Saudi Arabia Commercial Telematics Market Size, Share, Trends and Forecast by Type, System Type, Provider Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Commercial Telematics Market Overview:

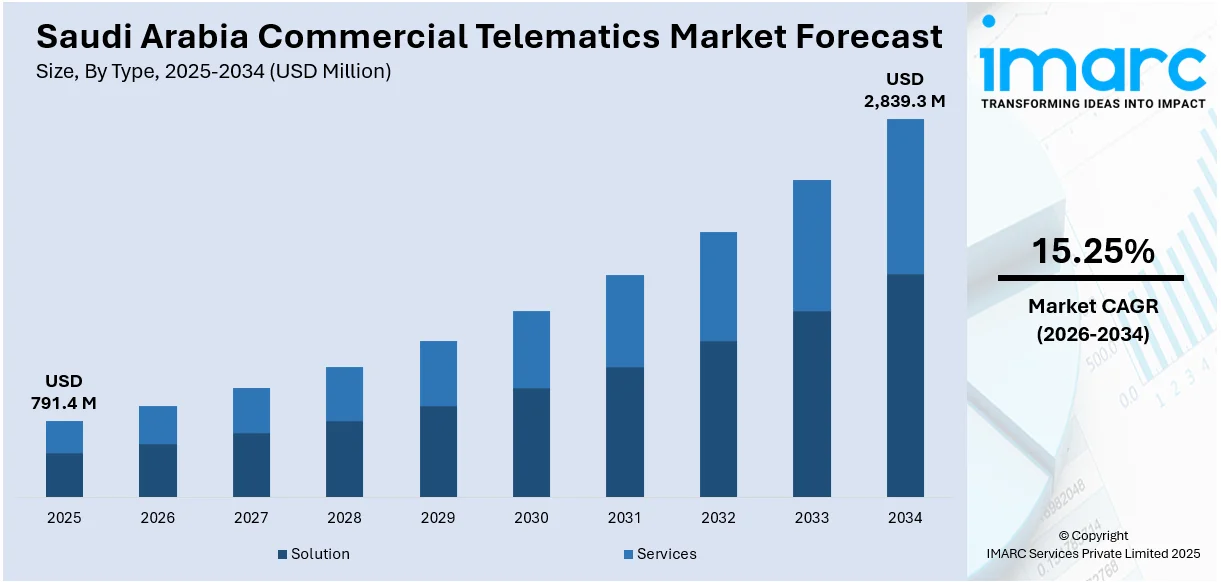

The Saudi Arabia commercial telematics market size reached USD 791.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,839.3 Million by 2034, exhibiting a growth rate (CAGR) of 15.25% during 2026-2034. Saudi Arabia’s digital transformation initiatives and booming e-commerce sector are driving commercial telematics adoption, as smart city investments, regulatory mandates, and rising last-mile delivery demands require logistics and transport companies to enhance efficiency, safety, and real-time fleet management capabilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 791.4 Million |

| Market Forecast in 2034 | USD 2,839.3 Million |

| Market Growth Rate 2026-2034 | 15.25% |

Saudi Arabia Commercial Telematics Market Trends:

Government Initiatives and Smart City Development

Saudi Arabia's drive for digital transformation, in line with Vision 2030, is greatly enhancing the commercial telematics industry. By prioritizing economic diversification, upgrading infrastructure, and implementing technology-driven urban planning, the governing authority is establishing a solid foundation for the adoption of telematics. Investments in smart cities and extensive digital infrastructure are directly associated with the implementation of advanced telematics systems, which facilitate functions such as traffic management, emissions control, and public transportation efficiency. Regulatory requirements for vehicle tracking and safety adherence further bolster this trend by promoting the extensive adoption of telematics in commercial fleets. These actions enhance road safety and lessen environmental effects, while also guaranteeing operational efficiency in logistics and transportation services. A notable instance is the initiation of the $1.6 billion “Heart of Khobar” smart city initiative by Tilal Real Estates in 2024. Covering 268,000 square meters, the project in Al Khobar features residential areas, business offices, hotels with 250 rooms, parks, shopping malls, and recreational facilities. Conducted in three stages over four years, the initiative intends to convert the city into a lively urban center. Projects like this highlight how the incorporation of telematics is becoming essential for managing mixed-use infrastructure, improving services, and elevating the quality of urban life. As these projects increase, they generate ongoing demand for telematics solutions and solidify their importance in Saudi Arabia’s digital development pathway.

