Saudi Arabia Cold Pressed Juices Market Size, Share, Trends and Forecast by Category, Distribution Channel, and Region 2026-2034

Saudi Arabia Cold Pressed Juices Market Summary:

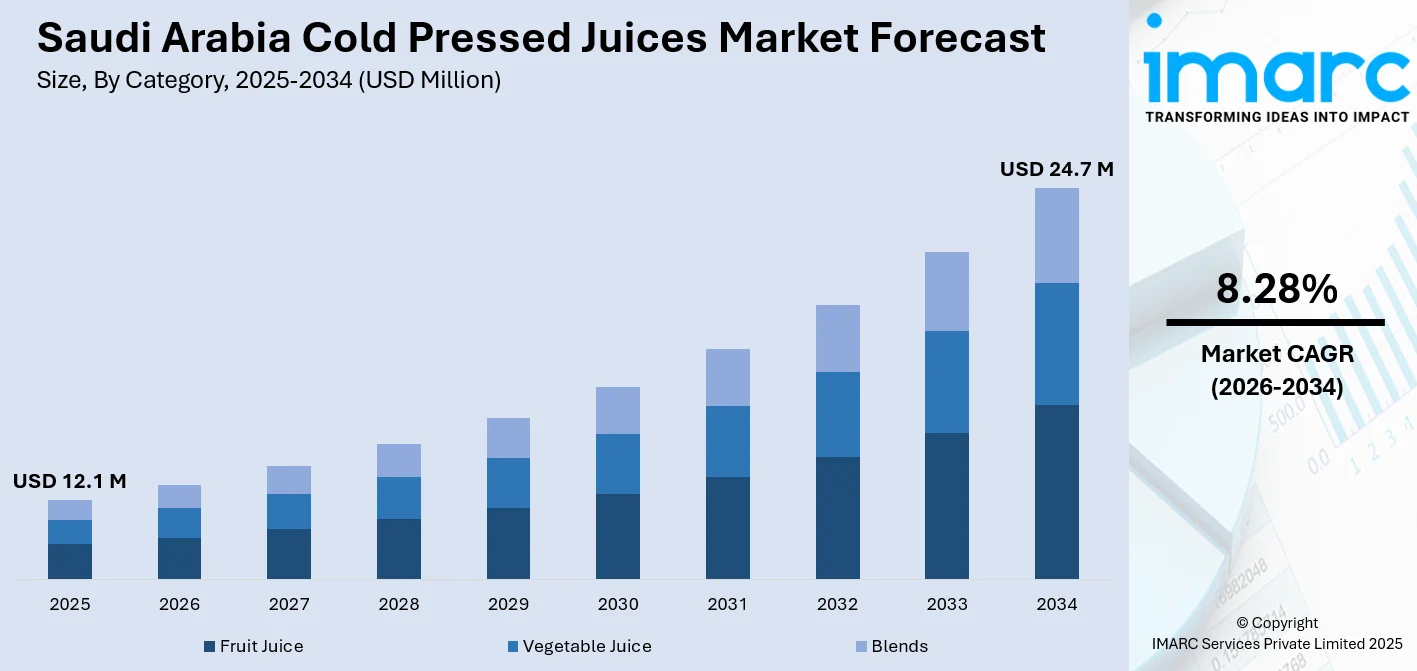

The Saudi Arabia cold pressed juices market size was valued at USD 12.1 Million in 2025 and is projected to reach USD 24.7 Million by 2034, growing at a compound annual growth rate of 8.28% from 2026-2034.

The market is primarily driven by increasing health consciousness among Saudi consumers seeking nutrient-dense alternatives to carbonated beverages and traditional juices. The Kingdom's evolving wellness culture, supported by Vision 2030 initiatives promoting healthier lifestyles, is reshaping beverage consumption patterns. Rising disposable incomes, expanding modern retail infrastructure, and the proliferation of premium juice bars in metropolitan areas are creating favorable conditions for cold pressed juice adoption across diverse consumer segments in the Saudi Arabia cold pressed juices market share.

