Saudi Arabia Ceiling Light Market Size, Share, Trends and Forecast by Light Source, Mounting Type, Application, Smart Features, Style, and Region, 2026-2034

Saudi Arabia Ceiling Light Market Summary:

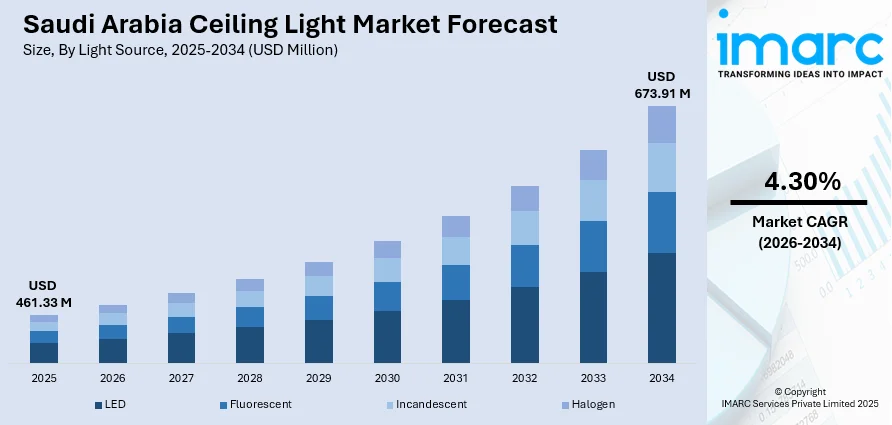

The Saudi Arabia ceiling light market size was valued at USD 461.33 Million in 2025 and is projected to reach USD 673.91 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034.

The Saudi Arabia ceiling light market is experiencing robust expansion as Vision 2030 drives unprecedented urban development and infrastructure modernization across the Kingdom. Growing consumer preference for energy-efficient LED technologies, combined with rising demand for smart home integration capabilities, is reshaping the competitive landscape. Increasing investment in commercial real estate, hospitality facilities, and residential developments continues to stimulate demand for sophisticated ceiling lighting solutions that balance aesthetics with functionality, contributing to the expansion of the Saudi Arabia ceiling light market share.

Key Takeaways and Insights:

- By Light Source: LED dominates the market with a share of 64% in 2025, driven by government energy efficiency mandates and superior performance characteristics including longer lifespan and reduced maintenance requirements.

- By Mounting Type: Recessed leads the market with a share of 46% in 2025, owing to its popularity in commercial and residential false ceiling applications offering discreet and uniform illumination.

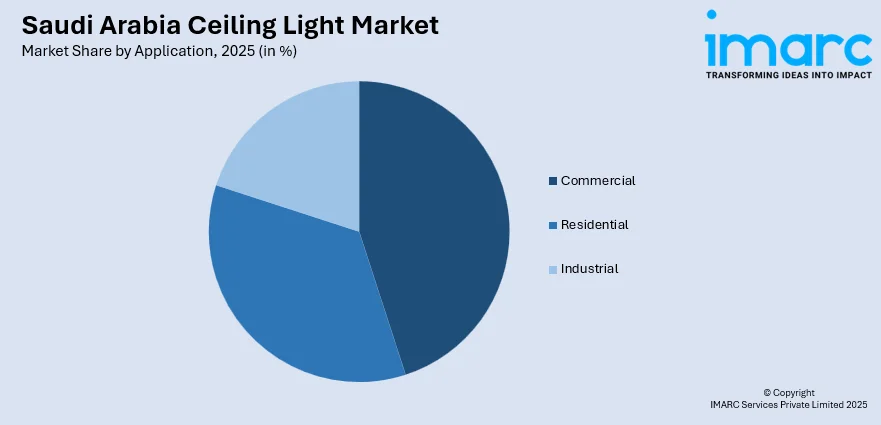

- By Application: Commercial represents the largest segment with a market share of 45% in 2025, fueled by rapid expansion of shopping centers, office buildings, and hospitality venues under Vision 2030 projects.

