Saudi Arabia Cement Board Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2026-2034

Saudi Arabia Cement Board Market Overview:

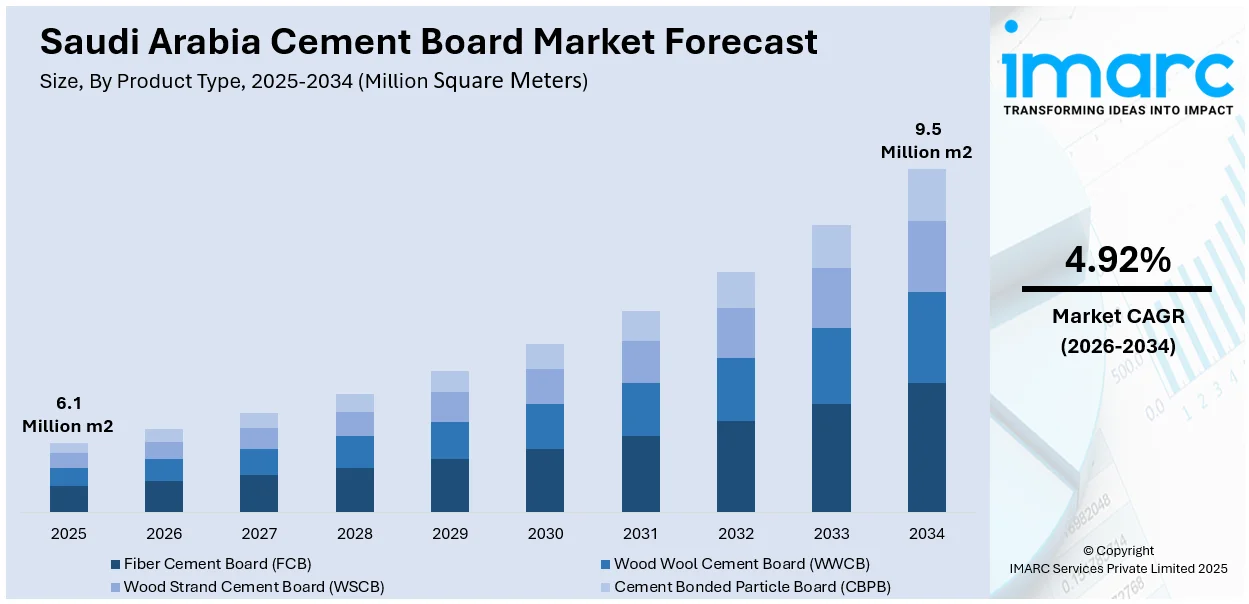

The Saudi Arabia cement board market size reached 6.1 Million Square Meters in 2025. Looking forward, IMARC Group expects the market to reach 9.5 Million Square Meters by 2034, exhibiting a growth rate (CAGR) of 4.92% during 2026-2034. The growth of the market is driven by factors such as increasing construction activities, a shift towards energy-efficient building materials, and rising demand for fire-resistant and durable materials. These trends support the ongoing expansion, boosting the Saudi Arabia cement board market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 6.1 Million Square Meters |

| Market Forecast in 2034 | 9.5 Million Square Meters |

| Market Growth Rate 2026-2034 | 4.92% |

Saudi Arabia Cement Board Market Trends:

Shift Towards Sustainable Building Materials

Saudi Arabia is seeing a significant change in adopting sustainable and eco-friendly building materials. Cement boards, consisting of natural and recyclable products, fit in perfectly with the emerging trend for green building strategies. The enhanced focus on sustainability in Saudi Arabia as part of Vision 2030 is urging contractors to shift to energy-saving options. Cement boards are finding increasing favor owing to their heat insulation properties, helping to save energy in buildings. This increased sense of sustainability is having a large influence in the Saudi Arabia market for cement boards as increasingly more projects look for green building solutions. For instance, in October 2024, City Cement, in partnership with Next Generation SCM, launched a joint venture in Saudi Arabia to produce low-carbon concrete using calcined clay. This sustainable technology reduces CO2 emissions by up to 58%, offering a significant environmental benefit. The first factory will open in Riyadh by Q3 2025, targeting 350,000 tons in its first year. This initiative aligns with Saudi Arabia’s Vision 2030 sustainable infrastructure goals.

To get more information on this market Request Sample

Rising Demand for Fire-Resistant and Durable Materials

With increasing urbanization and the construction of taller buildings, the need for fire-resistant and durable building materials has become critical. For instance, as per industry reports, in 2024, residential buildings in Saudi Arabia represent 69% of all building fire incidents. Cement boards, known for their exceptional fire resistance and structural integrity, are being widely adopted in the Saudi Arabian construction sector. The demand is particularly high in areas prone to extreme heat and fire hazards. These boards provide long-lasting protection and are increasingly used in building facades, wall panels, and interior applications. This trend is further bolstering the Saudi Arabia cement board market growth, as both commercial and residential projects prioritize safety and durability in their designs.

