Saudi Arabia Cargo Security and Surveillance Market Size, Share, Trends and Forecast by Security Type, Mode of Transport, Technology, End-User Industry, and Region, 2026-2034

Saudi Arabia Cargo Security and Surveillance Market Summary:

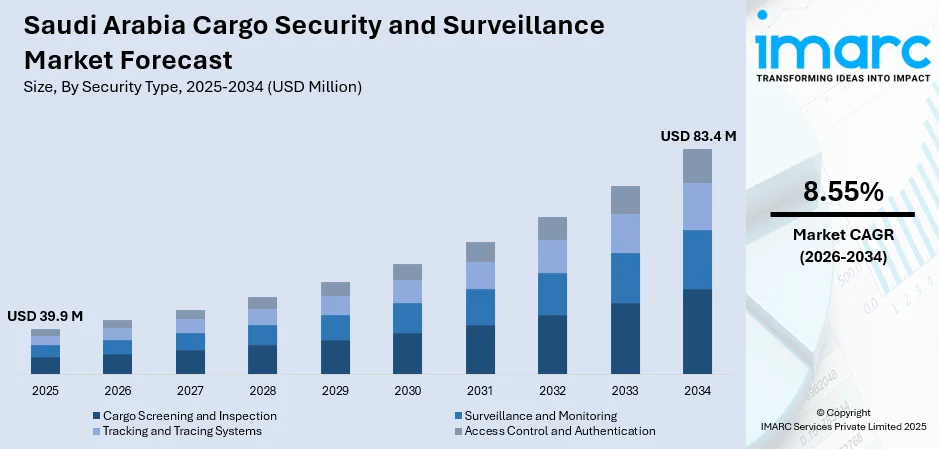

The Saudi Arabia cargo security and surveillance market size was valued at USD 39.9 Million in 2025 and is projected to reach USD 83.4 Million by 2034, growing at a compound annual growth rate of 8.55% from 2026-2034.

The market is propelled by Saudi Arabia's ambitious Vision 2030 strategy positioning the Kingdom as a global logistics hub through extensive airport modernization programs and enhanced cargo handling infrastructure. Deployment of artificial intelligence (AI)-powered screening technologies and automated threat detection systems across major air cargo terminals supports efficient processing of rapidly growing freight volumes while maintaining stringent security protocols. Integration of advanced X-ray scanners and surveillance platforms at logistics facilities addresses escalating demands from e-commerce expansion and international trade growth, strengthening the Saudi Arabia cargo security and surveillance market share.

Key Takeaways and Insights:

-

By Security Type: Cargo screening and inspection dominate the market with a share of 32.12% in 2025, driven by nationwide deployment of automated detection systems utilizing machine learning (ML) algorithms that accelerate baggage sorting processes.

-

By Mode of Transport: Air cargo security leads the market with a share of 33.08% in 2025, bolstered by significant infrastructure investments at major airports supporting the Vision 2030 target.

-

By Technology: X-ray scanners represent the largest segment with a market share of 35.14% in 2025, reflecting widespread adoption of advanced imaging systems for baggage inspection, explosives detection, and rapid cargo screening.

