Saudi Arabia Chimneys & Built-In Hobs Market Size, Share, Trends and Forecast by Chimney Type, Suction Power Range, Chimney Filter Type, Hood Type, Number of Burner, Stove Type, End Use, and Region, 2026-2034

Saudi Arabia Chimneys & Built-In Hobs Market Summary:

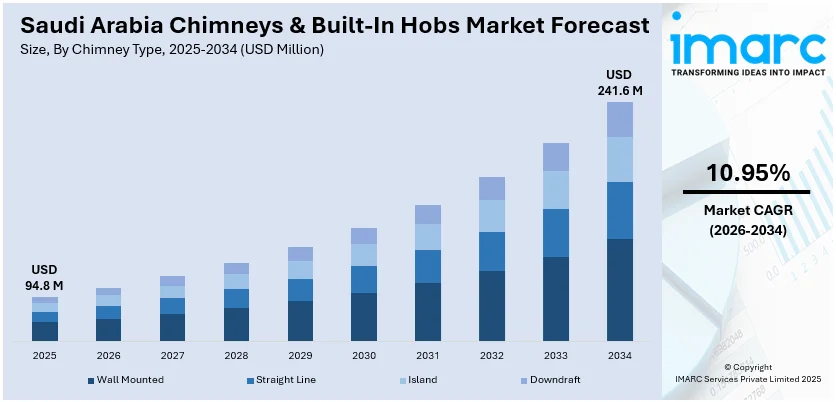

The Saudi Arabia chimneys & built-in hobs market size was valued at USD 94.8 Million in 2025 and is projected to reach USD 241.6 Million by 2034, growing at a compound annual growth rate of 10.95% from 2026-2034.

The robust market growth is driven by rapid residential construction under Vision 2030, rising adoption of modular kitchen solutions, and heightened preference for energy-efficient smart appliances. The government's commitment to infrastructure development and urban modernization initiatives, including mega-projects like NEOM and extensive housing programs, continues to fuel demand for modern kitchen ventilation systems. Growing female workforce participation and evolving lifestyle preferences toward Western-style open kitchens are accelerating the shift from traditional to built-in cooking and ventilation appliances. Additionally, heightened awareness of energy efficiency and sustainability is expanding the Saudi Arabia chimneys & built-in hobs market share.

Key Takeaways and Insights:

- By Chimney Type: Wall mounted dominates the market with a share of 33% in 2025, preferred for their striking design aesthetics in contemporary Saudi kitchens and suitability for modular configurations. These models act as key design features while providing simpler installation than island or downdraft options.

- By Suction Power Range: 1,000-1,500 m3/hr leads the market with a share of 40% in 2025, ensuring the best combination of ventilation effectiveness and energy conservation. This moderate capacity efficiently manages oil-rich Saudi cuisine while keeping noise levels and energy use in check for middle-class families.

- By Chimney Filter Type: Baffle filter represents the largest segment with a market share of 44% in 2025, appreciated for exceptional grease-capturing efficiency via multi-tiered deflection mechanisms. Their resilience and low upkeep are ideal for the regular oil-intensive cooking typical in Saudi homes, lowering long-term replacement expenses.

- By Hood Type: Ducted hood leads the market with a share of 55% in 2025, providing excellent ventilation by pushing air outside via a permanent ducting system. Favored in new building projects, these systems reduce the need for regular filter changes that recirculating models require.

- By Number of Burner: 3-4 burners represent the largest segment with a market share of 50% in 2025, conforming to traditional Saudi family sizes and culinary needs. This setup allows for various dishes to be cooked at once, crucial for the preparation of traditional Saudi and Middle Eastern cuisine.

- By Stove Type: Gas hob leads the market with a share of 40% in 2025, preferred for conventional cooking habits and extensive natural gas infrastructure throughout Saudi cities. Reduced operating expenses through subsidized gas prices present attractive value offers for households with middle incomes.