- By Smart Features: Dimmable holds the largest share at 37% in 2025, reflecting growing adoption of adjustable lighting solutions that enhance energy savings and personalized ambiance control.

- By Style: Modern accounts for the largest share at 48% in 2025, driven by contemporary architectural preferences in new construction and renovation projects across urban centers.

- Key Players: The Saudi Arabia ceiling light market exhibits a competitive landscape with international lighting manufacturers competing alongside regional suppliers, focusing on energy efficiency, smart technology integration, and localized production capabilities.

To get more information on this market Request Sample

The Saudi Arabia ceiling light market is advancing as the Kingdom positions itself as a regional hub for commerce, tourism, and innovation under Vision 2030. Smart city developments and mega-projects are creating substantial demand for advanced ceiling lighting solutions that integrate with home automation systems and support energy efficiency objectives. In July 2024, Versatile International announced the establishment of Asheil Versatile Lighting Technologies, a joint venture with Haneco Lighting to manufacture lighting products domestically and serve the Kingdom's giga-projects. The hospitality sector expansion, with licensed facilities in Makkah increasing 80% in 2024, is generating significant requirements for ceiling lighting across hotels, retail establishments, and entertainment venues. Continued government investment in infrastructure modernization and energy-efficient building standards reinforces the sustained Saudi Arabia ceiling light market growth trajectory.

Saudi Arabia Ceiling Light Market Trends:

Integration of Smart Home Automation Technologies

The incorporation of ceiling lighting systems with home automation technology is transforming the Saudi Arabia ceiling light market landscape. Consumers increasingly seek connected solutions enabling remote control through smartphones and voice assistants. This trend aligns with smart city initiatives, exemplified by Banan City, a smart city project spanning 10 sq km northeast of Riyadh featuring over 20,000 smart residences with integrated home automation technologies, driving demand for intelligent ceiling lighting that enhances the intelligent infrastructure ecosystem.

Accelerated Transition to Energy-Efficient LED Solutions

Government-led energy efficiency initiatives are accelerating the transition from conventional lighting to LED-based ceiling fixtures across residential and commercial sectors. Saudi Arabia aims to become the first G20 nation to replace all streetlights with energy-efficient LEDs, as announced by Tarshid at the Global Project Management Forum 2024 in Riyadh. This ambitious target reflects broader policy objectives supporting LED adoption in ceiling lighting applications, reducing electricity consumption while meeting sustainability goals.

Expansion of Digital Retail Distribution Channels

The expansion of e-commerce platforms is revolutionizing how consumers access ceiling lighting products in Saudi Arabia. Digital channels enable buyers to compare prices, features, and designs across diverse product ranges, democratizing access to premium lighting solutions. Saudi Arabia announced plans to grow its e-commerce sales to USD 30 billion by 2027, enhancing the overall availability of ceiling lighting products and intensifying market competition and innovation.

How Vision 2030 is Transforming the Saudi Arabia Ceiling Light Market:

Saudi Arabia's Vision 2030 is fundamentally reshaping the ceiling light market by driving unprecedented infrastructure development and energy efficiency mandates across the Kingdom. Mega-projects such as NEOM, Qiddiya, the Red Sea developments, and smart city initiatives like Banan City are generating substantial demand for sophisticated ceiling lighting solutions that integrate modern aesthetics with advanced technology. Government programs targeting LED adoption, including Tarshid's initiative to become the first G20 nation with complete LED streetlight coverage, are accelerating the transition from conventional lighting. Regulatory frameworks mandating energy-efficient lighting in new construction are creating favorable market conditions. The hospitality sector expansion, tourism infrastructure development, and smart home integration requirements are further catalyzing ceiling light market transformation.

