Saudi Arabia Cold Chain Pharmaceutical Logistics Market Size, Share, Trends and Forecast by Product, Service, and Region, 2026-2034

Saudi Arabia Cold Chain Pharmaceutical Logistics Market Overview:

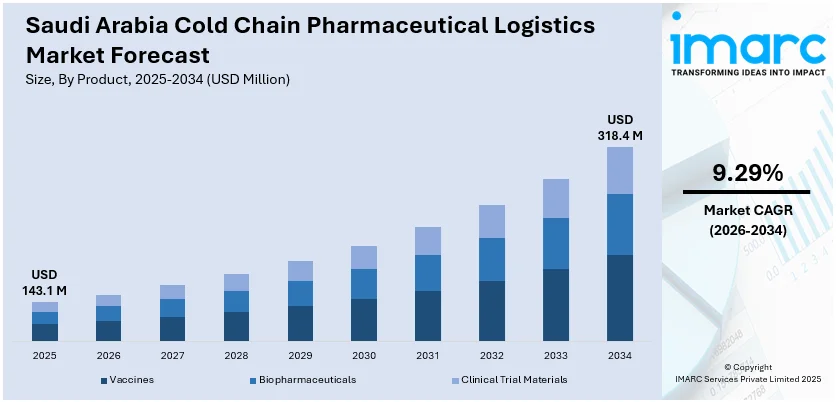

The Saudi Arabia cold chain pharmaceutical logistics market size reached USD 143.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 318.4 Million by 2034, exhibiting a growth rate (CAGR) of 9.29% during 2026-2034. Presently, rising investments in healthcare infrastructure are resulting in an increase in the distribution of temperature-sensitive medications, vaccines, and biologics, which require rigorous cold chain management. Besides this, the growing adoption of online platforms for purchasing medicines is contributing to the expansion of the Saudi Arabia cold chain pharmaceutical logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 143.1 Million |

| Market Forecast in 2034 | USD 318.4 Million |

| Market Growth Rate 2026-2034 | 9.29% |

Saudi Arabia Cold Chain Pharmaceutical Logistics Market Trends:

Rising investments in healthcare infrastructure

Increasing government expenditure on healthcare infrastructure is positively influencing the market. As the government is expanding hospitals, clinics, and healthcare facilities under national initiatives like Vision 2030, the need for reliable and efficient pharmaceutical logistics is growing rapidly. These investments are leading to a rise in the procurement and distribution of temperature-sensitive medicines and vaccines, which require strict cold chain management. The broadening of public health programs and immunization campaigns is driving the demand for secure storage and transport systems. New healthcare centers in remote areas also need cold chain solutions to ensure uninterrupted supply of critical medicines. With the rise in chronic diseases like diabetes and the government’s focus on preventive care, more pharmaceuticals are entering the supply chain, requiring advanced monitoring and temperature-controlled logistics. As per the International Diabetes Federation, 23.1% of the adult population in Saudi Arabia had diabetes, equating to 5,344,600 total cases. Authorities are also implementing stringent quality standards, encouraging the use of modern technologies like real-time tracking and temperature sensors. These improvements not only enhance drug safety but also promote transparency and compliance across the logistics network. Additionally, the growing collaborations between government bodies and private logistics providers are supporting the development of specialized infrastructure, such as refrigerated trucks and cold storage units.

To get more information on this market Request Sample

Expansion of e-pharmacies

The expansion of e-pharmacies is propelling the Saudi Arabia cold chain pharmaceutical logistics market growth. According to the IMARC Group, the Saudi Arabia e-pharmacy market size reached USD 969.3 Million in 2024. As more people are turning to online platforms for purchasing medicines, the demand for efficient and reliable cold chain logistics is increasing rapidly. E-pharmacies offer convenience and access to a wide range of temperature-sensitive drugs, such as vaccines, biologics, and insulin, which require strict temperature control during storage and transport. To maintain the quality and safety of these products, cold chain logistics providers are employing advanced solutions like temperature monitoring systems and insulated packaging. The growing trust in e-pharmacy services is encouraging individuals to order medicines online, increasing shipment volumes. Additionally, e-pharmacies often serve remote or underserved areas where traditional pharmacies are limited, making cold chain logistics essential for timely and safe delivery. The rapid growth of e-commerce infrastructure and digital payment systems is further supporting the broadening of e-pharmacies.

Saudi Arabia Cold Chain Pharmaceutical Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and service.

Product Insights:

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

The report has provided a detailed breakup and analysis of the market based on the product. This includes vaccines, biopharmaceuticals, and clinical trial materials.

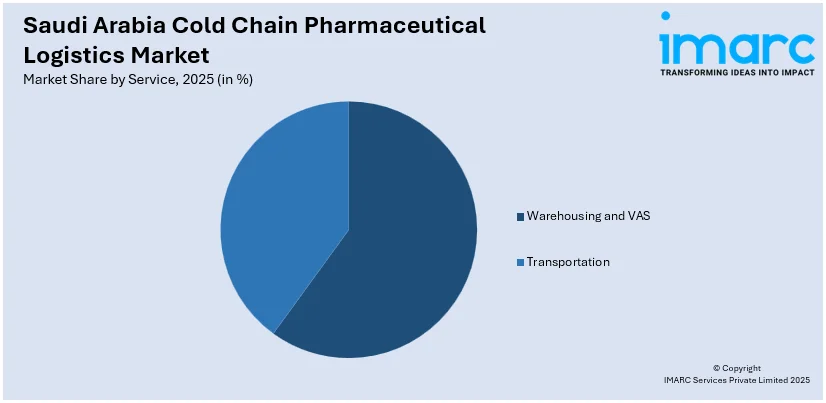

Service Insights:

Access the comprehensive market breakdown Request Sample

- Warehousing and VAS

- Transportation

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes warehousing and VAS and transportation.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cold Chain Pharmaceutical Logistics Market News:

- In May 2025, Four Winds Saudi Arabia Limited reaffirmed its commitment to improving the efficiency and compliance standards of pharmaceutical logistics by actively participating in the MiPharma 2025 conference. The company emphasized accuracy, reliability, and safety, understanding that operational precision was vital in healthcare logistics. It guaranteed prompt and safe deliveries, backed by teams thoroughly trained to uphold cold chain integrity.

- In February 2025, NUPCO obtained SAR 2.5 Billion in funding to enhance healthcare logistics in Saudi Arabia. The agreements expanded upon NUPCO’s recent partnerships with international pharmaceutical giants like Novo Nordisk and Sanofi to localize insulin provision and strengthen the Kingdom’s pharmaceutical production abilities, enabling the firm to discover new opportunities and implement solutions that could improve supply chain resilience while generating long-term value for all stakeholders.

Saudi Arabia Cold Chain Pharmaceutical Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Vaccines, Biopharmaceuticals, Clinical Trial Materials |

| Services Covered | Warehousing and VAS, Transportation |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cold chain pharmaceutical logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cold chain pharmaceutical logistics market on the basis of product?

- What is the breakup of the Saudi Arabia cold chain pharmaceutical logistics market on the basis of service?

- What is the breakup of the Saudi Arabia cold chain pharmaceutical logistics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cold chain pharmaceutical logistics market?

- What are the key driving factors and challenges in the Saudi Arabia cold chain pharmaceutical logistics market?

- What is the structure of the Saudi Arabia cold chain pharmaceutical logistics market and who are the key players?

- What is the degree of competition in the Saudi Arabia cold chain pharmaceutical logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cold chain pharmaceutical logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cold chain pharmaceutical logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cold chain pharmaceutical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)