Saudi Arabia Cement Additives Market Size, Share, Trends and Forecast by Type, Function, and Region, 2026-2034

Saudi Arabia Cement Additives Market Overview:

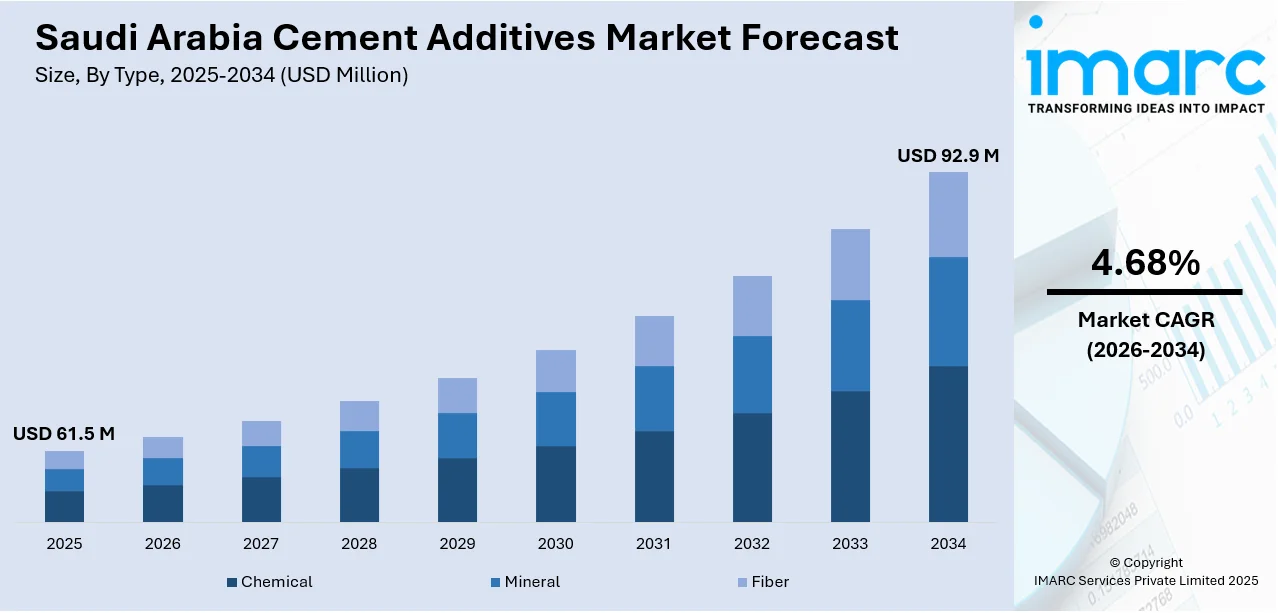

The Saudi Arabia cement additives market size reached USD 61.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 92.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.68% during 2026-2034. The market is driven by strong demand from Saudi Arabia’s rapidly expanding construction and infrastructure sector. Additionally, technological innovations in cement production processes have led to the development of advanced additives that cater to both performance and sustainability. The increasing focus on environmental sustainability further strengthens the demand for eco-friendly construction materials, including additives that improve the durability and environmental footprint of cement are further augmenting the Saudi Arabia cement additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 61.5 Million |

| Market Forecast in 2034 | USD 92.9 Million |

| Market Growth Rate 2026-2034 | 4.68% |

Saudi Arabia Cement Additives Market Trends:

Demand from Construction and Infrastructure Development

Considerable growth in the construction and infrastructure sector in Saudi Arabia remains a central driver of the market. The rapid urbanization, governmental initiatives, and large-scale infrastructure projects have significantly increased the demand for cement, directly influencing the need for additives. Cement additives are crucial for enhancing the properties of cement, such as improving durability, workability, and setting time, thus supporting the development of high-quality structures. Notably, the Saudi government's Vision 2030 plan emphasizes large-scale infrastructure projects, including the development of smart cities, transportation networks, and residential complexes. On March 7, 2024, Saudi Arabia's Yamama Cement announced plans to transform its old factory land in south Riyadh into a clean industry city dedicated to sustainable industrial practices and logistics services. The 4.71 million square meter plot, valued at SAR 1 (USD 0.27) per square meter, is set for development once regulatory approvals are secured. This comes shortly after the company launched a new USD 1.6 billion plant in Al-Kharj, which boasts a production capacity of 20,000 tonnes of clinker per day using the latest environmentally friendly technologies. This focus on infrastructure necessitates the use of advanced construction materials, including cement modified with additives, to meet the stringent demands of modern construction. Furthermore, the increasing number of private sector investments in real estate projects and commercial buildings in urban areas also plays a key role in fueling the market growth. With cement additives integral to the production of high-strength, low-maintenance, and eco-friendly materials, the growing construction activities are vital in shaping the future trajectory of the Saudi Arabia cement additives market growth. As the sector continues to expand, the demand for specialized cement products and their additives will likely remain a fundamental driver, fueling overall market performance.