Key Takeaways and Insights:

- By Category: Fruit juice dominates the market with a share of 53% in 2025, driven by consumer preference for natural fruit-based beverages that offer superior taste profiles along with vitamins and antioxidants essential for daily nutritional requirements.

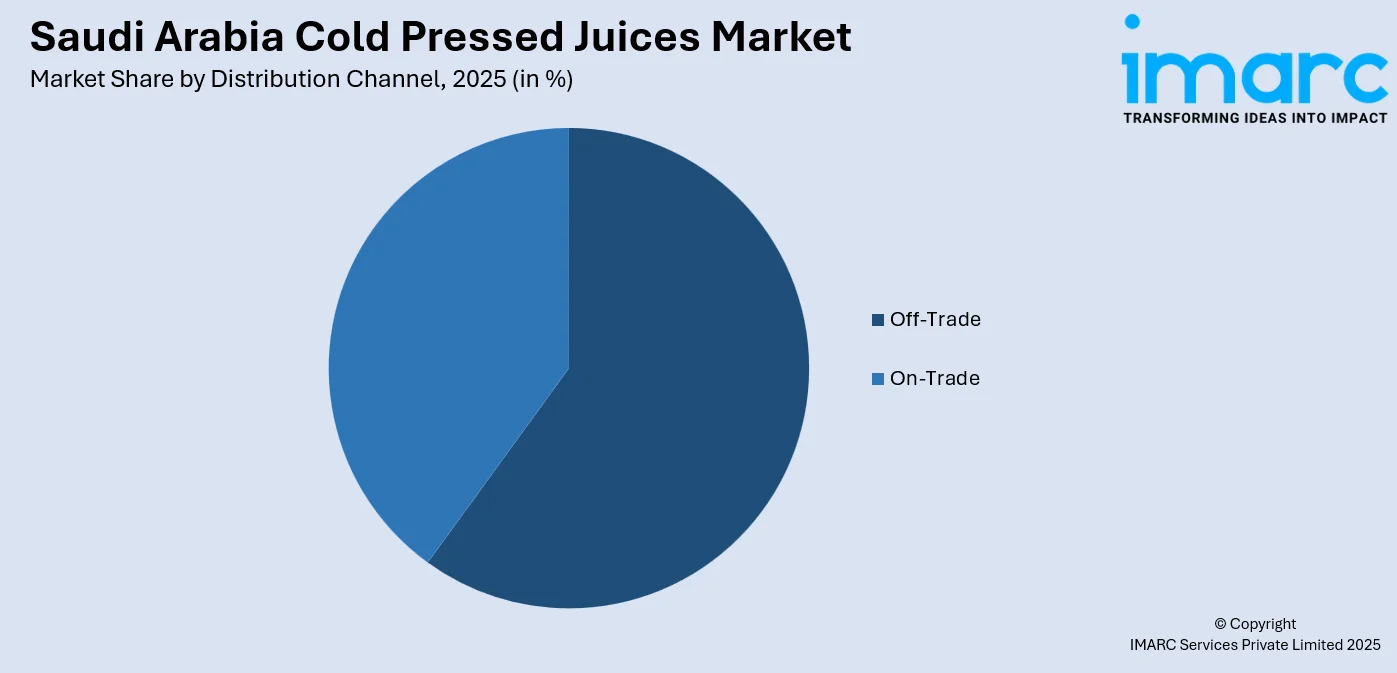

- By Distribution Channel: Off-trade represents the largest segment with a market share of 60% in 2025. This dominance is supported by the expansion of supermarkets, hypermarkets, and specialty health food stores offering dedicated sections for premium cold pressed products.

- By Region: Northern and Central Region lead the market with a share of 32% in 2025, owing to the concentration of health-conscious urban populations in Riyadh metropolitan area, higher purchasing power, and superior retail infrastructure supporting premium beverage distribution.

