Saudi Arabia Cold Chain Warehousing Market Size, Share, Trends and Forecast by Type of Storage, Temperature Range, Ownership, End Use Industry, and Region, 2026-2034

Saudi Arabia Cold Chain Warehousing Market Summary:

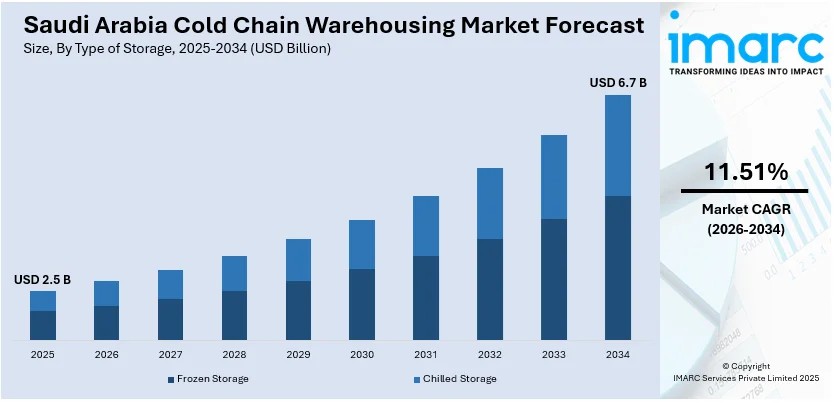

The Saudi Arabia cold chain warehousing market size was valued at USD 2.5 Billion in 2025 and is projected to reach USD 6.7 Billion by 2034, growing at a compound annual growth rate of 11.51% from 2026-2034.

The food and beverage, pharmaceutical, and healthcare industries' growing need for temperature-controlled storage solutions is propelling the Saudi Arabian cold chain warehousing market's rapid growth. Infrastructure development is still being driven by growing urbanization and customer demands for high-quality, fresh goods. The Kingdom is positioned as a regional center for temperature-sensitive logistics activities thanks to its advantageous geographic location and economic diversification ambitions.

Key Takeaways and Insights:

- By Type of Storage: Frozen storage dominates the market with a share of 55% in 2025, due to the growing domestic poultry production and significant imports of protein goods, which necessitate maintaining sub-zero temperatures throughout the supply chain.

- By Temperature Range: Refrigerated leads the market with a share of 36% in 2025. This dominance is driven by the heavy reliance on warehousing for both imported and domestically produced temperature-sensitive goods requiring consistent chilled environments.

- By Ownership: Private warehouses exhibit a clear dominance in the market with 60% share in 2025, reflecting vertically integrated operations by major food producers ensuring quality control across dairy, poultry, and processed food supply chains.

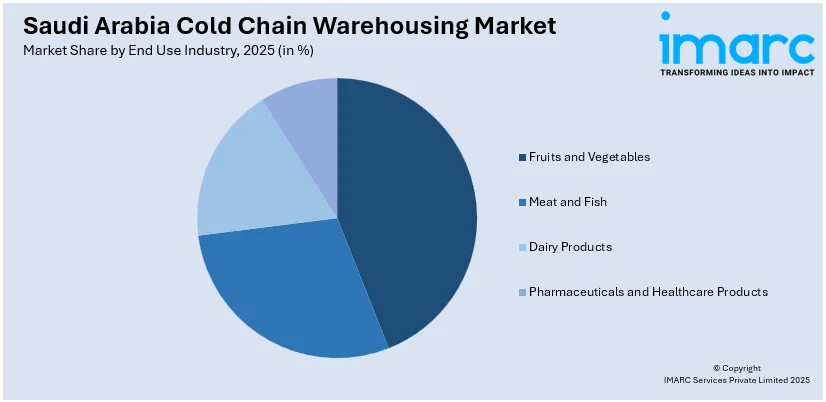

- By End Use Industry: Pharmaceuticals and healthcare products represent the biggest segment with a market share of 33% in 2025, reflecting increasing healthcare investments and stringent temperature requirements for biologics, vaccines, and insulin distribution.

- By Region: Northern and Central Region is the largest region with 30% share in 2025, driven by Riyadh's position as the primary distribution hub and concentration of pharmaceutical buyers, customs authorities, and healthcare facilities.

- Key Players: Key players drive the Saudi Arabia cold chain warehousing market by expanding temperature-controlled storage capacities, implementing advanced IoT-based monitoring systems, and strengthening nationwide distribution networks. Their investments in automation technologies, GDP-certified facilities, and strategic partnerships with food and pharmaceutical distributors boost operational efficiency and ensure consistent product availability across diverse industry segments.

