Saudi Arabia Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Saudi Arabia Catheters Market Overview:

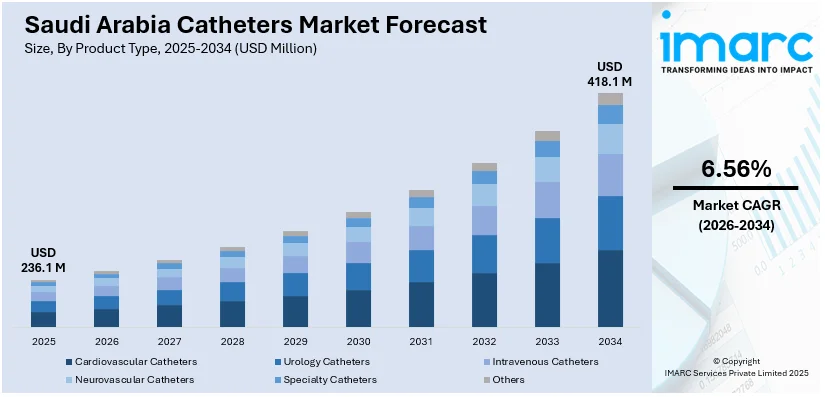

The Saudi Arabia catheters market size reached USD 236.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 418.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.56% during 2026-2034. Growing elderly population, rising chronic disease incidence, increased surgical procedures, expanding healthcare infrastructure, and higher demand for minimally invasive treatments are some of the factors contributing to Saudi Arabia catheters market share. Government initiatives to improve healthcare access and technological advancements in catheter design also support industry expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 236.1 Million |

| Market Forecast in 2034 | USD 418.1 Million |

| Market Growth Rate 2026-2034 | 6.56% |

Saudi Arabia Catheters Market Trends:

Regional Outreach Enhancing Procedural Expertise

International medical missions are playing a growing role in shaping procedural capabilities and product familiarity across neighboring regions. Saudi-led healthcare initiatives, involving specialized cardiac and catheter-based interventions, are reinforcing clinical competencies while showcasing advanced medical techniques. These programs not only support patient care abroad but also contribute to domestic readiness by strengthening practitioner experience with a range of catheterization procedures. As professionals engage in complex interventions, their exposure to high-performance medical devices increases, indirectly influencing usage patterns back home. The broader emphasis on regional medical support is encouraging greater emphasis on quality, precision, and adaptability in catheter selection. This evolving approach is subtly guiding preferences toward technologies that can perform reliably across varied clinical environments. These factors are intensifying the Saudi Arabia catheters market growth. For example, in May 2024, Saudi Arabia's KSrelief medical volunteers are conducting cardiac surgeries and catheterization procedures at Prince Mohammed bin Salman Hospital in Aden, Yemen. The team completed 166 catheterizations and 25 open-heart surgeries. Supported by the Saudi Development and Reconstruction Program for Yemen, this initiative highlights Saudi Arabia’s commitment to global healthcare aid, with a specific impact on advancing catheter-related medical support in the region.

To get more information on this market Request Sample

Infection Control Measures Reshaping Market Direction

In Saudi Arabia, improved infection prevention protocols in intensive care settings are influencing product choices across the catheter segment. A national healthcare initiative focused on training medical professionals and enhancing clinical practices is driving safer usage of central lines. This push aligns with broader efforts to raise healthcare quality and patient outcomes. As medical facilities emphasize safety and compliance, interest is growing in solutions that reduce the risk of bloodstream infections. The shift is encouraging manufacturers and suppliers to develop and distribute catheters with enhanced protective features. Across the sector, procurement preferences are evolving to favor devices that support long-term quality standards and clinical efficiency, reflecting a broader move toward performance-oriented healthcare delivery. For instance, in December 2024, Saudi Arabia achieved a 48.8% annual reduction in central catheter-associated bloodstream infections (CLABSI) in ICUs from 2021 to 2024, quadrupling the global average, according to WHO. This success stems from a national strategy launched in 2022, including training over 5,000 healthcare practitioners in infection control. The initiative aligns with Saudi Vision 2030, enhancing patient safety and healthcare quality across the Kingdom.

Saudi Arabia Catheters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cardiovascular catheters, urology catheters, intravenous catheters, neurovascular catheters, specialty catheters, and others.

End User Insights:

.jpeg)

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Catheters Market News:

- In April 2025, Saudi Arabia’s King Faisal Specialist Hospital introduced an advanced, minimally invasive catheter-based artery stent technique for treating peripheral artery disease. The procedure, performed through the thigh, uses bioresorbable stents that restore blood flow and dissolve naturally, reducing surgery and long-term complications.

Saudi Arabia Catheters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters, Specialty Catheters, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia catheters market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia catheters market on the basis of product type?

- What is the breakup of the Saudi Arabia catheters market on the basis of end user?

- What is the breakup of the Saudi Arabia catheters market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia catheters market?

- What are the key driving factors and challenges in the Saudi Arabia catheters?

- What is the structure of the Saudi Arabia catheters market and who are the key players?

- What is the degree of competition in the Saudi Arabia catheters market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia catheters market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia catheters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia catheters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)