Saudi Arabia Carbon Capture and Storage Market Size, Share, Trends and Forecast by Service, Technology, End Use Industry, and Region, 2026-2034

Saudi Arabia Carbon Capture and Storage Market Overview:

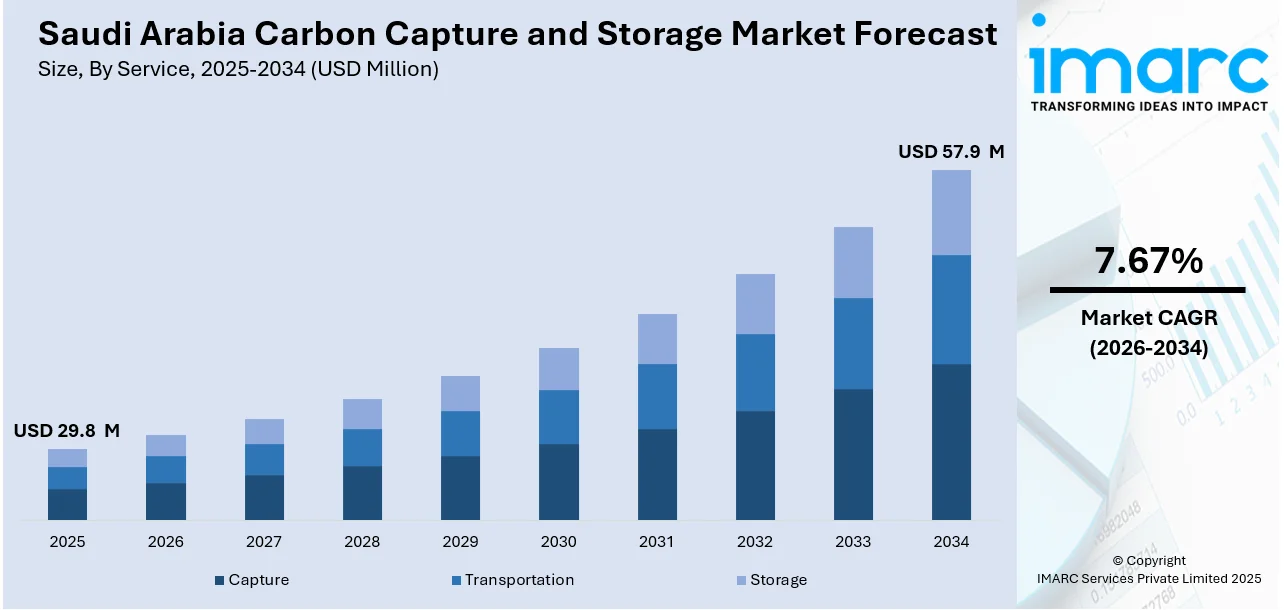

The Saudi Arabia carbon capture and storage market size reached USD 29.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 57.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.67% during 2026-2034. The market is driven by the country’s ambitious climate goals and commitment to reducing carbon emissions in alignment with Vision 2030. Strong governmental support, including significant investments in renewable energy and CCS infrastructure, further propels the market growth. Additionally, the increasing demand from industrial sectors such as oil, gas, and power generation to meet environmental regulations and sustainability targets is augmenting the Saudi Arabia carbon capture and storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 29.8 Million |

| Market Forecast in 2034 | USD 57.9 Million |

| Market Growth Rate 2026-2034 | 7.67% |

Saudi Arabia Carbon Capture and Storage Market Trends:

Government Initiatives and Policy Support

The Saudi government is proactively making carbon capture and storage (CCS) a key element of its wider environmental and economic diversification strategies under Vision 2030. The government's initiative for minimizing greenhouse gas emissions is strengthening through a range of initiatives. These efforts encompass support for industrial-scale CCS projects and the creation of regulatory mechanisms to facilitate carbon capture in sectors like oil and gas. In addition to this, the Kingdom has established ambitious carbon emissions reduction targets of achieving net zero emissions by 2060, and CCS is playing a major role in attaining these targets. Furthermore, the government also creates specialized institutions and partners with foreign corporations to facilitate the construction of CCS infrastructure further and make Saudi Arabia a top Middle Eastern hub for CCS technology deployment. For instance, the establishment of a significant CCS hub in Jubail City, led by Saudi Aramco in partnership with SLB and Linde, seeks to capture up to 9 Million Tons of CO2 per year by 2027, with a projected annual capacity of 44 Million Tons by 2035. The strong policy encouragement is establishing an environment that is contributing to Saudi Arabia carbon capture and storage market growth, which is also attracting local and international investments.

