Saudi Arabia Cargo Containers Market Size, Share, Trends and Forecast by Type, Size, End User, and Region, 2026-2034

Saudi Arabia Cargo Containers Market Overview:

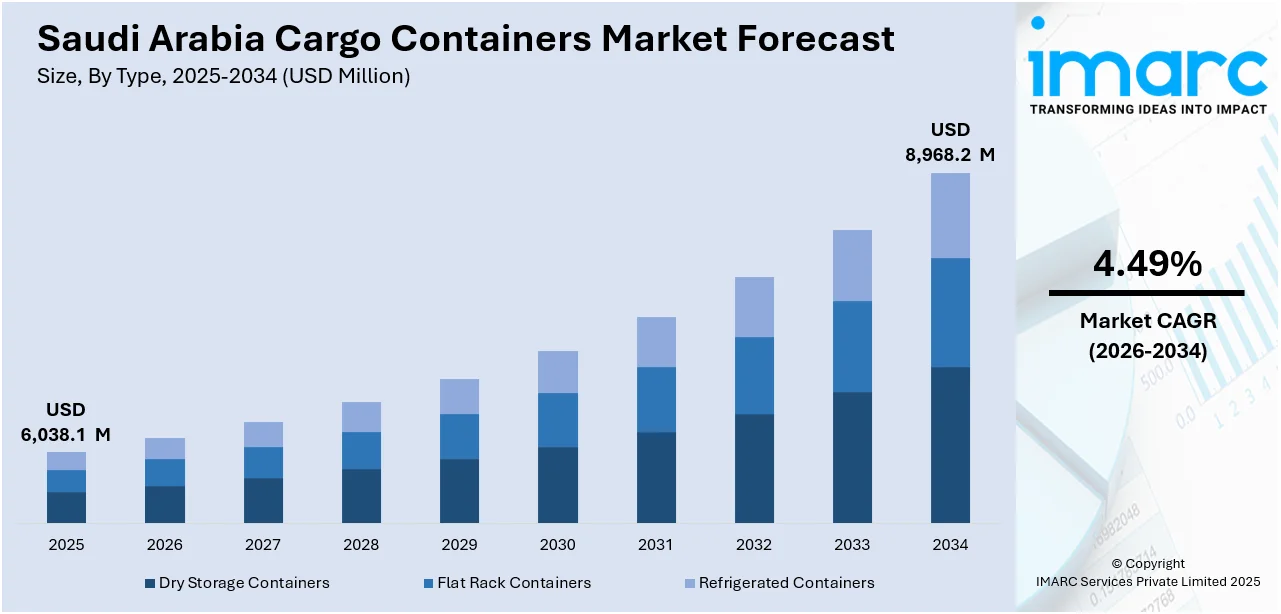

The Saudi Arabia cargo containers market size reached USD 6,038.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,968.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.49% during 2026-2034. The market is growing due to significant infrastructure investments, such as the expansion of Jeddah Islamic Port and King Abdulaziz Port’s record container handling. These developments enhance efficiency and capacity, contributing to an increase in Saudi Arabia cargo containers market share and global trade connectivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,038.1 Million |

| Market Forecast in 2034 | USD 8,968.2 Million |

| Market Growth Rate 2026-2034 | 4.49% |

Saudi Arabia Cargo Containers Market Trends:

Infrastructure Expansion and Increased Capacity

A key trend in Saudi Arabia's cargo containers market is the significant investment in port infrastructure to meet growing global trade demands. The expansion of port facilities is becoming crucial as the region positions itself as a major logistics hub. In March 2025, DP World inaugurated the expanded South Container Terminal at Jeddah Islamic Port with a USD 800 Million investment, doubling its capacity to 4 Million TEUs. The terminal's expansion, which includes advanced reefer capacity and sustainability efforts, is expected to support the increasing volume of containerized goods, especially perishables. With plans for further expansion to 5 million TEUs, the new terminal will enhance operational efficiency, allowing Saudi Arabia to accommodate larger container volumes while meeting environmental goals. This expansion reinforces Saudi Arabia's role as a key global trade hub, aligned with the country's Vision 2030 economic diversification objectives. The new infrastructure upgrades will make the port more competitive, positioning it as an essential gateway for both regional and global trade. As the port continues to improve its facilities, it will contribute significantly to the growth of the market, driving further investment and strengthening trade flows across key global routes.