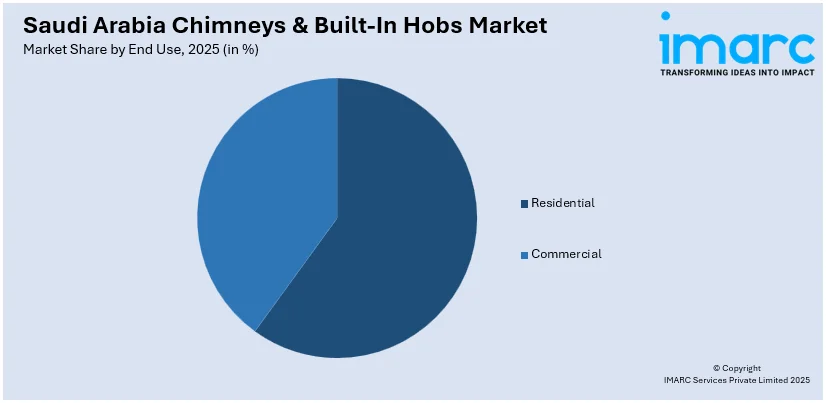

- By End Use: Residential represents the largest segment with a market share of 69% in 2025, driven by Vision 2030 housing development initiatives and rising homeownership rates.

- By Region: Northern and Central Region leads the market with a share of 30% in 2025, anchored by Riyadh's position as economic and demographic center, with higher spending enabling premium appliance purchases.

- Key Players: Saudi Arabia’s chimney and built-in hob brands are expanding dealer networks, launching energy-efficient and smart kitchen appliances, offering premium designs, strengthening after-sales service, and partnering with real estate developers to capture growing housing demand.

To get more information on this market Request Sample

The market is experiencing transformative growth driven by accelerated urban developments and ambitious government infrastructure initiatives under Vision 2030. The Riyadh Municipality announced development of 19 new residential plans in 2024, with a total area of approximately 13,522,478 square meters, directly driving the demand for integrated cooking and ventilation systems. IKEA Saudi Arabia's opening of its largest kitchen planning studio in Riyadh's Al Narjis district, featuring modular kitchen displays, demonstrates the surging consumer appetite for contemporary kitchen solutions. People are moving toward energy-efficient and technology-enabled models, leading brands to introduce features such as touch-control hobs, sleek built-in designs, and automated ventilation systems. One example is how more people are using sensor-based chimney devices to detect smoke or vapors from the stove and automatically change the strength of the fan to help improve the air quality of homes with little effort on the part of the consumer. Major manufacturers are building their distribution networks, forming alliances with real estate builders for new construction projects, and improving the level of customer service after the sale. By doing this, they will be able to fulfil the desire for kitchen products that are modern, take up little space and are compatible with the evolving lifestyle standards of consumers in Saudi Arabia.

Saudi Arabia Chimneys & Built-In Hobs Market Trends:

Heightened Adoption of Modular Kitchen Solutions

The modular kitchen market in Saudi Arabia is fundamentally transforming consumer preferences for kitchen appliances. Faisal Al-Ibrahim, the Minister of Economy and Planning, told Al-Arabiya Business that the Saudi government has created a conducive environment for the private sector in 2025, encouraging quality investments in real estate development. This commitment is clear through particular measures aimed at stabilizing and improving market accessibility, creating an ideal atmosphere for investors seeking dependable and sustainable returns. Crown Prince Mohammed bin Salman introduced additional initiatives to strengthen the sector, including eliminating limitations on land transactions and improving key areas in northern Riyadh. This measure will improve housing accessibility and at the same time render the market more dynamic and attractive to international investors. The Saudi Kitchen Manufacturers Association recorded a yearly rise in modular kitchen installations in the Western Region, fueled by new construction and renovation initiatives. This trend is motivating manufacturers to create chimneys and hobs tailored for seamless incorporation with modular cabinetry and uniform dimensions.

Integration of Smart Home Technologies and Energy-Efficient Features Accelerates Market Evolution

The Saudi Arabia smart home appliances market's expansion underscores the rapid technology integration in kitchen appliances. Government initiatives under Vision 2030 and smart city projects like NEOM actively promote digital transformation and Internet of Things technology deployment. The surge in smartphone users has created a tech-savvy consumer base comfortable with app-controlled appliances. The Saudi Energy Efficiency Center's mandatory energy labels and the Standards and Quality Law effective are pushing manufacturers to incorporate inverter motors, LED lighting, and real-time energy consumption monitoring in chimneys and hobs, making energy efficiency a primary purchase criterion rather than a premium feature. IMARC Group predicts that the Saudi Arabia smart homes market is expected to reach USD 3.3 Billion by 2034.

