Saudi Arabia Cargo Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Cargo Insurance Market Overview:

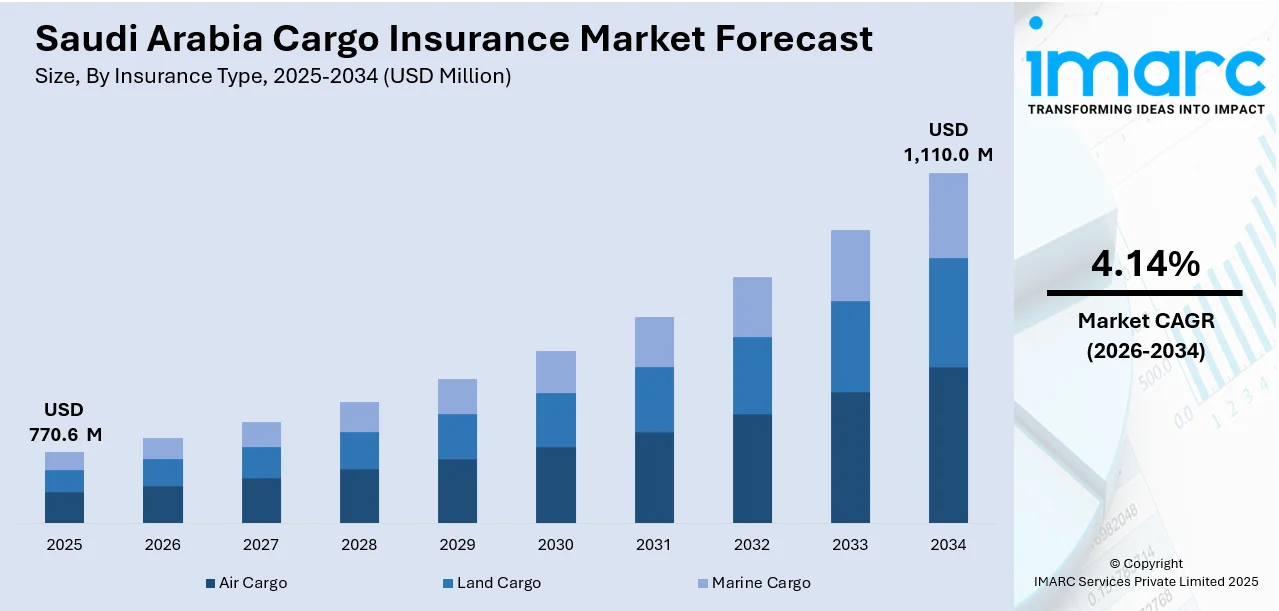

The Saudi Arabia cargo insurance market size reached USD 770.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,110.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.14% during 2026-2034. The market is driven by the growth of international trade, as Saudi Arabia strengthens its position in global trade routes. Additionally, regulatory changes mandating sufficient cargo coverage are pushing businesses to secure appropriate insurance. Moreover, significant infrastructure investments in the Kingdom enhance logistics operations, necessitating greater protection for shipments, further augmenting the Saudi Arabia cargo insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 770.6 Million |

| Market Forecast in 2034 | USD 1,110.0 Million |

| Market Growth Rate 2026-2034 | 4.14% |

Saudi Arabia Cargo Insurance Market Trends:

Growth in International Trade

International trade growth is one major driver of the market. Imports and exports are both experiencing sustained growth as the Kingdom continues to solidify its position as a global trade center. Saudi Arabia's geographical advantage as a gateway between Asia, Europe, and Africa increases its significance in the international logistic network. This increase in volume of trade directly enhances the demand for insurance services that will cover risks involved in the movement of goods. The increased volume of goods shipped by sea, air, or land increases the likelihood of damage, loss, or other unexpected risks in transit. Hence, companies dealing with cargo shipping look for extensive insurance coverage to safeguard their interests and preserve business continuity. As more trade routes open, Saudi Arabia cargo insurance demand is bound to follow an upward trend, becoming an integral part of the logistics process as a whole. Further growth in cross-border business in the country will make shipping grow, further contributing to the Saudi Arabia cargo insurance market growth.

To get more information on this market Request Sample

Regulatory and Policy Changes

Government regulations and policies play a crucial role in the market. The Kingdom’s regulatory framework is increasingly being aligned with global standards to ensure safe and secure trade. Over the past few years, the Saudi government has introduced and enhanced policies that require businesses to have sufficient cargo coverage for both domestic and international shipments. These regulations are designed to protect businesses from unforeseen losses and reduce the risk of claims. In addition to mandatory insurance for certain types of shipments, the government is actively promoting digitalization of the logistics sector, which includes improved insurance technology solutions for better claims management and data analytics. This shift not only increases efficiency but also contributes to market growth by simplifying insurance processes for businesses. Regulatory changes designed to improve the country's infrastructure and trade agreements further underscore the need for reliable insurance coverage, which directly influences the increasing market demand. As Saudi Arabia continues to modernize its trade policies, these regulatory advancements are expected to continue driving growth in the cargo insurance sector.