Market Outlook 2026-2034:

The Saudi Arabia ceiling light market is poised for sustained expansion driven by continued infrastructure investment, urbanization, and evolving consumer preferences for smart, energy-efficient solutions. Large-scale construction projects across Riyadh, Jeddah, and emerging cities will generate consistent demand for sophisticated ceiling lighting installations. The market generated a revenue of USD 461.33 Million in 2025 and is projected to reach a revenue of USD 673.91 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034.

Saudi Arabia Ceiling Light Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Light Source | LED | 64% |

| Mounting Type | Recessed | 46% |

| Application | Commercial | 45% |

| Smart Feature | Dimmable | 37% |

| Style | Modern | 48% |

Light Source Insights:

- LED

- Fluorescent

- Incandescent

- Halogen

LED dominates the market with a share of 64% of the total Saudi Arabia ceiling light market in 2025.

LED ceiling lights have established clear dominance in the Saudi Arabia market due to their superior energy efficiency, extended operational lifespan, and declining prices. Government initiatives mandating energy-efficient lighting in public infrastructure and commercial buildings have accelerated adoption. The National Energy Services Company announced plans to replace 74,000 streetlamps in Riyadh with LED lights, aiming to reduce power consumption by over 70% and avoid more than 48,000 metric tons of carbon emissions.

Commercial and residential developers increasingly specify LED ceiling fixtures as standard installations to comply with building energy codes and achieve operational cost savings. The availability of LED options across various form factors, color temperatures, and dimming capabilities enables designers to meet diverse aesthetic and functional requirements while supporting Saudi Arabia's sustainability objectives under Vision 2030.

Mounting Type Insights:

- Recessed

- Surface-Mounted

- Pendant

- Chandelier

Recessed holds the largest share at 46% of the total Saudi Arabia ceiling light market in 2025.

Recessed ceiling lights, including LED downlights and panel lights, have emerged as the preferred mounting solution for commercial and modern residential applications throughout Saudi Arabia. These fixtures provide discreet illumination while maintaining clean architectural lines preferred in contemporary design schemes. LED panel lights offer uniform, glare-free illumination for offices, schools, hospitals, and commercial buildings, enhancing visual comfort and productivity in indoor environments.

The growing adoption of false ceilings in commercial buildings, retail establishments, and hospitality venues creates favorable conditions for recessed lighting installations. Advanced LED downlights featuring adjustable beam angles, color temperature options, and dimming capabilities enable customizable lighting atmospheres across diverse application settings, reinforcing the segment's market leadership position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Commercial represents the largest segment with a share of 45% of the total Saudi Arabia ceiling light market in 2025.

Commercial applications lead the Saudi Arabia ceiling light market driven by extensive construction activity across office buildings, shopping centers, hospitality venues, and retail establishments. Vision 2030 infrastructure projects are generating sustained demand for high-quality ceiling lighting solutions that combine functionality, aesthetics, and energy efficiency. In 2024, Tilal Real Estates introduced the USD 1.6 Billion Heart of Khobar initiative, comprising residences, workplaces, parks, shopping centers, and hotels requiring innovative lighting installations.

The hospitality sector's rapid expansion, with licensed facilities in Makkah increasing to provide enhanced accommodation for religious tourists, is creating substantial ceiling lighting requirements. Commercial developments increasingly specify integrated lighting controls, daylight harvesting, and human-centric lighting designs to improve occupant comfort and energy performance.

Smart Features Insights:

- Dimmable

- Color-Changing

- Voice-Controlled

- Smart Home Integration

Dimmable leads the market with a share of 37% of the total Saudi Arabia ceiling light market in 2025.

Dimmable ceiling lights have achieved market leadership among smart features due to their practical benefits in energy management and ambiance customization. These systems enable users to adjust brightness levels according to time of day, occupancy, and activity requirements, delivering tangible electricity savings while enhancing comfort. Smart street lighting projects in cities like Riyadh are expected to cut energy costs through intelligent dimming and automated controls.