-

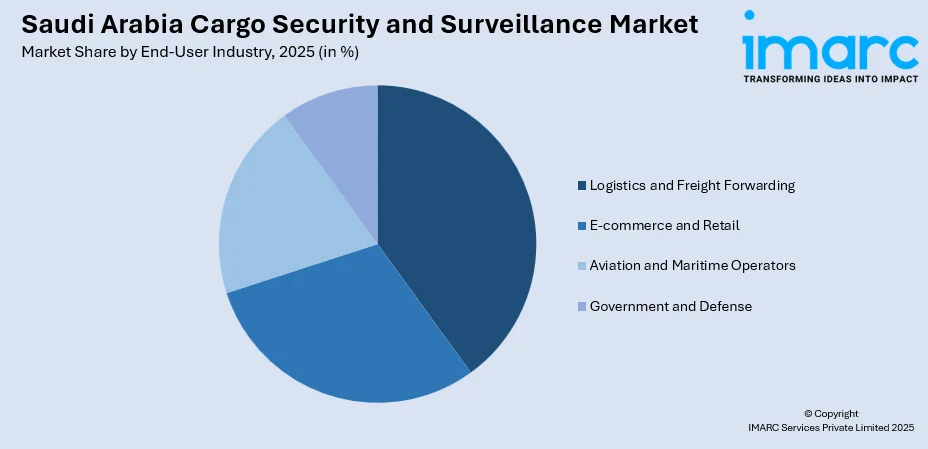

By End-User Industry: Logistics and freight forwarding leads the market with a share of 30.06% in 2025, as comprehensive cargo handling services integrate sophisticated security screening protocols across air freight terminals and multimodal logistics hubs.

-

Key Players: The Saudi Arabia cargo security and surveillance market exhibits moderate competitive intensity, with international security technology manufacturers partnering with domestic entities to localize advanced screening solutions while regional service providers expand operational capabilities across the Kingdom's growing logistics infrastructure.

To get more information on this market Request Sample

The market's trajectory reflects accelerating investments in airport security infrastructure aligned with the Kingdom's strategic positioning as a regional logistics nexus connecting Asia, Europe, and Africa. Government mandates for enhanced cargo screening protocols drive widespread adoption of X-ray inspection systems and surveillance technologies at major freight terminals. In 2024 Saudia Cargo has reinforced its status as a worldwide air cargo leader after the successful completion of its annual meeting for global sales agents. The gathering united essential collaborators globally to synchronize on the firm’s 2025 strategic goals, tackle changing market issues, and acknowledge a year of remarkable successes in 2024. Aiming to scale operations for increasing global demand, Saudia Cargo detailed its strategy to enhance fleet capacity, broaden network connectivity, and speed up digital transformation. Strategic collaborations between international security providers and domestic entities facilitate technology transfer and workforce development, supporting the Kingdom's objective of establishing world-class cargo security capabilities across its expanding aviation and logistics network.

Saudi Arabia Cargo Security and Surveillance Market Trends:

AI Integration in Automated Threat Detection Systems

Security screening operations increasingly incorporate AI algorithms that enhance pattern recognition capabilities and reduce false alarm rates in cargo inspection processes. Machine learning platforms analyze X-ray imagery in real-time, identifying suspicious items with greater accuracy than traditional manual review methods while simultaneously increasing throughput capacity at high-volume terminals. Moreover, the heightened occurrence of these intelligent systems adapt to evolving threat profiles through continuous training datasets, enabling security personnel to focus resources on genuine risks rather than routine clearance procedures. In 2025, Leidos will team up with Saudi Arabia’s National Security Services Company (SAFE) to work on security screening technology for airports and various entry points throughout the kingdom. The updated memorandum of understanding offers a structure for enhancing the modernization of Saudi Arabia’s security screening system. By providing Leidos’s systems along with localized training and services, the companies seek to enhance threat detection abilities, including scanning of people and baggage, detecting explosives, and swiftly screening cargo and vehicles.

Strategic Public-Private Partnerships Accelerating Technology Deployment

Collaborative frameworks between government aviation authorities and international security technology manufacturers facilitate rapid deployment of advanced screening equipment across the Kingdom's logistics network. These partnerships extend beyond simple procurement arrangements to encompass technology transfer initiatives, localized training programs, and joint development of solutions tailored to Saudi Arabia's specific operational requirements and regulatory environment. Memorandums of understanding signed between domestic security entities and global providers create pathways for knowledge sharing and capability building that strengthen domestic expertise while ensuring compliance with international aviation security standards. In 2025, the newly established Saudi Arabian airline, Riyadh Air, has chosen SATS Saudia Arabia to handle cargo services at various airports throughout the nation. The five-year contract encompasses cargo activities at the Riyadh Air hub located at King Khalid International Airport (RUH), along with additional assistance at King Fahd International Airport (DMM) in Dammam and King Abdulaziz International Airport (JED) in Jeddah.

