Saudi Arabia Car Subscription Market Size, Share, Trends and Forecast by Service Provider, Vehicle Type, Subscription Period, End Use, and Region, 2026-2034

Saudi Arabia Car Subscription Market Overview:

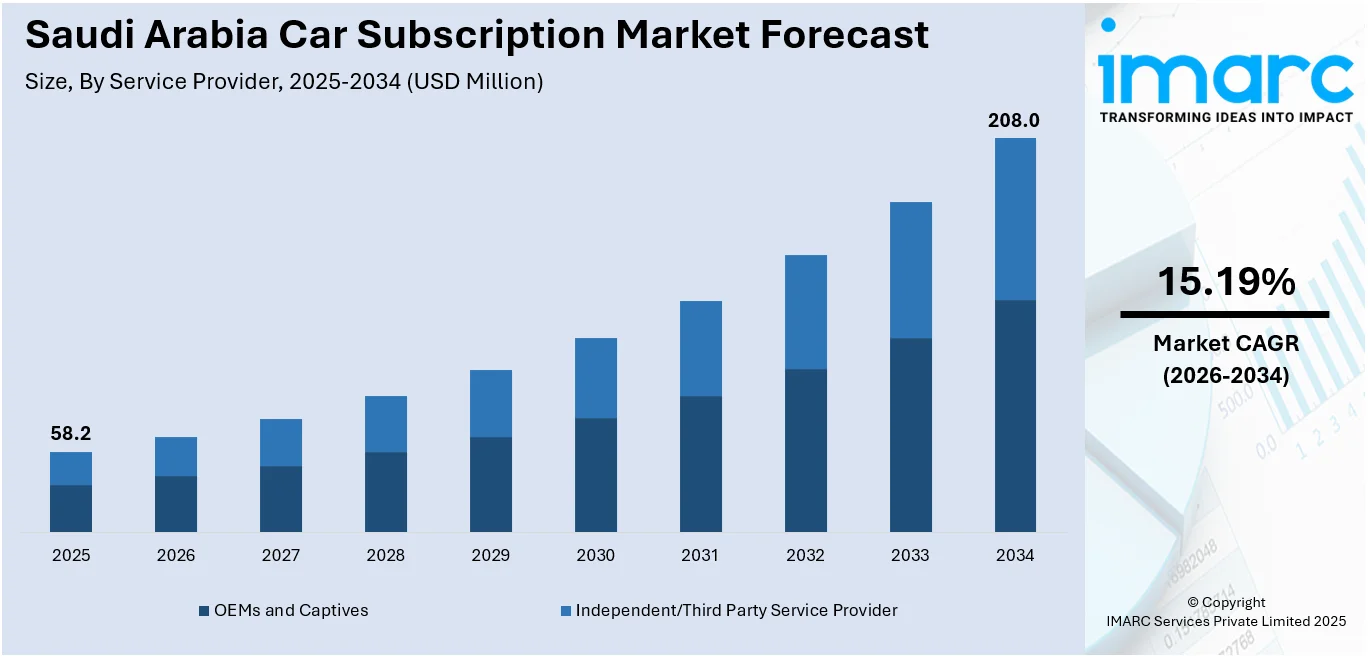

The Saudi Arabia car subscription market size reached USD 58.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 208.0 Million by 2034, exhibiting a growth rate (CAGR) of 15.19% during 2026-2034. Increasing consumer preference for flexible ownership, rising demand for cost-effective transportation solutions, the growth of the rental market, enhanced convenience, and the shift toward urbanization with a focus on convenience and sustainability in mobility options are some of the factors contributing to Saudi Arabia car subscription market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 58.2 Million |

| Market Forecast in 2034 | USD 208.0 Million |

| Market Growth Rate 2026-2034 | 15.19% |

Saudi Arabia Car Subscription Market Trends:

Growth in Flexible and Digital Car Subscription Services

increasingly focused on flexibility and digital convenience. Consumers may now hire a wide range of automobiles, including electric and premium versions, without making upfront deposits. This approach provides additional flexibility, with rental lengths ranging from short to lengthy, adapting to a wide range of customer demands. The service is completely digital, allowing for easy online booking and prompt car delivery. Major cities around the country are seeing an increase in demand for such services, which is driven by the convenience and accessibility they provide, as well as the growing need for more sustainable and flexible transportation choices. These factors are intensifying the Saudi Arabia car subscription market growth. For example, in January 2023, SelfDrive Mobility expanded its zero-deposit car rental service to Saudi Arabia, offering daily, weekly, and monthly rentals without upfront payments. Customers can choose from over 65 car models, including electric and luxury vehicles, with delivery within 60 to 180 minutes. The service is fully digital, supporting flexible durations from one day to 36 months, and is available across major Saudi cities like Riyadh, Jeddah, and Dammam.

To get more information on this market Request Sample

Shifting Dynamics in Car Ownership Models

The car subscription market in Saudi Arabia is evolving with innovative models designed to offer affordable car ownership. The subscribe to own (STO) model has gained traction, addressing financing challenges by allowing customers to gradually own a vehicle through a subscription service. This model provides a more accessible pathway to car ownership, appealing to those who may face difficulties with traditional financing options. As the market matures, there is a growing emphasis on sustainable operations and profitable growth, with a focus on strong unit economics. This approach is reshaping the mobility landscape in the region, offering customers flexibility, affordability, and a streamlined process for vehicle ownership. The adoption of such models is expected to continue growing, catering to changing consumer preferences. For instance, in October 2024, Invygo, a leading Saudi-based car subscription platform, raised USD 8 Million in a Series A extension to enhance its subscribe-to-own (STO) model, which has driven growth in the Saudi market. The innovative model offers affordable car ownership, addressing financing challenges in Saudi Arabia. Invygo aims for profitability by FY2024, with a focus on sustainable operations and strong unit economics, reshaping mobility in the region.