- Key Players: The Saudi Arabia cold pressed juices market exhibits a competitive landscape characterized by the presence of local juice bar chains, regional beverage manufacturers, and international premium brands competing across various price segments and distribution channels.

To get more information on this market Request Sample

The Saudi Arabia cold pressed juices market is driven by rising health awareness and increasing concern over lifestyle related conditions. As per the information provided by the 2024 National Health Survey conducted by the General Authority for Statistics (GSTAT), 23.1% of adults and 14.6% of children in Saudi Arabia are affected by obesity, underscoring the need for healthier dietary choices. This growing health challenge is encouraging consumers to reduce sugar intake and seek natural, nutrient rich beverage alternatives. Cold pressed juices benefit from their perception as minimally processed products with higher nutritional value. Furthermore, the expanding modern retail and online grocery platforms, improved cold chain infrastructure, and supportive national initiatives promoting healthier lifestyles are contributing to the market growth. The rising disposable income and increased participation in fitness and wellness activities further drive the demand for cold pressed juices. Together, these factors are accelerating adoption and positioning cold pressed juices as a preferred functional beverage option across key consumer segments.

Saudi Arabia Cold Pressed Juices Market Trends:

Increasing Prevalence of Lifestyle Related Health Conditions

The rising prevalence of obesity, diabetes, and cardiovascular conditions is reshaping dietary choices across Saudi Arabia, with consumers increasingly limiting sugar intake and avoiding heavily processed beverages. As per the 2024 National Health Survey and the Woman and Child Health Survey, 18.95% of adults stated at least one chronic illness, including diabetes at 9.1%, high cholesterol at 3.6%, heart and vascular diseases at 1.5%, and cancer at 0.6%. This health burden is encouraging adoption of beverages perceived as supportive of daily wellness. Cold pressed juices benefit from this shift due to their association with natural ingredients and nutrient retention.

Expansion of Modern Retail and E-Commerce Channels

The rapid expansion of modern retail formats and online grocery platforms is improving consumer access to cold pressed juices across Saudi Arabia. Supermarkets, hypermarkets, specialty health stores, and digital delivery services are increasing product visibility and purchase convenience for premium beverages. According to the International Trade Administration, the number of internet users participating in e commerce in Saudi Arabia is projected to reach 33.6 million by 2024, reflecting strong digital retail adoption. This growth is supported by improved refrigeration and in store display infrastructure that preserves product quality.

Growing Aging Population and Preventive Nutrition Demand

Saudi Arabia’s aging population is catalyzing the demand for preventive nutrition and daily wellness solutions. Older individuals are more focused on dietary choices that support digestion immunity and overall vitality while remaining easy to consume. The Elderly Survey 2025 reported that approximately 1.7 million people in Saudi Arabia were aged 60 years and above accounting for 4.8% of the total population highlighting the growing size of this consumer group. This demographic trend is encouraging demand for beverages that are easy to consume and nutritionally supportive. Cold pressed juices benefit from their natural composition hydration value and lower reliance on additives, supporting steady consumption among mature consumers seeking gentle nutrition aligned with long term health goals.

How Vision 2030 is Transforming the Saudi Arabia Cold Pressed Juices Market:

Saudi Vision 2030 is reshaping the cold pressed juices market by encouraging healthier lifestyles, food sector diversification, and local manufacturing growth. Government focus on preventive healthcare, nutrition awareness, and reduced lifestyle related diseases is increasing consumer preference for natural, minimally processed beverages. Investments under Vision 2030 are supporting food processing facilities, cold chain infrastructure, and small and medium-sized enterprise (SME) participation, enabling domestic juice brands to scale production and improve quality standards. The rise of tourism and hospitality sector is also driving the demand for premium health focused beverages across hotels, cafes, and wellness centers. In addition, regulatory support for clean labeling and food safety is strengthening consumer trust, positioning cold pressed juices as a growing segment within Saudi Arabia’s evolving beverage industry.