Digital Transformation of Cargo Tracking and Documentation Processes

Logistics operators transition toward integrated digital platforms that unify security screening data with shipment tracking and customs clearance documentation in unified information systems. Real-time visibility networks enable stakeholders across the supply chain to monitor cargo movement and security status simultaneously, reducing processing delays and enhancing coordination between screening facilities, customs authorities, and freight forwarders. Blockchain-enabled transparency solutions provide immutable audit trails for high-value shipments while automated documentation systems minimize manual data entry errors that can trigger security holds or clearance complications. These digital ecosystems support the Kingdom's broader objective of establishing seamless, technology-driven trade facilitation capabilities that meet international best practices. In 2024, The Ministry of Transport and Logistics in Saudi Arabia has progressed significantly in its digital transformation by launching a new Digitalization and Technical Processing Center, as well as introducing the Unified Documents and Records Platform.

How Vision 2030 is Transforming the Saudi Arabia Cargo Security and Surveillance Market:

Vision 2030 is reshaping Saudi Arabia’s cargo security and surveillance market by pushing large investments into ports, airports, logistics zones, and land border infrastructure. As trade volumes rise under logistics hub ambitions, authorities are upgrading cargo screening with AI-based X-ray systems, automated threat detection, smart CCTV, and integrated command centers. Customs digitization, non-intrusive inspection, and real-time tracking are reducing clearance times while tightening risk control. Public–private partnerships and localization policies are also encouraging global security technology providers to manufacture and operate locally. Together, these changes are driving steady demand for advanced, compliant, and scalable cargo security solutions.

Market Outlook 2026-2034:

The Saudi Arabia cargo security and surveillance market is positioned for sustained expansion as Vision 2030 infrastructure investments materialize across the Kingdom's aviation and logistics sectors. Airport modernization programs at major hubs including Riyadh, Jeddah, and Dammam incorporate state-of-the-art security screening facilities designed to accommodate projected cargo volume growth annually. The market generated a revenue of USD 39.9 Million in 2025 and is projected to reach a revenue of USD 83.4 Million by 2034, growing at a compound annual growth rate of 8.55% from 2026-2034. This growth is supported by e-commerce expansion generating increased demand for rapid yet thorough cargo screening processes and enhanced surveillance protocols protecting high-value logistics infrastructure.

Saudi Arabia Cargo Security and Surveillance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Security Type | Cargo Screening and Inspection | 32.12% |

| Mode of Transport | Air Cargo Security | 33.08% |

| Technology | X-ray Scanners | 35.14% |

| End-User Industry | Logistics and Freight Forwarding | 30.06% |

Security Type Insights:

- Cargo Screening and Inspection

- Surveillance and Monitoring

- Tracking and Tracing Systems

- Access Control and Authentication

Cargo screening and inspection dominate with a market share of 32.12% of the total Saudi Arabia cargo security and surveillance market in 2025.

Cargo screening and inspection encompasses X-ray imaging systems, explosive trace detection equipment, and automated threat recognition platforms deployed at air cargo terminals, port facilities, and land border crossings. Smith Detection Group's partnership with GACA brings advanced X-ray screening devices capable of identifying prohibited items through sophisticated image analysis, supporting the Kingdom's objective of processing growing cargo volumes efficiently while meeting international aviation security standards. These automated inspection systems reduce dependency on manual screening procedures, enabling security personnel to focus on anomaly investigation rather than routine cargo clearance, thereby improving both throughput capacity and threat detection accuracy across the Kingdom's expanding logistics infrastructure network.

Cargo screening and inspection regulate entry to sensitive cargo handling zones through biometric authentication systems, vehicle barrier controls, and credential verification platforms. They also monitor restricted areas using sensor networks that identify unauthorized access attempts and trigger immediate security responses. In 2025, Saudi Arabia's national airline Saudia is using Apple technology to help reconnect travelers with baggage that has gone missing or been delayed. The Share Item Location feature enables bags equipped with an Apple AirTag or Find My network accessory to discreetly share their location with the airline through its specific digital portal. Location sharing concludes when the baggage is collected, can be halted at any moment by the owner, and lapses after seven days.

Mode of Transport Insights:

- Air Cargo Security

- Maritime Cargo Security

- Rail Cargo Security

- Road Cargo Security

Air cargo security leads with a share of 33.08% of the total Saudi Arabia cargo security and surveillance market in 2025.

