Saudi Arabia Cold Chain Transport Market Size, Share, Trends and Forecast by Type, Application, Equipment, and Region, 2026-2034

Saudi Arabia Cold Chain Transport Market Summary:

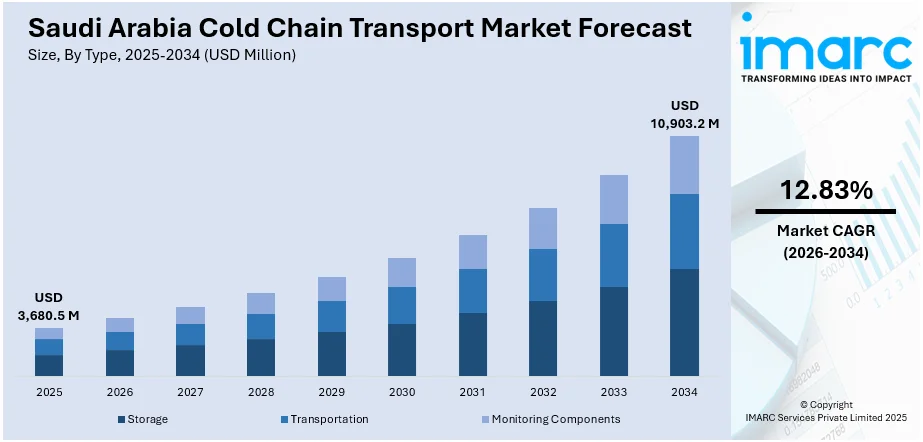

The Saudi Arabia cold chain transport market size was valued at USD 3,680.5 Million in 2025 and is projected to reach USD 10,903.2 Million by 2034, growing at a compound annual growth rate of 12.83% from 2026-2034.

The Saudi Arabia cold chain transport market is experiencing rapid expansion, driven by the Kingdom's Vision 2030 economic diversification initiatives and strategic positioning as a regional logistics hub. The government’s focus on food security and modernizing infrastructure is driving significant investment in temperature-controlled logistics networks. Major infrastructure projects including NEOM and King Abdullah Port expansion, are creating substantial demand for advanced cold storage and distribution capabilities, particularly for pharmaceuticals, fresh produce, dairy, and frozen goods. The strengthening demand for temperature-controlled logistics is transforming how businesses manage perishables across the Kingdom's harsh climatic conditions, contributing to the Saudi Arabia cold chain transport market share.

Key Takeaways and Insights:

- By Type: Storage dominates the market with a share of 48% in 2025, driven by the country's heavy reliance on warehousing for both imported and domestically produced temperature-sensitive goods, including food products and pharmaceuticals.

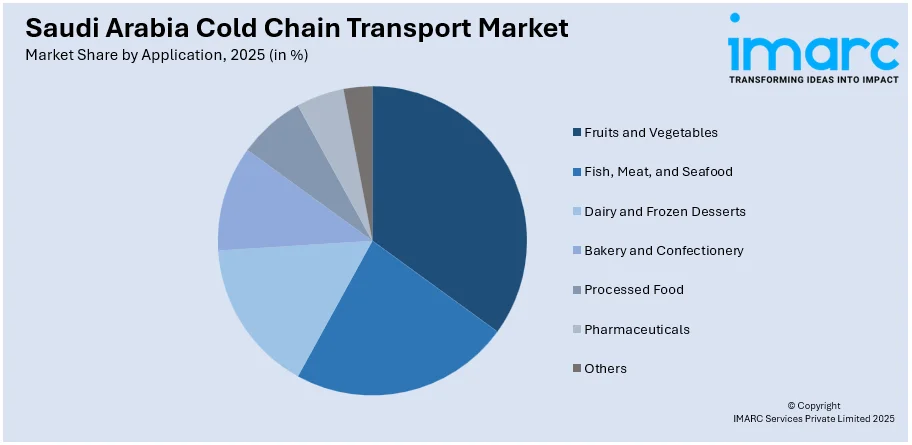

- By Application: Fruits and vegetables lead the market with a share of 23% in 2025, supported by public-private partnerships aimed at enhancing food security and reducing post-harvest losses through advanced temperature-controlled systems.

