Saudi Arabia Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2026-2034

Saudi Arabia Carbon Black Market Overview:

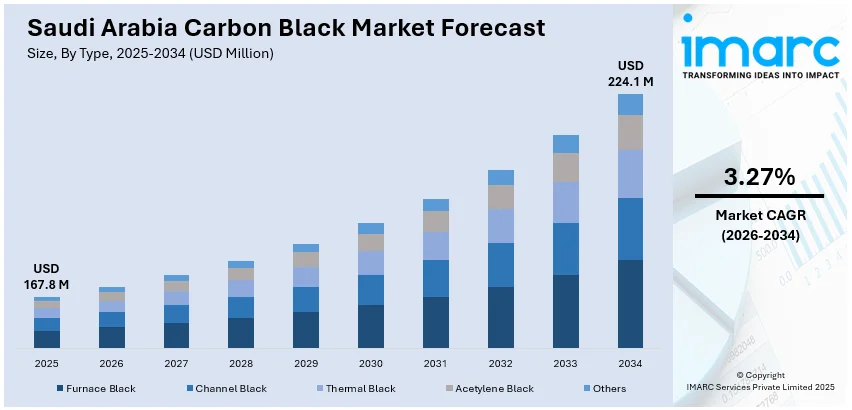

The Saudi Arabia carbon black market size reached USD 167.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 224.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.27% during 2026-2034. The market share is expanding, driven by the implementation of improvised industrialization initiatives as a part of its Vision 2030 plan, heightened innovations in the petrochemical industry and the production of various petrochemical products, and ongoing advancement of new technologies in production processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 167.8 Million |

| Market Forecast in 2034 | USD 224.1 Million |

| Market Growth Rate 2026-2034 | 3.27% |

Saudi Arabia Carbon Black Market Trends:

Industrialization and Infrastructure Development

Saudi Arabia is undergoing improvised industrialization measures as part of its Vision 2030 plan, which looks to diversify the country's economy and lower dependence on oil. This significantly boosted the use of different industrial products such as carbon black Woodstock carbon black is a vital raw material used in rubber, plastics, and coatings production, particularly for sectors such as automotive production and construction. With growing infrastructure development, especially in industries such as transportation, manufacturing, and consumer goods, the demand for carbon black increases. For example, carbon black is heavily used to manufacture tires, which are a central element in the automotive industry. Moreover, with growing construction activities, carbon black is needed to manufacture products such as paints and coatings, which are essential for buildings, roads, and other construction projects. For instance, the Saudi Arabia's Roads General Authority (RGA) stated that Riyadh region road sector was undergoing massive change in 2024 as SAR3 billion ($798 million) worth projects were already in pipeline.

To get more information on this market, Request Sample

Innovations in Petrochemical Sector

Saudi Arabia is a major leader in the petrochemical industry, with its vast reserves of oil and natural gas. Carbon black, a by-product of oil refining, is closely tied to the country's petrochemical sector. As the petrochemical industry expands and diversifies into more value-added products, the demand for carbon black is increasing. Carbon black is primarily used in rubber production, where it enhances the strength, durability, and wear resistance of products like tires and hoses. Given Saudi Arabia's strategic location as a hub for petrochemical production and the growing emphasis on manufacturing high-quality products for both domestic use and export, the country has seen an increase in carbon black consumption. Moreover, Saudi petrochemical companies are investing in expanding their production capacities, which further drives the need for carbon black. As per the predictions of the IMARC Group, the Saudi Arabia refined petrochemical products market size is expected to reach USD 57.88 Billion by 2033. This will further drive the production and need for carbon black.

Technological Advancements and Innovation

The ongoing advancement of new technologies in production processes, along with enhancements in the characteristics of carbon black, is another factor catalyzing its demand in Saudi Arabia. Advancements in carbon black manufacturing and its applications have led to the creation of specialized grades featuring enhanced properties for particular industrial purposes. For example, new types of carbon black are being developed to boost tire performance, enhance the conductivity of electronic parts, and improve the durability of coatings and paints. As the industries in Saudi Arabia become more advanced and require superior performance materials, the demand for high-quality carbon black products is rising. Moreover, technological improvements are enhancing the carbon black production process, making it more energy-efficient and eco-friendly. This corresponds with the nation's dedication to sustainability and lowering carbon emissions. Additionally, novel uses in developing fields like electric vehicles (EVs), where carbon black finds application in batteries and conductors, offer prospects for market growth. For instance, in 2025, Tesla announced that it will start selling EVs in Saudi Arabia with a launch event taking place in April in Riyadh. This is expected to further increase the need for carbon black

Saudi Arabia Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, grade, and application.

Type Insights:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, channel black, thermal black, acetylene black, and others.

Grade Insights:

- Standard Grade

- Specialty Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes standard grade and specialty grade.

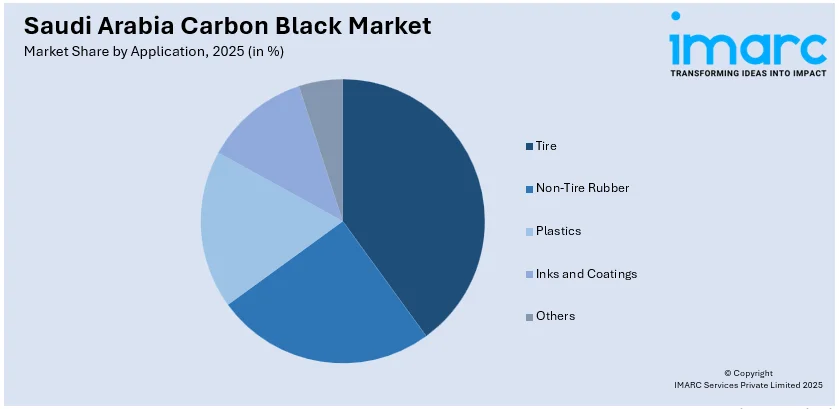

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tire, non-tire rubber, plastics, inks and coatings, and others.

Regional Insights:

- Northern And Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia carbon black market on the basis of type?

- What is the breakup of the Saudi Arabia carbon black market on the basis of grade?

- What is the breakup of the Saudi Arabia carbon black market on the basis of application?

- What is the breakup of the Saudi Arabia carbon black market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia carbon black market?

- What are the key driving factors and challenges in the Saudi Arabia carbon black?

- What is the structure of the Saudi Arabia carbon black market and who are the key players?

- What is the degree of competition in the Saudi Arabia carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia carbon black market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)