The growing trend toward human-centric lighting in commercial environments is driving adoption of dimmable ceiling fixtures that can replicate natural light patterns and support occupant wellbeing. Government-funded housing initiatives and residential towers increasingly incorporate motion-activated and dimmable corridor lighting as standard features.

Style Insights:

- Modern

- Traditional

- Contemporary

- Industrial

- Coastal

Modern accounts for the largest share at 48% of the total Saudi Arabia ceiling light market in 2025.

Modern style ceiling lights dominate the Saudi Arabia market reflecting contemporary architectural preferences in new construction and renovation projects across urban centers. The Kingdom's emphasis on modernizing infrastructure and developing world-class urban environments creates strong demand for sleek, minimalist lighting designs that complement contemporary interiors. Smart city developments require lighting solutions that integrate seamlessly with advanced building management systems while delivering aesthetic appeal.

Residential developers and commercial property owners increasingly specify modern ceiling lighting to enhance property values and appeal to younger, design-conscious consumers. The availability of modern LED fixtures combining clean lines with advanced functionality, including smart controls and energy-efficient performance, supports continued segment expansion.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region, anchored by the capital Riyadh, represents the primary hub for ceiling light demand in Saudi Arabia driven by large-scale infrastructure and urban development projects. Riyadh's growing skyline, influenced by Vision 2030, emphasizes modern architecture and sustainable lighting solutions. The region hosts major construction initiatives including the New Murabba development and numerous commercial complexes requiring sophisticated ceiling lighting installations. Government initiatives and smart city investments further enhance demand for advanced lighting systems.

The Western Region, encompassing Jeddah and the holy cities of Makkah and Madinah, represents a significant market driven by religious tourism and commercial development. The hospitality sector expansion to accommodate growing pilgrim numbers generates substantial ceiling lighting requirements across hotels and accommodation facilities. Jeddah's tourism and hospitality sectors drive demand for innovative lighting solutions in commercial and entertainment venues, with the Jeddah Central Development Project set to contribute to the Saudi economy by 2030.

The Eastern Region, including Dammam and Al Khobar, contributes meaningfully to market demand driven by industrial growth and urban expansion. The region's industrial development and manufacturing activities create demand for efficient ceiling lighting in commercial and industrial facilities. HEBA Lighting, headquartered in Dammam, supplies architectural and decorative lighting solutions serving the luxury and hospitality sectors. The Heart of Khobar initiative exemplifies ongoing commercial development driving lighting requirements.

The Southern Region, centered on Abha and the Asir province, is emerging as a growing market driven by tourism development initiatives. The Asir Region Development Strategy aims to transform the area into a world-class tourism destination attracting over 10 Million visitors annually by 2030. Tourism infrastructure projects including hotels, resorts, and entertainment facilities generate ceiling lighting demand. The Soudah Peaks Mixed-Use Development in the Aseer region, featuring luxury hotels and commercial space, represents ongoing hospitality investment supporting market growth.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Ceiling Light Market Growing?

Vision 2030 Infrastructure Development and Urban Expansion

Saudi Arabia's Vision 2030 program is driving transformative urban development, creating substantial demand for sophisticated ceiling lighting solutions across residential, commercial, and public infrastructure projects. Smart city initiatives emphasize modern, energy-efficient lighting as foundational infrastructure. Under Vision 2030, Saudi Arabia plans to construct smart cities and automate 4,000 factories, generating sustained ceiling lighting requirements across diverse application segments.

Government Energy Efficiency Mandates and Sustainability Initiatives

Government-led energy efficiency programs are accelerating ceiling light market growth by mandating transitions from conventional to LED-based solutions. The National Energy Efficiency Program requires compliance with minimum energy performance standards for lighting products, aiming to reduce energy consumption by 2030. The Saudi Ministry of Transport launched a project to replace 17,000 traditional streetlights with LED lights across Jeddah and Madinah, targeting electricity savings exceeding 60% and avoiding 68,000 tons of carbon emissions annually. These regulatory frameworks create favorable conditions for energy-efficient ceiling lighting adoption across all building types.