- By Equipment: Storage equipment represents the largest segment with a market share of 55% in 2025, reflecting significant investments in refrigerated warehouses, blast freezers, and cold rooms to meet growing demand for temperature-sensitive goods storage.

- By Region: Northern and Central region exhibits a clear dominance with a 30% share in 2025, owing to Riyadh's strategic location as a commercial hub and its robust infrastructure supporting cold chain operations.

- Key Players: The Saudi Arabia cold chain transport market shows moderate competition, driven by both multinational and regional logistics providers. Companies are focusing on expanding service networks, enhancing temperature-controlled solutions, and adopting advanced technologies to meet growing demand for efficient, reliable, and safe transportation of perishable goods across the country.

To get more information on this market Request Sample

The Saudi Arabia cold chain transport market has witnessed a notable transformation driven by expanding e-commerce activities and increasing pharmaceutical requirements. With rising consumer expectations for freshness, safety, and extended shelf life, logistics providers are rapidly adopting advanced cooling technologies and real-time tracking systems. The government has earmarked USD 133 billion for new roads, ports, airports, and 59 logistics centers spanning 100 million square meters to be delivered by 2030, with 21 centers already in execution. The integration of cold chain hubs with the national rail network is helping reduce inland transport costs while expanding access to temperature-controlled storage for food importers and pharmaceutical distributors. Strategic partnerships and joint ventures within the logistics sector are further strengthening Saudi Arabia’s cold chain capabilities, supporting efficient distribution, enhancing operational scale, and aligning with broader national objectives to modernize and expand the country’s logistics and healthcare infrastructure.

Saudi Arabia Cold Chain Transport Market Trends:

Expansion of E-Commerce and Online Grocery Services

The expansion of e-commerce platforms is fueling market growth as businesses need effective cold chain operations to preserve product integrity. As more consumers purchase groceries, dairy goods, and frozen products online, the demand for last-mile refrigerated transport is increasing, particularly in urban areas. The Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. The market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033, with 33.9 million internet users participating in e-commerce activities. Logistics providers are being motivated to expand their cold fleet and establish robust supply networks as customer expectations for safe and on-time deliveries continue rising.

Integration of IoT and Smart Technology Solutions

The integration of Internet of Things devices and automation is enhancing real-time monitoring and management of temperature-sensitive goods throughout the supply chain. AI-powered sensors and monitoring systems are transforming cold chain operations by providing precise temperature control and significantly reducing product spoilage across pharmaceutical and food distribution networks. Advanced AI algorithms also enable predictive maintenance of refrigeration equipment, helping minimize downtime and ensure more reliable and efficient cold chain management. The Saudi Arabia cold chain monitoring solutions market size reached USD 315.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,438.53 Million by 2033, exhibiting a growth rate (CAGR) of 22.70% during 2025-2033.

Strategic Logistics Partnerships and Consolidation

Strategic consolidation in logistics services is revolutionizing Saudi Arabia's cold chain capabilities through major partnerships and joint ventures. Companies are combining global reach with local expertise to serve multiple sectors, including energy, automotive, retail, and healthcare. For instance, the first Global Logistics Forum 2024 in Riyadh witnessed various agreements including partnerships with FedEx to investigate investment possibilities in transportation and collaborations with Pacific International Lines and the Saudi Ports Authority to improve multimodal transport services. In November 2024, GFH and GWC announced plans for 200,000 square meters of Grade-A cold-chain facilities across Riyadh, Jeddah, and Dammam.