Saudi Arabia Car Subscription Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service provider, vehicle type, subscription period, and end use.

Service Provider Insights:

- OEMs and Captives

- Independent/Third Party Service Provider

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes OEMs and captives and independent/third party service provider.

Vehicle Type Insights:

- IC Powered Vehicle

- Electric Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes IC powered vehicle and electric vehicle.

Subscription Period Insights:

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

The report has provided a detailed breakup and analysis of the market based on the subscription period. This includes 1 to 6 months, 6 to 12 months, and more than 12 months.

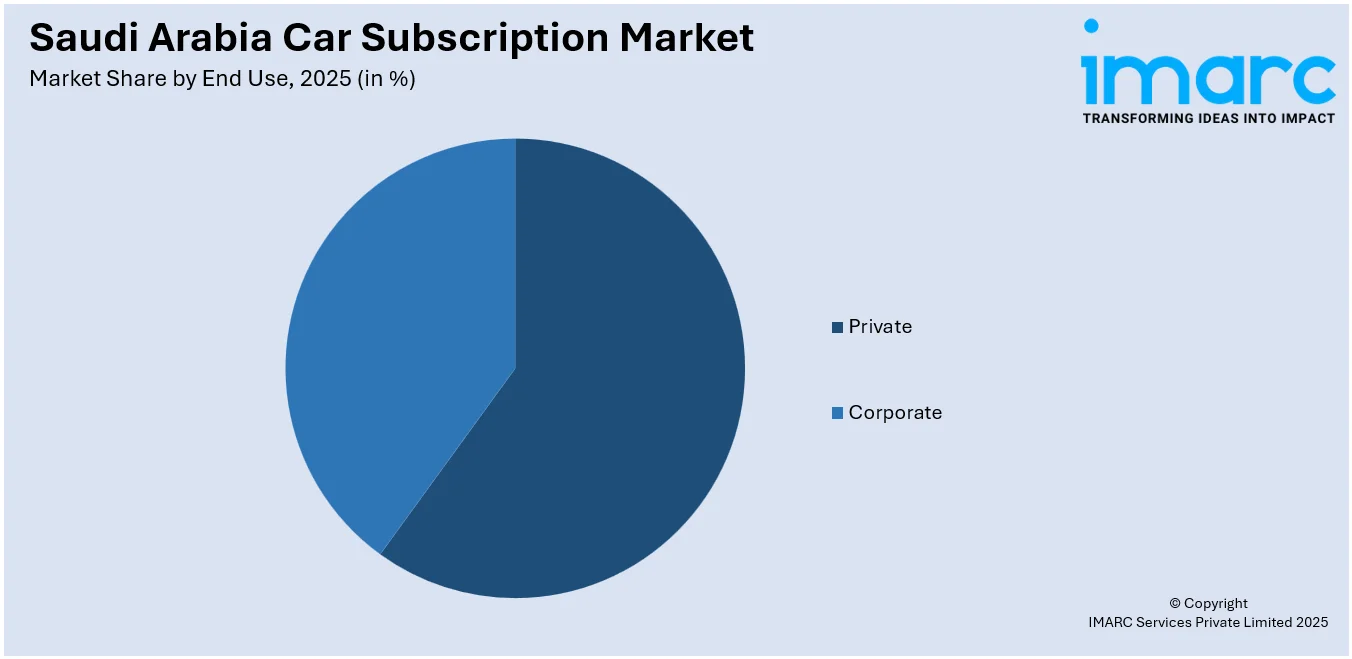

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Corporate

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes private and corporate.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Car Subscription Market News:

- In April 2025, SelfDrive Mobility, a UAE-based mobility tech company, expanded its car rental and subscription services to Saudi Arabia. The platform offers over 100 car models from more than 50 brands, including luxury and electric vehicles, sourced directly from dealerships. Customers can book vehicles digitally with flexible durations ranging from one day to 36 months, featuring doorstep delivery and paperless transactions. This expansion aligns with Saudi Arabia's growing demand for flexible mobility solutions.

Saudi Arabia Car Subscription Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | OEMs and Captives, Independent/Third Party Service Provider |

| Vehicle Types Covered | IC Powered Vehicle, Electric Vehicle |

| Subscription Periods Covered | 1 to 6 Months, 6 to 12 Months, More Than 12 Months |

| End Uses Covered | Private, Corporate |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia car subscription market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia car subscription market on the basis of service provider?

- What is the breakup of the Saudi Arabia car subscription market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia car subscription market on the basis of subscription period?

- What is the breakup of the Saudi Arabia car subscription market on the basis of end use?

- What is the breakup of the Saudi Arabia car subscription market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia car subscription market?

- What are the key driving factors and challenges in the Saudi Arabia car subscription market?

- What is the structure of the Saudi Arabia car subscription market and who are the key players?

- What is the degree of competition in the Saudi Arabia car subscription market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia car subscription market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia car subscription market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia car subscription industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)