Saudi Arabia Commercial Vehicle Market Size, Share, Trends and Forecast by Vehicle Body Type, Propulsion Type, and Region, 2026-2034

Saudi Arabia Commercial Vehicle Market Overview:

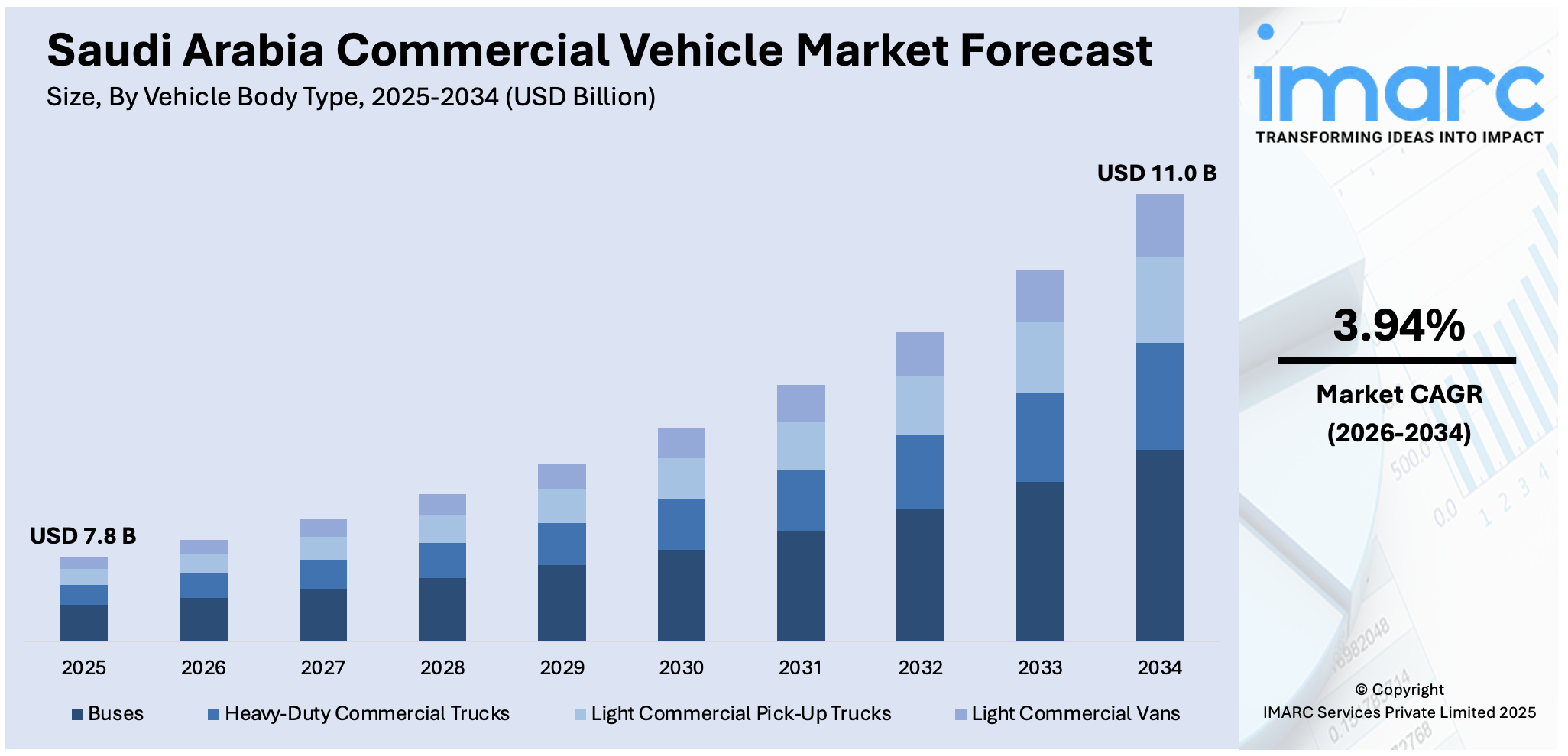

The Saudi Arabia commercial vehicle market size reached USD 7.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2034, exhibiting a growth rate (CAGR) of 3.94% during 2026-2034. The market is driven by the rapid infrastructure development, growing logistics and e-commerce sectors, and government initiatives under Vision 2030 aimed at diversifying the economy. Large-scale projects like NEOM and increased demand for freight and passenger transport are boosting vehicle sales. Additionally, modernization of public transport, rising tourism, and improved financing options for fleet operators are bolstering the Saudi Arabia commercial vehicle market share. Environmental regulations and technological advancements are also influencing fleet upgrades toward more efficient and sustainable commercial vehicles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.8 Billion |

| Market Forecast in 2034 | USD 11.0 Billion |

| Market Growth Rate 2026-2034 | 3.94% |

Saudi Arabia Commercial Vehicle Market Trends:

Surging Demand for Light Commercial Vehicles (LCVs)

The market for Saudi Arabia's light commercial vehicles (LCVs) is booming with the growth of e-commerce, development of small and medium-sized businesses (SMEs), and increasing urban logistics needs. LCVs like pickups and vans are essential for last-mile delivery and small-level transportation. Strong-selling models by Toyota (Hilux), Ford, and Nissan are taking over the market. Economic diversification under Vision 2030 is further accelerating demand, with industries such as retail, healthcare, and food delivery witnessing an increase in demand. Demand is also changing driven by the modernization of fleets, enhanced financing solutions, and digitalized fleet management technology to improve operating efficiency. Policy shifts, including the tightening of emissions regulations and safety standards, are impacting vehicle specs. As urban areas keep expanding at high rates, LCVs come in handy as a critical determinant of effective and adaptable transportation of goods and services, complementing the Kingdom's changing business climate.

To get more information on this market Request Sample

Heavy-Duty Truck Market

Saudi Arabia's Vision 2030 seeks to diversify the economy and increase public services via large-scale infrastructure projects, such as NEOM and Qiddiya, with significant developments made in February 2025. These projects have greatly increased demand in the heavy-duty truck segment, which plays a significant role in supporting construction, logistics, and national development. Top manufacturers like Volvo, Mercedes-Benz, and MAN produce strong vehicles that are specifically designed for tough desert conditions. Investments in oil, mining, and road infrastructure further drive Saudi Arabia commercial vehicle market growth. Fleet operators place greater importance on reliability, fuel efficiency, and robust after-sales support. Also, growing environmental issues are prompting a move toward cleaner engine technologies. With the support of both public and private sectors, the market is poised for steady growth, acting as a pillar to the Kingdom's ambitious modernization and infrastructure projects.

Bus and Passenger Transport Vehicle Market

Saudi Arabia's bus and passenger transport vehicle industry is developing at a frantic pace with growth in public transportation infrastructure. Supported by government-initiated schemes like the Riyadh Metro and city buses, the demand for high-end, fuel-efficient buses has gained momentum. Firms such as SAPTCO and private transportation companies are looking to deploy air-conditioned vehicles, safety equipment, and environmentally friendly engines in their fleets. Tourism expansion and pilgrimage travel to Mecca and Medina also play a major role, with high-capacity buses carrying millions of Hajj and Umrah pilgrims every year. Companies like Mercedes-Benz, King Long, and Yutong are major suppliers. The market is also reacting to rising urbanization and attempts to cut car dependency, with buses playing a key role in sustainable urban mobility plans.

Saudi Arabia Commercial Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on vehicle body type and propulsion type.

Vehicle Body Type Insights:

- Buses

- Heavy-Duty Commercial Trucks

- Light Commercial Pick-Up Trucks

- Light Commercial Vans

The report has provided a detailed breakup and analysis of the market based on the vehicle body type This includes buses, heavy-duty commercial trucks, light commercial pick-up trucks, and light commercial vans.