How Vision 2030 is Transforming the Saudi Arabia Cold Chain Transport Market:

Vision 2030 is significantly transforming Saudi Arabia’s cold chain transport market by driving infrastructure development, technological adoption, and industry modernization. Government initiatives aimed at enhancing food security, healthcare logistics, and pharmaceutical distribution are increasing demand for reliable temperature-controlled transport solutions. Investments in advanced warehousing, refrigerated fleets, and digital tracking systems are improving efficiency, reducing spoilage, and ensuring compliance with international standards. The focus on local manufacturing and import substitution under Vision 2030 is further boosting cold chain requirements for perishable goods. Combined with growing consumer demand for fresh and processed products, these developments position the market for sustained growth and modernization across multiple sectors.

Market Outlook 2026-2034:

The Saudi Arabia cold chain transport market is poised for substantial expansion, driven by rising consumer expectations, pharmaceutical sector growth, and national food security initiatives. The government's Vision 2030 framework continues to attract significant investments in temperature-controlled logistics infrastructure, with the Saudi Logistics Hub initiative aiming to attract USD 10 billion in foreign investment by 2030. Major port expansions at King Abdullah Port and Jeddah Islamic Port, alongside railway network expansion targeting 8,000 kilometers, are significantly boosting cold chain distribution capabilities nationwide. The market generated a revenue of USD 3,680.5 Million in 2025 and is projected to reach a revenue of USD 10,903.2 Million by 2034, growing at a compound annual growth rate of 12.83% from 2026-2034.

Saudi Arabia Cold Chain Transport Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Storage |

48% |

|

Application |

Fruits and Vegetables |

23% |

|

Equipment |

Storage Equipment |

55% |

|

Region |

Northern and Central Region |

30% |

Type Insights:

- Storage

- Transportation

- Monitoring Components

Storage dominates with a market share of 48% of the total Saudi Arabia cold chain transport market in 2025.

Storage dominates the Saudi Arabia cold chain transport market due to the country’s growing need for temperature-controlled facilities to support perishable goods across the food, pharmaceuticals, and healthcare sectors. With rising domestic production, imports of temperature-sensitive products, and expanding retail and e-commerce channels, companies increasingly rely on cold storage to maintain product quality and extend shelf life. Advanced storage facilities offer controlled environments, allowing businesses to manage inventory efficiently, reduce spoilage, and meet regulatory standards, making storage a critical component of the overall cold chain infrastructure.

Additionally, the focus on storage is reinforced by strategic government initiatives under Vision 2030, which aim to enhance food security, healthcare logistics, and industrial growth. Investment in state-of-the-art warehouses, ultra-low-temperature storage, and automated inventory systems strengthens operational efficiency and ensures reliable distribution across the Kingdom. As logistics networks expand, storage hubs serve as central points for consolidation and redistribution, positioning them as the backbone of the cold chain transport market and enabling seamless integration with transportation and last-mile delivery services.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Fish, Meat, and Seafood

- Dairy and Frozen Desserts

- Bakery and Confectionery

- Processed Food

- Pharmaceuticals

- Others

Fruits and vegetables lead with a share of 23% of the total Saudi Arabia cold chain transport market in 2025.

Fruits and vegetables dominate the Saudi Arabia cold chain transport market due to their highly perishable nature and the country’s growing demand for fresh produce. Maintaining quality and extending shelf life during transportation requires temperature-controlled logistics, making cold chain solutions essential. With increasing imports to supplement domestic production and the expansion of modern retail, supermarkets, and food service sectors, efficient cold chain transport ensures minimal spoilage, preserves nutritional value, and meets consumer expectations for freshness, driving consistent demand for specialized refrigerated transport.

The dominance of fruits and vegetables is further supported by government initiatives under Vision 2030, which emphasize food security and supply chain modernization. Investments in refrigerated storage facilities, advanced logistics hubs, and temperature-monitored transportation networks enable safe and timely delivery of produce across the Kingdom. As consumer preferences shift toward healthier diets and fresh products, the reliance on cold chain infrastructure for fruits and vegetables strengthens, reinforcing their leading position in the Saudi cold chain transport market.

