Saudi Arabia Cargo Handling Equipment Market Size, Share, Trends and Forecast by Equipment Type, Propulsion Type, Application, and Region, 2026-2034

Saudi Arabia Cargo Handling Equipment Market Overview:

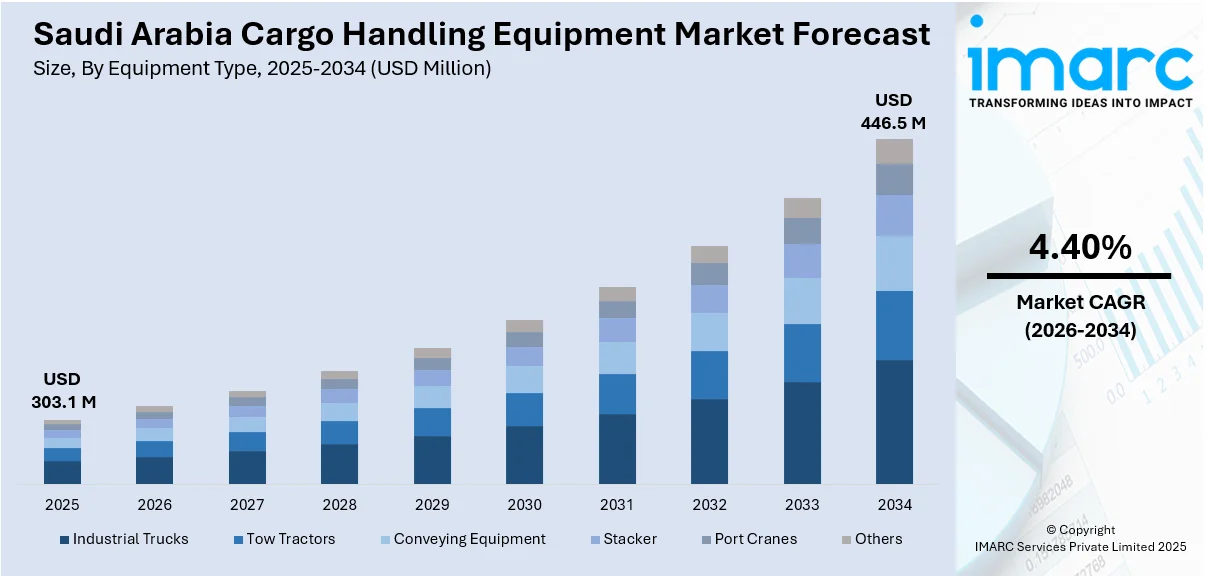

The Saudi Arabia cargo handling equipment market size reached USD 303.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 446.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.40% during 2026-2034. The market is driven by robust growth in trade and port infrastructure development, supported by government-led initiatives aimed at turning Saudi Arabia into a logistics hub. Technological advancements, including automation and efficiency improvements, are reshaping operations within the sector. Additionally, Saudi Arabia's strategic geopolitical positioning and the strengthening of trade agreements further stimulate cargo movement while creating demand for more sophisticated handling systems, further augmenting the Saudi Arabia cargo handling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 303.1 Million |

| Market Forecast in 2034 | USD 446.5 Million |

| Market Growth Rate 2026-2034 | 4.40% |

Saudi Arabia Cargo Handling Equipment Market Trends:

Increasing Trade and Port Infrastructure Development

Saudi Arabia's economic diversification plan, particularly within the logistics and transport sector, has led to significant developments in trade and port infrastructure. The government’s Vision 2030 initiative aims to transform the nation into a global logistics hub, fostering expansion at major ports like Jeddah Islamic Port and King Abdulaziz Port. Investment in advanced infrastructure, such as upgraded cargo terminals and expanded port facilities, directly influences demand for efficient cargo handling equipment. The rise in both domestic and international trade drives the need for optimized solutions that can accommodate increased volumes of goods. This growth is also linked to the expansion of industrial zones, contributing to a growing reliance on robust cargo handling technologies for smoother operations. On May 15, 2025, Saudi Arabia's ports saw a significant rise in cargo handling, processing 320.78 million tons of goods in 2024, marking a 14.45% year-on-year increase. Container exports rose by 8.86%, reaching over 2.8 million TEUs, while the Kingdom’s ports have secured positions in the global top 100, further strengthening Saudi Arabia's role in international logistics. Additionally, major logistics projects in Jeddah and Dammam, backed by an investment of approximately USD 773 million, align with Vision 2030’s strategy to enhance Saudi Arabia's position as a global trade and logistics hub. The strategic positioning of Saudi Arabia, serving as a key trade link between Asia, Europe, and Africa, enhances its logistics capabilities. This global role further accelerates the integration of advanced cargo handling systems. As the country's ports expand their capacity to manage more complex and diverse cargo, the demand for state-of-the-art equipment increases. This growth in the logistics and transport sectors plays a central role in Saudi Arabia cargo handling equipment market growth.

