Saudi Arabia Command and Control System Market Size, Share, Trends and Forecast by Platform, Solution, Application, and Region, 2026-2034

Saudi Arabia Command and Control System Market Overview:

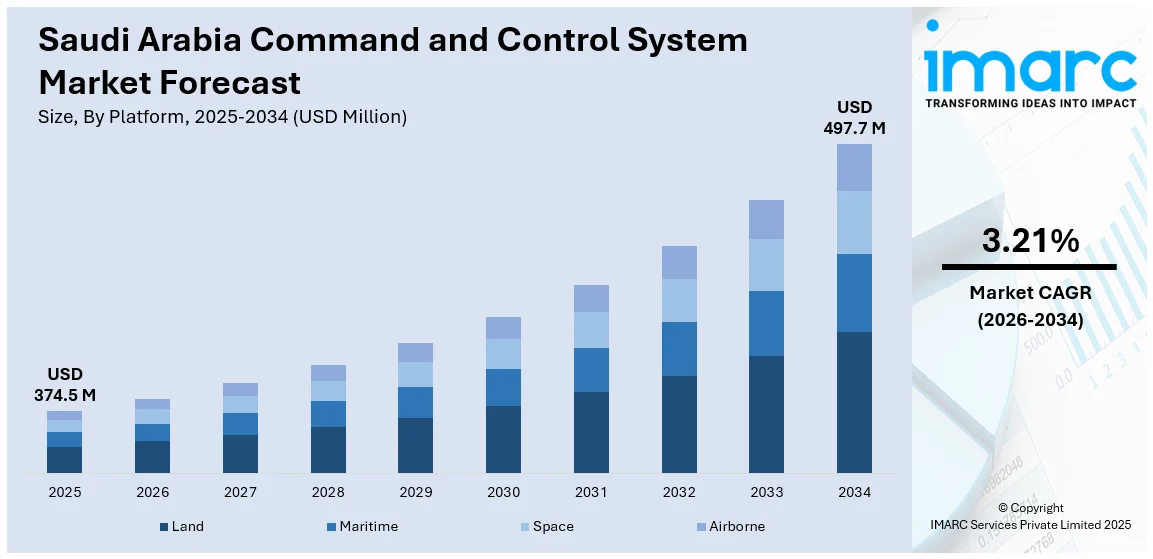

The Saudi Arabia command and control system market size reached USD 374.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 497.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.21% during 2026-2034. The market is driven by rising defense spending, geopolitical tensions, and Vision 2030’s push for advanced security infrastructure. Demand for integrated, AI-powered C2 solutions, smart city projects, and border security enhancements further fuels growth. Additionally, increasing cyber threats are accelerating investments in secure, resilient command systems, enhancing market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 374.5 Million |

| Market Forecast in 2034 | USD 497.7 Million |

| Market Growth Rate 2026-2034 | 3.21% |

Saudi Arabia Command and Control System Market Trends:

Increasing Demand for Integrated Command and Control Systems

The growing demand for integrated solutions that enhance operational efficiency across defense, security, and critical infrastructure sectors is expanding the Saudi Arabia command and control system market share. With rising geopolitical tensions and the need for advanced surveillance, government and military agencies are investing in unified C2 platforms that consolidate data from multiple sources, such as drones, radar systems, and IoT sensors. These integrated systems enable real-time decision-making, improving situational awareness and response times. Additionally, Vision 2030’s focus on modernizing national security infrastructure is driving the procurement of smart city and border control solutions. Saudi Arabia ranked as the safest of all G20 countries in the 2023 Safety Index, where 92.6 percent of the country's residents said they feel safe walking alone in their local area at night. This figure highlights the success of the nation’s residential security protocols, which utilize cutting-edge security technology. These initiatives are part of Saudi Vision 2030 efforts that seek to enhance security and quality of life across the Kingdom. Key players are introducing AI-powered analytics and cloud-based C2 systems to meet these demands, fostering Saudi Arabia command and control system market growth. As Saudi Arabia continues to prioritize technological advancements in defense and public safety, the adoption of interoperable C2 systems is expected to accelerate significantly in the coming years.

To get more information on this market Request Sample

Expansion of Cybersecurity Measures in Command and Control Systems

The market is experiencing a rise in cybersecurity investments to protect critical command centers from cyber threats. As digital transformation accelerates in defense and homeland security, the risk of cyberattacks on C2 networks has increased, prompting stricter regulatory frameworks and advanced encryption technologies. Saudi Arabia experienced over 180 major cyber incidents in 2023, while 47% of hacked data linked to domestic organizations was offered for sale on the dark web. Moreover, more than 50 million email threats and 34 million malware attacks were blocked. This data underlines the urgency for cybersecurity, risk and compliance solutions to protect national infrastructure and compliance with the regulatory framework. The government is collaborating with global cybersecurity firms to implement multi-layered defense mechanisms, including zero-trust architectures and AI-driven threat detection. Furthermore, the rise of smart city projects and IoT-based surveillance systems has increased the need for secure C2 platforms to prevent data breaches. With Saudi Arabia emerging as a regional hub for defense technology, vendors are focusing on developing cyber-resilient C2 solutions to safeguard sensitive military and civilian operations. This trend is creating a positive Saudi Arabia command and control system market outlook, aligning with the Kingdom’s Vision 2030 goals for a secure digital future.