Equipment Insights:

- Storage Equipment

- Transportation Equipment

Storage equipment represents the largest share with 55% of the total Saudi Arabia cold chain transport market in 2025.

Storage equipment maintains its leadership position in the market due to substantial investments in refrigerated warehouses, blast freezers, walk-in coolers, deep freezers, and cold rooms to meet the growing demand for temperature-sensitive goods storage. The segment benefits from the expansion of organized retail, increased import-export activity, and government initiatives to improve food security and infrastructure. Deep-frozen and ultra-low operations stand out with significant growth as pharmaceutical and biotech sectors install facilities accommodating vaccines and clinical-trial samples.

The Saudi Arabia cold storage market continues to grow, driven by strong demand for storage equipment across various sectors. For instance, in April 2025, Arcapita was set to increase investment in urban distribution centers, cold storage, and temperature-regulated warehousing facilities in Saudi Arabia. Additionally, Companies are investing in urban distribution centers and upgrading facilities to enhance their cold, chilled, and ambient storage capacities, improving service for food, pharmaceutical, and other temperature-sensitive products while supporting efficient regional supply chains.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region dominates with a market share of 30% of the total Saudi Arabia cold chain transport market in 2025.

The Northern and Central Region, headed by Riyadh, controls the market because the region is centrally located as the capital and a large commercial center with well-developed infrastructure that promotes cold chain operations. Riyadh is the major distribution center of the pharmaceuticals, as the number of GDP-certified warehouses increases and is expected to record the most significant growth by 2030. The region has the advantage of large investments in logistic infrastructure and the concentration of large food manufacturers, importers, and medical institutions.

Government initiatives under Vision 2030 are strengthening Saudi Arabia’s transportation networks and cold storage infrastructure, boosting the efficiency and reach of the country’s cold chain systems. Strategic developments, including new logistics partnerships and large-scale food industry clusters, are enhancing regional capabilities, combining advanced operational expertise with expanded storage and distribution facilities to support multiple sectors, from food and pharmaceuticals to perishable goods, and improving overall supply chain resilience across the Kingdom.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cold Chain Transport Market Growing?

Government Infrastructure Investments Under Vision 2030

The Saudi government’s Vision 2030 initiatives are driving significant investments in logistics and transportation infrastructure, with a strong focus on developing cold chain capabilities. Efforts include upgrading storage facilities, integrating advanced technologies, and expanding logistics centers to enhance operational efficiency. These developments are improving delivery speed, reducing transit times, and strengthening the overall competitiveness of the cold chain sector. Integration with customs and national rail networks further supports seamless import and inland transport, ensuring cargo integrity and reliable distribution of temperature-sensitive goods across the Kingdom.

Growing Pharmaceutical and Healthcare Logistics Demand

The expansion of the pharmaceutical sector is significantly driving the cold chain transport market as the necessity for temperature-sensitive vaccines, biologics, and specialty medications increases. The Saudi Arabia pharmaceuticals market size was valued at USD 9.60 Billion in 2025 and is projected to reach USD 11.79 Billion by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034. The pharmaceutical cold chain segment is growing rapidly, capitalizing on Riyadh's role as a distribution hub and the proliferation of GDP-certified warehouses. The Saudi Food and Drug Authority has ramped up investments in Good Distribution Practice-compliant infrastructure, with regulatory requirements mandating proper storage and handling conditions. For instance, in February 2025, NUPCO obtained SAR 2.5 billion in funding to enhance healthcare logistics, expanding partnerships with international pharmaceutical giants to localize insulin provision and strengthen the Kingdom's pharmaceutical production capabilities.

Rising Demand for Perishable Food Products

The growing demand for fresh and processed food products is a major driver of Saudi Arabia’s cold chain market. Rapid population growth and shifting consumer preferences toward convenience and quality are increasing the need for efficient temperature-controlled logistics. High reliance on imported pharmaceuticals and food products requires robust cold transportation to maintain safety and quality. Key segments such as meat, poultry, and dairy are supported by domestic production initiatives and premium branding, while ongoing investments in agricultural and cold storage infrastructure aim to reduce food waste and enhance supply chain efficiency across the Kingdom.