To get more information on this market Request Sample

Technological Advancements in Automation and Efficiency

The integration of automation technologies within Saudi Arabia’s cargo handling operations is another significant driver shaping the market. With the increasing complexity of logistics requirements and the need for higher efficiency, automated systems such as robotic cargo handlers, automated stacking cranes, and intelligent cargo tracking solutions are becoming essential. These technologies reduce human labor dependency, minimize operational risks, and enhance throughput, making them an attractive solution for port operators and logistics companies. The Saudi government’s initiatives to incorporate cutting-edge technologies into key infrastructure projects support the adoption of these systems. Automation improves not only the speed and precision of cargo handling but also ensures greater safety, reducing the likelihood of accidents or damage to goods. On January 27, 2023, SAL Saudi Logistics Services and Menzies Aviation signed a Memorandum of Understanding (MoU) to enhance passenger handling services for low-cost carriers at Saudi airports. This collaboration aligns with Saudi Arabia's Vision 2030, aiming to improve airport services and increase passenger capacity, with a goal of welcoming 330 million travelers by 2030. The partnership will leverage Menzies' global expertise and SAL's logistics capabilities, reinforcing the Kingdom's push to become a global logistics hub and enhance its aviation sector. The sector is also witnessing a shift toward sustainable practices, with green technologies being integrated into cargo handling equipment, such as electric-powered cranes and automated vehicles. These innovations are expected to continue driving the demand for advanced handling equipment across ports and terminals. Automation plays a key role in improving the overall efficiency of operations, significantly contributing to market growth as the logistics sector moves toward more automated and technologically advanced solutions.

Saudi Arabia Cargo Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type, propulsion type, and application.

Equipment Type Insights:

- Industrial Trucks

- Tow Tractors

- Conveying Equipment

- Stacker

- Port Cranes

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes industrial trucks, tow tractors, conveying equipment, stacker, port cranes, and others.

Propulsion Type Insights:

- IC Engine

- Electric

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes IC engine and electric.

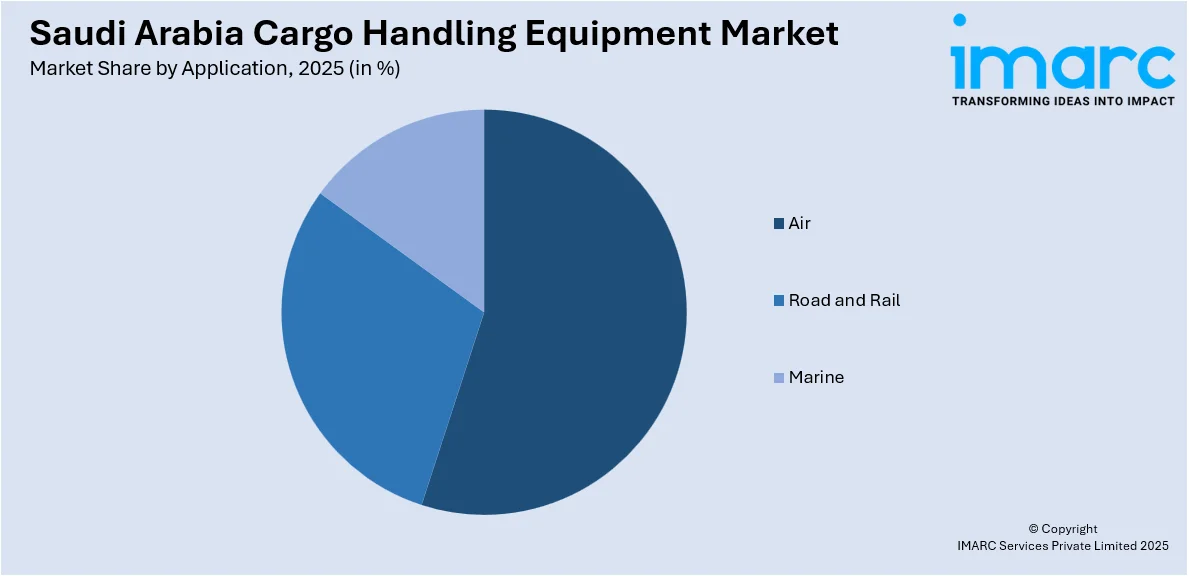

Application Insights:

Access the comprehensive market breakdown Request Sample

- Air

- Road and Rail

- Marine

The report has provided a detailed breakup and analysis of the market based on the application. This includes air, road and rail, and marine.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cargo Handling Equipment Market News:

- On April 17, 2025, Saudia Cargo and Worldwide Flight Services (WFS) launched a significant ONE Record integration with CHAMP Cargosystems' 1Neo-Connect service, advancing digital transformation in air cargo handling. This collaboration improves data accuracy, enhances shipment visibility, and enables real-time updates, significantly boosting operational efficiency and agility. By adopting IATA's ONE Record initiative, the partnership sets a new industry benchmark for transparency and proactive decision-making, supporting Saudi Arabia's broader logistics and digital transformation goals under Vision 2030.

Saudi Arabia Cargo Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Industrial Trucks, Tow Tractors, Conveying Equipment, Stacker, Port Cranes, Others |

| Propulsion Types Covered | IC Engine, Electric |

| Applications Covered | Air, Road and Rail, Marine |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cargo handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cargo handling equipment market on the basis of equipment type?

- What is the breakup of the Saudi Arabia cargo handling equipment market on the basis of propulsion type?

- What is the breakup of the Saudi Arabia cargo handling equipment market on the basis of application?

- What is the breakup of the Saudi Arabia cargo handling equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cargo handling equipment market?

- What are the key driving factors and challenges in the Saudi Arabia cargo handling equipment market?

- What is the structure of the Saudi Arabia cargo handling equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia cargo handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cargo handling equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cargo handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cargo handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)