Saudi Arabia Composite Market Size, Share, Trends and Forecast by Product, MFG Process, Application, and Region, 2026-2034

Saudi Arabia Composite Market Overview:

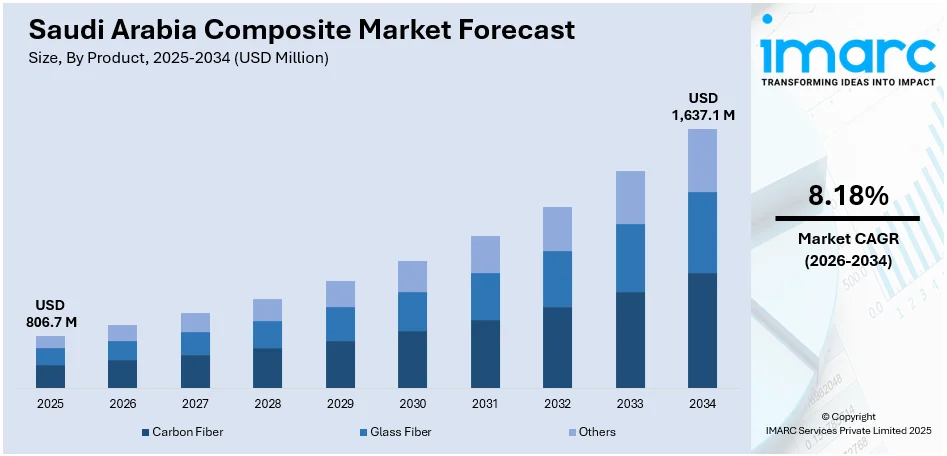

The Saudi Arabia composite market size reached USD 806.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,637.1 Million by 2034, exhibiting a growth rate (CAGR) of 8.18% during 2026-2034. Innovations in composite materials drive the market, enhancing performance and expanding broader applications in major industries. Increasing demand for lightweight, high-performance materials in automotive, aerospace, and construction further speeds up the penetration of composites. Government policies and industry cooperation fosters innovations and play an essential role in further increasing the Saudi Arabia composite market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 806.7 Million |

| Market Forecast in 2034 | USD 1,637.1 Million |

| Market Growth Rate 2026-2034 | 8.18% |

Saudi Arabia Composite Market Trends:

Technological Advancements in Composite Materials

Advances in composite materials technology are one of the principal market growth drivers. The nation is experiencing an increase in high-performance composite developments as well as uptake, particularly in applications like automotive, construction, and oil and gas. As of May 16, 2025, the S&P Kuwait, Saudi Arabia & UAE Composite LargeCap Index stood at 1,678.88, reflecting a 6.19% one-year return. The index tracks large-cap companies domiciled in Saudi Arabia, Kuwait, and the UAE and is a key benchmark for regional equity performance. Advances in composite materials, including carbon fiber, glass fiber, and resin systems, have increased their performance and longevity, making them increasingly desirable for a variety of applications. For instance, improvements in resin infusion methods and automated manufacturing processes are lowering the cost of production and increasing the uniformity of composite products. These advancements are enabling Saudi companies to adopt composites for various industrial applications, including infrastructure, transportation, and energy. The energy sector, in particular, has benefited from the use of composites due to their resistance to corrosion and ability to withstand harsh environmental conditions, which are common in the region. As the development of composite materials continues, the country is positioned to creating new opportunities for industries seeking durable, lightweight, and cost-effective solutions for their operations and leverage these innovations to drive Saudi Arabia composite market growth.

