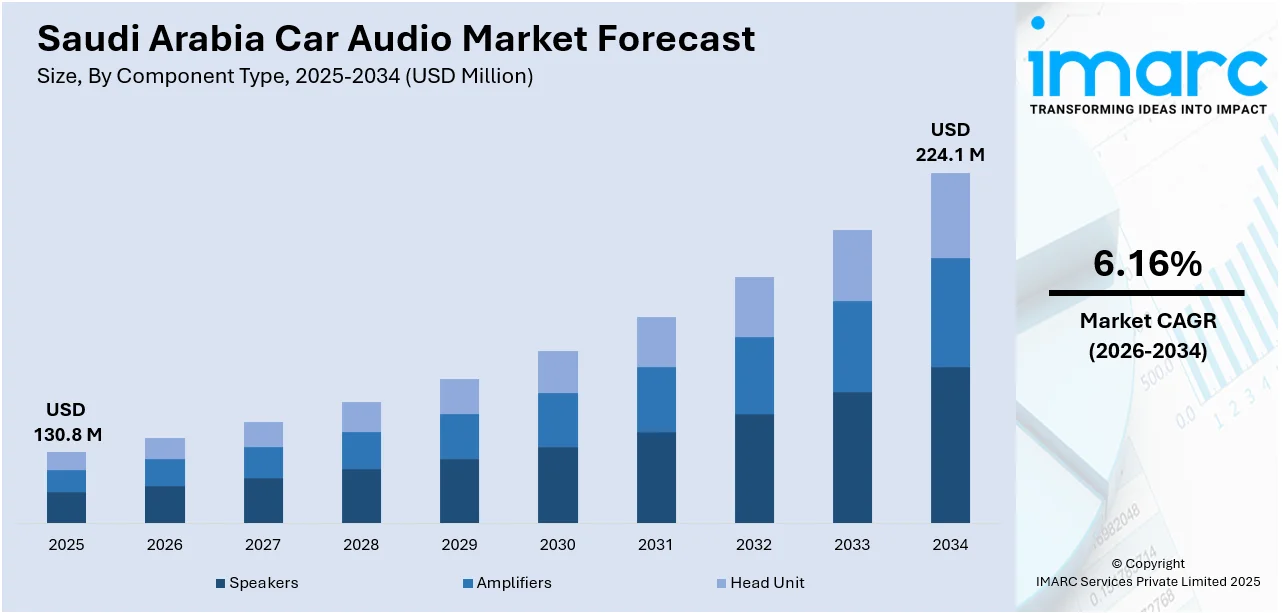

The Saudi Arabia car audio market size reached USD 130.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 224.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.16% during 2026-2034. The increasing disposable income, growing preference for high-quality sound, and rise in car ownership are fueling the market growth. Moreover, expanding middle class, demand for in-car connectivity, technological advancements in infotainment systems, and the shift toward electric vehicles are supporting the market growth. Apart from this, interest in luxury and premium audio systems, e-commerce accessibility, demand for audio system upgrades, a youthful and tech-savvy population, and the expansion of the automotive aftermarket are driving the Saudi Arabia car audio market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 130.8 Million |

| Market Forecast in 2034 | USD 224.1 Million |

| Market Growth Rate 2026-2034 | 6.16% |

Saudi Arabia Car Audio Market Trends:

Increasing Disposable Income

One of the strongest drivers for the car audio market in Saudi Arabia is increased disposable incomes among people. With the economy growing, particularly with the increased development of non-oil sectors, Saudi Arabia has witnessed increased purchasing power among citizens. According to the World Bank, Saudi Arabia's per capita gross domestic product (GDP) has steadily been on an upward path, which is directly linked with rising disposable incomes among citizens. Saudi Arabia per capita GDP reached approximately USD 23,331.77 by 2023, a sign of improved economic conditions. This increase in income allows consumers the luxury of buying premium and non-essential items such as high-end automotive audio systems, which they could not previously afford. The new-found prosperity is easily identifiable among young people, who spend their money on superior in-car products, including high-end audio goods, as a lifestyle choice.

To get more information on this market Request Sample

Growing Preference for High-Quality Sound Experiences

One of the key drivers for Saudi Arabia's car audio industry is the growing emphasis on premium sound quality experience among customers, particularly the youth segment. With the entertainment sector of Saudi Arabia on the rise, customers have changed their mindset to embracing quality audio experience. With the popularity of streaming platforms like Spotify and Apple Music, customers have become used to good sound quality and expect the same from their vehicles. The younger generation, being more tech-savvy in most cases, are willing to pay for high-end car audio systems to enhance their driving experience. In 2023, Jaguar Land Rover launched DAB+ digital audio broadcasting vehicle models in Saudi Arabia, aiming to improve the driving experience by providing superior digital sound quality across the Kingdom.