Expansion of Residential Construction and Government Housing Initiatives Fuels Baseline Demand

Saudi Arabia’s Housing Program, a crucial project within Vision 2030, has added approximately 27 billion riyals ($7.2 billion) to the non-oil GDP of the Kingdom since 2021 and has created over 72,000 jobs in the private sector since 2019, as stated in an official report reviewed by Asharq Al-Awsat. Darco Real Estate unveiled its newest and biggest initiative, “Darco Prime Waterfront,” in a lavish event at the Jeddah Yacht Club, which was graced by several royal dignitaries along with a select assembly of officials and business leaders. The project lies in the center of Jeddah's tourist region, known as the bride of the Red Sea, along the waterfront in the Al-Shati neighborhood. The initiative includes 533 housing units across 22 structures, featuring architectural styles that reflect the culture and identity of Jeddah, along with a range of sizes and configurations to satisfy the diverse desires of those seeking homes and ownership in one of the city's most picturesque regions. These mega-developments are standardizing built-in kitchen appliances as default offerings in new residential units, transitioning chimneys and hobs from optional upgrades to essential infrastructure components.

How Vision 2030 is Transforming the Saudi Arabia Chimneys & Built in Hobs Market:

Saudi Vision 2030 is reshaping the chimneys and built-in hobs market in Saudi Arabia by propelling the growth in modern housing, premium kitchens, and lifestyle-focused urban development. Large-scale projects like NEOM, The Line, and new residential communities are increasing demand for integrated kitchen appliances that match contemporary interior designs. As more middle- and high-income households shift toward modular kitchens, built-in hobs and stylish chimney hoods are becoming standard rather than optional. Vision 2030’s push for tourism and hospitality expansion is also boosting demand from hotels, serviced apartments, and luxury developments, where high-performance ventilation and sleek cooking systems are essential. Additionally, energy efficiency and sustainability goals are encouraging adoption of advanced electric and induction hobs, along with low-consumption chimney technologies. Rising participation of global appliance brands, stronger retail networks, and growing local distribution are further accelerating market expansion, making Saudi Arabia a key growth hub in the Gulf region.

Market Outlook 2026-2034:

The Saudi Arabia chimneys & built-in hobs market is poised for sustained growth through Vision 2030's economic diversification programs and the Kingdom's commitment to smart city development. The market generated a revenue of USD 94.8 Million in 2025 and is projected to reach a revenue of USD 241.6 Million by 2034, growing at a compound annual growth rate of 10.95% from 2026-2034. Government infrastructure investments in housing development for 2025, combined with NEOM and other giga-projects, will create persistent demand for premium built-in kitchen appliances throughout the forecast period. The evolution toward energy-efficient and IoT-enabled products, reinforced by Saudi Energy Efficiency Center mandates and consumer preference for connected appliances, positions technologically advanced chimneys and hobs for significant market share gains.

Saudi Arabia Chimneys & Built-In Hobs Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Chimney Type |

Wall Mounted |

33% |

|

Suction Power Range |

1,000-1,500 m3/hr |

40% |

|

Chimney Filter Type |

Baffle Filter |

44% |

|

Hood Type |

Ducted Hood |

55% |

|

Number of Burner |

3-4 Burners |

50% |

|

Stove Type |

Gas Hob |

40% |

|

End Use |

Residential |

69% |

|

Region |

Northern and Central Region |

30% |

Chimney Type Insights:

- Wall Mounted

- Straight Line

- Island

- Downdraft

Wall mounted dominates with a market share of 33% of the total Saudi Arabia chimneys & built-in hobs market in 2025.

Wall-mounted chimneys offer significant advantages for modern kitchens by providing efficient smoke, grease, and odor removal directly above the cooking surface. Since they are installed against the wall, they save valuable space while keeping the kitchen layout clean and organized. These chimneys are especially useful in homes where open kitchens are common, as they help maintain better indoor air quality by reducing the spread of cooking fumes into living areas. Many wall-mounted models come with powerful suction capacity, ensuring effective ventilation even during heavy cooking. They also support hygiene by preventing grease buildup on cabinets, tiles, and walls, making kitchen maintenance easier over time. Their placement allows for better airflow management, helping to create a more comfortable cooking environment without excessive heat or lingering smells.