Market Outlook 2026-2034:

The Saudi Arabia cold pressed juices market shows growth potential over the forecast period, supported by shifting consumer preferences toward natural, fresh, and nutrient rich beverage options. Rising health awareness, increasing disposable income, and demand for clean label products are strengthening the market growth. The market generated a revenue of USD 12.1 Million in 2025 and is projected to reach a revenue of USD 24.7 Million by 2034, growing at a compound annual growth rate of 8.28% from 2026-2034. Expanding retail availability, product innovation, and the growing adoption among urban consumers are expected to sustain demand across the Kingdom.

Saudi Arabia Cold Pressed Juices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Category |

Fruit Juice |

53% |

|

Distribution Channel |

Off-Trade |

60% |

|

Region |

Northern and Central Region |

32% |

Category Insights:

- Fruit Juice

- Vegetable Juice

- Blends

Fruit juice dominates with a market share of 53% of the total Saudi Arabia cold pressed juices market in 2025.

Fruit juice represents the largest segment due to strong consumer preference for naturally sweet, refreshing, and familiar flavor profiles. High fruit availability and widespread acceptance across age groups support consistent demand within both retail and foodservice channels.

The category also benefits from its association with natural energy, hydration, and essential nutrients, aligning well with health focused consumption trends. The growing awareness about vitamin intake and immunity support further strengthens the popularity of fruit based cold pressed juice offerings.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Stores

- Others

Off-trade leads with a market share of 60% of the total Saudi Arabia cold pressed juices market in 2025.

Off-trade (supermarkets/hypermarkets, convenience/grocery stores, online stores, and others) holds the biggest market share owing to the strong presence of supermarkets, hypermarkets, and convenience stores. These outlets provide wide product availability, competitive pricing, and convenient access for consumers seeking health focused beverage options.

The dominance of off trade channels is reinforced by expanding online grocery platforms and home delivery services. The Ministry of Commerce announced that by the fourth quarter of 2024, Saudi Arabia recorded 40,953 registered e-commerce companies, reflecting 10% annual growth. These channels enable brand comparison, nutritional review, and bulk purchasing, supporting higher sales volumes.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibit a clear dominance with a 32% share of the total Saudi Arabia cold pressed juices market in 2025.

Northern and Central Region lead the market because of higher urbanization levels, stronger purchasing power, and a dense concentration of modern retail outlets. Cities like Riyadh serve as economic hubs, driving demand for premium health beverages through supermarkets, cafes, and wellness focused outlets.

This regional dominance is further supported by a growing working population and increased adoption of healthy lifestyles. Better cold chain infrastructure, wider product availability, and strong presence of fitness centers and wellness focused establishments drive consistent consumer demand. In 2025, GymNation launched its largest and most advanced 77,000 square foot fitness facility in Qurtubah, Riyadh, reinforcing wellness culture.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cold Pressed Juices Market Growing?

Improvement in Cold Chain and Logistics Infrastructure

Investments in cold storage, refrigerated transport, and distribution infrastructure are significantly improving product availability and shelf life management for cold pressed juices in Saudi Arabia. In 2025, Starlinks announced the launch of Polaris, Riyadh’s most advanced cold chain warehouse, covering 40,000 square meters and designed to serve the food, pharmaceutical, and FMCG sectors with multi temperature storage, advanced automation, and high-capacity throughput. Such infrastructure developments enhance logistics efficiency and quality assurance. Improved cold chain reliability enables wider geographic distribution beyond major urban centers, reduces spoilage risks, and encourages retailers to allocate more shelf space to premium refrigerated beverage products.