To get more information on this market Request Sample

Record Container Handling and Efficiency Gains

The emphasis on improving container handling efficiency to meet the demands of growing trade volumes is driving the Saudi Arabia cargo containers market growth. Efficiency in port operations is crucial for maintaining the competitive edge in global shipping and trade. In August 2024, King Abdulaziz Port in Dammam set a new record by managing 20,645 containers on a single vessel, the Cosco Shipping Aquarius 036E. This milestone underscores the growing efficiency and capability of the port, which is further supported by continuous infrastructure investments, including new cranes and equipment. As a result, King Abdulaziz Port has been able to handle larger volumes of containers with increased speed and accuracy, positioning it as a critical player in the region's logistics network. The port's ability to accommodate record-breaking numbers of containers on a single vessel reflects its improving infrastructure and operational efficiency. This achievement enhances Saudi Arabia's reputation as a key logistics hub and strengthens its competitive advantage in the global cargo containers market. As King Abdulaziz Port continues to handle more containers efficiently, it will further streamline Saudi Arabia's supply chain, ensuring smoother operations and promoting trade growth within the region and beyond.

Saudi Arabia Cargo Containers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type, size, and end user.

Type Insights:

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

The report has provided a detailed breakup and analysis of the market based on the type. This includes dry storage containers, flat rack containers, and refrigerated containers.

Size Insights:

- Small Containers (20 ft)

- Medium Containers (40 ft)

- Large Containers (Above 40 ft)

The report has provided a detailed breakup and analysis of the market based on the size. This includes small containers (20 ft), medium containers (40 ft), and large containers (above 40 ft).

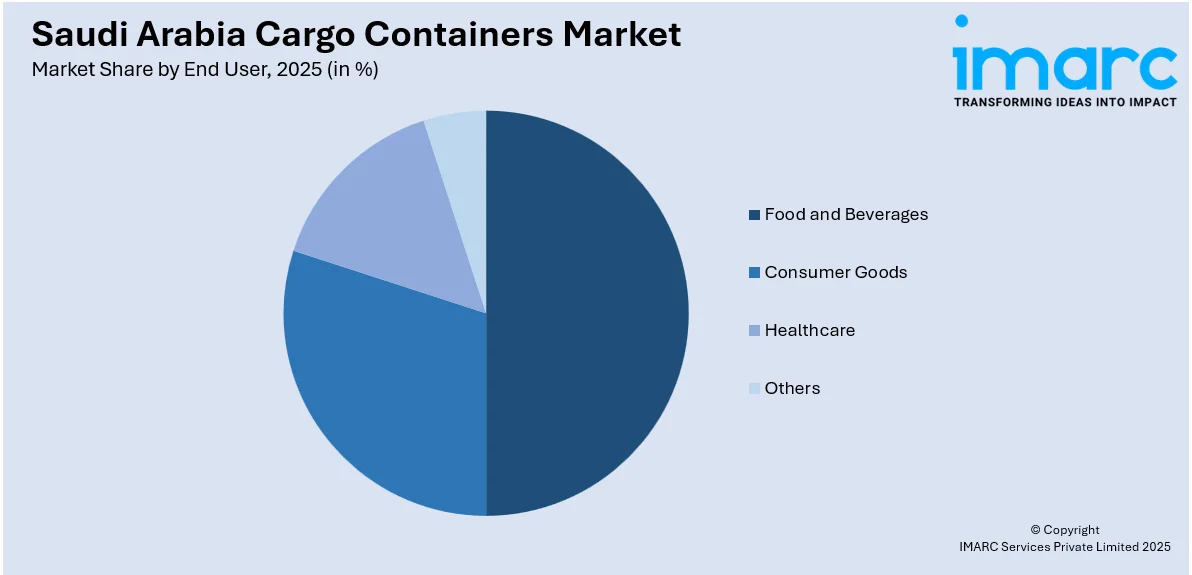

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Consumer Goods

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverages, consumer goods, healthcare, others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cargo Containers Market News:

- March 2025: DP World and Mawani inaugurated the SAR 3 Billion South Container Terminal at Jeddah Islamic Port. The expansion doubled capacity to 4 Million TEUs and integrated automation, sustainability, and refrigerated container enhancements, boosting Saudi Arabia’s role as a key global trade hub in the cargo containers market.

- January 2025: Almar Container Saudi Arabia signed a lease agreement with Folk Maritime to supply containers, supporting the company's growing feeder services and regional connectivity. This partnership enhances Saudi Arabia’s shipping capabilities, contributing to the expansion and efficiency of the Saudi cargo containers market.

Saudi Arabia Cargo Containers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Storage Containers, Flat Rack Containers, Refrigerated Containers |

| Sizes Covered | Small Containers (20 ft), Medium Containers (40 ft), Large Containers (Above 40 ft) |

| End Users Covered | Food and Beverages, Consumer Goods, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cargo containers market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cargo containers market on the basis of type?

- What is the breakup of the Saudi Arabia cargo containers market on the basis of size?

- What is the breakup of the Saudi Arabia cargo containers market on the basis of end user?

- What is the breakup of the Saudi Arabia cargo containers market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cargo containers market?

- What are the key driving factors and challenges in the Saudi Arabia cargo containers?

- What is the structure of the Saudi Arabia cargo containers market and who are the key players?

- What is the degree of competition in the Saudi Arabia cargo containers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cargo containers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cargo containers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cargo containers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)