Another key benefit of wall-mounted chimneys is their design flexibility and aesthetic contribution. They are available in a wide variety of styles, including curved glass, stainless steel, and minimalist finishes, allowing homeowners to match them with contemporary kitchen interiors. Modern wall-mounted chimneys often include advanced features such as LED lighting, touch controls, and auto-clean technology, improving ease of use. Some models also operate with lower noise levels, making them more suitable for apartments and open-plan homes. Their installation can enhance kitchen value, as built-in ventilation is increasingly seen as a premium feature in residential developments. Overall, wall-mounted chimneys combine functional performance with stylish

Suction Power Range Insights:

- Below 1,000 m3/hr

- 1,000-1,500 m3/hr

- Above 1,500 m3/hr

1,000-1,500 m3/hr leads with a share of 40% of the total Saudi Arabia chimneys & built-in hobs market in 2025.

A chimney with a suction power range of 1,000–1,500 m³/hr offers strong ventilation performance, making it ideal for medium to large kitchens and heavy cooking habits. This level of suction efficiently removes smoke, oil particles, steam, and strong food odors, helping keep indoor air fresh and reducing discomfort during cooking. It is especially beneficial for cuisines that involve frying, grilling, or using multiple burners at once, where fumes build up quickly. Higher suction capacity also prevents grease from settling on kitchen walls, cabinets, and countertops, supporting better hygiene and reducing long-term cleaning efforts.

Another advantage of the 1,000–1,500 m³/hr suction range is its balance between power and practicality. It provides fast air purification without requiring oversized commercial equipment, making it suitable for premium residential kitchens. Chimneys in this category often come with multi-speed settings, allowing users to adjust airflow depending on cooking intensity, which improves energy efficiency. Advanced models may also include features like auto-suction adjustment, filter-clean indicators, and quieter motor designs, enhancing convenience. This suction range supports modern kitchen lifestyles where frequent cooking and stylish interiors demand effective ventilation.

Chimney Filter Type Insights:

- Baffle Filter

- Mesh Filter

- Charcoal Filter

Baffle filter exhibits a clear dominance with a 44% share of the total Saudi Arabia chimneys & built-in hobs market in 2025.

Baffle filter chimneys are highly valued for their efficiency in handling heavy cooking fumes, especially in kitchens where frying, grilling, or oil-based cooking is common. The baffle filter is designed with multiple overlapping panels that force air to change direction, trapping grease particles more effectively than basic mesh filters. This helps prevent oil buildup inside the chimney and reduces the chances of clogging, ensuring consistent suction performance over time. Because they can handle high heat and large amounts of smoke, baffle filters are widely preferred in Indian and Middle Eastern cooking environments. They also improve indoor air quality by capturing airborne grease and reducing strong food odors, creating a cleaner and more comfortable kitchen space.

Another major benefit of baffle filter chimneys is durability and ease of maintenance. Unlike charcoal filters that require frequent replacement, baffle filters are usually made of stainless steel or aluminum and can last for many years. They are easy to clean, often dishwasher-safe, and require only periodic washing to maintain efficiency. This makes them cost-effective for households that cook regularly. Baffle filters also support better airflow even under heavy use, making them suitable for chimneys with high suction capacity. Their strong construction, long lifespan, and ability to perform well in demanding cooking conditions make baffle filter chimneys a premium and reliable choice for modern kitchens.

Hood Type Insights:

- Ducted Hood

- Ductless Hood

Ducted hood leads with a share of 55% of the total Saudi Arabia chimneys & built-in hobs market in 2025.

Ducted hoods provide powerful and effective kitchen ventilation by expelling smoke, steam, grease particles, and odors directly outside the home through a duct system. This makes them one of the most efficient options for maintaining clean indoor air, especially in households with frequent cooking. Unlike recirculating models that filter and release air back into the kitchen, ducted hoods completely remove airborne pollutants, reducing lingering smells and improving overall comfort. They are particularly useful for heavy cooking styles that involve frying, grilling, or spicy foods, where fumes can quickly spread. By controlling moisture and heat buildup, ducted hoods also help prevent condensation on walls and cabinets, supporting a healthier and cleaner cooking environment.

Another advantage of ducted hoods is their long-term performance and lower maintenance requirements. Since the air is vented outdoors, there is less dependence on replaceable charcoal filters, making upkeep simpler and more cost-effective. Ducted systems tend to provide stronger suction power and quieter operation because they work with external ventilation pathways. They also help protect kitchen interiors by minimizing grease deposition on surfaces, reducing cleaning effort and preserving cabinetry finishes. For modern open-plan homes, ducted hoods are especially valuable because they stop cooking odors from traveling into living spaces. Overall, ducted hoods combine high efficiency, durability, and premium ventilation, making them a preferred choice for advanced kitchen setups.