Air cargo security solutions protect freight operations at the Kingdom's major aviation hubs where significant capacity expansion programs support Vision 2030 objectives. In 2024, Saudi airports collectively handled 1.2 million tons of cargo, representing a 34 percent increase compared to 2023, according to the General Authority of Statistics. King Abdulaziz International Airport in Jeddah achieved a milestone by serving over 49.1 million passengers in 2024, managing 278,000 flights with an 11 percent year-over-year increase while processing 47.1 million pieces of luggage. August 2025 brought the strategic partnership between Riyadh Air and SATS Saudi Arabia, establishing comprehensive cargo handling services at King Khalid International Airport in Riyadh, King Fahd International Airport in Dammam, and King Abdulaziz International Airport in Jeddah through a five-year agreement. This collaboration directly supports Saudi Arabia's Vision 2030 goal of managing air cargo annually.

Additionally, air cargo security promotes operational efficiency. By implementing advanced screening technologies, such as x-ray systems and explosive detection devices, airports and airlines can streamline the inspection process without causing unnecessary delays. This boosts supply chain resilience and ensures faster delivery times. Finally, stringent security measures foster compliance with international regulations, facilitating smoother trade and ensuring that airlines and freight companies meet government requirements for cargo handling. This compliance can also help avoid penalties and delays in shipments.

Technology Insights:

- X-ray Scanners

- Explosive Detection Systems (EDS)

- Video Surveillance Systems

- RFID and GPS-based Tracking

X-ray scanners exhibit a clear dominance with a 35.14% share of the total Saudi Arabia cargo security and surveillance market in 2025.

X-ray scanners constitute the primary technology platform for non-intrusive cargo inspection across Saudi Arabia's logistics network, enabling security personnel to identify concealed threats without physically opening shipments or disrupting cargo flows. May 2025 marked a significant development as Leidos signed a memorandum of understanding with Saudi Arabia's National Security Services Company (SAFE) to modernize the Kingdom's security screening infrastructure through delivery of advanced solutions for baggage inspection, explosive detection devices, and rapid cargo screening systems. This framework agreement supports collaborative deployment of cutting-edge threat detection capabilities across airports and ports of entry throughout the Kingdom, accompanied by localized training programs and technical services ensuring optimal system performance.

X-ray scanners utilize advanced sensors and chemical analysis technologies to identify explosive materials concealed within cargo shipments, providing critical protection against terrorism threats at high-risk facilities. They authenticate personnel accessing restricted cargo handling zones through various technologies that prevent unauthorized entry. Apart from this, X-ray scanners often enable security teams to observe operations in real-time while maintaining recorded documentation for investigation and compliance verification purposes.

End-User Industry Insights:

Access the comprehensive market breakdown Request Sample

- Logistics and Freight Forwarding

- E-commerce and Retail

- Aviation and Maritime Operators

- Government and Defense

Logistics and freight forwarding lead with a share of 30.06% of the total Saudi Arabia cargo security and surveillance market in 2025.

Logistics and freight forwarding companies constitute the largest end-user segment as these operators manage cargo movements across air, sea, and land transportation modes, requiring integrated security screening capabilities at their facilities. The Saudi Arabia logistics market reached USD 81.2 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033, according to IMARC Group. Logistics involves the planning, implementation, and control of the efficient flow and storage of products, services, and information from the point of origin to the final consumer. It covers everything from warehousing, inventory management, packaging, and transportation, ensuring that products reach their destination on time and in optimal condition.

Freight forwarding, on the other hand, refers to the coordination and management of shipments for individuals or companies, usually involving the movement of goods internationally. Freight forwarders act as intermediaries between the shipper and various transportation services, such as ocean, air, rail, and road carriers. They handle documentation, customs clearance, and ensure compliance with international regulations, helping businesses navigate complex logistics challenges. Together, logistics and freight forwarding are crucial for maintaining supply chain efficiency and meeting customer demands in a timely manner.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central regions of Saudi Arabia, with key hubs such as Riyadh, serve as critical logistics and transportation centers. These areas handle significant cross-border land freight and inland shipments, making cargo security a priority. Advanced surveillance systems, including tracking technologies, CCTV, and access control mechanisms, are essential for safeguarding goods and infrastructure.