To get more information on this market Request Sample

Expansion of E-commerce and Last-Mile Delivery Services

The swift rise of the e-commerce industry in Saudi Arabia is contributing to the growth of the commercial telematics market. As online shopping gains popularity, the need for quicker and more dependable delivery services, especially in last-mile logistics, is increasing significantly. Telematics technologies are essential for assisting logistics firms in addressing these needs by facilitating real-time vehicle monitoring, enhancing delivery routes, and guaranteeing on-time drop-offs. These systems help companies track fuel efficiency, vehicle condition, and driver conduct, enhancing resource use and managing operational costs. The need to provide fast, reliable service in a fiercely competitive e-commerce environment makes telematics an essential resource for firms looking to improve their delivery efficiency. In 2024, the value of Saudi Arabia's e-commerce sector was USD 222.9 billion, with projections estimating it will reach USD 708.7 billion by 2033, reflecting a CAGR of 12.8% from 2025 to 2033, as reported by IMARC Group. This significant growth projection indicates a continuous demand for logistics infrastructure that can handle high order volumes swiftly and effectively. As companies expand their operations, employing telematics becomes crucial for overseeing delivery fleets and fulfilling client demands. With more individuals expecting real-time updates and swift deliveries, telematics is no longer optional but foundational for maintaining service standards and staying competitive in Saudi Arabia’s rapidly evolving e-commerce landscape.

Saudi Arabia Commercial Telematics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, system type, provider type, and end use industry.

Type Insights:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

The report has provided a detailed breakup and analysis of the market based on the type. This includes Solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) and services (professional services and managed services).

System Type Insights:

- Embedded

- Tethered

- Smartphone Integrated

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes embedded, tethered, and smartphone integrated.

Provider Type Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes OEM and aftermarket.

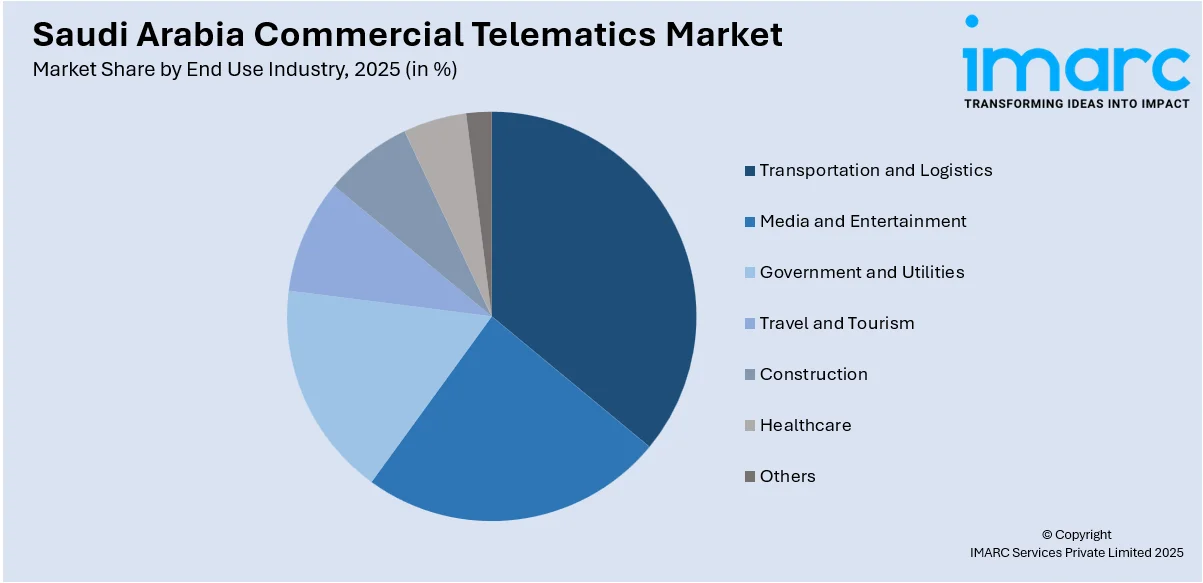

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes transportation and logistics, media and entertainment, government and utilities, travel and tourism, construction, healthcare, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Commercial Telematics Market News:

- In July 2024, Najm for Insurance Services launched a telematics initiative in Saudi Arabia to enhance road safety using AI-driven analytics from Cambridge Mobile Telematics and AiGeNiX. The program measured driving behavior through smart devices, offering insights to reduce accidents and promote safer driving. It aligned with Saudi Arabia’s Vision 2030 goals for smarter, safer transportation.

- In February 2024, Intangles partnered with Bahwan Commercial Company to bring advanced Digital Twin-based telematics solutions to Saudi Arabia and Bahrain. The collaboration focused on predictive maintenance, driver behavior analytics, and mobility efficiency using AI and real-time data. This alliance aimed to enhance safety, sustainability, and innovation in the regional mobility sector.

Saudi Arabia Commercial Telematics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| System Types Covered | Embedded, Tethered, Smartphone Integrated |

| Provider Types Covered | OEM, Aftermarket |

| End Use Industries Covered | Transportation and Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia commercial telematics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia commercial telematics market on the basis of type?

- What is the breakup of the Saudi Arabia commercial telematics market on the basis of system type?

- What is the breakup of the Saudi Arabia commercial telematics market on the basis of provider type?

- What is the breakup of the Saudi Arabia commercial telematics market on the basis of end use industry?

- What is the breakup of the Saudi Arabia commercial telematics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia commercial telematics market?

- What are the key driving factors and challenges in the Saudi Arabia commercial telematics market?

- What is the structure of the Saudi Arabia commercial telematics market and who are the key players?

- What is the degree of competition in the Saudi Arabia commercial telematics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia commercial telematics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia commercial telematics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia commercial telematics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)