To get more information on this market Request Sample

Increasing Focus on Sustainability and Eco-friendly Practices

The push for sustainability in Saudi Arabia has heightened the demand for eco-friendly construction materials, including cement additives that enhance the sustainability of building projects. With global and local pressures to reduce carbon emissions and the environmental impact of construction activities, the market for cement additives that improve the environmental footprint of cement products has expanded significantly. Additives that enable the use of alternative, recycled raw materials in cement production, such as fly ash and slag, are increasingly in demand. This shift toward greener cement solutions supports Saudi Arabia's sustainability agenda, aligning with international trends in sustainable construction. On December 29, 2024, Al Jouf Cement Company announced the approval of its new green cement product for use in NEOM projects, developed in collaboration with ASAS AlMohileb Co. This green cement reduces carbon dioxide emissions by 30% and offers an alternative to imported additives such as ground granulated blast furnace slag (GGBS) and fly ash. Additionally, it improves concrete durability, lowers construction costs, and meets the stringent standards required for large-scale concrete works in NEOM. Additionally, additives that reduce water consumption and enhance the durability of concrete structures play a critical role in meeting the country’s growing emphasis on resource-efficient building practices. Moreover, cement additives contribute to the creation of materials that are not only durable and resistant to wear but also have a lesser impact on the environment throughout their lifecycle. This focus on sustainability, in line with the Vision 2030 initiative, ensures that eco-friendly cement additives will continue to be integral to public and private sector construction projects. As the demand for sustainable construction methods rises, these factors will drive continued growth in the market.

Saudi Arabia Cement Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and function.

Type Insights:

- Chemical

- Mineral

- Fiber

The report has provided a detailed breakup and analysis of the market based on the type. This includes chemical, mineral, and fiber.

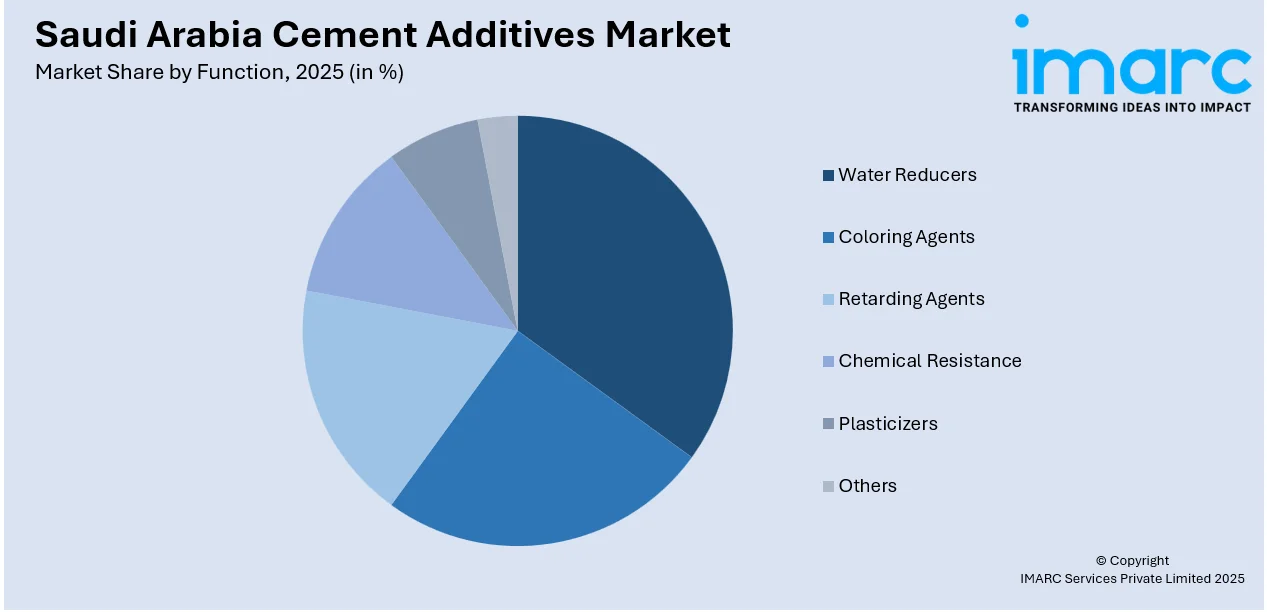

Function Insights:

Access the comprehensive market breakdown Request Sample

- Water Reducers

- Coloring Agents

- Retarding Agents

- Chemical Resistance

- Plasticizers

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes water reducers, coloring agents, retarding agents, chemical resistance, plasticizers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cement Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chemical, Mineral, Fiber |

| Functions Covered | Water Reducers, Coloring Agents, Retarding Agents, Chemical Resistance, Plasticizers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cement additives market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cement additives market on the basis of type?

- What is the breakup of the Saudi Arabia cement additives market on the basis of function?

- What is the breakup of the Saudi Arabia cement additives market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cement additives market?

- What are the key driving factors and challenges in the Saudi Arabia cement additives market?

- What is the structure of the Saudi Arabia cement additives market and who are the key players?

- What is the degree of competition in the Saudi Arabia cement additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cement additives market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cement additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cement additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)