Rise in Tourism and Hospitality

Expansion of tourism under national development initiatives is driving the demand for health focused beverages across Saudi Arabia. Hotels, resorts, and wellness retreats increasingly incorporate premium beverage options to meet expectations of both international and domestic visitors. As per the government data, in the first quarter of 2025, Saudi Arabia recorded a 9.7 percent increase in international visitor spending compared to the same period in 2024, reflecting strong growth in tourism activity. This rise in visitor numbers supports greater consumption within hospitality settings. Cold pressed juices align well with hospitality trends centered on wellness sustainability and high-quality dining experiences, contributing to the market growth.

Shifting Consumer Preferences Toward Clean Label Products

Consumers in Saudi Arabia are focused on ingredient transparency and product composition, catalyzing the demand for clean label beverages. Cold pressed juices align with this preference by emphasizing natural ingredients minimal processing and the absence of preservatives. In 2025, Saudi Arabia introduced new food packaging and labelling regulations for fruits and vegetables, requiring clear product information and the use of food grade durable and recyclable materials. These regulatory measures reinforce consumer trust and accountability across the food sector. As awareness about artificial additives is growing, there is a rise in the demand for beverages perceived as fresh nutritionally supportive and aligned with transparent labeling standards, positively influencing the market.

Market Restraints:

What Challenges the Saudi Arabia Cold Pressed Juices Market is Facing?

Premium Pricing Constraints Limiting Mass Market Penetration

Cold pressed juices are priced significantly higher than conventional juice products, which limits adoption among price sensitive consumers. The premium reflects higher costs linked to specialized extraction equipment, high quality raw ingredients, and strict cold storage requirements. These factors restrict penetration beyond affluent urban consumers and limit volume growth across broader retail markets.

Short Shelf Life and Cold Chain Infrastructure Requirements

Cold pressed juices have a short shelf life due to the absence of preservatives, creating complex storage and distribution challenges. Continuous refrigeration is required from production to retail, which results in higher operational costs. Limited cold chain infrastructure in remote and smaller markets further constrains geographic expansion and increases product spoilage risks.

Limited Consumer Awareness in Secondary Markets

Awareness about cold pressed juice benefits remains low in secondary cities and smaller towns. Many consumers do not clearly differentiate cold pressed products from traditional juices. This knowledge gap increases the need for educational marketing, sampling, and branding efforts, raising customer acquisition costs and slowing adoption outside major metropolitan areas.

Competitive Landscape:

The Saudi Arabia cold pressed juices market exhibits a competitive landscape characterized by the presence of local juice bar chains, regional beverage manufacturers, and international premium brands competing across diverse price segments and distribution channels. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing advanced cold pressing technologies and organic ingredients to value-oriented products targeting emerging health-conscious consumer segments. The competitive landscape is increasingly shaped by product innovation, sustainable packaging initiatives, and digital marketing effectiveness in reaching health-aware consumers through social media and influencer partnerships. Local players benefit from understanding regional taste preferences and established distribution relationships, while international brands leverage global expertise in cold pressed formulations and premium brand positioning.

Saudi Arabia Cold Pressed Juices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Fruit Juice, Vegetable Juice, Blends |

| Distribution Channels Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cold pressed juices market size was valued at USD 12.1 Million in 2025.

The Saudi Arabia cold pressed juices market is expected to grow at a compound annual growth rate of 8.28% from 2026-2034 to reach USD 24.7 Million by 2034.

Fruit juice dominates the market with 53% share in 2025, driven by consumer preference for natural fruit-based beverages offering vitamins and antioxidants.

Key factors driving the Saudi Arabia cold pressed juices market include the rapid expansion of modern retail and online grocery platforms, supported by an estimated 33.6 million e-commerce users by 2024. Improved refrigeration infrastructure, stronger digital delivery networks, and wider product visibility are increasing convenience and supporting consistent demand for premium health focused beverages.

Major challenges include premium pricing constraints limiting mass market penetration, short shelf life requiring extensive cold chain infrastructure, limited consumer awareness in secondary markets, and logistical complexities associated with maintaining product quality during distribution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)