Saudi Arabia Command and Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on platform, solution, and application.

Platform Insights:

- Land

- Maritime

- Space

- Airborne

The report has provided a detailed breakup and analysis of the market based on the platform. This includes land, maritime, space, and airborne.

Solution Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes hardware, software, and services.

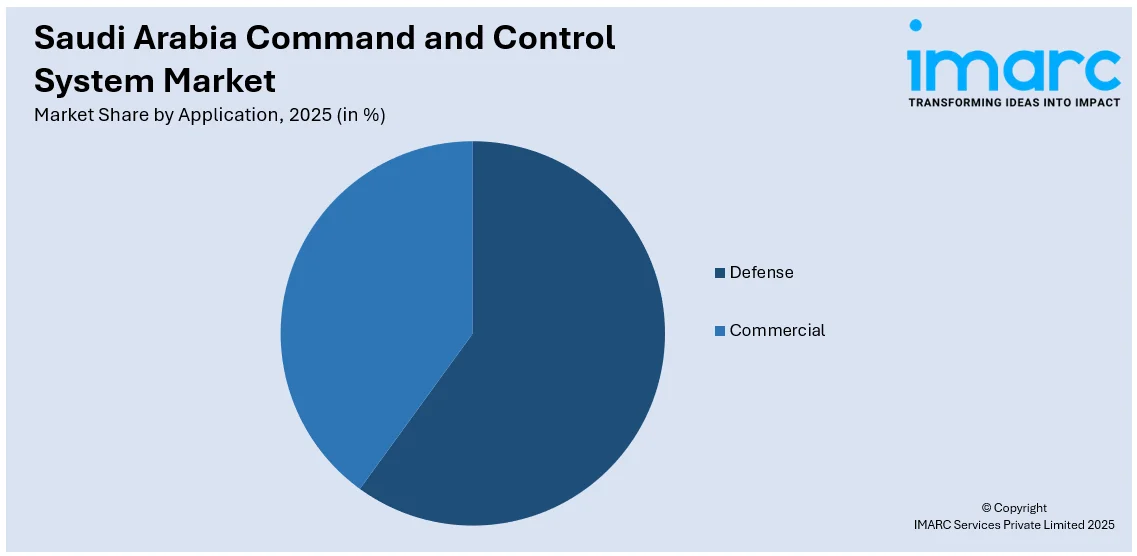

Application Insights:

Access the comprehensive market breakdown Request Sample

- Defense

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes defense and commercial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Command and Control System Market News:

- February 21, 2025: MARSS, a UK company, has delivered, as part of a contract worth in excess of USD 50 Million and announced at IDEX 2025, two AI-augmented NiDAR 4D command and control systems to naval bases in the Gulf region, including Saudi Arabia. A sophisticated C4 platform combines multi-domain sensors with AI-powered threat assessment to improve real-time situational awareness and facilitate autonomous risk management. This is a major upgrade to Saudi Arabia's command and control, including extensive operational support and training.

- September 27, 2024: Raytheon delivered the first of seven AN/TPY-2 missile defense radars to Saudi Arabia under a USD 2.3 Billion deal. This delivery augments the nation’s command and control architecture as part of a larger USD 15 Billion THAAD-based air defense program. The use of Gallium Nitride (GaN) technology enhances long-range detection, threat identification, and missile tracking capabilities in land, sea and air domains for the radar system. This development underscores the growing importance of advanced C2 systems in modern defense strategies, particularly in Saudi Arabia that faces complex security challenges.

Saudi Arabia Command and Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Land, Maritime, Space, Airborne |

| Solutions Covered | Hardware, Software, Services |

| Applications Covered | Defense, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia command and control system market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia command and control system market on the basis of platform?

- What is the breakup of the Saudi Arabia command and control system market on the basis of solution?

- What is the breakup of the Saudi Arabia command and control system market on the basis of application?

- What is the breakup of the Saudi Arabia command and control system market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia command and control system market?

- What are the key driving factors and challenges in the Saudi Arabia command and control system market?

- What is the structure of the Saudi Arabia command and control system market and who are the key players?

- What is the degree of competition in the Saudi Arabia command and control system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia command and control system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia command and control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia command and control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)