The Western region of Saudi Arabia, home to key ports like Jeddah, plays a central role in the country’s cargo security needs. As a gateway for imports and exports, particularly during peak seasons like Hajj and Umrah, advanced surveillance systems are vital to managing high volumes of cargo. Automated inspection and monitoring technologies, including AI-based systems and real-time tracking, ensure the safe transport of goods.

The Eastern region is a hub for Saudi Arabia’s oil and petrochemical industries, making cargo security essential in this area. Ports and transport corridors that manage heavy industrial exports require robust security infrastructure, such as advanced video surveillance, RFID tracking, and access control systems.

The Eastern region is a hub for Saudi Arabia’s oil and petrochemical industries, making cargo security essential in this area. Ports and transport corridors that manage heavy industrial exports require robust security infrastructure, such as advanced video surveillance, RFID tracking, and access control systems.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cargo Security and Surveillance Market Growing?

Vision 2030 Infrastructure Investments and National Logistics Strategy Implementation

Saudi Arabia's comprehensive economic diversification program channels substantial capital toward logistics infrastructure development, positioning the Kingdom as a regional hub connecting Asia, Europe, and Africa through world-class cargo handling facilities. Government allocations exceeding USD 106.6 billion target enhancements across land, air, and sea cargo operations, with the Saudi Port Authority (MAWANI) committing USD 4.5 billion in 2023 specifically toward maritime logistics and port infrastructure focusing on technology-enabled logistics parks. These strategic initiatives create sustained demand for advanced cargo security solutions as new logistics facilities require comprehensive security infrastructure from initial design phases.

Rapid Air Cargo Volume Growth Driven by E-Commerce Expansion

Escalating freight volumes flowing through Saudi Arabia's aviation network necessitate proportional expansion of security screening capacity to maintain operational efficiency while meeting regulatory compliance requirements. Saudia Cargo transported 577,870 tons in 2024 with e-commerce shipments, reflecting the surge in cross-border online retail fulfillment demands. Growing cargo and passenger loads compel airport operators to deploy automated screening technologies capable of maintaining high inspection standards without creating bottlenecks that delay freight movements, driving continuous investment in advanced X-ray scanners and AI-enhanced threat detection systems that accelerate processing while improving security outcomes.

Enhanced Regulatory Frameworks and Mandatory Security Compliance

Evolving international aviation security standards and domestic regulatory requirements mandate continuous technology upgrades across cargo handling facilities, compelling operators to adopt advanced screening capabilities meeting stringent compliance benchmarks. Saudi Arabia’s air cargo industry keeps rising, with 866,000 tonnes processed from January to September 2025, indicating the Kingdom’s increasing role as a global logistics center. The General Authority of Civil Aviation (GACA) announced the most recent performance statistics at the 18th Aviation Program Steering Committee, highlighting the importance of cargo in promoting Vision 2030 and the National Transport and Logistics Strategy (NTLS). International aviation authorities continuously refine cargo screening standards in response to emerging threat patterns, requiring Saudi facilities to maintain technology currency through regular equipment upgrades and capability enhancements ensuring alignment with global best practices.

Market Restraints:

What Challenges the Saudi Arabia Cargo Security and Surveillance Market is Facing?

High Capital Requirements for Advanced Technology Deployment

Implementation of sophisticated cargo security systems demands substantial upfront investments in hardware, software licenses, and facility modifications that create financial barriers particularly for smaller logistics operators and regional facilities. Advanced X-ray scanning equipment, artificial intelligence-powered threat detection platforms, and integrated surveillance networks require significant capital outlays that may strain budgets of companies competing for market share in an increasingly cost-conscious logistics environment. Technology refresh cycles necessitate regular equipment upgrades to maintain compliance with evolving security standards, generating ongoing capital expenditure requirements that compound initial deployment costs.