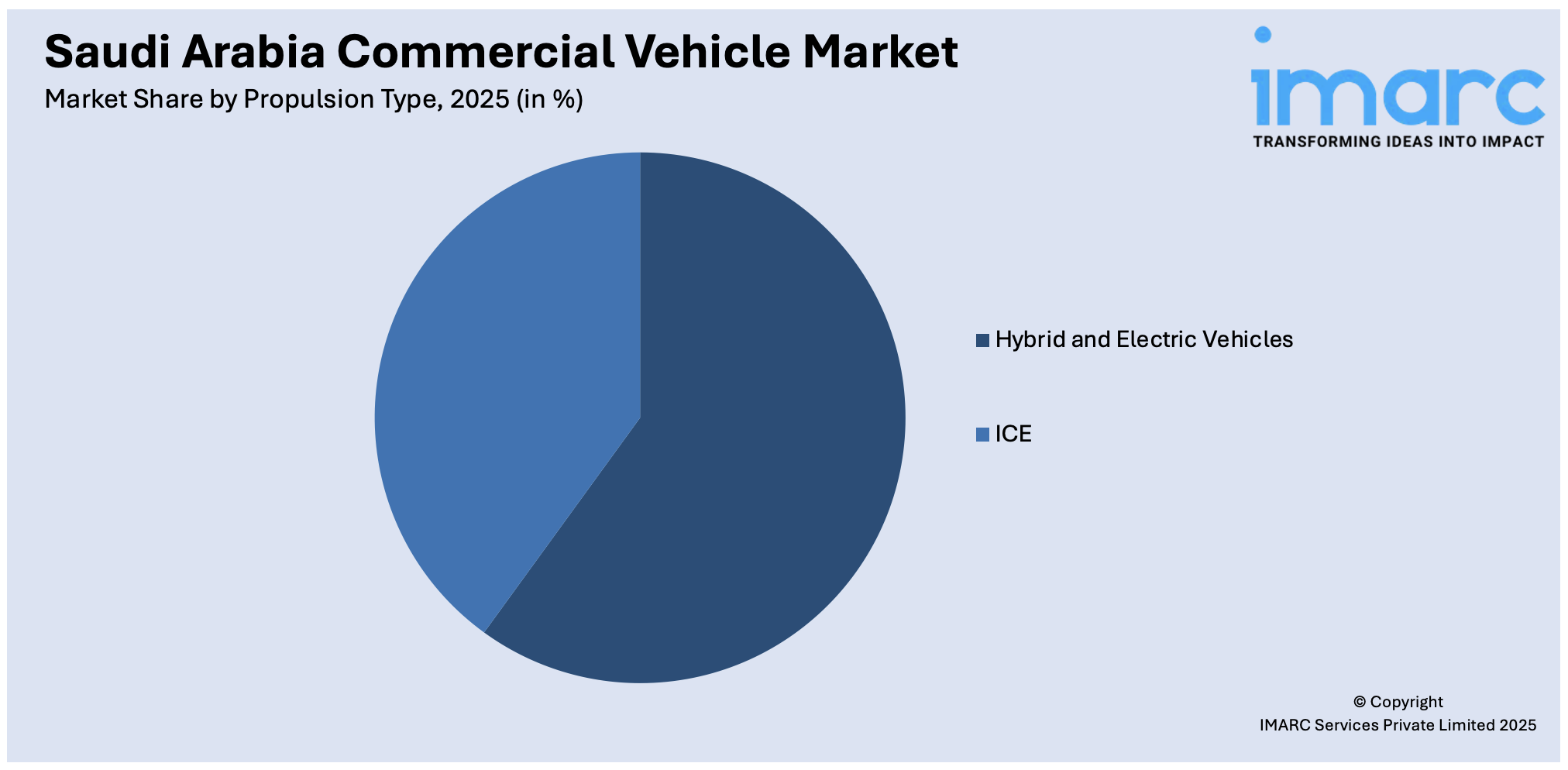

Propulsion Type Insights:

Access the comprehensive market breakdown Request Sample

- Hybrid and Electric Vehicles

- Fuel Category

- BEV

- FCEV

- HEV

- PHEV

- Fuel Category

- ICE

- Fuel Category

- CNG

- Diesel

- Gasoline

- LPG

- Fuel Category

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes hybrid and electric vehicles [fuel category (BEV, FCEV, HEV, and PHEV)] and ICE [fuel category (CNG, diesel, gasoline, and LPG)].

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central, Western, Eastern, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Commercial Vehicle Market News:

- In May 2025, Victory Saudi Arabia launched its 2026 next-generation 2-ton diesel commercial trucks at an event in Riyadh, in partnership with dealer Motiat Alkhair. Featuring fuel-efficient 4-cylinder engines and bold, SUV-inspired designs, the new Victory J models are tailored for Saudi Arabia’s evolving transport needs. Backed by Victory Auto China, the trucks support Vision 2030 goals with lower emissions and long-term reliability, targeting logistics firms, businesses, and independent operators across the Kingdom.

- In February 2024, Budget Saudi Arabia received approval from the Kingdom's competition authority for its acquisition of Auto World, a car leasing and maintenance company. The deal involves increasing Budget's capital by issuing new shares to acquire 100% of Auto World, valued at SR455 million. The transaction, managed through Budget’s subsidiary Rahal, will see Budget's capital rise by 9.84%, from SR711.66 million to SR781.66 million.

Saudi Arabia Commercial Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Body Types Covered | Buses, Heavy-Duty Commercial Trucks, Light Commercial Pick-Up Trucks, Light Commercial Vans |

| Propulsion Types Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia commercial vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia commercial vehicle market on the basis of vehicle body type?

- What is the breakup of the Saudi Arabia commercial vehicle market on the basis of propulsion type?

- What is the breakup of the Saudi Arabia commercial vehicle market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia commercial vehicle market?

- What are the key driving factors and challenges in the Saudi Arabia commercial vehicle market?

- What is the structure of the Saudi Arabia commercial vehicle market and who are the key players?

- What is the degree of competition in the Saudi Arabia commercial vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia commercial vehicle market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia commercial vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia commercial vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)