To get more information on this market Request Sample

The market for cold chain warehousing in Saudi Arabia is expanding significantly due to a number of convergent factors that are changing the landscape of temperature-controlled logistics. Due to the Kingdom's heavy reliance on imports for a variety of food categories and the need for a strong refrigerated storage system to reduce spoilage and increase shelf life, the country's dedication to food security has become a major catalyst. Specialized cold storage facilities that can maintain stringent temperature regulations for biologics, vaccines, and other temperature-sensitive pharmaceuticals are in high demand due to the booming pharmaceutical and healthcare industries. The strict compliance requirements imposed by the Saudi Food and Drug Authority's regulatory framework highlight the need of certified warehouse solutions across the supply chain. Infrastructure development is being accelerated by the growth of the food and beverage industry, especially in the consumption of frozen and processed foods. The Kingdom is positioned as a regional logistics powerhouse thanks to strategic government efforts that support economic diversification and logistics modernization, which further increase investment in cold chain infrastructure.

Saudi Arabia Cold Chain Warehousing Market Trends:

Integration of Smart Technologies in Cold Storage Operations

The Kingdom's cold chain warehouse operations are changing due to the use of cutting-edge technologies like Internet of Things sensors, artificial intelligence-powered monitoring systems, and predictive analytics. Automated alarms and real-time temperature monitoring allow for quick action before temperature fluctuations jeopardize product integrity. End-to-end supply chain visibility is made possible by warehouse management systems coupled with enterprise resource planning platforms, which improves operational effectiveness and regulatory compliance documentation capabilities.

Strategic Consolidation Through Joint Ventures and Partnerships

As foreign logistics companies build strategic partnerships with well-established local operators, the cold chain warehouse industry is undergoing substantial consolidation. These collaborations create improved service offerings and increased geographic coverage by fusing localized market knowledge with worldwide operational competence. Faster deployment of standardized buildings, specialized staff training programs, and technology transfer are made possible by the collaborative approach, which speeds up sector modernization while satisfying the increasing demand from pharmaceutical and food consumers.

Rising Demand for Multi-Temperature Warehousing Facilities

In order to accommodate a wide range of product requirements, from ambient to ultra-low temperatures, modern cold chain warehousing facilities increasingly have various temperature zones within single complexes. Fresh fruit, frozen commodities, and pharmaceutical medicines that need diverse storage conditions can all be handled efficiently with this design. For clients managing a variety of product portfolios, the flexibility minimizes operational complexity while maximizing storage capacity usage across temperature ranges and optimizing energy consumption.

How Vision 2030 is Transforming the Saudi Arabia Cold Chain Warehousing Market:

By emphasizing logistics infrastructure as a key component of economic diversification, Saudi Arabia's Vision 2030 project is radically changing the cold chain warehousing landscape. By promoting significant investments in temperature-controlled storage facilities in key areas, the National Industrial Development and Logistics Program is establishing the Kingdom as a hub for regional logistics that connects Asia, Europe, and Africa. International operators are drawn to create sophisticated storage operations by government-sponsored special economic zones because they provide incentives and simplified regulatory regimes. Vision 2030's focus on food security has spurred the building of infrastructure to lessen reliance on imports and cut down on post-harvest losses. The initiative's modernization of the healthcare sector necessitates advanced pharmaceutical cold chain capabilities, hastening the establishment of GDP-certified facilities. An ecosystem that supports long-term cold chain infrastructure growth is created by these concerted efforts.

Market Outlook 2026-2034:

The Saudi Arabia cold chain warehousing market demonstrates promising growth prospects as fundamental demand drivers continue strengthening across multiple sectors. Increasing urbanization and rising consumer expectations for fresh, high-quality products sustain momentum for temperature-controlled logistics infrastructure expansion. The market generated a revenue of USD 2.5 Billion in 2025 and is projected to reach a revenue of USD 6.7 Billion by 2034, growing at a compound annual growth rate of 11.51% from 2026-2034. Healthcare sector expansion and vaccine distribution requirements continue driving demand for specialized pharmaceutical warehousing with ultra-low temperature capabilities. Strategic infrastructure investments supported by public-private partnerships are accelerating facility development across major urban centers and port cities. E-commerce growth in perishable goods delivery necessitates distributed cold storage networks enabling efficient last-mile fulfillment operations throughout the Kingdom.