Skilled Workforce Shortages and Technical Training Requirements

Operation of advanced security screening technologies requires specialized personnel capable of interpreting artificial intelligence-generated threat assessments, maintaining sophisticated X-ray systems, and managing integrated digital cargo platforms. Saudi Arabia's Saudization workforce localization policies compound recruitment challenges by prioritizing employment of Saudi nationals who may require extensive technical training before achieving proficiency in operating complex security equipment. Continuous technology evolution necessitates ongoing workforce development programs keeping security personnel current with latest system capabilities and threat identification methodologies, creating persistent training costs and potential operational disruptions during transition periods.

Complex Multi-Jurisdictional Regulatory Compliance Requirements

Cargo security operations must navigate evolving international aviation security standards, customs regulations, dangerous goods protocols, and data protection requirements across multiple transportation modes. Compliance costs escalate as authorities introduce more stringent screening mandates and documentation procedures requiring continuous adaptation of operational protocols and technology configurations. Coordination between various regulatory agencies overseeing different aspects of cargo security creates administrative complexity that may delay technology deployments or necessitate redundant screening procedures satisfying multiple compliance frameworks simultaneously.

Competitive Landscape:

The Saudi Arabia cargo security and surveillance market features international technology providers collaborating with domestic entities through strategic partnerships that facilitate localized deployment of advanced screening solutions. Global security equipment manufacturers leverage established expertise in X-ray scanning systems, explosives detection technologies, and surveillance platforms while partnering with Saudi companies possessing local market knowledge and government relationships enabling efficient project execution. Competition centers on technology differentiation through artificial intelligence integration, automated threat detection capabilities, and system interoperability supporting seamless integration with existing logistics operations. Regional service providers focus on maintenance support, training services, and operational consulting that complement hardware deployments from international vendors. Market consolidation remains limited as diverse technology requirements across different cargo handling applications support multiple specialized providers rather than concentration among few dominant players.

Recent Developments:

-

In December 2025, Vehant Technologies, a Security solutions provider incubated at IIT Delhi, has deployed locally designed and produced security and surveillance systems in 120 international locations. The firm has obtained more orders from the Saudi-based Saline Water Conversion Corporation, enhancing the company's international footprint in secure infrastructure solutions. Vehant Technologies' export orders encompass not only explosive detectors but also modern systems like advanced X-ray baggage screening, Under Vehicle Scanning Systems, and ANPR (automatic number plate recognition) cameras.

Saudi Arabia Cargo Security and Surveillance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Security Types Covered | Cargo Screening and Inspection, Surveillance and Monitoring, Tracking and Tracing Systems, Access Control and Authentication |

| Modes of Transports Covered | Air Cargo Security, Maritime Cargo Security, Rail Cargo Security, Road Cargo Security |

| Technologies Covered | X-ray Scanners, Explosive Detection Systems (EDS), Video Surveillance Systems, RFID & GPS-based Tracking |

| End-User Industries Covered | Logistics and Freight Forwarding, E-commerce and Retail, Aviation and Maritime Operators, Government and Defense |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cargo security and surveillance market size was valued at USD 39.9 Million in 2025.

The Saudi Arabia cargo security and surveillance market is expected to grow at a compound annual growth rate of 8.55% from 2026-2034 to reach USD 83.4 Million by 2034.

X-ray scanners dominated the market with 35.14% share, driven by widespread deployment across cargo inspection facilities and ongoing technology upgrade programs supporting automated threat detection capabilities at airports and logistics hubs throughout the Kingdom.

Key factors driving the Saudi Arabia cargo security and surveillance market include Vision 2030 infrastructure investments targeting logistics sector development, rapid air cargo volume growth with Saudi airports handling 1.2 million tons in 2024, enhanced regulatory frameworks including new National Cybersecurity Authority Regulations establishing enforcement authority, and strategic partnerships between government entities and international security technology providers accelerating deployment of advanced screening solutions across the Kingdom's expanding aviation and logistics network.

Major challenges include high capital requirements for deploying sophisticated X-ray scanning equipment and AI-powered threat detection platforms creating financial barriers particularly for smaller regional operators, skilled workforce shortages compounded by Saudization policies requiring specialized technical training for operating advanced security systems, and complex multi-jurisdictional regulatory compliance requirements necessitating coordination across various agencies overseeing different aspects of cargo security with escalating costs from continuously evolving international aviation security standards and documentation procedures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)