Market Restraints:

What Challenges the Saudi Arabia Cold Chain Transport Market is Facing?

High Operational and Energy Costs

Maintaining temperature-controlled environments demands substantial investment in infrastructure, energy, and technology. The high operational costs associated with running cold storage facilities, along with the significant initial outlay for advanced systems, pose challenges for smaller operators. These financial pressures can affect profitability and limit competitiveness, making it difficult for new or smaller players to establish a strong foothold in the cold chain transport market.

Limited Skilled Workforce in Cold Chain Management

A shortage of skilled personnel in cold chain logistics, particularly in handling temperature-sensitive products and operating advanced cold storage systems, has constrained industry efficiency. This lack of trained workforce impacts service quality, operational reliability, and the overall effectiveness of cold chain operations, highlighting the need for specialized training and talent development in the sector.

Infrastructure Gaps in Remote Regions

While major cities like Riyadh, Jeddah, and Dammam boast advanced cold storage facilities, remote areas face significant cold chain infrastructure shortages. Saudi Arabia's geography includes remote regions and long distances between cities, making transport time-consuming and resource intensive. Maintaining consistent temperature control during cross-country transport is complex, especially in areas with limited infrastructure and extreme heat conditions often exceeding 45°C during summer months.

Competitive Landscape:

The Saudi Arabia cold chain transport market exhibits moderate competitive intensity with multinational logistics corporations competing alongside established regional operators. The market is characterized by the presence of both established logistics providers and new entrants seeking to capture market share. Companies are differentiating themselves through expansion of service offerings, strategic partnerships, and investments in cutting-edge technology. Major players are focusing on enhancing cold fleet capacity, establishing GDP-certified facilities, and integrating advanced monitoring systems to meet growing demand. The increasing focus on customer-centric solutions and value-added services, including kitting, relabeling, and quality testing tailored to SFDA rules, is driving innovation across the industry. Sustainability considerations are also becoming important, with companies adopting energy-efficient cooling systems and alternative refrigerants to align with global environmental standards.

Recent Developments:

- October 2024: CEVA Logistics and Almajdouie Logistics formed a joint venture, CEVA Almajdouie Logistics, based in Dammam, combining extensive resources and workforce to strengthen Saudi Arabia’s cold chain infrastructure. This collaboration leverages both global expertise and local knowledge to advance the Kingdom’s temperature-controlled logistics capabilities, supporting the objectives outlined under Vision 2030.

- September 2024: Duroub Integrated Logistics unveiled its new website to improve access to comprehensive logistics services in Saudi Arabia, providing optimized cold chain storage, transport, and delivery solutions.

Saudi Arabia Cold Chain Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Canned Meat and Seafood, Canned Fruit and Vegetables, Canned Ready Meals, Others |

| Applications Covered | Organic, Conventional |

| Equipment Covered | Supermarkets and Hypermarkets, Convenience Stores, E-Commerce, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cold chain transport market size was valued at USD 3,680.5 Million in 2025.

The Saudi Arabia cold chain transport market is expected to grow at a compound annual growth rate of 12.83% from 2026-2034 to reach USD 10,903.2 Million by 2034.

Storage dominates the market with a 48% share in 2025, driven by the country's heavy reliance on warehousing for both imported and domestically produced temperature-sensitive goods, including food products and pharmaceuticals requiring specialized storage infrastructure.

Key factors driving the Saudi Arabia cold chain transport market include government infrastructure investments under Vision 2030, growing pharmaceutical and healthcare logistics demand, rising consumption of perishable food products, expansion of e-commerce and online grocery services, and increasing adoption of IoT and smart monitoring technologies.

Major challenges include high operational and energy costs, a limited skilled workforce in cold chain management, infrastructure gaps in remote regions, extreme climatic conditions requiring robust temperature control systems, and complex regulatory compliance requirements across multiple sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)