Increasing Infrastructure Developments

Infrastructure development in Saudi Arabia plays a vital role in expanding the cargo insurance sector. The Kingdom has been investing heavily in modernizing its logistics infrastructure, including ports, airports, highways, and railways, with the goal of becoming a leading logistics hub in the region. These improvements have facilitated smoother and more efficient transportation of goods, encouraging businesses to engage in more expansive trade and shipping activities. However, with enhanced infrastructure comes an increase in the volume of shipments, making cargo insurance essential. This greater volume of goods being transported raises the complexity of logistics, increasing the need for insurance that provides financial protection against various risks. The Saudi government's Vision 2030 plan, which includes significant investment in the logistics sector, further underscores the importance of cargo insurance to protect assets as trade volumes rise. These infrastructure projects provide a solid foundation for market growth, encouraging both local and international businesses to secure insurance for their cargo. As the market grows in tandem with the rise in international shipments, insurers in Saudi Arabia are likely to offer more customized solutions tailored to specific sectors of the industry.

Saudi Arabia Cargo Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on insurance type, distribution channel, and end user.

Insurance Type Insights:

- Air Cargo

- Land Cargo

- Marine Cargo

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes air cargo, land cargo, and marine cargo.

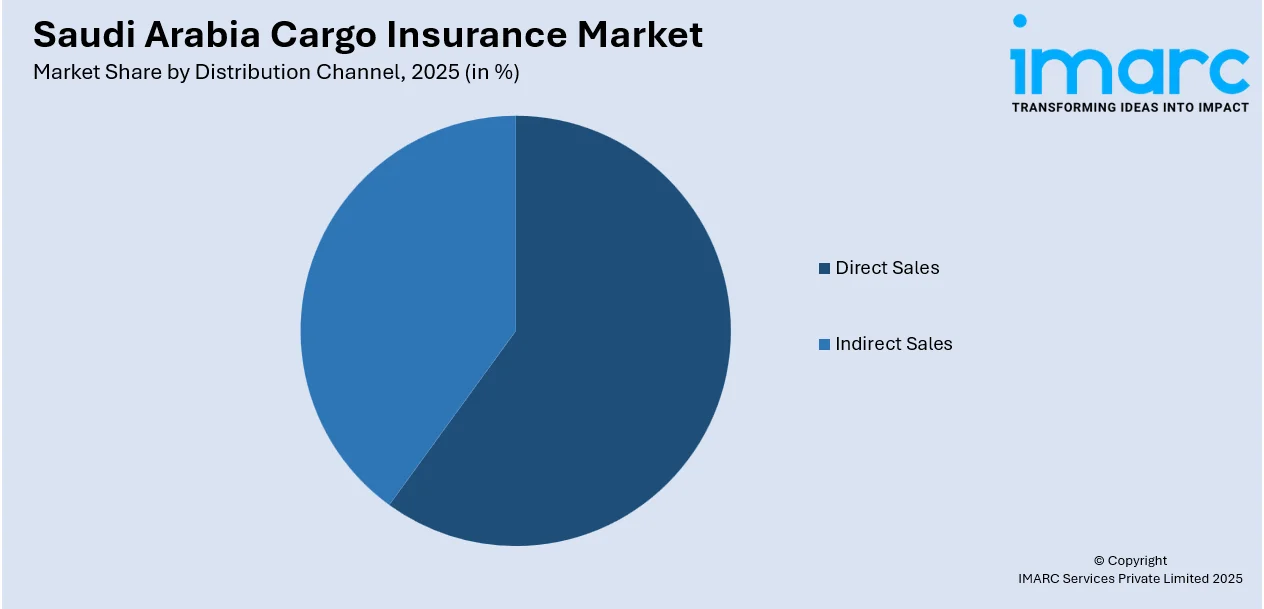

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and indirect sales.

End User Insights:

- Traders

- Cargo Owners

- Ship Owners

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes traders, cargo owners, ship owners, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cargo Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Air Cargo, Land Cargo, Marine Cargo |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End Users Covered | Traders, Cargo Owners, Ship Owners, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cargo insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cargo insurance market on the basis of insurance type?

- What is the breakup of the Saudi Arabia cargo insurance market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia cargo insurance market on the basis of end user?

- What is the breakup of the Saudi Arabia cargo insurance market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cargo insurance market?

- What are the key driving factors and challenges in the Saudi Arabia cargo insurance?

- What is the structure of the Saudi Arabia cargo insurance market and who are the key players?

- What is the degree of competition in the Saudi Arabia cargo insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cargo insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cargo insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cargo insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)