Saudi Arabia Cement Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, application, and end use industry.

Product Type Insights:

- Fiber Cement Board (FCB)

- Wood Wool Cement Board (WWCB)

- Wood Strand Cement Board (WSCB)

- Cement Bonded Particle Board (CBPB)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fiber cement board (FCB), wood wool cement board (WWCB), wood strand cement board (WSCB), and cement bonded particle board (CBPB).

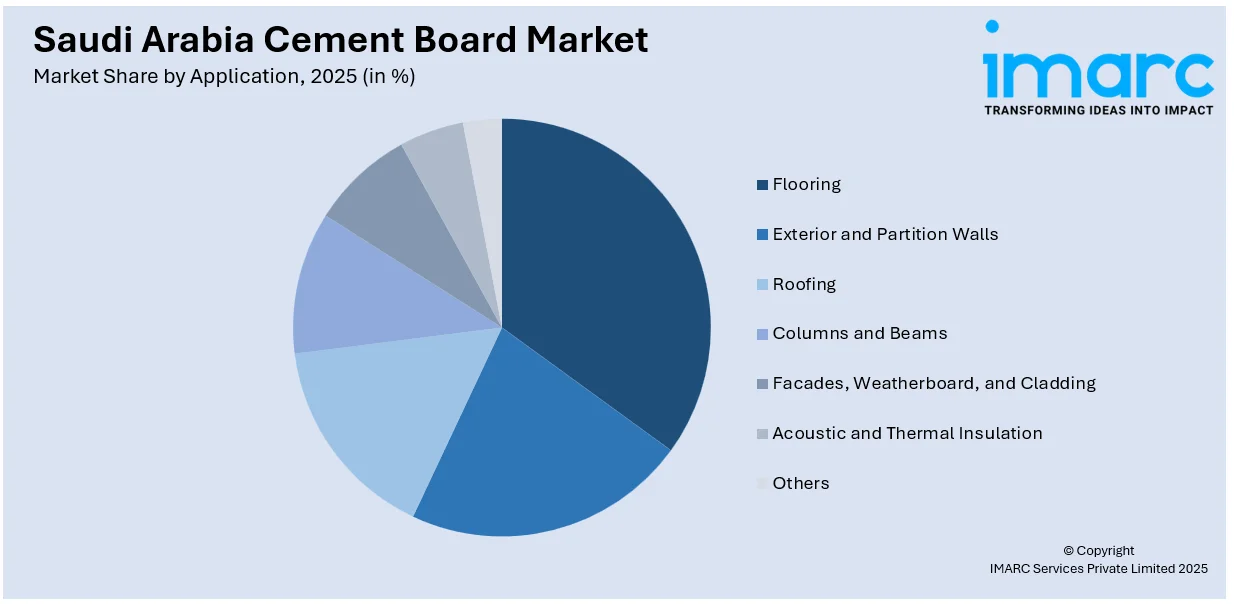

Application Insights:

Access the comprehensive market breakdown Request Sample

- Flooring

- Exterior and Partition Walls

- Roofing

- Columns and Beams

- Facades, Weatherboard, and Cladding

- Acoustic and Thermal Insulation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flooring, exterior and partition walls, roofing, columns and beams, facades, weatherboard, and cladding, acoustic and thermal insulation, and others.

End Use Industry Insights:

- Residential

- Commercial

- Industrial and Institutional

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, commercial, and industrial and institutional.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cement Board Market News:

- In January 2025, Masheed and SESCO Trading partnered to build a cement grinding station in Saudi Arabia, in collaboration with the Saudi Authority for Industrial Cities and Technology Zones (MODON). The station, producing 2 million tons of cement alternatives annually, aims to reduce carbon emissions by 50%, creating over 500 jobs and supporting Vision 2030 goals.

- In June 2024, Yanbu Cement and Southern Province Cement Company signed a non-binding Memorandum of Understanding (MoU) to explore a potential merger. The companies will conduct due diligence to assess operational, financial, and legal aspects.

Saudi Arabia Cement Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Square Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fiber Cement Board (FCB), Wood Wool Cement Board (WWCB), Wood Strand Cement Board (WSCB), Cement Bonded Particle Board (CBPB) |

| Applications Covered | Flooring, Exterior and Partition Walls, Roofing, Columns and Beams, Facades, Weatherboard, and Cladding, Acoustic and Thermal Insulation, Others |

| End-User Industries Covered | Residential, Commercial, Industrial and Institutional |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cement board market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cement board market on the basis of product type?

- What is the breakup of the Saudi Arabia cement board market on the basis of application?

- What is the breakup of the Saudi Arabia cement board market on the basis of end use industry?

- What is the breakup of the Saudi Arabia cement board market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cement board market?

- What are the key driving factors and challenges in the Saudi Arabia cement board market?

- What is the structure of the Saudi Arabia cement board market and who are the key players?

- What is the degree of competition in the Saudi Arabia cement board market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cement board market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cement board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cement board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)