Rise in Car Ownership

Growth in car ownership in Saudi Arabia is one of the major reasons for the growth in the car audio market. Since the population of the country continues to grow, more individuals purchase cars, and thus there is an increased demand for car accessories, including audio systems. The government of Saudi Arabia's efforts to bring about development in infrastructure, improve road networks, and promote car manufacturing have all contributed towards this end. With more cars on the roads, market demand for advanced in-car audio technology also grows since car owners desire to personalize their vehicles and boost the driving experience, further propelling the Saudi Arabia car audio market growth. In a notable development, Lucid Motors announced in 2024 the opening of its first international manufacturing plant in King Abdullah Economic City, further reinforcing the Kingdom’s commitment to becoming a regional automotive hub.

Saudi Arabia Car Audio Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, vehicle type, sound management, and sales channel.

Component Type Insights:

- Speakers

- Amplifiers

- Head Unit

The report has provided a detailed breakup and analysis of the market based on the component type. This includes speakers, amplifiers, and head units.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicles (SUVs)

- Multi-Purpose Vehicles (MPVs)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes hatchback, sedan, sports utility vehicles (SUVs), and multi-purpose vehicles (MPVs).

Sound Management Insights:

- Voice Recognition

- Manual

The report has provided a detailed breakup and analysis of the market based on sound management. This includes voice recognition and manual.

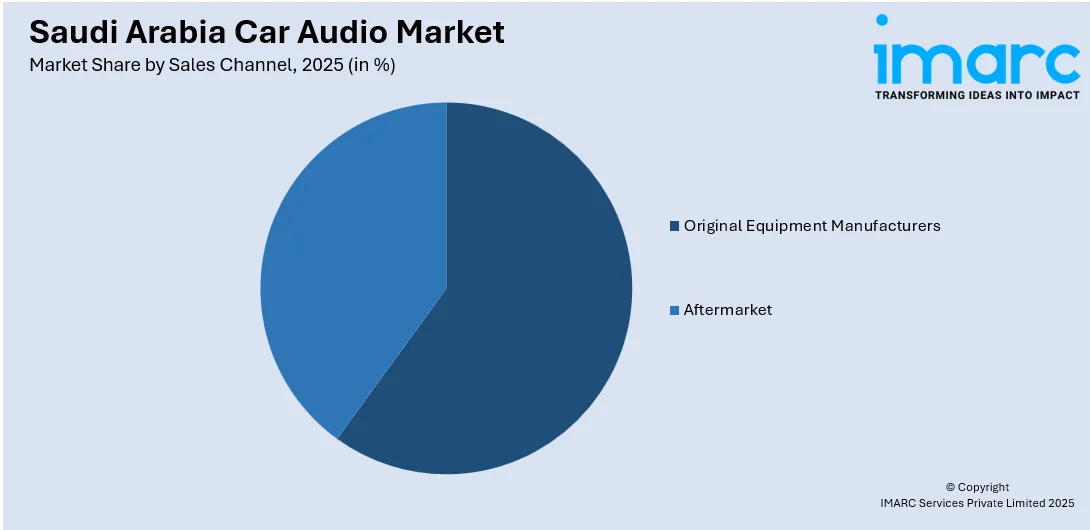

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturers

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturers and aftermarket.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Car Audio Market News:

- In 2025, NAVA signed agreements with Ceer, Lucid, and Hyundai to enhance automotive workforce development in Saudi Arabia. These partnerships aim to align education and training with industry needs, potentially impacting the car audio sector through skilled labor development.

Saudi Arabia Car Audio Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Speakers, Amplifiers, Head Unit |

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicles (SUVs), Multi-Purpose Vehicles (MPVs) |

| Sound Managements Covered | Voice Recognition, Manual |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia car audio market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia car audio market on the basis of component type?

- What is the breakup of the Saudi Arabia car audio market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia car audio market on the basis of sound management?

- What is the breakup of the Saudi Arabia car audio market on the basis of sales channel?

- What is the breakup of the Saudi Arabia car audio market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia car audio market?

- What are the key driving factors and challenges in the Saudi Arabia car audio market?

- What is the structure of the Saudi Arabia car audio market and who are the key players?

- What is the degree of competition in the Saudi Arabia car audio market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia car audio market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia car audio market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia car audio industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)