Saudi Arabia Cold Chain Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, and Region, 2026-2034

Saudi Arabia Cold Chain Equipment Market Overview:

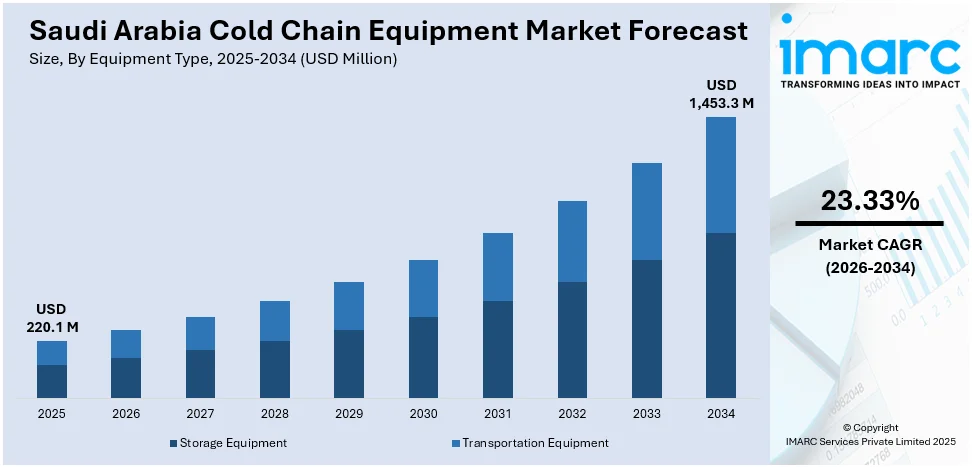

The Saudi Arabia cold chain equipment market size reached USD 220.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,453.3 Million by 2034, exhibiting a growth rate (CAGR) of 23.33% during 2026-2034. Presently, the broadening of e-commerce and internet-based grocery delivery services is creating the need for efficient cold chain equipment to preserve product integrity while in transit. Besides this, the growing adoption of artificial intelligence (AI) is contributing to the expansion of the Saudi Arabia cold chain equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 220.1 Million |

| Market Forecast in 2034 | USD 1,453.3 Million |

| Market Growth Rate 2026-2034 | 23.33% |

Saudi Arabia Cold Chain Equipment Market Trends:

Growing demand for frozen and dairy products

The escalating demand for frozen and dairy products is positively influencing the market in Saudi Arabia. As per industry reports, with a value of USD 4.6 Billion in 2024, the dairy market in Saudi Arabia was by far the largest in the Middle East, exceeding the United Arab Emirates' USD 1.9 Billion by more than two times. The need for effective frozen goods storage and transportation is growing as user preferences are shifting towards convenience food items and ready-to-eat (RTE) meals. Stringent temperature control is necessary for dairy products like milk, cheese, and yogurt to preserve freshness and avoid spoiling. Businesses are being encouraged by this increasing demand to invest in cutting-edge freezing and refrigeration equipment for guaranteeing product quality across the supply chain. To satisfy user demands, Saudi Arabian retailers, supermarkets, and food service providers are enhancing their cold storage capacities. Furthermore, because of the region's hot environment, dependable cold chain equipment is necessary to preserve dairy and frozen goods. The government is also implementing food safety regulations, promoting the adoption of modern cold chain technologies. Additionally, the rise of online grocery delivery services and e-commerce is further creating the need for effective cold chain equipment to maintain product integrity during transport. Consequently, manufacturers and suppliers in Saudi Arabia are continuously innovating and offering energy-efficient and high-performance refrigeration systems.

To get more information on this market Request Sample

Rising need for temperature-sensitive vaccines

Increasing requirement for temperature-sensitive vaccines is impelling the Saudi Arabia cold chain equipment market growth. Vaccines require strict temperature control to maintain their effectiveness and safety during storage and transportation. As Saudi Arabia is expanding its healthcare infrastructure and vaccination programs, the demand for reliable cold chain equipment is rising rapidly. Hospitals, clinics, and vaccination centers are investing in advanced refrigeration systems, cold storage units, and temperature monitoring devices to ensure vaccines remain within the required temperature range. The government is implementing stringent regulations for vaccine storage, further encouraging the adoption of modern cold chain technologies. Additionally, the ongoing focus on immunization drives is creating the need for efficient healthcare cold chain logistics solutions, further strengthening the market growth. According to the IMARC Group, the Saudi Arabia healthcare cold chain logistics market size reached USD 162.90 Million in 2024. This requirement is motivating cold chain equipment manufacturers to develop innovative, energy-optimized, and precise cooling systems tailored for vaccine storage.

