Saudi Arabia Cement Admixtures Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Saudi Arabia Cement Admixtures Market Overview:

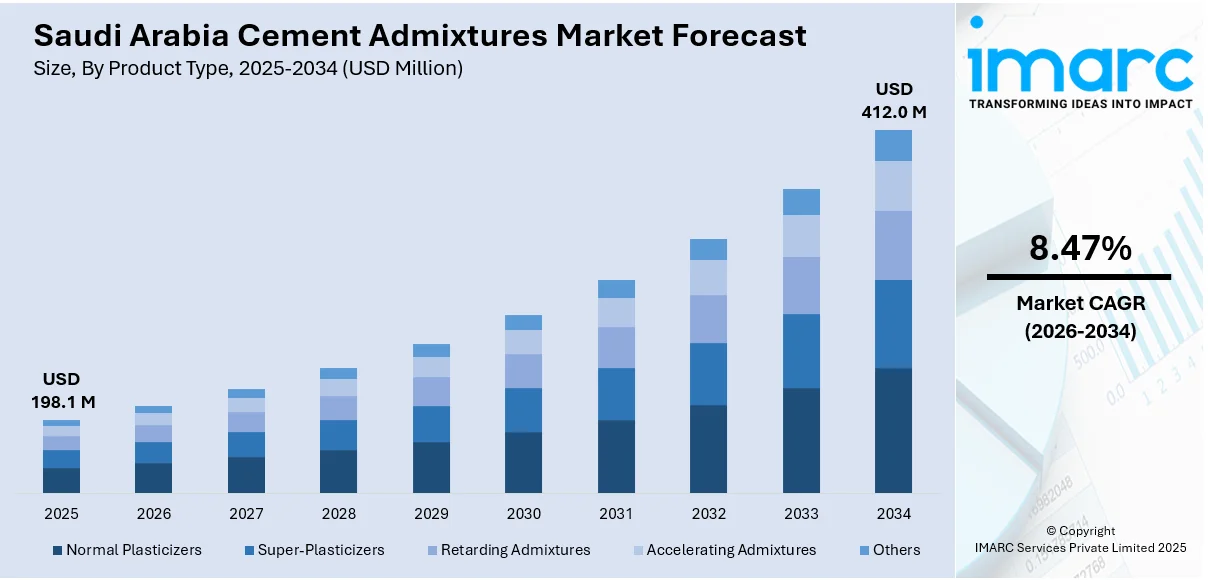

The Saudi Arabia cement admixtures market size reached USD 198.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 412.0 Million by 2034, exhibiting a growth rate (CAGR) of 8.47% during 2026-2034. Rapid urbanization, government-led infrastructure projects, and growing demand for sustainable construction materials are key drivers of the market. Technological advancements and increased private sector investments also influence the Saudi Arabia cement admixtures market share, supporting its upward trajectory.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 198.1 Million |

| Market Forecast in 2034 | USD 412.0 Million |

| Market Growth Rate 2026-2034 | 8.47% |

Saudi Arabia Cement Admixtures Market Trends:

Rising Integration of Green Building Practices

The growing emphasis on sustainable construction practices is significantly impacting the Saudi Arabia cement admixtures market growth. As environmental concerns gain prominence, there is a marked shift toward using low-carbon and eco-friendly admixtures. For instance, as per latest industry trends, Saudi cement sales rose 5% in Q3 2024 to 12.84m tonnes, with a strong domestic focus and a shift toward low-carbon production. This trend aligns with Saudi Arabia’s Vision 2030 goals, which prioritize environmentally responsible development. The integration of green building standards, such as LEED certifications, compels the construction sector to adopt advanced admixture formulations that enhance durability and minimize environmental impact. Additionally, regulatory frameworks promoting sustainable infrastructure are creating a conducive environment for innovation in eco-admixtures. Manufacturers are increasingly investing in R&D to cater to these demands, resulting in product diversification. This emphasis on sustainability is projected to remain a key influence on Saudi Arabia cement admixtures market growth.

To get more information on this market Request Sample

Infrastructure Expansion Driven by Mega Projects

Saudi Arabia’s large-scale infrastructure initiatives, including NEOM, Qiddiya, and The Line, are major catalysts for Saudi Arabia cement admixtures market growth. For instance, as per industry reports, cement demand in Saudi Arabia is projected to rise in 2025, driven by Public Investment Fund-led giga projects in the Makkah region. The Western Region's cement consumption, already at 26.8%, is expected to grow due to ongoing housing and religious infrastructure developments. These giga-projects necessitate high-performance building materials that meet stringent engineering standards, leading to increased adoption of specialized cement admixtures. The scale and complexity of these developments demand admixtures that ensure faster construction, improved strength, and longer durability under varying environmental conditions. Additionally, the ongoing expansion of transportation networks, such as highways, airports, and railways, further boosts the demand for admixtures. Government funding and international collaborations in infrastructure further amplify this trend. The continued rollout of such mega-projects ensures a steady and rising demand trajectory, reinforcing the strategic importance of admixtures in supporting the market growth.

