Saudi Arabia Concrete Market Size, Share, Trends and Forecast by Concrete Type, Application, End Use Industry, and Region, 2026-2034

Saudi Arabia Concrete Market Overview:

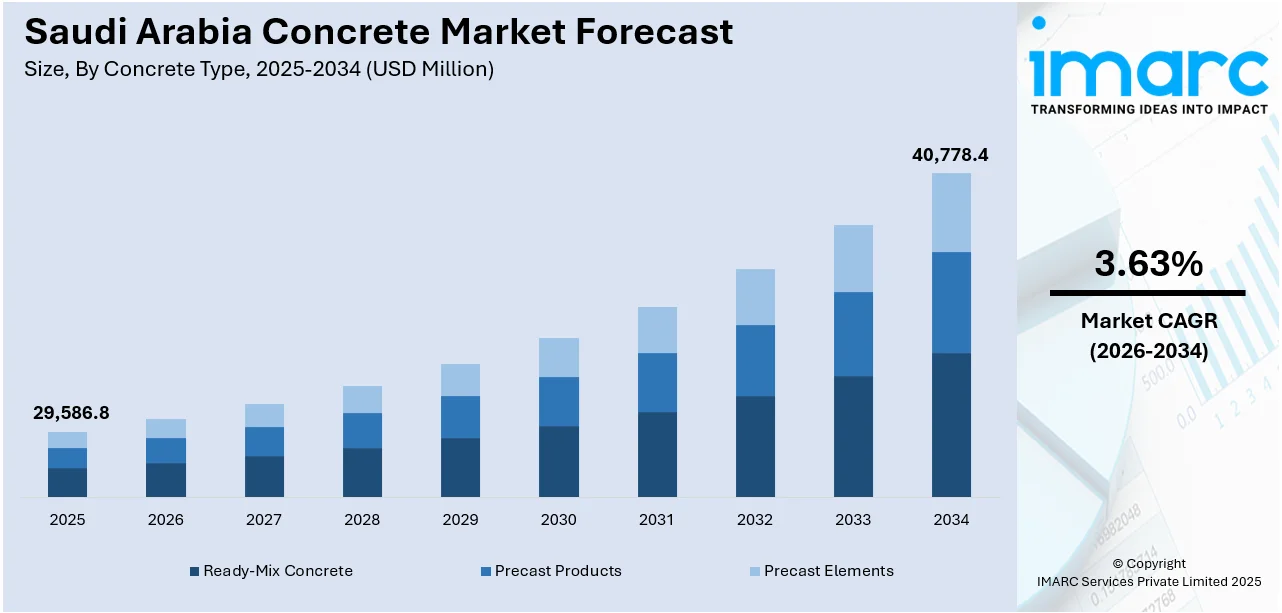

The Saudi Arabia concrete market size reached USD 29,586.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 40,778.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.63% during 2026-2034. The market is driven by Vision 2030-backed urban mega-projects requiring advanced concrete for high-performance, climate-adapted infrastructure. Domestic industrial policy is strengthening local production capacity, ensuring material reliability across major developments, thereby fueling the market. Rising sustainability mandates and new green construction codes are accelerating the shift to environmentally certified, low-emission concrete materials, further augmenting the Saudi Arabia concrete market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 29,586.8 Million |

| Market Forecast in 2034 | USD 40,778.4 Million |

| Market Growth Rate 2026-2034 | 3.63% |

Saudi Arabia Concrete Market Trends:

