Saudi Arabia Cloud Kitchen Market Size, Share, Trends and Forecast by Type, Product Type, Nature, and Region, 2026-2034

Saudi Arabia Cloud Kitchen Market Size and Share:

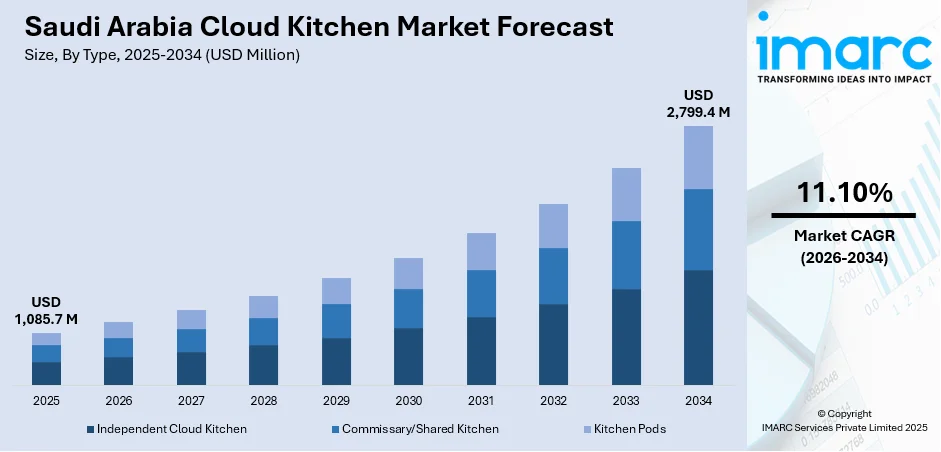

The Saudi Arabia cloud kitchen market size reached USD 1,085.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,799.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.10% during 2026-2034. The industry is fueled by surging demand for food delivery services, growing smartphone penetration, and expanding urban population. Online ordering, convenience, and cost-efficient business models for restaurant operators are also significant drivers boosting the Saudi Arabia cloud kitchen market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,085.7 Million |

| Market Forecast in 2034 | USD 2,799.4 Million |

| Market Growth Rate 2026-2034 | 11.10% |

Saudi Arabia Cloud Kitchen Market Trends:

Rise in Online Food Delivery Platforms

Growing use of online food delivery platforms is one of the key drivers of the cloud kitchen market in Saudi Arabia. With increasing smartphone usage and high internet penetration, food delivery platforms like Uber Eats, Zomato, and Talabat are gaining popularity. These platforms allow customers to easily order from multiple restaurants without having to step out of their homes, building a successful demand for cloud kitchens, which do not require the usual dine-in spaces. Cloud kitchens are advantaged by the growing dependence on digital ordering, cutting down overheads related to physical stores. Recently, in March 2025, Keeta, the global division of China's largest food delivery application, Meituan, emerged as the third-largest food delivery service in Saudi Arabia only four months following its launch abroad. This trend is bound to persist as consumers increasingly value convenience and speed in their eating experiences, in turn influencing a shift in the Saudi Arabia cloud kitchen market outlook.

To get more information on this market, Request Sample

Growing Preference for Delivery-Only Models

The cloud kitchen concept, where the sole focus is on food preparation for delivery, is becoming increasingly popular in Saudi Arabia. With changing consumer tastes towards convenience, cloud kitchens provide a more cost-effective and flexible option compared to conventional restaurants. Cloud kitchens are run out of shared facilities or dedicated spaces, enabling operators to concentrate on high-quality food and quick delivery without the cost of a storefront or dining space. This trend is notably prominent in Saudi Arabian cities, where hectic lifestyles and a lack of time to dine out fuel demand for quick, delivery-centric food solutions. This also further helps in augmenting the Saudi Arabia cloud kitchen market share.