Saudi Arabia Cold Chain Warehousing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Storage | Frozen Storage | 55% |

| Temperature Range | Refrigerated | 36% |

| Ownership | Private Warehouses | 60% |

| End Use Industry | Pharmaceuticals and Healthcare Products | 33% |

| Region | Northern and Central Region | 30% |

Type of Storage Insights:

- Frozen Storage

- Chilled Storage

Frozen storage dominates with a market share of 55% of the total Saudi Arabia cold chain warehousing market in 2025.

Frozen storage facilities maintain temperatures below minus eighteen degrees Celsius, accommodating substantial protein imports and expanding domestic poultry production that forms a significant portion of the Kingdom's food supply chain. The infrastructure supports both imported frozen goods arriving through major ports and locally processed products requiring extended preservation periods to maintain quality and safety standards. These facilities feature dedicated frozen zones engineered for high throughput operations without compromising temperature stability, utilizing advanced insulation materials and sophisticated refrigeration systems.

The growing demand for frozen convenience foods and ready-to-eat meals among urban consumers continues driving infrastructure expansion, as changing lifestyles increase preference for time-saving food solutions that maintain nutritional value. National food security initiatives prioritizing reduced import dependency further amplify investment in frozen storage capacity, enabling strategic stockpiling and buffer inventory management during supply chain disruptions. Advanced refrigeration systems utilizing low global warming potential refrigerants align facilities with international environmental standards while improving energy efficiency and reducing operational costs for warehouse operators throughout the Kingdom.

Temperature Range Insights:

- Ambient

- Refrigerated

- Frozen

- Deep-Frozen

Refrigerated leads with a share of 36% of the total Saudi Arabia cold chain warehousing market in 2025.

Refrigerated storage maintaining temperatures between two and eight degrees Celsius serves the largest share of temperature-controlled warehousing demand, supporting both imported and domestically produced perishable goods requiring consistent chilled environments throughout their storage duration. This temperature range accommodates diverse product categories including fresh produce, dairy products, and pharmaceutical items with specific cold chain requirements mandated by regulatory authorities.

Stringent government regulations require real-time temperature logging for pharmaceutical cold storage operations, driving widespread adoption of advanced monitoring systems featuring automated alerts and comprehensive documentation capabilities. Public warehouses capturing smaller shippers seeking economies of scale operate alongside private facilities that ensure quality control across vertically integrated supply chains for major food producers serving domestic markets. The expansion of organized retail and modern supermarket chains necessitates reliable refrigerated storage networks positioned strategically near consumption centers to ensure timely product availability. National food waste reduction campaigns create additional demand for produce and dairy cold chains that extend shelf life and minimize post-harvest losses, supporting broader sustainability objectives across the agricultural sector.

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

Private warehouses exhibit a clear dominance with 60% share of the total Saudi Arabia cold chain warehousing market in 2025.

Private warehouse ownership dominates the market as major food producers and pharmaceutical distributors maintain dedicated facilities ensuring complete control over temperature-sensitive inventory throughout storage duration and distribution processes. Vertically integrated operations spanning dairy, poultry, and processed food production lines benefit from proprietary cold chain infrastructure that guarantees product quality standards while enabling customized handling procedures tailored to specific product requirements.

The preference for private warehousing reflects the critical importance of product integrity in temperature-sensitive supply chains where any cold chain breach can result in significant financial losses, regulatory complications, and reputational damage affecting consumer trust. Companies operating proprietary facilities maintain direct oversight of handling procedures, temperature monitoring protocols, and compliance documentation essential for meeting stringent regulatory requirements established by government authorities. Investment in private warehousing infrastructure continues expanding as businesses prioritize supply chain resilience, quality assurance capabilities, and operational independence from third-party logistics providers. This ownership model enables rapid response to changing market conditions and customer requirements while maintaining consistent service standards across distribution networks.

End Use Industry Insights:

To get detailed segment analysis of this market Request Sample

- Fruits and Vegetables

- Meat and Fish

- Dairy Products

- Pharmaceuticals and Healthcare Products

Pharmaceuticals and healthcare products represent the leading segment with 33% share of the total Saudi Arabia cold chain warehousing market in 2025.

The pharmaceutical sector commands the largest share of cold chain warehousing demand driven by increasing healthcare investments, vaccine distribution requirements, and growing biologics markets requiring sophisticated temperature control. Saudi Arabia represents the largest pharmaceutical market in the Middle East and Africa region, generating substantial demand for specialized storage facilities meeting Good Distribution Practice standards. In February 2025, NUPCO secured SAR 2.5 Billion in funding to enhance healthcare logistics infrastructure, including advanced storage and transport systems for temperature-sensitive medicines.