Saudi Arabia Cement Admixtures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Normal Plasticizers

- Super-Plasticizers

- Retarding Admixtures

- Accelerating Admixtures

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes normal plasticizers, super-plasticizers, retarding admixtures, accelerating admixtures, and others.

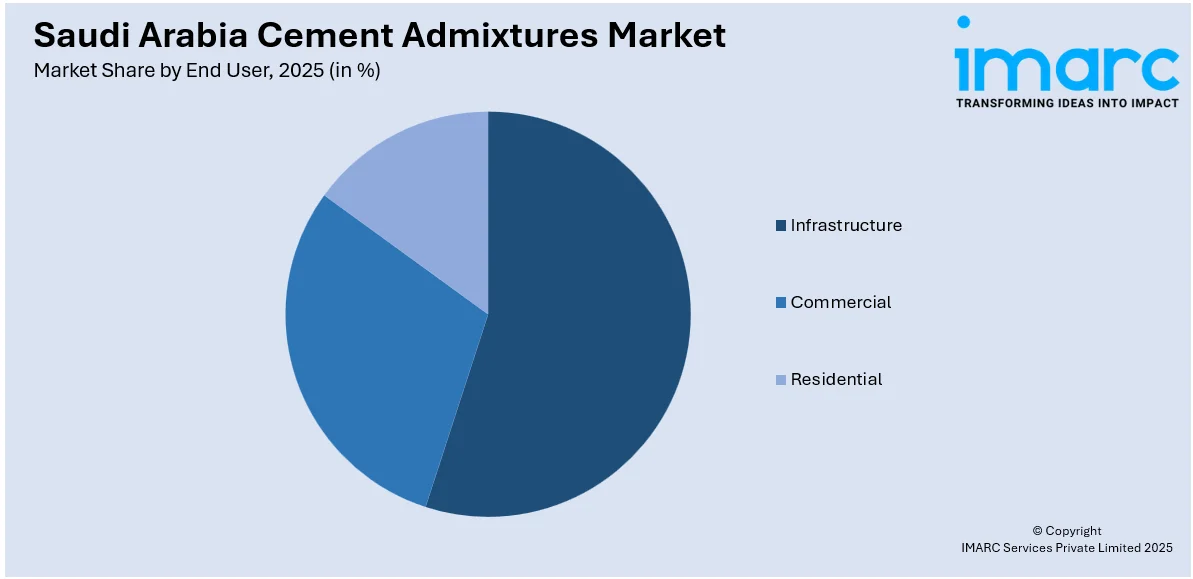

End User Insights:

Access the comprehensive market breakdown Request Sample

- Infrastructure

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes infrastructure, commercial, and residential.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cement Admixtures Market News:

- In May 2025, Saudi Readymix Concrete Co. (SRMCC) and Aramco partnered to develop a lower-carbon concrete alternative using locally sourced materials. The project focuses on scaling up Aramco’s lab-developed Affordable Localized Engineered Cementitious Composite (AL-ECC), which aims to reduce costs and emissions in construction. A key achievement is jointless AL-ECC pavement, offering environmental and economic benefits. This collaboration supports Saudi Vision 2030 by promoting sustainable, innovative building materials for widespread use across the Kingdom’s infrastructure and development projects.

- In December 2024, Saudi Arabia’s General Authority of Foreign Trade imposed anti-dumping duties on sulphonated naphthalene formaldehyde (SNF), a concrete admixture imported from China and Russia. The five-year tariffs, ranging from 18.12% to 34%, aims to protect local manufacturers under the Law of Trade Remedies in International Trade by countering unfair pricing practices impacting Saudi Arabia's concrete admixture sector.

Saudi Arabia Cement Admixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Normal Plasticizers, Super-Plasticizers, Retarding Admixtures, Accelerating Admixtures, Others |

| End Users Covered | Infrastructure, Commercial, Residential |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cement admixtures market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cement admixtures market on the basis of product type?

- What is the breakup of the Saudi Arabia cement admixtures market on the basis of end user?

- What is the breakup of the Saudi Arabia cement admixtures market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cement admixtures market?

- What are the key driving factors and challenges in the Saudi Arabia cement admixtures market?

- What is the structure of the Saudi Arabia cement admixtures market and who are the key players?

- What is the degree of competition in the Saudi Arabia cement admixtures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cement admixtures market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cement admixtures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cement admixtures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)