Number of Burner Insights:

- 1-2 Burners

- 3-4 Burners

- More than 4 Burners

3-4 burners exhibit a clear dominance with a 50% share of the total Saudi Arabia chimneys & built-in hobs market in 2025.

A 3-4 burner hob offers an ideal balance of space, functionality, and cooking flexibility for most households. With multiple burners available, users can prepare several dishes at the same time, making daily cooking faster and more convenient. This is especially helpful for families where meals often involve different cooking methods such as boiling, frying, and simmering simultaneously. A 3-4 burner setup supports better time management in the kitchen and reduces the need to cook in batches. It also allows users to handle both quick meals and more elaborate cooking without needing a larger commercial-style appliance. For medium-sized kitchens, this burner range provides sufficient capacity while maintaining a compact footprint.

Another key benefit of 3-4 burner hobs is their versatility across modern kitchen lifestyles. They are suitable for everything from small apartments to larger family homes, offering enough burners for regular use without taking up excessive counter space. Many models include burners of different sizes, designed to accommodate varying pot and pan requirements, improving cooking efficiency. Inbuilt features like auto-ignition, flame control, and energy-saving burner designs further enhance convenience and safety. A 3-4 burner hob is also a popular choice in new residential developments, as it combines practicality with modern built-in kitchen aesthetics. Overall, it provides the right mix of performance, usability, and space efficiency for everyday cooking needs.

Stove Type Insights:

- Gas Hob

- Induction Hob

- Hybrid

- Electric Plate

Gas hob leads with a share of 40% of the total Saudi Arabia chimneys & built-in hobs market in 2025.

Gas hobs remain one of the most preferred cooking appliances because they provide instant heat control and reliable performance. Unlike electric or induction alternatives, gas burners respond immediately when the flame is adjusted, allowing precise temperature management for simmering, boiling, or frying. This makes them especially useful for cooking styles that require careful control, such as preparing sauces, curries, or stir-fried dishes. Gas hobs also work during power outages, offering uninterrupted cooking convenience. Their strong flame output supports faster cooking times, reducing overall energy use in many households. With proper ventilation, gas hobs provide an efficient and familiar cooking experience that suits both everyday meals and more intensive cooking needs.

Another advantage of gas hobs is their wide compatibility with cookware and durable design. They can be used with nearly all types of pots and pans, unlike induction systems that require specific materials. Modern gas hob models also come with features such as auto-ignition, flame failure safety devices, and toughened glass or stainless-steel surfaces that enhance safety and aesthetics. They are easy to clean and maintain, especially when designed with sealed burners and removable pan supports. Gas hobs are also cost-effective in regions where gas supply is affordable and widely available. Overall, they offer a practical combination of speed, control, and long-term value in modern kitchens.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential exhibits a clear dominance with a 69% share of the total Saudi Arabia chimneys & built-in hobs market in 2025.

Residential use of chimneys and built-in hobs offers significant benefits by improving everyday cooking comfort, cleanliness, and convenience in modern homes. These appliances are designed to match household needs, providing efficient ventilation and cooking performance without requiring commercial-scale systems. Kitchen chimneys help remove smoke, steam, grease particles, and odors, keeping indoor air fresh and reducing residue buildup on walls and cabinets. Built-in hobs support faster, safer cooking with better heat control and space efficiency. In residential settings, these solutions enhance the overall kitchen environment, making daily meal preparation more pleasant, especially for families that cook frequently at home.

Another key advantage of residential end use is the growing focus on lifestyle upgrades and home aesthetics. Consumers increasingly prefer integrated kitchen appliances that blend seamlessly with modern interiors, adding value to homes and improving functionality. Residential appliances also come with advanced features such as touch controls, auto-clean options, and energy-saving technologies, making them easier to operate and maintain. For apartments and villas alike, these products support organized kitchen layouts and healthier indoor conditions. As more households invest in premium kitchen renovations, residential end use continues to drive demand for stylish, efficient, and user-friendly cooking solutions.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 30% of the total Saudi Arabia chimneys & built-in hobs market in 2025.