Vision 2030 Infrastructure Development and Urban Mega-Projects

Saudi Arabia’s long-term strategic framework, Vision 2030, is reshaping the national infrastructure landscape with large-scale, capital-intensive developments. High-profile initiatives such as NEOM, The Line, Qiddiya, and the Red Sea Project are heavily reliant on advanced concrete technologies for foundational, structural, and environmental durability. These giga-projects span urban, tourism, and industrial sectors, requiring substantial volumes of concrete with specialized properties, ranging from high-performance mixes to corrosion-resistant formulations suitable for coastal and desert environments. A recent study examining the impact of various concrete grades on sustainability and cost found that the C70 mixture, compared to the base C40 mixture, led to a 33% cost reduction and a 27% decrease in environmental impact. Additionally, it highlighted that the selection of concrete grades significantly affects both embodied carbon (EC) emissions and construction costs, emphasizing the need for balancing environmental and economic factors in Saudi Arabia's growing construction sector. As traditional oil revenue models diversify, infrastructure plays a central role in catalyzing economic transition. The Ministry of Municipal and Rural Affairs and Housing is also driving urban renewal in Riyadh, Jeddah, and Makkah, focusing on road networks, smart mobility infrastructure, and public housing. These developments demand time-efficient, climate-adapted, and high-strength concrete solutions to meet accelerated construction schedules under harsh environmental conditions. Furthermore, the incorporation of digital tools like BIM and automated site monitoring enhances quality control and material planning for large-scale builds, which are central to Saudi Arabia concrete market growth.

To get more information on this market Request Sample

Sustainability Mandates and Green Construction Regulations

Saudi Arabia has begun enforcing environmental regulations across key sectors, including construction, as part of its broader commitments under the Saudi Green Initiative and Middle East Green Initiative. These mandates aim to reduce carbon emissions and water consumption, directly affecting concrete production and application standards. Traditional concrete practices are being revised, with a strong push for blended cements, recycled aggregates, and alternative binders that reduce clinker content. Major developers are implementing procurement policies that favor low-carbon concrete certified through Environmental Product Declarations (EPDs). On October 8, 2024, NEOM announced the establishment of a SAR 700 million (USD 186.7 million) ready-mix concrete facility in partnership with Asas Al-Mohileb to support the construction of THE LINE. The state-of-the-art facility is designed to produce over 20,000 cubic meters of green concrete daily, incorporating carbon capture and utilization technologies. The plant, expected to generate over 500 local jobs, is set to begin peak production in January 2025, contributing to NEOM's rapid development under Saudi Arabia's Vision 2030. In addition, the government is gradually tightening building codes through the Saudi Building Code (SBC), requiring lifecycle assessments and sustainability benchmarks for large-scale developments. Water-efficient curing technologies and dry batching systems are also being promoted, especially in water-stressed regions. These shifts align with investor and stakeholder expectations surrounding ESG compliance, further encouraging the adoption of sustainable construction materials. As the construction ecosystem adapts to these green mandates, materials with proven environmental performance credentials are being prioritized.

Saudi Arabia Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on concrete type, application, and end use industry.

Concrete Type Insights:

- Ready-Mix Concrete

- Transit Mix Concrete

- Central Mix Concrete

- Shrink Mix Concrete

- Precast Products

- Paving Stones and Slabs

- Bricks

- AAC Blocks

- Others

- Precast Elements

- Facade

- Floor

- Building blocks

- Pipe

- Others

The report has provided a detailed breakup and analysis of the market based on the concrete type. This includes ready-mix concrete (transit mix concrete, central mix concrete, and shrink mix concrete), precast products (paving stones and slabs, bricks, AAC blocks, and others), and precast elements (facade, floor, building blocks, pipe, and others).

Application Insights:

Access the comprehensive market breakdown Request Sample

- Reinforced Concrete

- Non-Reinforced Concrete

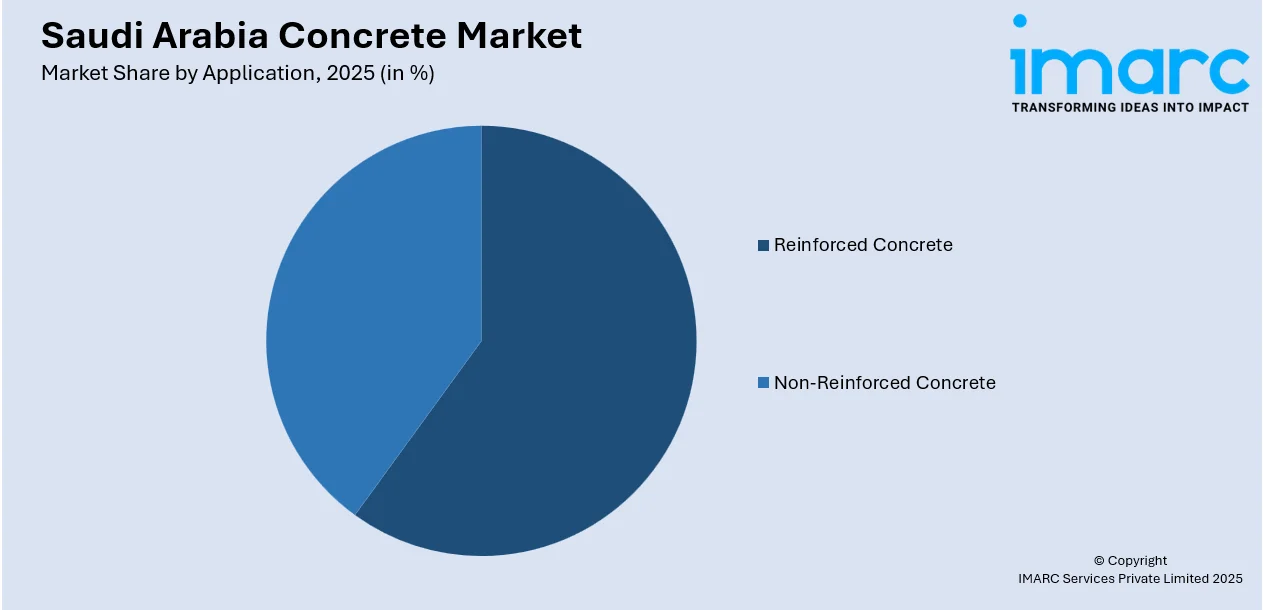

The report has provided a detailed breakup and analysis of the market based on the application. This includes reinforced concrete and non-reinforced concrete.

End Use Industry Insights:

- Roads and Highways

- Tunnels

- Residential Buildings

- Non-Residential Buildings

- Dams and Power Plants

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes roads and highways, tunnels, residential buildings, non-residential buildings, dams and power plants, mining, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Concrete Market News:

- On December 15, 2024, Abdullah Abdin Ready Mix Concrete became the first company in the MENA region to achieve Concrete Sustainability Council (CSC) certification, reinforcing its commitment to sustainable construction practices. This milestone aligns with Saudi Arabia's Vision 2030 and sets a new standard for environmentally responsible concrete production. The company also signed a Memorandum of Understanding with Cryo and CarbonCure Technologies to implement carbon capture solutions, further advancing its sustainability goals.

- On January 27, 2025, a new consortium named NovusCrete was launched with the aim of advancing sustainable concrete technologies. The consortium, which includes key players such as the Public Investment Fund (PIF), NEOM, Saudi Investment Recycling Company (SIRC), SIKA, and ClimateCrete, focuses on reducing the carbon footprint of the construction sector through innovations like recycled materials, seawater-based concrete, and alternative reinforcement methods.

Saudi Arabia Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Concrete Types Covered |

|

| Applications Covered | Reinforced Concrete, Non-Reinforced Concrete |

| End Use Industries Covered | Roads and Highways, Tunnels, Residential Buildings, Non-Residential Buildings, Dams and Power Plants, Mining, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia concrete market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia concrete market on the basis of concrete type?

- What is the breakup of the Saudi Arabia concrete market on the basis of application?

- What is the breakup of the Saudi Arabia concrete market on the basis of end use industry?

- What is the breakup of the Saudi Arabia concrete market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia concrete market?

- What are the key driving factors and challenges in the Saudi Arabia concrete market?

- What is the structure of the Saudi Arabia concrete market and who are the key players?

- What is the degree of competition in the Saudi Arabia concrete market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia concrete market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)