To get more information on this market Request Sample

Rising Demand for High-Performance and Lightweight Materials in Key Sectors

The increasing requirement for high-performance and lightweight materials in critical sectors such as automotive, aerospace, and construction is a major factor fueling the expansion of the Saudi Arabia market. In the automotive industry, the push toward fuel-efficient and environmentally friendly vehicles is leading to greater reliance on composites for lightweight vehicle parts, such as body panels and interior components. Similarly, in the aerospace industry, composite materials are increasingly being used for components like wings, fuselage, and engine parts, owing to their ability to withstand extreme temperatures while maintaining a light weight. In construction, composites are being adopted for structural reinforcement, roofing, and façade materials, offering durability and resistance to the harsh climate of the region. As Saudi Arabia aims to diversify its economy through initiatives like Vision 2030, there is a heightened focus on industries that contribute to sustainable development, with composites playing a vital role in reducing energy consumption and environmental impact. On January 16, 2025, Aramco signed 145 agreements and MoUs worth USD 9 Billion at the IKTVA 2025 Forum to enhance local supply chain capacity and raise in-Kingdom content. Key initiatives included the launch of ASMO’s logistics operations in Riyadh and the inauguration of the Novel Non-Metallic Solutions facility—focused on composite product development—in partnership with Baker Hughes. These developments signal expanded domestic manufacturing and align with Saudi Arabia’s goal to reach a 70% localization rate, up from 67% in 2024, across sectors including chemicals, non-metallics, and advanced engineering. The demand for high-performance materials in these sectors is expected to grow as industries look for solutions that combine strength, lightweight properties, and cost-efficiency, further driving the market.

Saudi Arabia Composite Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, MFG process, and application.

Product Insights:

- Carbon Fiber

- Glass Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes carbon fiber, glass fiber, and others.

MFG Process Insights:

- Layup

- Filament

- Injection Molding

- Pultrusion

- Compression Molding

- RTM

- Others

The report has provided a detailed breakup and analysis of the market based on the MFG process. This includes layup, filament, injection molding, pultrusion, compression molding, RTM, and others.

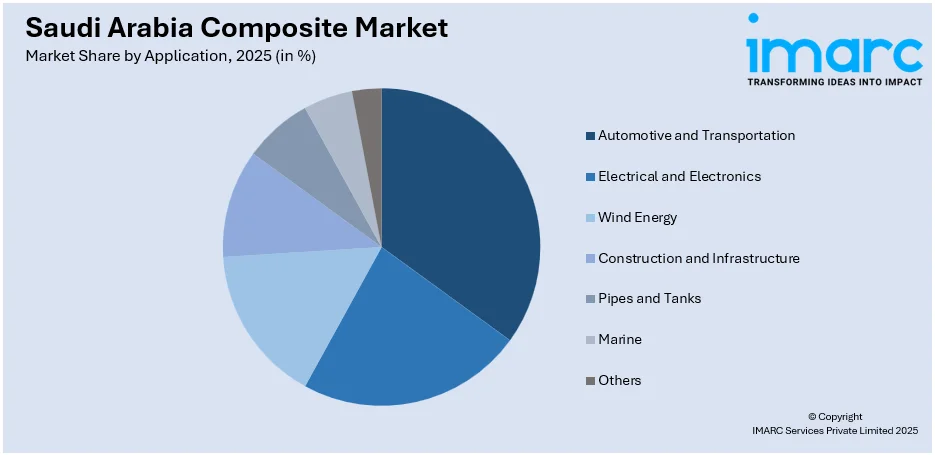

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Electrical and Electronics

- Wind Energy

- Construction and Infrastructure

- Pipes and Tanks

- Marine

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, electrical and electronics, wind energy, construction and infrastructure, pipes and tanks, marine, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Composite Market News:

- On January 27, 2025, Roboze signed a Memorandum of Understanding with SLB to expand its additive manufacturing operations in Saudi Arabia, focusing on the local production of SLB-qualified non-metallic and composite components. The partnership, announced during the IKTVA 2025 Forum in Dhahran, aims to support Vision 2030 by reducing supply chain dependency and enabling on-demand production using high-performance polymers like PEEK and Carbon Fiber PEEK. This move reinforces Saudi Arabia's push to build domestic capabilities in advanced composite manufacturing.

Saudi Arabia Composite Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carbon Fiber, Glass Fiber, Others |

| MFG Processes Covered | Layup, Filament, Injection Molding, Pultrusion, Compression Molding, RTM, Others |

| Applications Covered | Automotive and Transportation, Electrical and Electronics, Wind Energy, Construction and Infrastructure, Pipes and Tanks, Marine, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia composite market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia composite market on the basis of product?

- What is the breakup of the Saudi Arabia composite market on the basis of MFG process?

- What is the breakup of the Saudi Arabia composite market on the basis of application?

- What is the breakup of the Saudi Arabia composite market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia composite market?

- What are the key driving factors and challenges in the Saudi Arabia composite market?

- What is the structure of the Saudi Arabia composite market and who are the key players?

- What is the degree of competition in the Saudi Arabia composite market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia composite market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia composite market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia composite industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)