Stringent regulatory oversight by the Saudi Food and Drug Authority mandates comprehensive temperature monitoring and documentation throughout pharmaceutical supply chains, elevating infrastructure requirements beyond standard cold storage capabilities. The expansion of e-pharmacies across the Kingdom increases shipment volumes of temperature-sensitive medications requiring reliable last-mile cold chain solutions that maintain product integrity from warehouse to patient delivery. Ultra-low temperature facilities maintaining -20 to -80 degrees Celsius accommodate vaccines, biologics, and clinical trial materials as Saudi Arabia positions itself as a regional clinical trials hub, attracting international pharmaceutical research activities requiring sophisticated cold chain infrastructure.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 30% of the total Saudi Arabia cold chain warehousing market in 2025.

The Northern and Central Region centered around Riyadh dominates the cold chain warehousing market as the capital serves as the primary distribution hub for pharmaceutical products and consumer goods throughout the Kingdom. The concentration of regulatory authorities including the Saudi Food and Drug Authority, major healthcare buyers, and customs operations simplifies compliance processes and tender procedures for temperature-sensitive logistics providers. In November 2025, DHL Supply Chain signed a strategic agreement to invest EUR 130 Million in a new logistics hub at the Special Integrated Logistics Zone in Riyadh.

Riyadh's strategic infrastructure developments including the Riyadh Integrated Logistics Zone near King Khalid International Airport create integrated storage ecosystems connecting air freight with temperature-controlled warehousing through bonded corridors that streamline customs clearance processes. New industrial zones featuring dedicated cold storage facilities attract both domestic producers and international logistics operators establishing regional distribution centers to serve the broader Middle East and Africa markets. The region's growing population, expanding healthcare infrastructure, and concentration of major pharmaceutical buyers sustain demand momentum for cold chain capacity meeting stringent regulatory requirements established by government authorities.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cold Chain Warehousing Market Growing?

Expansion of Pharmaceutical and Healthcare Sectors

The pharmaceutical and healthcare sectors represent primary growth catalysts for cold chain warehousing infrastructure as increasing healthcare investments drive unprecedented demand for temperature-controlled storage solutions. The Kingdom's healthcare transformation initiative emphasizes localized pharmaceutical production and enhanced distribution networks requiring sophisticated cold chain capabilities that maintain product integrity from manufacturing to patient delivery. Rising incidence of chronic diseases and an aging population segment amplify medication requirements including biologics, insulin, and specialty pharmaceuticals that demand rigorous temperature control throughout their supply chains. The expansion of vaccine distribution programs necessitates specialized ultra-low temperature facilities capable of maintaining precise conditions for sensitive immunization products. Government-backed initiatives supporting domestic drug production create additional demand for cold chain infrastructure serving newly established manufacturing facilities. The growth of biotechnology and clinical trial activities positions Saudi Arabia as a regional hub requiring advanced pharmaceutical logistics capabilities that meet international standards for temperature-sensitive material handling and storage.

Rising Demand for Temperature-Sensitive Food Products

Consumer preferences shifting toward fresh, frozen, and processed food products generate sustained demand for cold chain warehousing infrastructure across the Kingdom's food supply chain. Urbanization and changing lifestyles increase consumption of convenience foods and ready-to-eat meals requiring reliable frozen storage and distribution networks. The country's substantial reliance on food imports necessitates robust refrigerated infrastructure positioned at ports and inland distribution centers to preserve product quality during storage before distribution. National food security initiatives prioritize reducing post-harvest losses through investment in temperature-controlled storage facilities that extend shelf life and minimize spoilage of perishable agricultural products. The hospitality and catering industries contribute significantly to demand as hotels, restaurants, and catering services require consistent delivery of fresh ingredients maintained at optimal temperatures. Expanding modern retail formats including supermarkets and hypermarkets demand reliable cold chain networks ensuring product availability and quality standards that meet consumer expectations for freshness and food safety compliance.