To get more information on this market Request Sample

Growing Demand from the Oil and Gas Sector

The oil and gas industry continues to be one of the main drivers of the market development in the Kingdom. As an oil-producing nation, Saudi Arabia increasingly finds itself under pressure to reverse the effects of its fossil fuel sector on the environment. The CCS technology offers a solution for the industry to pursue its activities while keeping the carbon emissions drastically low. Major industry leaders are pioneering the use of such technologies to meet the environmental norms, domestically and overseas. Besides this, the demand for CCS in the oil and gas industry is driven by the requirement to control emissions from oil refineries, gas processing, and power generation facilities. As per industry reports, the refining industry in Saudi Arabia, which comprises nine refineries, is responsible for about 49.5 Million Tons of CO2 emissions per year. Since refining is an energy-intensive process and feedstocks are carbon-intensive, this industry is a major emitter, with a single refinery emitting between 2.6 and 9.4 Million Tons of CO2 per year. As Saudi Arabia makes efforts to achieve its Vision 2030 goals and improve environmental sustainability, emissions from the refining process are becoming a more pressing concern. Due to the complexity of decarbonizing the industry, the incorporation of CCS technologies is crucial to reduce the carbon footprint of the refining industry. In line with this, continued investment by oil firms in CCS infrastructure reflects the increasing significance of these technologies.

Saudi Arabia Carbon Capture and Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service, technology, and end use industry.

Service Insights:

- Capture

- Transportation

- Storage

The report has provided a detailed breakup and analysis of the market based on the service. This includes capture, transportation, and storage.

Technology Insights:

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes post-combustion capture, pre-combustion capture, and oxy-fuel combustion capture.

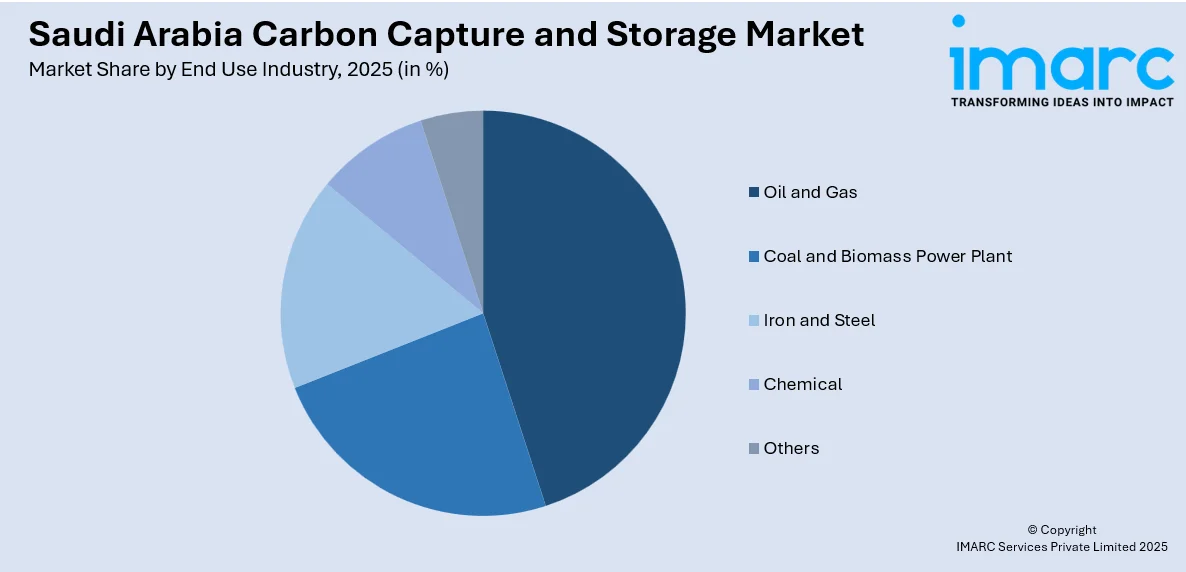

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, coal and biomass power plant, iron and steel, chemical, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Carbon Capture and Storage Market News:

- On February 24, 2025, Saudi Aramco awarded a USD 1.5 Billion engineering, procurement, and construction (EPC) contract to Larsen & Toubro's hydrocarbon division, for Phase I of its Carbon Capture & Storage (CCS) hub in Jubail, Eastern Province. This project is a part of Aramco's Accelerated Carbon Capture & Sequestration (ACCS) initiative.

Saudi Arabia Carbon Capture and Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Capture, Transportation, Storage |

| Technologies Covered | Post-combustion Capture, Pre-combustion Capture, Oxy-fuel Combustion Capture |

| End Use Industries Covered | Oil and Gas, Coal, Biomass Power Plant, Iron and Steel, Chemical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia carbon capture and storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia carbon capture and storage market on the basis of service?

- What is the breakup of the Saudi Arabia carbon capture and storage market on the basis of technology?

- What is the breakup of the Saudi Arabia carbon capture and storage market on the basis of end use industry?

- What is the breakup of the Saudi Arabia carbon capture and storage market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia carbon capture and storage market?

- What are the key driving factors and challenges in the Saudi Arabia carbon capture and storage market?

- What is the structure of the Saudi Arabia carbon capture and storage market and who are the key players?

- What is the degree of competition in the Saudi Arabia carbon capture and storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia carbon capture and storage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia carbon capture and storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia carbon capture and storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)