Rapid Growth in Tourism and Hospitality Sector

Saudi Arabia's expanding tourism sector generates significant demand for ceiling lighting across hotels, resorts, entertainment venues, and cultural facilities. The Kingdom welcomed 30 million international tourists in 2024, with licensed hospitality facilities in Makkah surging 80% to 1,030 facilities and Madinah's licensed facilities. With 221,000 new hotel rooms planned for Makkah and Madinah to accommodate religious tourists, and 362,000 total new rooms planned nationwide by 2030, the hospitality sector represents a substantial growth driver for ceiling lighting demand across diverse accommodation categories.

Market Restraints:

What Challenges the Saudi Arabia Ceiling Light Market is Facing?

High Dependency on Imported Lighting Products

Saudi Arabia currently imports significant volumes of lighting equipment, with majority of imports originating from China. This dependency creates supply chain vulnerabilities, cost pressures, and extended lead times for project implementation. While domestic manufacturing initiatives are emerging, the market remains substantially reliant on international suppliers.

Stringent Regulatory Compliance Requirements

Navigating complex regulatory requirements including Saudi Standards, Metrology and Quality Organisation (SASO) compliance presents challenges for market participants. Lighting imports must adhere to SASO 2870:2018 standards for energy efficiency and photobiological safety, requiring extensive certification processes that can delay market entry and increase costs.

High Initial Investment Costs for Premium Solutions

The premium pricing of advanced ceiling lighting solutions, particularly smart and IoT-enabled fixtures, presents adoption barriers for price-sensitive consumer segments. While long-term operational savings justify higher initial investments, upfront cost concerns can limit market penetration in certain segments without accessible financing options.

Competitive Landscape:

The Saudi Arabia ceiling light market exhibits a dynamic competitive landscape with international lighting manufacturers competing alongside regional suppliers and emerging domestic producers. Market participants are focusing on energy efficiency, smart technology integration, and localized manufacturing to differentiate their offerings. Companies are investing in product innovation, expanding distribution networks, and establishing strategic partnerships to strengthen market positions. The emphasis on Vision 2030 alignment, sustainability credentials, and smart home compatibility shapes competitive strategies. As demand for advanced ceiling lighting grows across commercial and residential applications, market players are refining approaches to capture opportunities arising from the Kingdom's transformation into a modern, sustainable economy.

Saudi Arabia Ceiling Light Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Light Sources Covered | LED, Fluorescent, Incandescent, Halogen |

| Mounting Types Covered | Recessed, Surface-Mounted, Pendant, Chandelier |

| Applications Covered | Residential, Commercial, Industrial |

| Smart Features Covered | Dimmable, Color-Changing, Voice-Controlled, Smart Home Integration |

| Styles Covered | Modern, Traditional, Contemporary, Industrial, Coastal |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia ceiling light market size was valued at USD 461.33 Million in 2025.

The Saudi Arabia ceiling light market is expected to grow at a compound annual growth rate of 4.30% from 2026-2034 to reach USD 673.91 Million by 2034.

LED, holding the largest revenue share of 64%, remains pivotal for Saudi Arabia's ceiling light market, driven by government energy efficiency mandates, superior performance characteristics, and declining costs that make LED technology the preferred choice across commercial and residential applications.

Key factors driving the Saudi Arabia ceiling light market include Vision 2030 infrastructure development projects, government energy efficiency mandates, rapid tourism and hospitality sector expansion, smart home technology adoption, and increasing urbanization across major cities.

Major challenges include high dependency on imported lighting products, stringent SASO regulatory compliance requirements, high initial investment costs for premium smart solutions, need for product customization to withstand Saudi Arabia's climate conditions, and integration complexities with evolving smart city technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)