Government Infrastructure Investment and Economic Diversification

Strategic government investment programs under national economic diversification initiatives are accelerating cold chain warehousing infrastructure development throughout the Kingdom. The National Industrial Development and Logistics Program prioritizes logistics infrastructure as a cornerstone of economic transformation, driving substantial public and private investment in temperature-controlled storage facilities. Special economic zones offering streamlined regulations and incentives attract international logistics operators to establish advanced warehousing operations serving regional markets. The development of integrated logistics hubs connecting ports, airports, and rail networks with cold storage facilities enhances supply chain efficiency and positions Saudi Arabia as a regional transshipment center. Public-private partnerships enable faster deployment of standardized facilities meeting international standards while distributing investment requirements across government and commercial participants. Infrastructure developments including road networks, rail connectivity, and port expansions improve cold chain logistics capabilities by reducing transit times and enabling more efficient temperature-controlled transportation across the Kingdom's geographic expanse.

Market Restraints:

What Challenges the Saudi Arabia Cold Chain Warehousing Market is Facing?

High Operational and Energy Costs

Maintaining temperature-controlled environments requires substantial ongoing investment in infrastructure, energy consumption, and advanced technology systems that significantly impact operational profitability. The Kingdom's hot climate necessitates continuous refrigeration operation throughout the year, creating elevated electricity demands compared to temperate regions. These elevated operational expenses particularly challenge smaller market participants lacking scale economies to absorb costs, limiting competitive diversity within the sector. Energy-intensive refrigeration systems require significant capital investment for efficiency upgrades and sustainable technology adoption.

Skilled Workforce Shortage

The cold chain warehousing sector faces significant challenges securing trained personnel specializing in temperature-sensitive logistics management, advanced refrigeration system operation, and sophisticated inventory control technologies. Limited availability of workers with specific expertise in handling pharmaceutical products, managing compliance documentation, and operating automated warehouse systems constrains operational capacity expansion. Industry surveys indicate substantial proportions of logistics operators report difficulties recruiting adequately skilled labor for cold chain operations. This workforce gap affects service quality, operational efficiency, and the sector's ability to scale rapidly alongside growing market demand.

Infrastructure Gaps in Remote Regions

While major urban centers including Riyadh, Jeddah, and Dammam feature advanced cold storage infrastructure, remote and rural areas face significant gaps in temperature-controlled warehousing availability and last-mile connectivity. Limited cold chain access in outlying regions results in elevated spoilage rates for perishable goods and restricts market access for agricultural producers located distant from established logistics networks. The geographic dispersion of population centers across the Kingdom's extensive territory creates infrastructure investment challenges requiring substantial capital deployment for facilities serving smaller markets. Addressing these regional disparities remains essential for achieving comprehensive national cold chain coverage.

Competitive Landscape:

The Saudi Arabia cold chain warehousing market exhibits a fragmented competitive structure characterized by the presence of both established regional operators and international logistics providers expanding their footprint in the Kingdom. Market participants differentiate through technological capabilities including IoT-enabled temperature monitoring, automated warehouse management systems, and real-time tracking platforms that enhance operational transparency. Strategic alliances between global logistics companies and local partners combine international best practices with regional market knowledge and established customer relationships. Investment in GDP-certified pharmaceutical facilities creates competitive advantages for operators targeting the growing healthcare logistics segment. Sustainability initiatives including energy-efficient refrigeration systems and low global warming potential refrigerants increasingly influence competitive positioning as environmental considerations gain prominence. Capacity expansion strategies focusing on strategic locations near ports, airports, and consumption centers enhance service offerings and geographic coverage capabilities.

Saudi Arabia Cold Chain Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Storage Covered | Frozen Storage, Chilled Storage |

| Temperature Ranges Covered | Ambient, Refrigerated, Frozen, Deep-Frozen |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| End Use Industries Covered | Fruits and Vegetables, Meat and Fish, Dairy Products, Pharmaceuticals and Healthcare Products |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cold chain warehousing market size was valued at USD 2.5 Billion in 2025.

The Saudi Arabia cold chain warehousing market is expected to grow at a compound annual growth rate of 11.51% from 2026-2034 to reach USD 6.7 Billion by 2034.

Frozen storage dominated the market with a share of 55%, driven by substantial protein imports, expanding domestic poultry production, and growing consumer demand for frozen convenience foods requiring sub-zero temperature maintenance.

Key factors driving the Saudi Arabia cold chain warehousing market include expansion of pharmaceutical and healthcare sectors, rising demand for temperature-sensitive food products, government infrastructure investments, and economic diversification initiatives under Vision 2030.

Major challenges include high operational and energy costs for maintaining temperature-controlled environments, limited availability of skilled workforce specialized in cold chain logistics management, infrastructure gaps in remote regions, and substantial capital investment requirements for facility development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)