Technological Advancements in Kitchen Operations

Technological developments are also playing a major role in transforming the Saudi Arabian cloud kitchen sector. Advanced technologies like AI-powered order management systems, automated food preparation, and intelligent kitchen appliances are optimizing kitchen procedures, facilitating quicker order processing and enhanced quality control. These innovations enable cloud kitchens not only to scale up their operations but also to optimize stock management, reduce food waste, and increase customer satisfaction. The increasing application of data analytics for future consumer preference forecasts and enhanced delivery times is also propelling the success of Saudi Arabian cloud kitchens to be more competitive in the fast-growing food delivery market.

Saudi Arabia Cloud Kitchen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, product type, and nature.

Type Insights:

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

The report has provided a detailed breakup and analysis of the market based on the type. This includes independent cloud kitchen, commissary / shared kitchen, and kitchen pods.

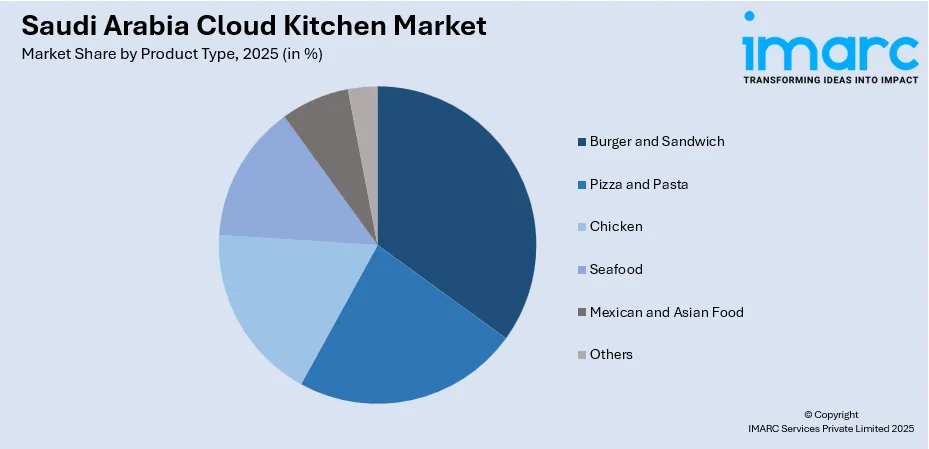

Product Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Burger and Sandwich

- Pizza and Pasta

- Chicken

- Seafood

- Mexican and Asian Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes burger and sandwich, pizza and pasta, chicken, seafood, Mexican and Asian food, and others.

Nature Insights:

- Franchised

- Standalone

The report has provided a detailed breakup and analysis of the market based on the nature. This includes franchised and standalone.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cloud Kitchen Market News:

- In July 2023, Rebel Foods, an operator of cloud kitchens, launched its first two cloud kitchens in Riyadh, marking its entry into Saudi Arabia. The company has additionally focused on setting up 60 internet restaurants across the city and aims to extend its services to other cities, such as Jeddah, Dammam, and Khobar.

Saudi Arabia Cloud Kitchen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Independent Cloud Kitchen, Commissary / Shared Kitchen, Kitchen Pods |

| Product Types Covered | Burger and Sandwich, Pizza and Pasta, Chicken, Seafood, Mexican and Asian Food, Others |

| Nature Covered | Franchised, Standalone |

| Regions Covered | Northern And Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cloud kitchen market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cloud kitchen market on the basis of type?

- What is the breakup of the Saudi Arabia cloud kitchen market on the basis of product type?

- What is the breakup of the Saudi Arabia cloud kitchen market on the basis of nature?

- What is the breakup of the Saudi Arabia cloud kitchen market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cloud kitchen market?

- What are the key driving factors and challenges in the Saudi Arabia cloud kitchen market?

- What is the structure of the Saudi Arabia cloud kitchen market and who are the key players?

- What is the degree of competition in the Saudi Arabia cloud kitchen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cloud kitchen market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cloud kitchen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cloud kitchen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)