Saudi Arabia’s northern and central regions represent the largest share of the chimneys and built-in hobs market due to their high concentration of urban development and residential expansion. Cities such as Riyadh, the capital in the central region, drive strong demand as they host a large population, growing middle-income households, and continuous housing projects. These regions also account for a significant portion of the country’s modern apartment complexes and premium villa communities, where built-in kitchen appliances are increasingly preferred. With more consumers upgrading from traditional cooking setups to integrated kitchen solutions, the need for efficient chimneys and stylish hobs is particularly high in these areas. Retail infrastructure and appliance showrooms are also more developed, supporting wider product availability and faster adoption.

Another reason the northern and central regions lead the market is their role as economic and commercial hubs. Riyadh and nearby cities attract large-scale real estate investments aligned with Vision 2030 initiatives, encouraging the construction of modern homes with advanced kitchen layouts. People in these regions tend to favor premium designs, smart appliances, and strong after-sales service, prompting key brands to focus distribution and marketing efforts here. Higher disposable income levels further support the purchase of high-suction chimneys and multi-burner built-in hobs. As urban lifestyles continue to evolve, northern and central Saudi Arabia are expected to remain the core demand centers for modern kitchen appliance growth.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Chimneys & Built-In Hobs Market Growing?

Saudi Vision 2030 Infrastructure Development and Urban Modernization

Vision 2030's emphasis on economic diversification and enhanced quality of life is fundamentally transforming Saudi Arabia's residential landscape, creating sustained demand for modern kitchen appliances including chimneys and built-in hobs. The government's infrastructure development programs include plans to build new homes across the Kingdom with budgets dedicated to residential construction in alone, systematically integrating built-in kitchen appliances as standard specifications. NEOM and smart city projects allocate substantial budgets for advanced connectivity, Internet of Things gateways, and management platforms, establishing infrastructure that favors smart, connected appliances capable of energy monitoring and remote control. The The Kingdom's commitment to achieving net-zero emissions by 2060 influences residential energy strategies and accelerates energy-efficient appliance adoption through regulatory frameworks and consumer incentives. In 2024, Saudi Arabia’s gross fixed capital formation hit SR1.33 trillion ($355 billion), showing a 4.5 percent rise from the previous year, as per recent data from the Ministry of Investment. This amount surpassed the ministry’s initial goal of SR964 billion by 38 percent, highlighting robust momentum in the Kingdom’s capital investment cycle and indicating ongoing advancement toward Vision 2030 goals.

Rising Female Workforce Participation and Lifestyle Evolution

Female labor force participation in Saudi Arabia has increased dramatically to 35.6% in 2023, xceeding the target of 30% set by Vision 2030, fundamentally reshaping household dynamics and kitchen appliance requirements. The growing share of dual-income households, with over 36% of employed Saudis being women, creates strong demand for time-saving kitchen solutions that reduce meal preparation burdens without compromising food quality or variety. The increasing working population has reduced time availability for traditional, time-intensive cooking and cleaning methods, making automated and efficient kitchen ventilation systems essential rather than optional conveniences.

Growing Consumer Preference for Premium and Western-Style Kitchen Designs

Increased exposure to global home décor trends through social media platforms, international travel, and a rising expatriate population is fundamentally shifting Saudi consumer preferences toward contemporary kitchen aesthetics and functionality. Western-style open kitchens with sleek finishes, integrated appliances, and ergonomic layouts are gaining substantial popularity among younger and urban populations who prioritize both form and function in residential spaces. As per IMARC Group, the Saudi Arabia modular kitchen market, valued at USD 362.0 Million in 2024 and projected to reach USD 491.4 Million by 2033, demonstrates the scale of consumer shift toward integrated kitchen solutions. Growing awareness of interior design concepts is influencing purchasing decisions for kitchen furniture and appliances, with consumers increasingly seeking products that complement their overall interior design schemes rather than merely fulfilling functional requirements.

Market Restraints:

What Challenges the Saudi Arabia Chimneys & Built-In Hobs Market is Facing?

High Initial Cost of Smart and Advanced Kitchen Appliances

The upfront prices of smart chimneys and built-in hobs with advanced features are considerably higher than conventional alternatives, creating accessibility barriers for middle- and lower-income households, especially in non-metropolitan areas. Smart appliances typically command price premiums of 30-50% over traditional models, with the cost of setting up complete smart home ecosystems including hubs, sensors, and compatible devices further elevating financial burden. Although the Saudi government promotes digital transformation under Vision 2030, price sensitivity among consumers continues to slow market penetration beyond affluent urban demographics. The return on investment through energy savings and convenience benefits is not immediately tangible, making consumers hesitant to absorb higher initial expenditures despite long-term value propositions.