Growing usage of AI

The rising adoption of AI is propelling the market growth. As per SDAIA's 2024 survey, 75% of Saudis knew about AI concepts, while 64% recognized its applications. AI-based systems help predict equipment failures, optimize energy use, and automate responses to temperature fluctuations, reducing spoilage and operational costs. These technologies ensure higher accuracy in maintaining required storage conditions, which is critical for sectors like pharmaceuticals, food, and dairy. Businesses are employing AI to enhance decision-making and improve inventory and logistics management. With the increasing demand for high-quality and safe items, companies continue to rely on AI to refine the reliability and performance of cold chain equipment. AI also supports predictive analytics, allowing firms to take preventive actions. This growing dependence on technology is stimulating the market growth, making AI a key driver in modernizing Saudi Arabia’s cold chain infrastructure.

Saudi Arabia Cold Chain Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type and application.

Equipment Type Insights:

- Storage Equipment

- On-Grid

- Walk-in Coolers

- Walk-in Freezers

- Ice-Lined Refrigerators

- Deep Freezers

- Off-Grid

- Solar Chillers

- Milk Coolers

- Solar Powered Cold Boxes

- Others

- Others

- On-Grid

- Transportation Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes storage equipment [on-grid (walk-in coolers, walk-in freezers, ice-lined refrigerators, and deep freezers), off-grid (solar chillers, milk coolers, solar powered cold boxes, and others), and others] and transportation equipment.

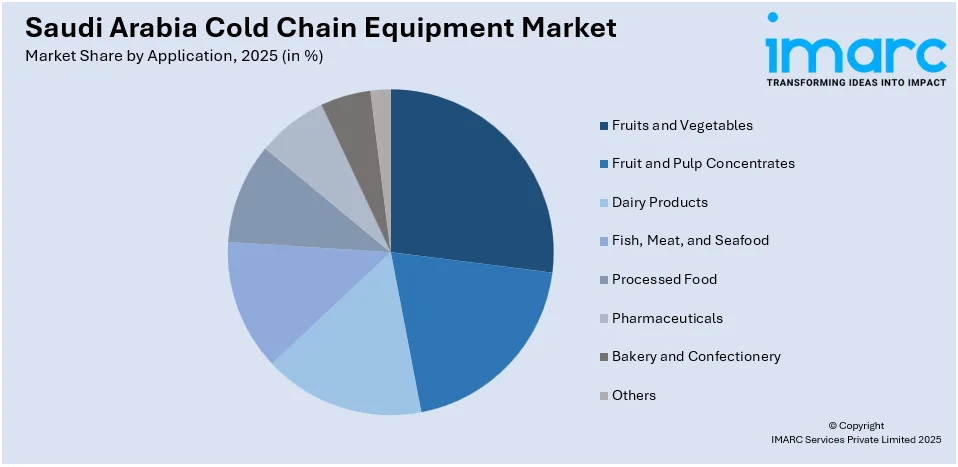

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Fruit and Pulp Concentrates

- Dairy Products

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Bakery and Confectionery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, fruit and pulp concentrates, dairy products, fish, meat, and seafood, processed food, pharmaceuticals, bakery and confectionery, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cold Chain Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Applications Covered | Fruits and Vegetables, Fruit and Pulp Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Pharmaceuticals, Bakery and Confectionery, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cold chain equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cold chain equipment market on the basis of equipment type?

- What is the breakup of the Saudi Arabia cold chain equipment market on the basis of application?

- What is the breakup of the Saudi Arabia cold chain equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cold chain equipment market?

- What are the key driving factors and challenges in the Saudi Arabia cold chain equipment market?

- What is the structure of the Saudi Arabia cold chain equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia cold chain equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cold chain equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cold chain equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cold chain equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)