Skilled Labor Shortage for Installation and Maintenance

The lack of trained professionals for custom design, installation, and servicing of complex built-in kitchen appliances poses significant challenges to market expansion and customer satisfaction. Built-in chimneys and hobs require precise installation to ensure proper ventilation, safety compliance, and aesthetic integration with surrounding cabinetry, demanding specialized expertise that remains in short supply. Complex smart features and connectivity requirements further compound installation challenges, with many technicians lacking training in Internet of Things protocols and troubleshooting procedures. Limited availability of qualified service personnel affects after-sales support quality, potentially leading to prolonged downtime and customer frustration that discourages adoption. The Saudi market's rapid expansion has outpaced workforce development programs, creating a persistent gap between product complexity and local technical capabilities.

Import Dependency and Supply Chain Vulnerabilities

Reliance on imported materials, components, and finished products makes the Saudi Arabia chimneys and built-in hobs market vulnerable to price volatility, supply chain disruptions, and geopolitical factors beyond domestic control. Global supply chain challenges including shipping delays, container shortages, and logistics bottlenecks can affect product availability and delivery timelines, frustrating consumers and developers operating on tight construction schedules. Import dependencies expose the market to international trade dynamics, currency fluctuations, and tariff changes that can rapidly alter pricing structures and competitive positioning. The absence of substantial domestic manufacturing capabilities for specialized components like high-efficiency motors, smart control boards, and advanced filtration systems necessitates continued reliance on international suppliers, limiting market resilience to external shocks.

Competitive Landscape:

Key market players in Saudi Arabia’s chimneys and built-in hobs segment are focusing on product innovation, premium positioning, and stronger distribution to improve business performance. Many brands are introducing smart chimneys with sensor-based suction control, low-noise motors, and auto-clean technology to meet rising demand for modern kitchen convenience. Built-in hob manufacturers are expanding portfolios with sleek glass-top designs, multi-burner options, and enhanced safety features such as flame failure protection and child locks. Companies are also strengthening their dealer and showroom networks beyond major cities, ensuring better access across northern and central regions where residential growth is strongest. Partnerships with real estate developers and kitchen solution providers are becoming common, as new housing projects increasingly include integrated cooking appliances. In addition, key players are investing in after-sales service centers, extended warranties, and faster maintenance support to build consumer trust. Through these strategies, brands aim to capture demand driven by lifestyle upgrades and Vision 2030-led urban development. all major companies have been provided.

Saudi Arabia Chimneys & Built-In Hobs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chimney Types Covered | Wall Mounted, Straight Line, Island, Downdraft |

| Suction Power Ranges Covered | Below 1,000 m3/hr, 1,000-1,500 m3/hr, Above 1,500 m3/hr |

| Chimney Filter Types Covered | Baffle Filter, Mesh Filter, Charcoal Filter |

| Hood Types Covered | Ducted Hood, Ductless Hood |

| Number of Burners Covered | 1-2 Burners, 3-4 Burners, More than 4 Burners |

| Stove Types Covered | Gas Hob, Induction Hob, Hybrid, Electric Plate |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region,Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia chimneys & built-in hobs market size was valued at USD 94.8 Million in 2025.

The Saudi Arabia chimneys & built-in hobs market is expected to grow at a compound annual growth rate of 10.95% from 2026-2034 to reach USD 241.6 Million by 2034.

Wall mounted dominate with 33% market share in 2025, favored for their prominent design presence in modern Saudi kitchens and seamless compatibility with modular layouts. These models serve as focal aesthetic elements while offering easier installation compared to island or downdraft alternatives.

The key drivers include Saudi Vision 2030 infrastructure development and urban modernization, rising female workforce participation and lifestyle evolution, growing consumer preference for premium and Western-style kitchen designs, expansion of modular kitchen adoption, smart home technology integration, and government housing initiatives with modern kitchen specifications.

Major challenges include high initial costs of smart appliances limiting accessibility for middle-income households, skilled labor shortage for complex installation and maintenance, and import dependency on components creating supply chain vulnerabilities and price volatility from international trade dynamics and currency fluctuations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)